Greece Processed Meat Market Forecast 2025–2033

Buy NowGreece Processed Meat Market Size

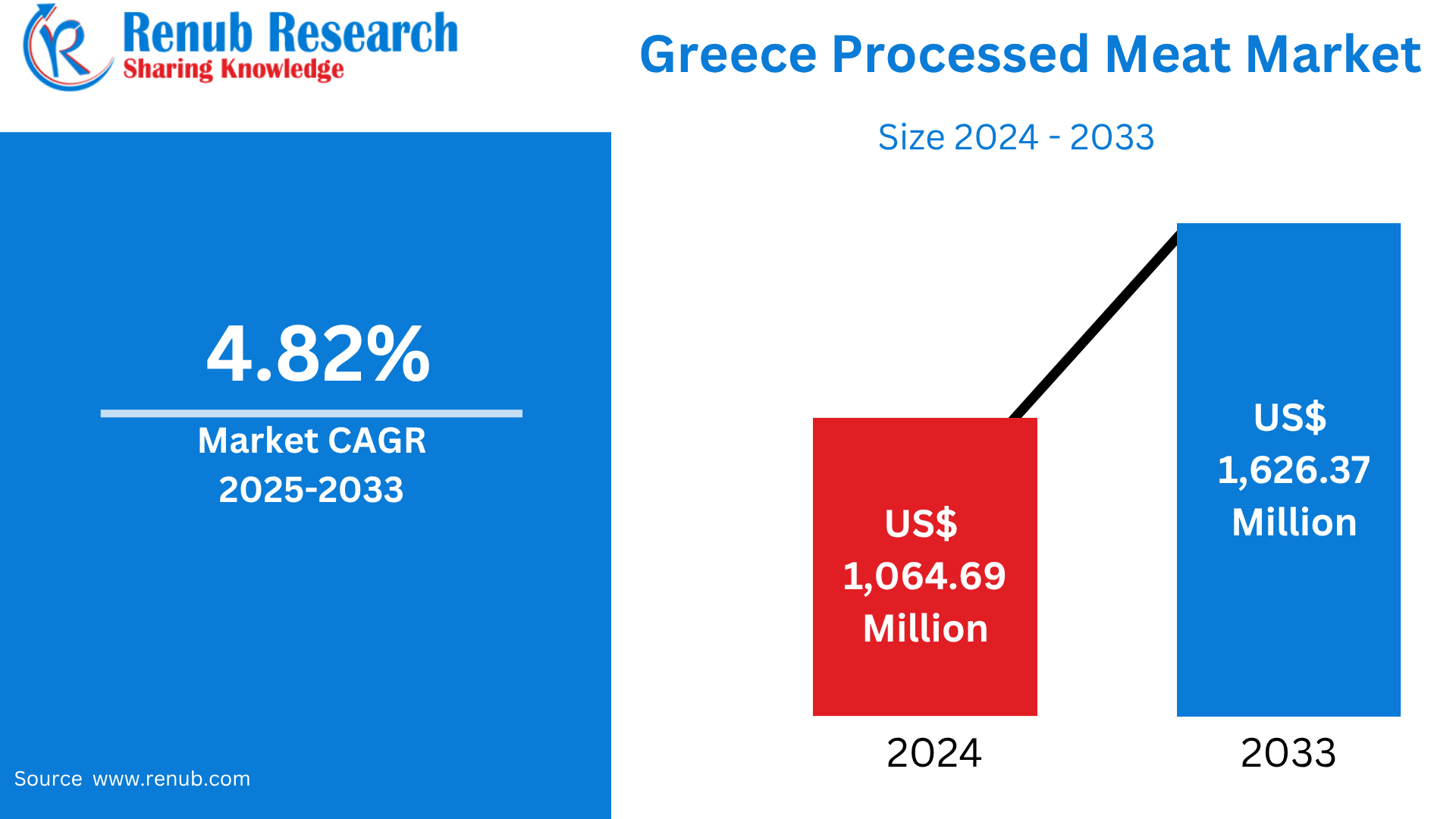

Greece Processed Meat Market is expected to reach US$ 1,626.37 million by 2033 from US$ 1,064.69 million in 2024, with a CAGR of 4.82% from 2025 to 2033. Increasing urbanization, increasing demand for convenience meals, tourism expansion, shifting consumer habits, increasing disposable incomes, growth in the retail sector, product innovation, and increasing preference for ready-to-consume meals and high-protein diets are some of the key drivers of the Greek processed meat market.

Greece Processed Meat Market Report by Meat Types (Poultry, Beef, Pork, Others), Processed Types (Frozen, Chilled, Canned), Distribution Channels (Hypermarkets and Supermarket, Convenience Stores, Online Retail Stores, Others) and Company Analysis 2025-2033.

Greece Processed Meat Industry Overview

Meat that has been changed by processing such as salting, curing, smoking, fermenting, or adding preservatives to enhance flavor or increase shelf life is called processed meat. Sausage, bacon, ham, salami, hot dogs, and deli meats are common examples. These processing techniques add flavor and texture and minimize the possibility of spoiling. Although popular and convenient, processed meats are linked with health threats, particularly when consumed in excess, due to their high sodium, saturated fat, and additive content. Their convenience, variety, affordability, and suitability for fast-paced, modern lifestyles and foodservice uses continue to support their ongoing popularity.

The Greek market for processed meat is growing as a result of several key factors. Convenient, easily consumed food items are more sought after with increasing urbanization and busy lives. Two drivers of increased consumption of processed meat are a growing middle class and increasing disposable incomes. Since tourists often consume local meat items, tourism is also responsible for adding to market coverage. In addition, advances in food processing and packaging technology increase the shelf life and safety of the products. Innovation in healthier meat products, including low-fat and nitrate-free offerings, is being led by health-conscious consumers. The steady growth of the market is also aided by shifting consumer preferences and increasing retail channels.

Growth Drivers for the Greece Processed Meat Market

Rising Urbanization

The process meat industry of Greece is significantly influenced by urbanization as it alters the nutritional and lifestyle options of consumers. Increases in urban populations lead individuals to have greater time constraints due to work and commuting, hence wanting speedy, convenient-to-consume foods such as processed meat. These products, e.g., sausages and deli meats, are suited for busy urban dwellers due to their long shelf life and ease of transport. In addition, residents in urban areas have more disposable incomes, enabling them to afford a larger variety of processed meat products. Usage of processed meat in cities is also reinforced by their higher accessibility in the stores and through food delivery services. Consequently, urbanization is the biggest driver of Greece's processed meat market, tracing global trends that associate increased consumption of processed meat with urbanization.

Convenience

The Greek processed meat market is expanding steadily as a result of convenience, in line with global trends toward eating ready-to-consume and easy-to-prepare foods. Ready-to-eat foods that are quick to consume without compromising on taste or nutrients, i.e., sausages, deli meats, and ready-to-cook meals, are increasingly sought after because of urbanization and busy lifestyles. These items are increasingly available due to the development of modern distribution channels such as supermarkets, hypermarkets, and online platforms, which target consumers searching for convenient dinner solutions. Additional driving market growth are developments in product presentation and packaging, including vacuum pack containers and single-item packs, enhancing convenience and storage life.

Growing Technological Advancements

The processed meat market in Greece is growing largely because of technological advances that enhance consumer confidence, quality of the product, and production efficiency. Automated and robotic applications in processes such as cutting, deboning, and packaging make them more efficient by reducing labor cost and errors. Predictive repair, improved quality control, and optimization of manufacturing processes are enabled by artificial intelligence (AI) and machine learning technologies, which increase operational efficiency and reduce downtime. Real-time monitoring of the production line is enabled by the integration of the Internet of Things (IoT), which enhances food safety and traceability. Increased shelf life and reduced food wastage are added advantages of food processing equipment upgradation, including vacuum packaging and high-pressure processing. Combined, these technologies enable Greece's processed meat sector to continue thriving in a sustainable way.

Challenges in the Greece Processed Meat Market

Regulatory Compliance

Complex and changing food safety regulations make regulatory compliance a major burden for Greece's processed meat business. Even when EU laws, such ISO 22000 and HACCP principles, are followed, enforcement varies by location. Significant fines of more than €17 million were levied by the Hellenic Food Authority (EFET) between 2005 and 2013 for infractions such as poor labeling, a lack of traceability systems, and insufficient hygienic measures. Additionally, several businesses have been suspended for failing to maintain and clean their facilities according to guidelines. These regulatory obstacles have an effect on the nation's meat processors' profitability and competitiveness by requiring large investments in compliance infrastructure, employee training, and quality assurance systems.

Supply Chain Disruptions

Greece's processed meat sector has major obstacles due to supply chain disruptions, which impact the effectiveness of production and distribution. Profitability and operational stability are impacted by variables such fluctuating energy costs, labor shortages, and raw material pricing. Furthermore, the business is exposed to risks related to global trade dynamics and geopolitical tensions because of its reliance on imported beef, which makes up around 80% of consumption. For example, the global food crises of 2022–2023 put additional strain on supply networks due to disruptions in logistics and higher costs brought on by the COVID-19 pandemic and geopolitical events. Strategic investments in regional production capacities, supply source diversification, and improved supply chain resilience are necessary to meet these issues.

Greece Processed Meat Market Segmentation:

Meat Types

- Poultry

- Beef

- Pork

- Others

Processed Types

- Frozen

- Chilled

- Canned

Distribution Channels

- Hypermarkets and Supermarket

- Convenience Stores

- Online Retail Stores

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Hormel foods

- Tyson Foods

- Conagra Brands Inc.

- General Mills

- The Kraft Heinz Company

- Cargill, Incorporated

- Pilgrim’s Pride Corp

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Meat Type, Processed Type and Distribution Channels |

| Distribution Channels Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Greece Processed Meat Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Meat Types

6.2 By Processed Types

6.3 By Distribution Channels

7. Meat Types

7.1 Poultry

7.1.1 Historical Market Trends

7.1.2 Market Forecast

7.2 Beef

7.2.1 Historical Market Trends

7.2.2 Market Forecast

7.3 Pork

7.3.1 Historical Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Historical Market Trends

7.4.2 Market Forecast

8. Processed Types

8.1 Frozen

8.1.1 Historical Market Trends

8.1.2 Market Forecast

8.2 Chilled

8.2.1 Historical Market Trends

8.2.2 Market Forecast

8.3 Canned

8.3.1 Historical Market Trends

8.3.2 Market Forecast

9. Distribution Channels

9.1 Hypermarkets and Supermarket

9.1.1 Historical Market Trends

9.1.2 Market Forecast

9.2 Convenience Stores

9.2.1 Historical Market Trends

9.2.2 Market Forecast

9.3 Online Retail Stores

9.3.1 Historical Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Historical Market Trends

9.4.2 Market Forecast

10. Porter’s Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 Hormel foods

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Tyson Foods

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Conagra Brands Inc.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Developments

12.3.4 Revenue

12.4 General Mills

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Developments

12.4.4 Revenue

12.5 The Kraft Heinz Company

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Cargill, Incorporated

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Pilgrim’s Pride Corp

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Developments

12.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com