Global Halal Food Market Size, Share & Forecast 2025–2033"

Buy NowHalal Food Market Size

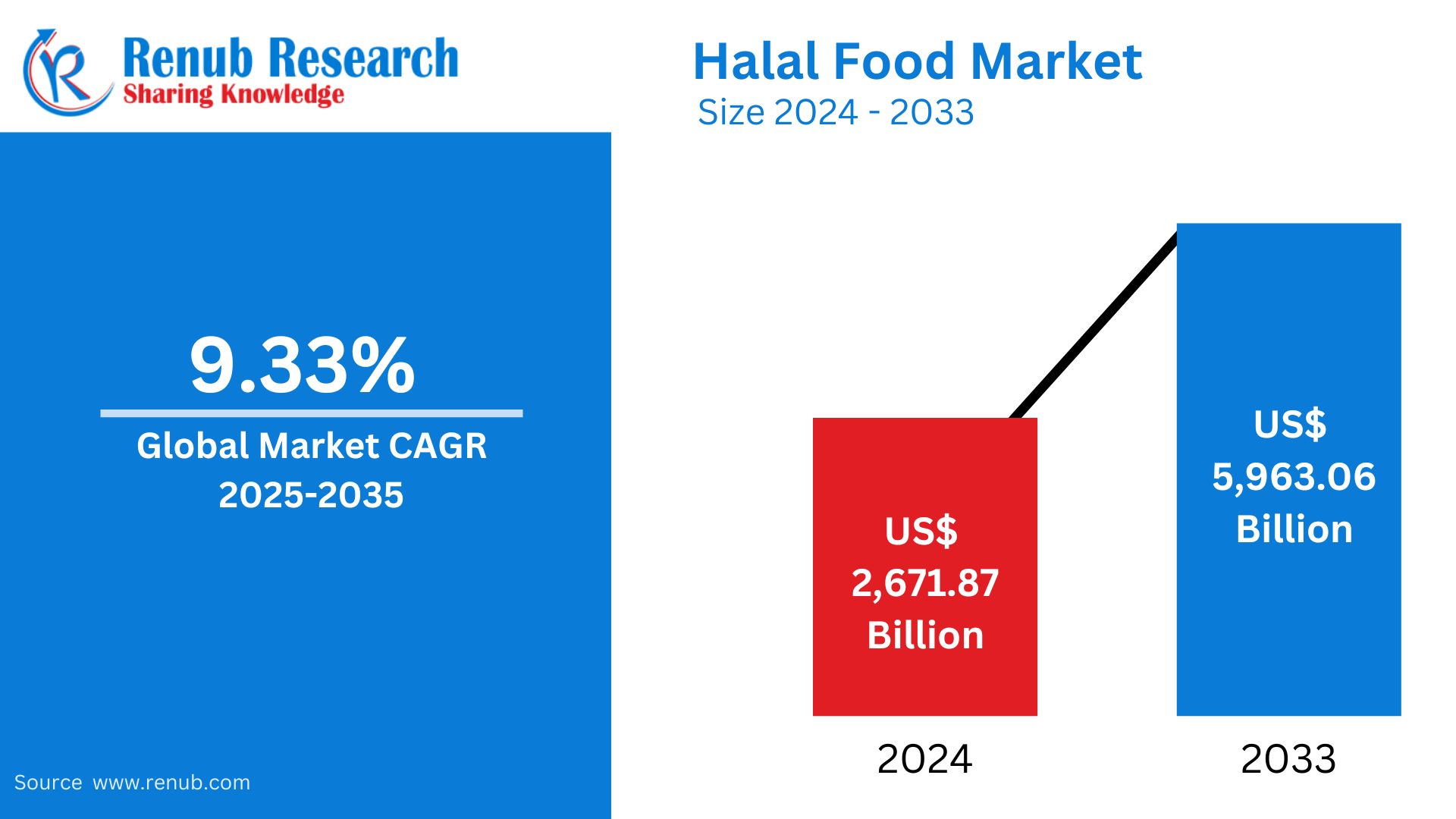

Halal Food market is expected to reach US$ 5,963.06 billion in 2033 from US$ 2,671.87 billion in 2024, with a CAGR of 9.33% from 2025 to 2033. The market is primarily driven by the Muslim population, increased public awareness, the speed at which multiculturalism and globalization are occurring, strict standardization, the growth of digital marketing and e-commerce, and the escalating worries about health and safety.

Global Halal Food Industry Trends

Halal, which translates to "permissible," refers to the conduct, deeds, and products that are acceptable under Shariah, the Islamic legal code. The production, packaging, distribution, and storage of food and drink items are all carried out in accordance with Islamic law within the halal foods market ecosystem. For those looking for natural, clean, and ethically produced food these products can be a wonderful choice because they are seen as fresh, organic, and healthful. The market for halal meals is expected to have strong demand in the upcoming years as a result of the expanding global Islamic population. Additionally, another factor propelling market expansion is the growing number of vegans worldwide. Furthermore, there should be a significant increase in demand for halal food and drinks as a result of the better economic situations in Islamic countries.

In cooperation with their worldwide counterparts, governments and regulatory bodies, especially those in countries with a majority of Muslims, have started a number of programs to promote and monitor the halal food industry. Laws, licensing, and labeling requirements are all covered by these initiatives. As the travel and tourism industry grows, so does the global halal food trade. Non-Islamic nations are opening halal restaurants, cafes, and other businesses in response to Muslim tourists' desire for halal food, which will open up new growth prospects for the halal foods industry over the projection period. According to the Pew Research Center, the number of Muslims will rise by 70% by 2060, which will raise demand for halal products. This demographic transition is having a big impact on the food industry and creating a lucrative market.

Growth Drivers for the Halal Food Market

Growing Adoption of Halal Foods

In recent years, these foods have grown in popularity among both Muslim and non-Muslim consumers, transitioning from a religious dietary need to a representation of meal safety, dependability, and hygiene. The demand for halal foods has increased as a result of several governments throughout the world passing legislation requiring halal certification and labeling. Manufacturers have expanded their product lines and created a number of value-added products in response to this consumer interest. For example, Midamar Corporation declared the release of its high-end Halal Beef Jerky in February 2024. Jerky will come in three flavors—original, spicy honey, and Teriyaki—and is all-natural and gluten-free, according to the business. Thus, the rise of the halal food business is driven by the growing popularity of halal cuisine.

Increasing Awareness and Premiumization to Accelerate Market Growth

The market's premiumization allows producers to charge a premium for inventive and superior halal goods. This is particularly true in developed and established marketplaces, where buyers are prepared to pay more for halal goods. The health benefits of halal food products are significantly greater than those of non-halal food products. These food items are generally well-processed and have a longer shelf life without sacrificing their nutritional content. As a result, such products contribute significantly to health and wellness, which increases their appeal.

Growing Uptake of Technological Developments

Utilizing cutting-edge methods for food processing, packaging, and distribution in the manufacturing of halal food improves production efficiency while preserving the integrity of the product supply chain. To meet the changing tastes of consumers, a wide variety of halal goods have been made possible by a number of cutting-edge food technologies, including 3D printing and plant-based meat substitutes. In order to achieve the intricate standards of halal certification and guarantee adherence to Islamic dietary regulations, technological developments are essential. Because of all these benefits, one of the major trends expected to propel the expansion of the halal food industry is the emergence of technological innovations in halal food products.

Challenges in the Halal Food Market

Perception and Stereotyping

Stereotyping and perception provide serious obstacles for the halal food industry. Many non-Muslim customers believe that halal cuisine is just important for Muslims and only relates to religious requirements. This idea may restrict the halal items' wider appeal and prevent them from being accepted in mainstream markets. Furthermore, consumers may become reluctant due to misunderstandings regarding halal practices, such as worries about animal slaughter or food preparation techniques. Effective marketing that emphasizes the general advantages of halal food, such as its cleanliness, quality, and ethical sourcing, is necessary to dispel these misconceptions. In order to ensure that halal food may be accepted as a premium choice for all customers, regardless of faith, education efforts are crucial in educating both Muslim and non-Muslim consumers about the high safety and quality standards of halal products.

Consumer Education and Awareness

Consumer awareness and education are essential to the halal food market's expansion. Many consumers don't fully understand what halal certification means or why it matters, particularly in areas where Muslims do not make up the majority. This lack of understanding might result in misconceptions about halal food, such as that it is solely important to Muslims or that it differs greatly from non-halal cuisine in terms of quality. These obstacles can be removed by educating customers about the halal food's advantages for health, safety, and ethics, such as traceability, cleanliness, and ethical sourcing. The widespread popularity of halal cuisine can be promoted through advertising efforts, unambiguous labeling, and open communication. The market is probably going to see wider consumer acceptability outside of the Muslim community as knowledge grows.

Halal Certification Process in the Food Sector

Halal certification process guarantees that food items are in conformity with Islamic dietary regulations. The process starts with the submission of an application to a certified Halal certification authority, and then there is a thorough examination of the ingredients, sources, processes, and packaging practices. Inspectors check that meat is halal slaughtered according to Islamic conditions and that there is no cross-contamination with non-Halal materials. The plant should be clean and traceable during production. If the process fulfills all requirements, a Halal certificate is awarded, and the product can be packaged and sold as Halal. Periodic checks and renewals are necessary to keep the certification, and there should be continuous adherence to religious and quality standards.

Regulatory Requirements for Halal Certification

Halal certification is controlled by religious laws and national or international regulatory standards. In order to gain certification, companies have to adhere to Shariah-based principles, which rule out ingredients such as pork, alcohol, and animals slaughtered incorrectly. Moreover, most nations also have their own regulatory agencies or accept certain certification bodies that use ISO standards, like ISO 22000 for food safety. Sourcing, processing, sanitation, and storage documentation is a requirement. There has to be access for audits and inspections by accredited Halal bodies. In certain nations such as Malaysia or the UAE, Halal certification is mandated by law for food imports. Compliance guarantees that products comply with religious expectations as well as government import or export regulations.

Middle East vs. Asia-Pacific Halal Food Demand

The Middle East boasts a steady high demand for Halal food as a result of its predominantly Muslim population and religion-driven food intake. Saudi Arabia, the UAE, and Qatar are among countries with stringent Halal laws and recognized certification bodies. Halal food is not merely a religious demand but also an enforced standard by the government. The region imports huge quantities of Halal-certified goods, and hence compliance with regulations becomes essential for exporters.

The Asia-Pacific region, led by Indonesia, Malaysia, and India, is witnessing strong Halal food consumption growth. Aided by their high Muslim population bases and incomes, consumers increasingly have awareness regarding Halal certification. The Halal-certified exports and indigenous production are growing in the region, making it a world hub for Halal trade.

Consumer Preferences: Packaged vs. Fresh Halal Products

Packaged Halal food is becoming increasingly popular because it is convenient, longer-lasting, and transparently labeled. Quick urban consumers demand ready-to-consume or quick-to-prepare foods like frozen foods, snacks, and processed meats. Packaged food is commonly supported by credible Halal certification marks, providing assurance of transparency and traceability. This form is most preferred among young consumers and in places where access to fresh Halal food is scarce, including non-Muslim-majority nations.

New Halal foods, such as produce and meats, continue to be integral to traditional cooking and are favored by consumers in need of authenticity and greater perceived quality. Most still appreciate shopping at nearby Halal butchers or shops, where they can see for themselves sourcing and freshness.

According to estimates, the majority of the halal food sector is made up of meat products

The meat phase is predicted to dominate the halal food industry. This is due to the increasing demand for microorganism-free meat, pushed via fitness, hygiene, and protection worries. In addition, there is a growing awareness and consideration for animal welfare and diversity, key elements driving an increase in this section.

In the halal food business, supermarkets and hypermarkets are important distribution outlets

Supermarkets and hypermarkets have contributed to most of the halal food market percentage. The main driving forces are the growing presence and choice of supermarkets and hypermarkets. As the global inflation rate rises, purchasers decide to shop from supermarkets, given that they can access a wider variety of options and other economic blessings, discounted charges, incentives, and a couple of offers on more recent merchandise. Moreover, several new groups launch their products in supermarkets due to a higher customer footfall, which translates to better advertising and marketing or advertising value performance.

Halal Food Market Overview by Regions

By countries, the global halal food market is comprised of Pakistan, Indonesia, India, Bangladesh, Nigeria, Egypt, Turkey, Iran, China, Algeria, Iraq, Morocco, Saudi Arabia, Malaysia, Russia, Kazakhstan, United Arab Emirates, France, Germany, United States, Italy, United Kingdom, Canada, Qatar, and Rest of the World.

United States Halal Food Market

Both the growing Muslim population and non-Muslim consumers' increased interest in halal products are contributing to the notable expansion of the US halal food sector. Due to its high standards of quality, ethical sourcing, and supposed health benefits, halal food is becoming more and more popular. The demand for halal-certified meat, packaged foods, and snacks is increasing in major cities with varied populations, like New York, Los Angeles, and Chicago. Additionally, consumers who are concerned about their health are drawn to plant-based and organic halal cuisine. The expansion of the sector is further supported by the increased availability of halal food in conventional supermarkets and dining establishments. The industry is expected to continue growing as awareness and demand rise throughout the United States, despite obstacles such supply chain complexity and the requirement for consumer education.

United Kingdom Halal Food Market

The growing Muslim population and the rising number of non-Muslim consumers looking for halal products due to their perceived quality, safety, and ethical sourcing are driving the UK's halal food market's rapid expansion. The demand for halal-certified meat, prepared foods, and snacks has increased in major cities including Manchester, Birmingham, and London. The sector is also gaining from the increased accessibility of halal food options in popular fast-food chains, restaurants, and supermarkets. In order to satisfy consumers who are concerned about their health, there is also a growing trend for plant-based and organic halal cuisine. Due to changing consumer choices and cultural demand, the UK industry is expected to continue growing as halal cuisine gains acceptance across various communities.

India Halal Food Market

India's sizable Muslim population and rising consumer awareness of halal certification are driving the country's halal food market's steady expansion. Meat, packaged goods, snacks, and drinks that are halal are becoming more and more popular among Muslims and non-Muslims who are looking for high-quality, ethical eating options. Supermarkets, eateries, and internet platforms are increasing their halal offers in response to the growing demand for halal items in major cities like Delhi, Mumbai, and Hyderabad. Interest in halal-certified food is also being fueled by the growing trend of ethical sourcing and health-conscious eating. With India's increased involvement in international food supply chains, the halal food sector is expected to grow even more, providing producers and retailers with new prospects.

United Arab Emirates (UAE) Halal Food Market

The market for halal food in the United Arab Emirates (UAE) is expanding rapidly due to the nation's sizable Muslim population and multicultural expat population. Due to the cultural and religious significance of halal dietary restrictions in the United Arab Emirates, there is a strong demand for halal food products, such as meat, dairy, snacks, and beverages. Due to its advantageous position, the nation is also a major regional center for the halal food business, enabling exports throughout the Middle East and North Africa (MENA) area. The market is expanding as a result of the growing demand for organic, plant-based, and health-conscious halal cuisine. The UAE is becoming a rising leader in the worldwide halal food market as a result of the increased demand for premium, certified halal food in supermarkets, eateries, and online marketplaces brought about by an increase in tourists and expat populations.

Leading Halal Food Companies

| Company Name | Headquarters | Estimated Revenue (Latest) | Key Halal Product Lines | Geographic Presence |

|---|---|---|---|---|

| Nestlé SA | Switzerland | US$XX billion | Halal-certified dairy, infant formula, beverages, processed foods | Global (Middle East, Asia, Africa) |

| JBS SA | Brazil | US$XX billion | Halal beef, poultry, processed meat (Seara & Friboi brands) | Middle East, Asia, Africa, EU |

| BRF SA | Brazil | US$XX billion | Halal poultry, beef, frozen meals (OneFoods brand) | 150+ countries (strong in GCC) |

| Kawan Food Berhad | Malaysia | US$XX billion | Halal frozen parathas, naan, ready-to-eat Asian foods | Asia-Pacific, Middle East, Europe |

| Cargill Inc. | USA | US$XX billion | Halal beef, poultry, oils, grains | Global |

| Carrefour SA | France | US$XX billion | Halal packaged foods, ready meals (private-label Halal ranges) | Middle East, Europe, Africa |

| Crescent Foods Inc. | USA | US$XX billion | Halal chicken, beef, lamb, ready-to-cook products | North America, select MENA |

| VegaVites | USA | US$XX billion | Halal-certified gummy vitamins, supplements | North America |

| American Halal Company Inc. (Saffron Road) | USA | US$XX billion | Halal frozen meals, sauces, snacks, shelf-stable foods | USA (25,000+ retail stores) |

| American Foods Group LLC | USA | US$XX billion | Halal beef, lamb, processed meat | USA, Middle East, Asia |

| Al Islami Foods | UAE | US$XX billion | Halal frozen meat, burgers, snacks, poultry | GCC, MENA region |

Product – Market breakup in 9 viewpoints:

1. Meat

2. Poultry & Seafood

3. Fruits & Vegetables

4. Dairy Products

5. Cereals & Grains

6. Oil

7. Fats & Waxes

8. Confectionery

9. Others

Distribution Channel – Market breakup in 5 viewpoints:

1. Hypermarkets & supermarkets

2. Online Stores

3. Convenience Stores

4. Specialty Stores

5. Others

Countries – Market breakup in 25 viewpoints:

- 1. North America

- 1.1 United States

- 1.2 Canada

- 2. Europe

- 2.1 Russia

- 2.2 France

- 2.3 Germany

- 2.4 Italy

- 2.5 United Kingdom

- 2.6 Turkey

- 3. Asia

- 3.1 Pakistan

- 3.2 Indonesia

- 3.3 India

- 3.4 Bangladesh

- 3.5 China

- 3.6 Malaysia

- 3.7 Kazakhstan

- 4. Middle East & Africa

- 4.1 Saudi Arabia

- 4.2 United Arab Emirates

- 4.3 Qatar

- 4.4 Iraq

- 4.5 Iran

- 4.6 Egypt

- 4.7 Algeria

- 4.8 Morocco

- 4.9 Nigeria

5. Rest of the World

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Key Players

- 1. Nestle SA

- 2. JBS SA

- 3. BRF SA

- 4. Kawan Food Berhad

- 5. Cargill Inc.

- 6. Carrefour SA

- 7. Crescent Foods Inc.

- 8. VegaVites

- 9. American Halal Company Inc.

- 10. American Foods Group LLC,

- 11. Al Islami Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel, and Countries |

| Countries Covered |

1. United States |

| Companies Covered |

1. Nestle SA |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Halal Food Market

6. Market Share

6.1 By product

6.2 By Distribution Channel

6.3 By Country

7. Product

7.1 Meat, Poultry & Seafood

7.2 Fruits & Vegetables

7.3 Dairy Products

7.4 Cereals & Grains

7.5 Oil, Fats & Waxes

7.6 Confectionery

7.7 Others

8. Distribution Channel

8.1 Hypermarkets & Supermarket

8.2 Online Stores

8.3 Convenience Stores

8.4 Speciality Stores

8.5 Others

9. Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 Russia

9.2.2 France

9.2.3 Germany

9.2.4 Italy

9.2.5 United Kingdom

9.2.6 Turkey

9.3 Asia

9.3.1 Pakistan

9.3.2 Indonesia

9.3.3 India

9.3.4 Bangladesh

9.3.5 China

9.3.6 Malaysia

9.3.7 Kazakhstan

9.4 Middle East & Africa

9.4.1 Saudi Arabia

9.4.2 United Arab Emirates

9.4.3 Qatar

9.4.4 Iraq

9.4.5 Iran

9.4.6 Egypt

9.4.7 Algeria

9.4.8 Morocco

9.4.9 Nigeria

9.5 Rest of the World

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Nestle SA

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 JBS SA

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 BRF SA

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Kawan Food Berhad

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Cargill Inc.

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Carrefour SA

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Crescent Foods Inc.

12.7.1 Overview

12.7.2 Recent Developments Solutions

12.8 VegaVites

12.8.1 Overview

12.8.2 Recent Development

12.9 American Halal Company Inc.

12.9.1 Overview

12.9.2 Recent Developments Solutions

12.10 American Foods Group LLC

12.10.1 Overview

12.10.2 Recent Development

12.11 Al Islami Foods

12.11.1 Overview

12.11.2 Recent Developments Solutions

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com