Saudi Arabia Processed Meat Market Size, Share, Growth & Forecast 2025-2033

Buy NowSaudi Arabia Processed Meat Market Trends & Summary

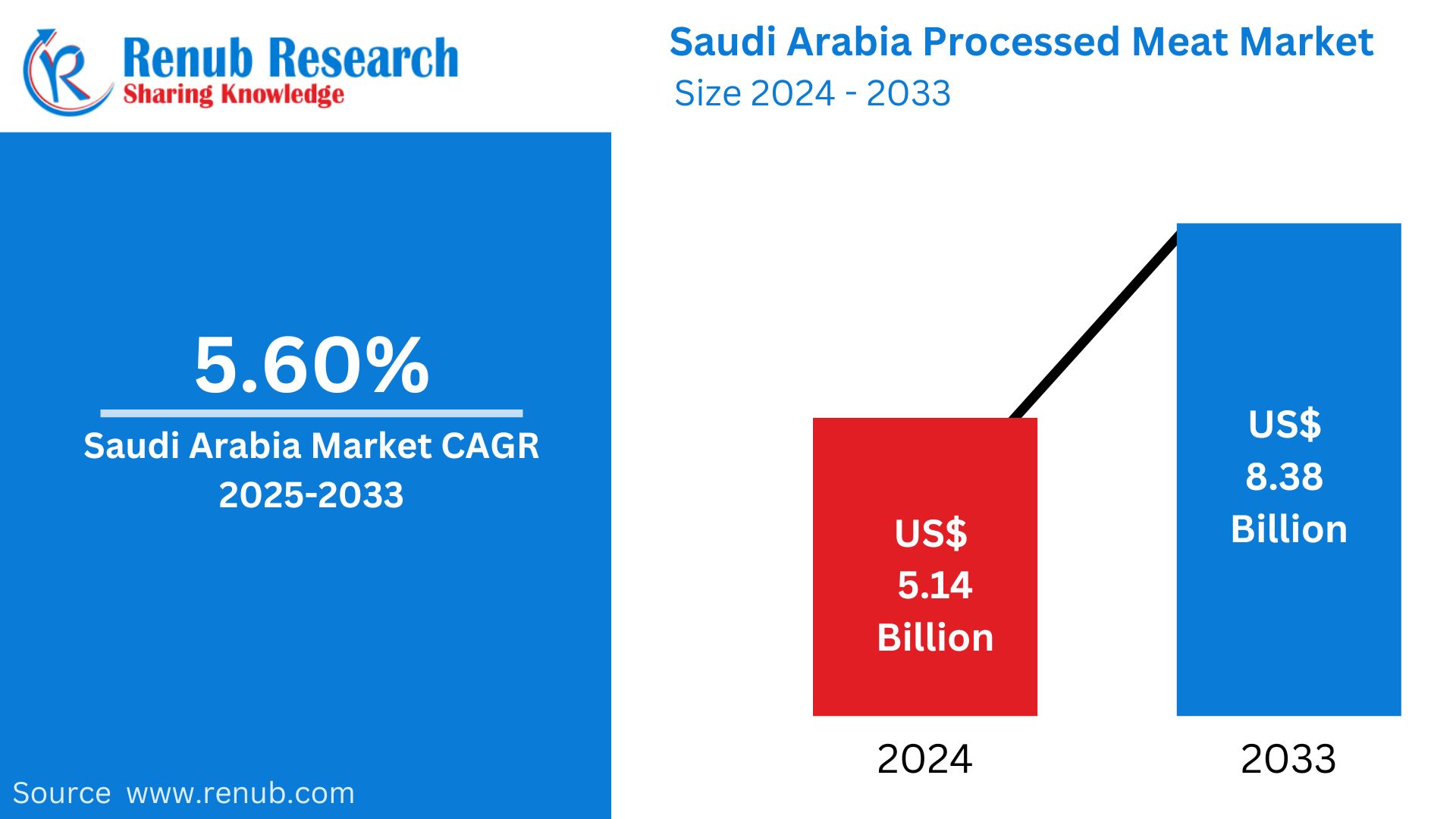

Saudi Arabia Processed Meat market is expected to reach US$ 8.38 billion by 2033 from US$ 5.14 billion in 2024, with a CAGR of 5.60% from 2025 to 2033. Urbanization, rising disposable incomes, shifting dietary tastes, convenience demand, growing retail networks, a sizable expat population, and rising consumption of foods high in protein are the main factors driving the growth of the processed beef market in Saudi Arabia.

The report Saudi Arabia Processed Meat Market & Forecast covers by Meat Type (Poultry, Beef, Pork, Others), Processed Type (Frozen, Chilled, Canned), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online Retail Stores) and Company Analysis 2025-2033.

Saudi Arabia Processed Meat Market Overview

Growing urbanization, increased disposable incomes, and shifting consumer preferences are all contributing to the substantial growth of the cold meat sector in Saudi Arabia. Convenient, ready-to-eat meals, especially processed meats like sausages, deli cuts, and frozen meat items, are in greater demand as more people relocate to metropolitan areas, especially in places like Riyadh and Jeddah. The consumption of these time-saving, high-protein products is being driven by the hectic lifestyles of urban inhabitants, especially families and working professionals. Furthermore, processed beef products are becoming more widely available nationwide due to the growing retail industry, which includes supermarkets, hypermarkets, and internet platforms. The substantial demand for processed meat types is largely driven by Saudi Arabia's sizable expatriate population, which has a wide range of dietary preferences.

The market is also significantly shaped by cultural and religious considerations, such as the need for halal food. The requirement that all cold meat products adhere to halal standards, which guarantee that they fulfill particular slaughtering and processing rules, restricts the range of products available but also increases consumer confidence. With customers having more money to spend on high-quality food options due to increased disposable incomes, premium, organic, and gourmet processed meats are likewise becoming more and more popular. Market dynamics are still impacted by issues like the excessive fat and sodium content of processed meats, the competition from plant-based substitutes, and shifting meat prices brought on by interruptions in the global supply chain. The Saudi Arabian cold meat market is nevertheless expected to grow steadily in spite of these obstacles.

Growth Drivers for the Saudi Arabia Cold Meat Market

Increasing Urbanization

The market for cold meat in Saudi Arabia is significantly influenced by the country's growing urbanization. Convenient meal options are in greater demand as more people move to metropolitan regions, especially in places like Riyadh and Jeddah. Younger people, working families, and busy professionals frequently look for meals that are quick to prepare or ready to eat to match their hectic schedules. For these customers, processed meats like sausages, deli meats, and frozen meat products provide a convenient and wholesome option. This demand is further supported in metropolitan areas by the availability of processed meats in supermarkets, hypermarkets, and foodservice establishments like cafes and restaurants. The market for preserved meat will probably continue to rise as a result of the convenience trend brought on by urbanization.

Rising Disposable Income has led to growth of Preserved Meat Industry

The demand for high-end processed beef products is being driven by Saudi Arabia's rising disposable incomes. Customers are more willing to spend money on premium, gourmet, organic, and specialized meat selections as their financial situation improves. Compared to conventional meats, these high-end products are frequently thought to be healthier, more environmentally friendly, and tastier. Customers are increasingly looking for items with unusual flavors or exotic cuts, as well as options like hormone-free, nitrate-free, and grass-fed meats. Additionally, having more disposable income enables one to spend more on gourmet processed meat products and ready-to-eat foods like vacuum-packed goods, premium deli meats, and artisanal sausages. The market for preserved meat is changing as a result of this move toward luxury products, which is also fostering innovation in the sector.

Changing Dietary Preferences

The usage of cold meats in Saudi Arabia is being driven largely by shifting dietary habits. Meat is a major source of protein for muscle growth and general nutrition, and as health consciousness grows, so does the emphasis on meals high in protein. The rising demand for cold meats like sausages, deli cuts, and frozen meat products—which provide quick, high-protein options for working people and families—is one example of this trend. Additionally, processed meats have become more appealing due to dietary changes toward lower-carb, higher-protein foods, such as the popular keto and paleo diets. Because customers are looking for quick, wholesome meal options that fit their changing nutritional requirements, the market for ready-to-eat processed meats is growing.

Challenges in the Saudi Arabia Cold Meat Market

Competition from Plant-Based Alternatives

The market for processed beef in Saudi Arabia is becoming more and more competitive due to plant-based substitutes. More customers are choosing plant-based proteins over traditional meat as a result of increased concerns about sustainability, animal welfare, and health. Compared to animal-based proteins, products derived from soy, peas, lentils, and mushrooms are thought to be healthier since they have less fat and cholesterol and a smaller environmental impact. In order to preserve market share, processed meat companies need to adapt as the global trend toward plant-based eating picks up speed, particularly among younger, health-conscious consumers. In metropolitan regions, where plant-based options are becoming more popular in fast-food chains, restaurants, and supermarkets, this competition is especially intense. Traditional meat producers are looking for ways to incorporate plant-based alternatives or enhance the nutritional value of their goods in order to remain competitive.

Cultural and Religious Preferences

The Saudi Arabian processed meat sector is severely hampered by cultural and religious sensitivities. Since the nation follows Islamic dietary regulations, all meat products have to adhere to halal standards, which guarantee that the animals are killed in keeping with religious precepts. Because producers must procure halal-certified meat and follow certain processing guidelines, this requirement restricts the sorts of meat that can be used and makes the production process more difficult. Furthermore, because manufacturers and suppliers must spend money on certification and compliance processes, halal certification may raise production prices. Because foreign suppliers must make sure their meat conforms with local rules, these stringent dietary laws may also restrict the availability of some goods.

In Saudi Arabia's market for corned beef might hold a significant place

Beef might hold a prominent position in the Saudi Arabian preserved meat market. This is due to cultural preferences and culinary traditions. As a staple in Middle Eastern cuisine, beef is famous, featuring prominently in kebabs, stews, and grilled meats. Beef's wealthy taste and flexibility contribute to its dominance, aligning with consumer tastes. Moreover, the developing urbanization and Western impact on Saudi Arabia similarly power the demand for beef-based processed meat products. This cements its leading function in the corned beef market.

The Saudi Arabian processed meat market may be dominated by frozen processed meat

Frozen processed meat could claim a substantial share in the Saudi Arabia processed meat market. The comfort of frozen products aligns with contemporary lifestyles, providing easy storage and extended shelf life. In a region with hot weather, frozen processed meats offer a practical solution for upkeep. Also, busy urban life and changing dietary habits contribute to the recognition of ready-to-cook frozen options. The frozen section's numerous varieties, including burgers, nuggets, and sausages, caters to client options, making it a sizeable participant in the dynamic market.

Supermarkets and hypermarkets may control a sizable share of Saudi Arabia's processed meat business and supermarkets might claim a substantial share of the Saudi Arabia processed meat industry. This is due to their sizeable presence and numerous product services. These retail giants provide clients with a convenient one-stop purchasing experience, offering a wide range of processed meat products below one roof. With their sizable distribution networks and promotional activities, hypermarkets and supermarkets effectively reach a massive client base. Further, those outlets' competitive pricing and promotional strategies attract budget-aware purchasers, further solidifying their position as key players in the Saudi Arabia processed meat industry.

Saudi Arabia Processed Meat Market Segmentation

By Meat Type

- Poultry

- Beef

- Pork

- Others

By Processed Type

- Frozen

- Chilled

- Canned

By Distribution Channel

- Hypermarkets and Supermarket

- Convenience Stores

- Online Retail Stores

- Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Almarai Company

- Al Islami Foods

- Almasa Diamond Meat Processing LLC

- Al Munajem Cold Stores Company

- Al-Watania Poultry

- The Savola Group

- Sunbulah Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Meat Type, Processed Type, and Distribution Channel |

| Distribution Channel Covered |

1. Hypermarkets and Supermarket |

| Companies Covered |

1. Almarai Company |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the Saudi Arabia processed meat industry by 2033?

-

What is the forecasted CAGR for the Saudi Arabia processed meat market from 2025 to 2033?

-

What are the major factors driving the growth of the processed meat market in Saudi Arabia?

-

How is urbanization influencing the demand for processed meat products in the country?

-

What are the key challenges faced by the processed meat market in Saudi Arabia?

-

How do cultural and religious preferences impact the processed meat industry?

-

Which meat type holds the largest market share in Saudi Arabia’s processed meat sector?

-

Which distribution channels contribute the most to processed meat sales in Saudi Arabia?

-

Who are the leading companies in the Saudi Arabia processed meat market?

-

How is the competition from plant-based alternatives affecting the processed meat industry in Saudi Arabia?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Processed Meat Market

6. Market Share

6.1 By Meat Types

6.2 By Processed Types

6.3 By Distribution Channels

7. Meat Types

7.1 Poultry

7.2 Beef

7.3 Pork

7.4 Others

8. Processed Types

8.1 Frozen

8.2 Chilled

8.3 Canned

9. Distribution Channels

9.1 Hypermarkets and Supermarket

9.2 Convenience Stores

9.3 Online Retail Stores

9.4 Others

10. Value Chain Analysis

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Almarai Company

13.1.1 Overviews

13.1.2 Recent Developments

13.2 Al Islami foods

13.2.1 Overviews

13.2.2 Recent Developments

13.3 Almasa Diamond Meat Processing LLC

13.3.1 Overviews

13.3.2 Recent Developments

13.4 Al Munajem Cold Stores Company

13.4.1 Overviews

13.4.2 Recent Developments

13.5 Al-Watania Poultry

13.5.1 Overviews

13.5.2 Recent Developments

13.6 The Savola Group

13.6.1 Overviews

13.6.2 Recent Developments

13.7 Sunbulah Group.

13.7.1 Overviews

13.7.2 Recent Developments

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com