Convenience Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025–2033

Buy NowConvenience Food Market Size and Forecast 2025-2033

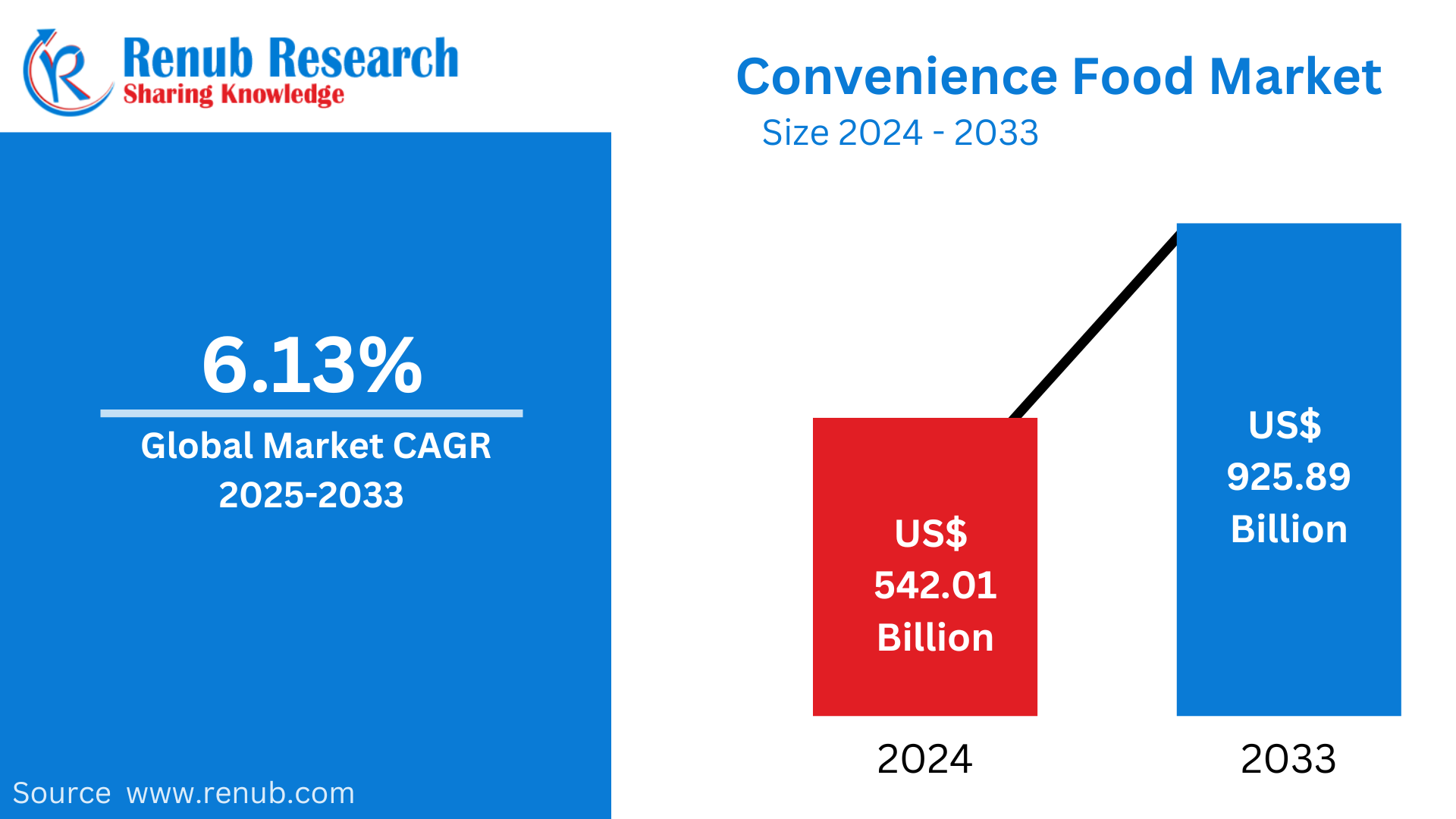

The global convenience food market size is valued at US$ 542.01 billion in 2024. It is estimated to grow at a 6.13% CAGR from 2025 to 2033, reaching US$ 925.87 billion by 2033. This is attributed to growing demand for ready-to-eat and easy-to-prepare meals, changing lifestyles, and urbanization.

The report Convenience Food Market & Forecast covers by Product (Ready-to-eat, Frozen food), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Others), Country and Company 2025-2033.

Convenience Food Market Overview

Convenience food, also referred to as processed or ready-to-eat food, is a pre-packaged meal that saves time and effort in preparation. These foods can include frozen dinners, canned goods, snacks, and instant beverages. They are partially or fully cooked and need little preparation, such as reheating or adding water.

Convenience foods are designed to aid fast-paced lifestyles of modern consumers, making meals convenient and hassle-free. Essentially, convenience foods are used for the saving of time of people possessing busy schedules or those with minimal cooking skills. They are commonly used in homes, work environment, and at various places while out and about. Besides, they feature a noteworthy role in food service, such as restaurants, catering, and vending machines. Convenience foods are also popular in emergencies or outdoor activities like camping, where traditional cooking methods may not be practical. Their versatility, variety, and ease of use make them integral to daily life.

Growth Driver in the Convenience Food Market

Busy Lifestyles and Urbanization

The rapid pace of modern life and increasing urbanization have led to higher demand for convenient meal solutions. As more people migrate to cities and adopt fast lifestyles, the need for ready-to-eat and easy-to-prepare food has increased. Convenience foods have become the staple for dual-income households with longer working hours and less time for traditional cooking. Urban areas also offer easy access to such products through supermarkets, convenience stores, and delivery services, thereby driving growth in this market. The world is becoming increasingly urbanized. In 1950, about one-third of the global population lived in cities and towns, but today, that number has risen to over half. By 2050, two-thirds of the world's population is projected to reside in urban areas.

Technological Advancements in Food Processing

Food preservation, packaging, and processing innovations have enhanced convenience foods' quality, shelf life, and nutritional value. Advanced freezing techniques, vacuum packaging, and microwave-ready containers ensure that the products retain their taste and freshness while remaining easy to use. These developments address consumer concerns about food safety and quality, making convenience foods more appealing. Automation in production has increased efficiency, enabling manufacturers to meet growing demand at competitive prices. In March 2024, Alfa Laval introduced the HL8-WG hygienic heat exchanger for oat beverage production in northern Europe. This technology reduces fouling, cuts cleaning intervals, and lowers energy consumption, meeting the demand for sustainable food processing.

Growing Preference for Healthier Options

As consumers become more health-conscious, the demand for convenience foods with healthier ingredients, lower preservatives, and organic or natural components has risen. Manufacturers are responding by introducing products that cater to dietary needs, such as gluten-free, vegan, or low-calorie options. Fortified foods that contain added nutrients and functional benefits, such as high protein or fiber are increasingly popular. This trend opens up the opportunity for a wider audience and creates an enabling factor for the market to grow as it responds to consumers' changing priorities. February 2024 - Base Culture launches its Simply Bread line as the first gluten-free and clean ingredient option in the bread aisle.

Issues facing Convenience Food Market

Health Issues and Nutritional Composition

Much convenience foods are criticized owing to the extent of preservatives, sodium levels, sugar percentages, and unfavorable fats. Higher awareness of being linked to ill health conditions that appear due to taking processed foods include obesity, diabetes, and cardiac diseases has heightened the scrutiny amongst consumers on check ingredients and nutritional statements. This need for healthier variations has compelled formulation changes in existing products. This will remain a significant challenge for the industry in maintaining consumer trust and complying with regulatory requirements for healthier food options.

Environmental and Packaging Issues

The use of single-use packaging and non-biodegradable materials by the convenience food industry leads to environmental pollution and waste management issues. As consumers become increasingly aware of the need for sustainability, they have been demanding greener alternatives, forcing companies to adapt to these practices. However, it becomes costly to implement sustainable packaging and balance it with price-sensitive consumer expectations. Environmental activism and regulatory pressure also create challenges, compelling the manufacturers to innovate and make a difference between the environment and the marketplace.

Ready-to-eat Convenience Food Market

Ready-to-eat convenience food is gaining market space because of growing urbanization, hectic lifestyles, and increased preference for quicker meal solutions. This market consists of pre-cooked meals, frozen foods, and snacks that can be consumed with minimal preparation, thus providing time efficiency and convenience to the consumer. The organic, gluten-free, and low-calorie varieties have been brought into the market by health-conscious trends. The development in technological food processing and packaging has improved the quality and shelf life of products. The rise in online food delivery services has increased the global demand for ready-to-eat convenience foods.

Convenience Food Supermarkets & Hypermarkets Market

The convenience food supermarkets and hypermarkets market play a pivotal role in the distribution and accessibility of convenience foods. These retail outlets offer a wide range of ready-to-eat, frozen, and packaged food products, catering to diverse consumer needs. Their extensive networks and large-scale operations provide a one-stop solution for shoppers, enhancing convenience and affordability. With the increasing demand for convenience foods, supermarkets and hypermarkets are increasing shelf space for healthier, premium options. In addition, loyalty programs, discounts, and in-store promotions attract consumers, while advanced inventory systems and supply chains ensure product availability and freshness, which enhances market growth.

United States Convenience Food Industry

The United States convenience food industry is dynamic and rapidly evolving, driven by changing consumer preferences and fast-paced lifestyles. It includes frozen foods, snack bars, canned food, and other ready-to-eat items. The growth of the market has been boosted by the increased demand for time-saving meal solutions due to advancements in food processing and packaging technologies. Trends in health consciousness in the U.S. have been driving organic, gluten-free, and low-calorie products; hence, the manufacturers have had to innovate. Online grocery shopping and meal delivery services have further increased accessibility and, therefore, the development of the industry.

United Kingdom Convenience Food Industry

The convenience food industry in the United Kingdom is a well-established market due to fast-paced lifestyles, urban living, and the increasing need for quick, ready-to-eat meal options. Pre-packed sandwiches, frozen meals, snacks, and canned goods are popular. A strong network of supermarkets, convenience stores, and online delivery services supports this thriving sector. Health-conscious consumers are driving demand for organic, plant-based, and low-calorie products, forcing manufacturers to be creative with their offerings. Sustainability is also key, as companies embrace eco-friendly packaging and sourcing practices to align with regulatory standards and consumer expectations. Overall, the market continues to grow steadily.

India Convenience Food Industry

The Indian convenience food industry has been growing at an incredible pace over the past few years, driven by urbanization, busy lifestyles, and changing consumer preferences. In response to increasing demand for ready-to-eat and frozen meals, companies are launching diversified product ranges to suit regional tastes. E-commerce and delivery services further enhance accessibility, making convenience foods popular among millennials and working professionals. Healthier products like organic and fortified ones are on the rise as people turn towards healthier consumption without sacrificing convenience. According to The Indian Institute of Journalism & New Media, IIJNM, Sales of ready-to-eat food items at supermarkets have experienced an intense rise in the last two years. With a rise in the sales percentage of ready-to-eat food products from 50% last year to 70% in 2023, the sales have gone up by 20%.

Brazil Convenience Food Industry

The Brazilian convenience food industry has grown significantly in recent years, driven by busy lifestyles and increased urbanization. Consumers are increasingly seeking quick meal solutions that blend convenience with quality. The rise of ready-to-eat meals, frozen foods, and snacks reflects changing eating habits, particularly among younger generations. Additionally, health-conscious options are gaining traction, with many brands introducing products that emphasize nutrition and natural ingredients. Major players are innovating and expanding their product lines to be in line with these trends. Convenience food is in for further growth and transformation as Brazil's economy continues its evolution.

Saudi Arabia Convenience Food Industry

Saudi Arabia's convenience food industry is growing rapidly because of changing consumer lifestyles, rapid urbanization, and an increase in the number of working professionals. With the increased demand for speedy meal solutions, companies are launching a wide variety of products, from ready-to-eat meals and frozen foods to snacks. Modern retail channels, including supermarkets and online grocery platforms, play a vital role in distributing these products. The government's Vision 2030 initiative promotes innovation and investment in food technology. Overall, the category of convenience food is bound for further growth based on changing attitudes of healthy-inclined, quality-seeking, and convenient-wanting consumers.

Convenience Food Market Segments

Type – Market breakup in 2 viewpoints:

- Ready-to-eat

- Frozen food

Distribution Channel – Market breakup in 4 viewpoints:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

Country – Market breakup of 25 Countries:

- United States

- Canada

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

- Brazil

- Mexico

- Argentina

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 3 Viewpoints:

• Overview

• Key Persons

• Recent Development & Strategies

• Revenue Analysis

Company Analysis:

- General Mills Inc.

- Conagra Brands

- Nestlé S.A.

- Hormel Foods

- Unilever PLC

- The Kraft Heinz Company

- Nomad Foods Ltd

- B&G Foods, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

1. General Mills Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Convenience Food Market

6. Market Share Analysis

6.1 By Type

6.2 By Distribution Channel

6.3 By Countries

7. Product

7.1 Ready-to-eat

7.2 Frozen food

8. Distribution Channel

8.1 Supermarkets & Hypermarkets

8.2 Convenience Stores

8.3 Online Retail

8.4 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 General Mills Inc.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Conagra Brands

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Nestlé S.A.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Hormel Foods

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Unilever PLC

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 The Kraft Heinz Company

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Nomad Foods Ltd

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 B&G Foods, Inc.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com