Organic Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowOrganic Food Market Trends & Summary

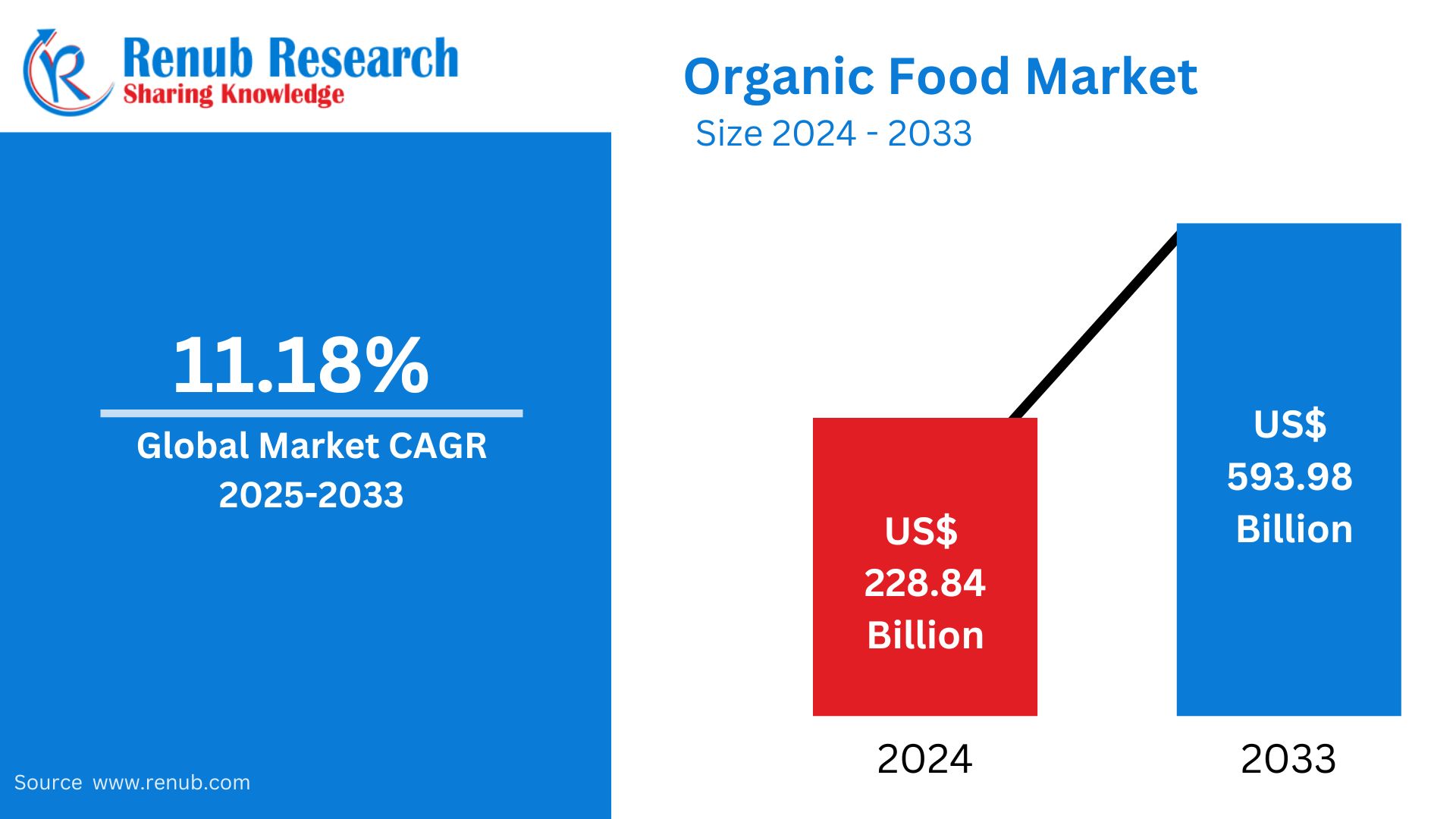

The global organic food market is expected to grow at a CAGR of 11.18% from 2025 to 2033. It is estimated to be valued at US$ 593.98 billion in 2033, compared to US$ 228.84 billion in 2024. The growth in the market is attributed to the increasing awareness of health and sustainability among consumers, increased demand for organic products, and a shift in dietary preferences towards natural, chemical-free foods, thereby propelling the market further.

The report Organic Food Market & Forecast covers by Product Type (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, and Others), Distribution Channel (Supermarkets/ Hypermarkets, Specialty Stores, Convenient Stores, Online Retail Stores), Region and Company Analysis 2025-2033.

Global Organic Food Market Overview

Organic food is that which is produced without the use of synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). These foods are produced with environmentally sustainable methods to improve soil health, water conservation, and pollution control. Organic farming also abstains from using artificial additives and preservatives in food processing. The goal of such a product is to remain as natural as possible.

Organic food consumption has increased significantly in the last few years. Increased consumer awareness of health and environmental issues has fueled the growth. People have increasingly turned to organic products because they believe them to be healthier, with fewer chemical residues, and richer in nutrients than conventionally grown foods. It transcends beyond an individual's health to embrace concerns about the environmental damage that conventional farming practices entail in relation to soil degradation and loss of biodiversity. Organic food products fall under several categories including fruits, vegetables, dairy products, meat products, and packaged foods. The world over, demand for organic foods continues to grow as increasing populations shift toward wholesome health-oriented lifestyles.

Global Organic Food Market Growth Drivers

Rising Health Consciousness

The main driver in the market is increasing awareness of health benefits associated with organic foods. Consumers are becoming increasingly conscious of the potential risks of synthetic pesticides, fertilizers, and GMOs in conventional food products. Organic foods, perceived as healthier and free from harmful chemicals, are being chosen to support better overall well-being, boost immunity, and reduce the risk of chronic diseases. As people become more health-conscious and take more preventive measures, the demand for organic products, including fruits, vegetables, dairy, and processed foods, will keep increasing and contribute to the growth of the market.

Increasing Environmental Concerns

Environmental concerns such as soil depletion, water pollution, and climate change are being discussed widely, and consumers are moving towards sustainable and eco-friendly food options. Organic farming focuses on sustainability and uses natural methods that conserve resources and protect ecosystems. This appeal to environmentally conscious consumers is fueling demand for organic food products. Further, concerns about the carbon footprint of conventional farming methods, which include excessive pesticide use and land degradation, are pushing people to choose organic as a more sustainable and planet-friendly alternative, supporting the growth of the organic food market.

Increasing Availability and Accessibility

The growing availability and accessibility of organic food products have greatly contributed to market growth. Supermarkets, grocery chains, and online platforms are expanding their organic food sections to cater to rising consumer demand. Additionally, many countries have introduced certification programs for organic farming, ensuring product authenticity and quality. With better distribution networks and increased consumer options, organic foods are now more accessible to a broader audience, including in developing regions. More expansion in organic food infrastructure will lead to the incorporation of organic options into diets of more people, thus pushing for an increase in market penetration.

Challenges in the Global Organic Food Market

Higher Organic Prices

One of the greatest challenges facing the global organic food market is the significantly higher prices of organic products in comparison to conventionally farmed variants. Organic farming is more labor-intensive, using specialized equipment, and mostly results in lower productivity due to which the cost of production rises. These costs are finally passed on to the customers, making organic food less affordable to many. Although demand for organic food is rising fast, the price barrier restricts the widespread adoption of these foods, especially in emerging markets or among price-conscious consumers.

Supply Chain and Certification Issues

The organic food market faces challenges in supply chain logistics and certification processes. Ensuring that products meet organic standards requires stringent regulatory compliance, which can be time-consuming and costly for producers. Additionally, organic food supply chains can be complex, with limited availability of raw materials in certain regions. This results in supply shortages, inconsistencies in product availability, and sometimes higher prices. It further complicates the issue that some countries do not have a standardized certification process, which creates confusion and mistrust among consumers.

Organic Food Market Overview by Regions

USA Organic Food Market

The US organic food market is growing rapidly due to increased consumer demand for healthier, environmentally friendly food options. Consumers are becoming more health-conscious and opting for organic products due to pesticide concerns, GMOs, and the long-term effects of conventional farming practices. Organic fruits, vegetables, dairy, and packaged goods are among the most popular categories. Expanding organic products in mainstream supermarkets, grocery chains, and online platforms has made organic food more accessible. Despite challenges such as higher prices and limited supply, the market is expected to grow, supported by strong consumer preferences for cleaner, more natural food choices. In October 2023 - With the introduction of its specialized branch, Dole Organics, and its new consumer brand, "DOLE® GO Organic!," the company hopes to take organics to the next level. Dole Organics is committed to revitalizing the organic fresh produce market through industry-wide cooperation, supply consolidation, maintaining product continuity and uniformity, and using best-in-class category management techniques in-store.

Denmark Organic Food Market

Denmark's organic food market is one of the most significant and developed in Europe, with a growing emphasis on sustainability, health, and environmental friendly practices. Danish consumers are very health-conscious, and they are increasingly demanding organic food because of pesticide, GMO, and food additives concerns. Organic food is widely spread throughout Denmark, from supermarkets to specialized organic stores, and even online platforms. It also leads in organic agriculture as a significant portion of its agricultural land is used for organic farming. Government policies supporting the organic farming sector and their emphasis on sustainability are supporting growth. According to data published by CSO Italy, in 2022, organic fruit and vegetables were bought in the quantity of 308,000 tonnes, the lowest in the last five years and compared to conventional, with an average price increase of +3 percent, rising to €2.22/kg in 2022.

India Organic Food Market

From 2019 to 2022, India exported over 1.9 million tons of organic products worth approximately US$ 2.48 billion. The United States alone accounted for about half of these exports, and the European Union accounted for around 37%. By 2025, the Indian organic food market is expected to grow to the tune of Rs 75,000 crores. This is expected to increase the annual income of farmers and benefit about 5 million farming families across about 6 million hectares of land. Moreover, this sector could create one million jobs in rural and semi-urban areas, which would provide valuable foreign exchange earnings of Rs 50,000 crores to India annually. Export and domestic markets are necessary for achieving this growth, which requires policy support. Farmers would be more likely to adapt to organic farming with high consumer demand for organic products.

Saudi Arabia Organic Food Market

Organic food in Saudi Arabia is gradually growing with steady growth in the market and increasing consumer awareness about health and wellness. In Saudi Arabia, as people are becoming healthy and mindful of the environment by going against the conventional way of farming, the demand for organic fruits, vegetables, dairy, and packaged products are on a rise. The trend of the consumers can also be attributed to government moves towards sustainability and food security. Organic food availability is growing, as most retail outlets, supermarkets, and online platforms have available organic products. Furthermore, an increased incidence of chronic diseases such as obesity and diabetes prompts people to opt for chemical-free natural food products. Recently, Saudi Arabia's Ministry of Environment, Water and Agriculture launched an initiative that sought to encourage investments in organic poultry production and increase the output in the sector to 5 percent in 2030.

Analysis of Organic Food Market Company

To satisfy the rising demand and organic food market share, companies are launching new products. Companies that are essential to the global organic food market include Danone S.A., General Mills Inc., Sprouts Farmers Market Inc., The Hain Celestial Group Inc., The Kroger Company, United Natural Foods Inc., Dole Food Company Inc., and Newman's Own.

In August 2024, Organic India, USA, supplement capsule and powder brand will introduce Organic Fiber Gummies and Ashwagandha Organic Gummies. These low-sugar, certified organic gummies are the company's first foray into the format.

In June 2024, the Gujarat Cooperative Milk Marketing Federation (GCCMF) will expand its "organic" product portfolio with the launch of Amul Sugar, Jaggery, and Tea.

TraceOrigin 360 and Humans of Organic were launched by Nature Bio Foods, one of the world's leading suppliers of organic food ingredients, in February 2024. The two innovative traceability initiatives connect consumers to the origins of organic food.

Organic Food Market Segmentation

Product Type

1. Organic Fruits and Vegetables

2. Organic Meat

3. Poultry and Dairy

4. Organic Processed Food

5. Organic Bread and Bakery

6. Organic Beverages

7. Organic Cereal and Food Grains

8. Others

Distribution Channel

1. Supermarkets/ Hypermarkets

2. Specialty Stores

3. Convenient Stores

4. Online Retail Stores

5. Others

Regional Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

1. Danone S.A.

2. General Mills Inc.

3. Sprouts Farmers Market Inc.

4. The Hain Celestial Group Inc.

5. The Kroger Company

6. United Natural Foods Inc.

7. Dole Food Company Inc.

8. Newman's Own

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered | 1. Danone S.A. 2. General Mills Inc. 3. Sprouts Farmers Market Inc. 4. The Hain Celestial Group Inc. 5. The Kroger Company 6. United Natural Foods Inc. 7. Dole Food Company Inc. 8. Newman's Own |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Organics Food Market

6. Global Organics Food Market Share Analysis

6.1 Product Type

6.2 Distribution Channel

6.3 By Country

7. Product Type

7.1 Fruits and Vegetables

7.2 Meat, Poultry and Dairy

7.3 Processed Food

7.4 Bread and Bakery

7.5 Beverages

7.6 Cereal and Food Grains

7.7 Others

8. Distribution Channel

8.1 Supermarkets/ Hypermarkets

8.2 Specialty Stores

8.3 Convenient Stores

8.4 Online Retail Stores

8.5 Others

9. By Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Danone S.A.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 General Mills Inc.

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Sprouts Farmers Market Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 The Hain Celestial Group Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 The Kroger Company

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 United Natural Foods Inc.

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Dole Food Company Inc.

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Newman's Own

12.8.1 Overview

12.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com