Global Plant-Based Meat Market Size, Share & Forecast 2025–2033

Buy NowGlobal Plant-Based Meat Market Forecast and Opportunities (2025–2033)

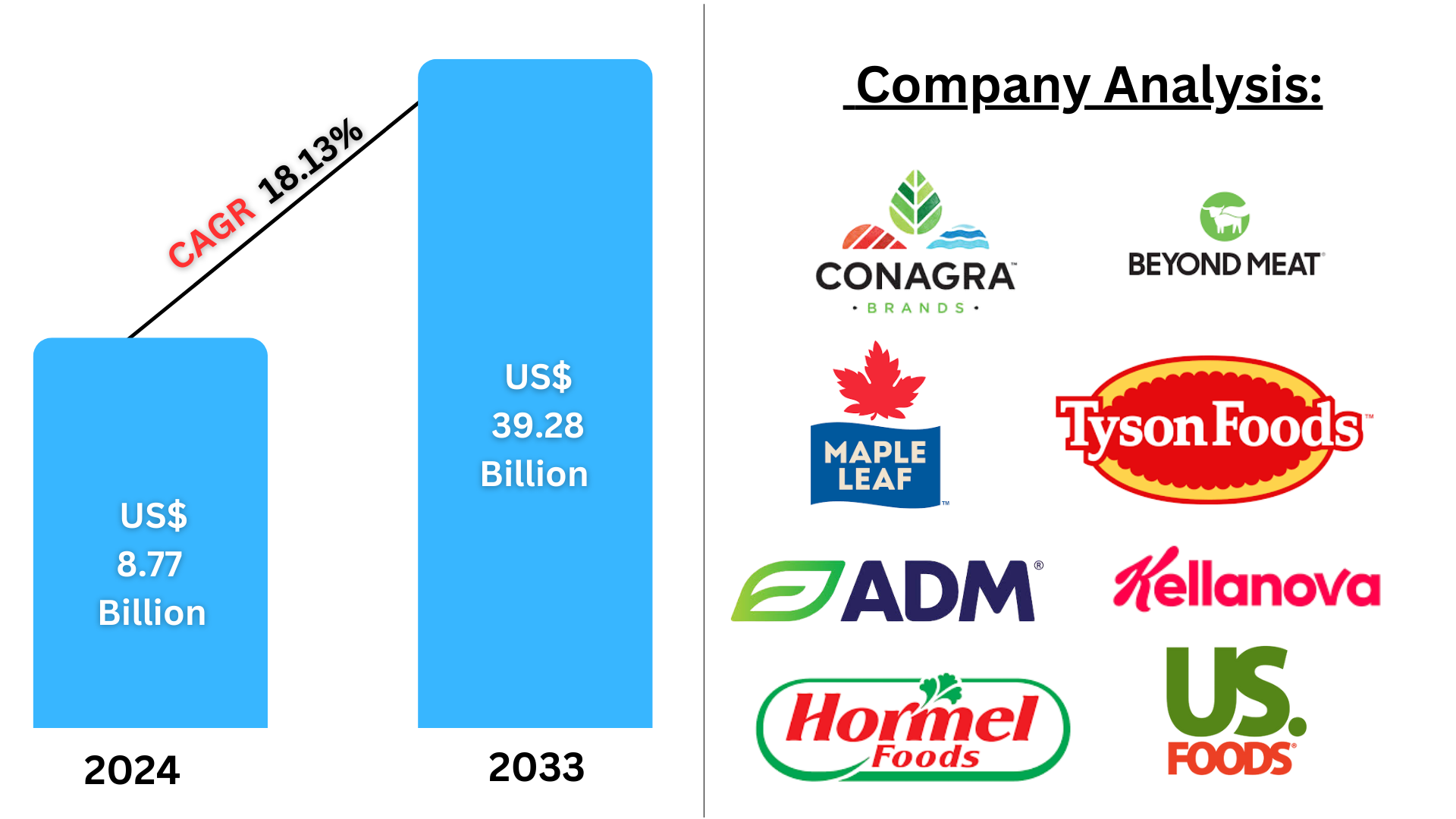

The global plant-based meat market size will reach US$39.28 billion by 2033, from US$ 8.77 billion in 2024, with a compound annual growth rate of 18.12% from 2025 to 2033. This growth is spurred by increasing consumer demand for sustainable, health-conscious, and ethically sourced alternatives to traditional meat products. Plant-based diets are becoming more popular, and the meats market continues to grow worldwide, transforming the food industry.

The report Plant Based Meat Market Covers by Source (Soy, Pea, Wheat, and Others), Type (Chicken, Pork, Beef, Fish, and Others), Product Type (Burger Patties,Sausages, Nuggets and Strips, Ground Meat, Meatballs), Distribution Channel (Food Retail, Food Service, and E-Commerce), Storage (Refrigerated, Frozen, and Shelf Stable), Region and Company Analysis 2025-2033

Plant-Based Meat Market Overview

Plant-based meat is food products that mimic animal meat's taste, texture, and appearance but are made entirely from plant ingredients. These products typically consist of ingredients like soy, pea protein, wheat gluten, and various vegetables, which are processed to replicate the structure and mouthfeel of meat. Plant-based meat is an emerging sustainable alternative to traditional meat associated with environmental concerns and issues with animal welfare and the risk of health problems through high cholesterol and saturated fats.

Its main applications can be seen in the food sector where plant-based meat functions as a substitute for beef, pork, poultry, and seafood for various dishes. Among popular products are burgers, sausages, meatballs, and nuggets. These products are especially for vegetarians, vegans, and those who consume minimal meat due to health, environmental, or ethical reasons. The rising demand for plant-based diets and growing awareness on the environmental implications of the production of meat have made this product more popular and prevalent in restaurants, supermarkets, and fast-food chains.

Growth Drivers of the Global Plant-Based Meat Market

Rising Demand for Sustainable and Ethical Products

A growth driver for the plant-based meat market is the increasing awareness about the environmental impact of animal agriculture. Traditional meat production emits a lot of greenhouse gases, causes deforestation, and consumes a lot of water. As consumers become increasingly aware of these environmental issues, they opt for plant-based meat alternatives, which provide a more sustainable and environmentally friendly option. This increasing demand for ethical food choices and concern about animal welfare is speeding up the adoption of plant-based meat products worldwide. Emissions caused by livestock and the industry amount to around 15% of global greenhouse gasses. With these emissions expected to increase by 9% by 2031, the need for solutions that can reduce the demand for meat is greater than ever before. One such solution is through plant-based meat innovations. In carbon emissions, they are up to 120 times more carbon efficient than meat products if considered separately.

Health-Conscious Consumer Trends

Increasingly, consumers prefer healthier eating habits to reduce the risk of chronic diseases like heart disease, obesity, and diabetes. Plant-based meats are generally low in saturated fats and have no cholesterol content, which makes them a healthier option than their counterparts in the meat industry. The growth of the health-conscious consumer segment has led to increasing demand for plant-based protein sources, which have the same texture and taste as meat but fewer health risks, therefore propelling the plant-based meat market. Garden Gourmet, a subsidiary of Nestlé, partnered with the International Olympic Committee in December 2023 for its plant-based meat offerings, including Burger Patties, Sausages and Hotdogs, and Steaks / Fillets to be included in Olympic and Paralympic Games 2024. The agreement would promote the consumption of plant-based meat.

Improvements in Food Technology and Innovation

Advances in food technology have played a significant role in the growth of the plant-based meat market. Improved processing techniques, enhanced flavors, and more meat-like textures have made plant-based meats increasingly appealing to consumers. Companies are investing in research and development to create plant-based products that closely replicate the taste and texture of animal meat, attracting even non-vegetarian consumers. The lab-grown plant-based meats and meat analogs are growing the market, and diversity is being enhanced to boost its growth even further. In January 2024, Prime Roots partnered with Three Little Pigs to bring its plant-based pâtés (minced meat) to New York's customers.

Challenges facing the Plant-Based Meat Market

High Production Costs

Among the many challenges facing the plant-based meat market is high production costs of producing these products. While plant-based meat alternatives are environmentally friendly and healthy, the ingredients used- such as high-quality plant proteins and specialty flavorings- tend to be more costly than traditional meat. Moreover, advanced production techniques, like fermentation and processing technology, make it even pricier. These expenses are reflected in the price of plant-based meat products, making them less affordable for many consumers compared to animal-based meat options, which can limit widespread adoption.

Consumer Perception and Acceptance

Despite the growing popularity of plant-based meat, consumer acceptance remains a challenge, particularly among traditional meat-eaters. Some individuals hesitate to switch to plant-based alternatives due to skepticism about conventional meat's taste, texture, and nutritional profile. Furthermore, plant-based meats will encounter resistance because of cultural preferences in those regions where meat consumption is a vital part of life. Thus, the success in the long run in the growth of markets and widespread acceptance will rely on overcoming such perceptions through better education, marketing, and product innovations.

United States Plant-Based Meat Market

The plant-based meat market is experiencing robust growth in the United States, driven by increasing consumer demand for sustainable, health-conscious, and ethical food alternatives. Major companies such as Beyond Meat and Impossible Foods are spearheading innovation in plant-based products, offering everything from burgers to sausages and nuggets. Additionally, the growing focus on reducing meat consumption due to health concerns and environmental sustainability is boosting market expansion. The U.S. market is supported by strong distribution networks, widespread retail availability, and consumer awareness campaigns promoting plant-based diets.

United Kingdom Plant-Based Meat Market

The United Kingdom is one of Europe's leading markets for plant-based meat, with a growing consumer base opting for plant-based alternatives due to environmental, ethical, and health reasons. UK consumers are now very much aware of the impact that animal agriculture has on the environment, and plant-based products are fast becoming mainstream in supermarkets, restaurants, and even fast food chains. All this support from the government through sustainable food practices and innovations in plant-based product development are driving the growth of this market and making the UK an important player in the European plant-based meat sector.

China Plant-Based Meat Market

China is rapidly adopting plant-based meat products as the country experiences a cultural shift towards vegetarian and flexitarian diets. The growing awareness of environmental impact from meat production, with concerns over health and food safety, is driving the demand for plant-based alternatives. With over 1.4 billion people, it presents a significant market opportunity. Local players and global plant-based brands are investing in the market to offer Chinese consumers plant-based meat alternatives to suit local tastes.

Brazil Plant-Based Meat Market

Brazil is becoming an essential market for plant-based meats in South America. With consumer interest growing in health, environmental sustainability, and animal welfare, plant-based products have increasingly been considered as an alternative to meat. Brazil's large agricultural industry and focus on sustainable food production have paved the way for innovation in plant-based alternatives. Companies are introducing plant-based options for local dishes such as burgers, sausages, and stews making them accessible to a wider population while promoting the practice of eating plants.

South Africa Plant-Based Meat Market

The plant-based meat market in South Africa is growing steadily, with health-conscious consumers and a rising awareness of environmental sustainability driving the trend. As demand for plant-based products increases, South African retailers and restaurants are introducing more plant-based alternatives. The country is also becoming a hub for international plant-based brands looking to expand into Africa. Although the market is still in its developing stage, it will continue to grow with increasing food prices, growing awareness over animal welfare, and an increase in healthier diets in the future.

Plant-Based Meat Market Segmentation

Source – Market breakup from 4 viewpoints:

- Soy

- Pea

- Wheat

- Others

Meat Type – Market breakup from 5 viewpoints:

- Chicken

- Pork

- Beef

- Fish

- Others

Product Type – Market breakup from 6 viewpoints:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

Distribution Channel – Market breakup from 3 viewpoints:

- Food Retail

- Food Service

- E-Commerce

Storage – Market breakup from 3 viewpoints:

- Refrigerated Plant Based Meat

- Frozen Plant Based Meat

- Shelf Stable Plant Based Meat

Regional Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherland

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Rest of the World

All companies have been covered from 3 viewpoints:

• Overview

• Recent Development

• Revenue

Top Companies Analysis:

- Beyond Meat

- Conagra Brands

- Maple Leaf Foods Inc,

- Tyson Foods Inc,

- Kellanavo

- Archer Daniels Midland,

- US Foods Holding

- Hormel Foods Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Source, Meat Type, Product Type, Distribution Channel, Storage and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Plant Based Meat Market

6. Market Share

6.1 By Source

6.2 By Meat Type

6.3 By Product Type

6.4 By Distribution Channel

6.5 By Storage

6.6 By Countries

7. Source

7.1 Soy

7.2 Pea

7.3 Wheat

7.4 Others

8. Meat Type

8.1 Chicken

8.2 Pork

8.3 Beef

8.4 Fish

8.5 Others

9. Product Type

9.1 Burger and Patties

9.2 Sausages

9.3 Nuggets and Strips

9.4 Ground Meat

9.5 Meatballs

9.6 Others

10. Distribution Channel

10.1 Food Retail

10.2 Food Service

10.3 E-Commerce

11. Storage

11.1 Refrigerated Plant Based Meat

11.2 Frozen Plant Based Meat

11.3 Shelf Stable Plant Based Meat

12. Countries

12.1 North America

12.1.1 United States

12.1.2 Canada

12.2 Europe

12.2.1 France

12.2.2 Germany

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Belgium

12.2.7 Netherland

12.2.8 Turkey

12.3 Asia Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 South Korea

12.3.5 Thailand

12.3.6 Malaysia

12.3.7 Indonesia

12.3.8 Australia

12.3.9 New Zealand

12.4 Latin America

12.4.1 Brazil

12.4.2 Mexico

12.4.3 Argentina

12.5 Middle East & Africa

12.5.1 Saudi Arabia

12.5.2 UAE

12.5.3 South Africa

12.6 Rest of the World

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 Beyond Meat

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue Analysis

15.2 Conagra Brands

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue Analysis

15.3 Maple Leaf Foods Inc.

15.3.1 Overview

15.3.2 Recent Development

15.3.3 Revenue Analysis

15.4 Tyson Foods Inc.

15.4.1 Overview

15.4.2 Recent Development

15.4.3 Revenue Analysis

15.5 Kellanavo

15.5.1 Overview

15.5.2 Recent Development

15.5.3 Revenue Analysis

15.6 Archer Daniels Midland

15.6.1 Overview

15.6.2 Recent Development

15.6.3 Revenue Analysis

15.7 US Foods Holding

15.7.1 Overview

15.7.2 Recent Development

15.7.3 Revenue Analysis

15.8 Hormel Foods Corporation

15.8.1 Overview

15.8.2 Recent Development

15.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com