India Organic Food Market Share Analysis and Size, Key Player, Growth Trends and Forecast Report 2025-2033

Buy NowIndia Organic Food Market Size and Forecast 2025-2033

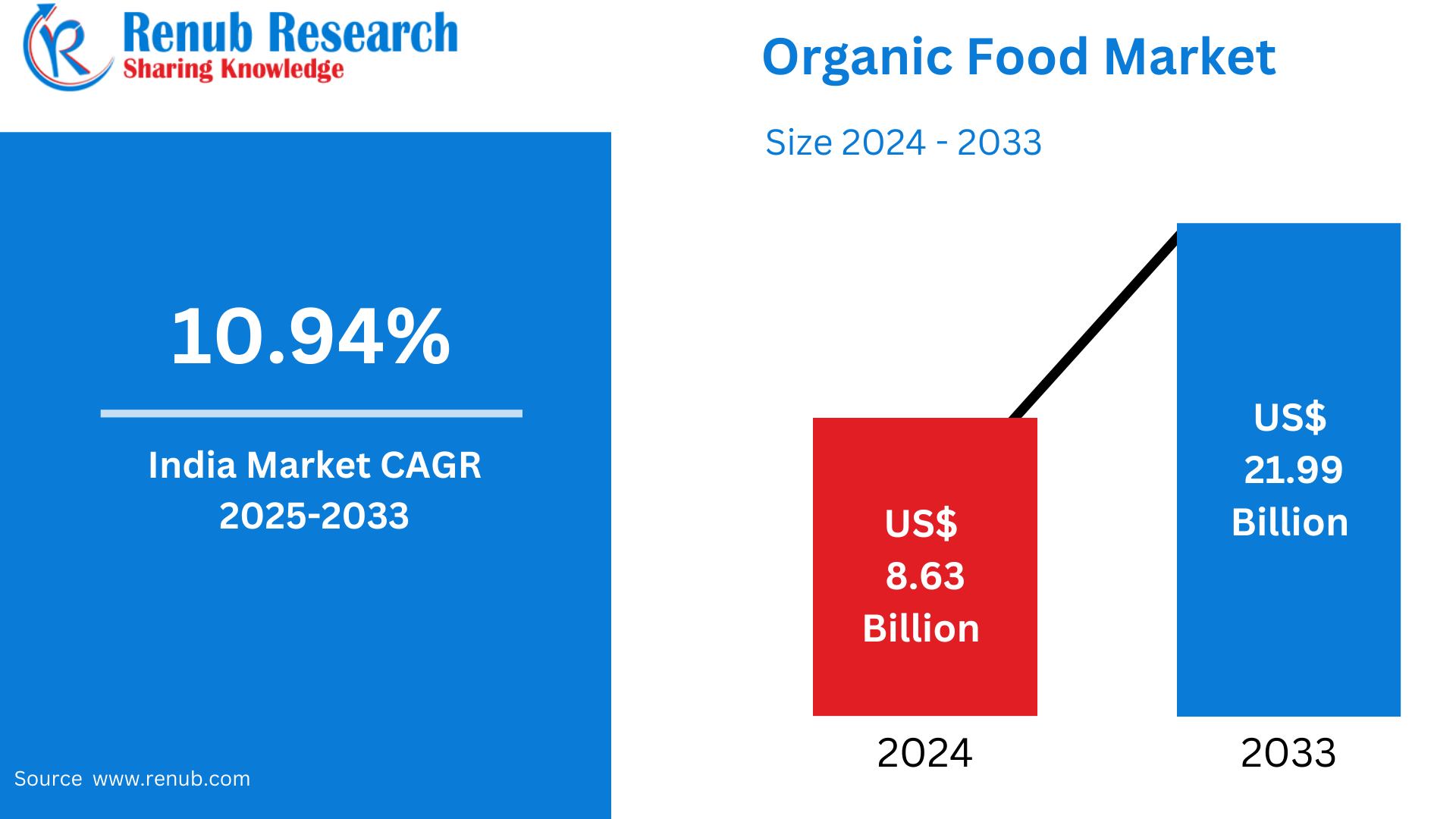

India Organic Food Market is expected to reach US$ 21.99 billion by 2033 from US$ 8.63 billion in 2024, with a CAGR of 10.94% from 2025 to 2033. Growing awareness of the health benefits of organic food products, the health risks associated with chemical pesticides and fertilizers, and the increasing investments made by Indian corporate firms in agribusinesses, agritech, and organic farming are some of the main factors propelling the organic food market in India.

India Organic Food Market Report by Cashew Production Market - Product Type (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, Others), Distribution Channel (Supermarkets/ Hypermarkets, Specialty Stores, Convenient Stores, Online Retail Stores, Others), Application (Bakery and Confectionery, Ready-to-Eat Food Products, Breakfast Cereals, Others), Region (East, West, North, South) and Company Analysis, 2025-2033.

India Organic Food Industry Overview

India's organic food market has grown significantly in recent years due to rising consumer demand for sustainable and healthier food alternatives. The demand for organic goods, such as fruits, vegetables, dairy, grains, and packaged meals, has increased as customers grow more ecologically concerned and health conscious. With programs like the National Program for Organic Production (NPOP) and subsidies for organic farming, the Indian government has helped facilitate this shift. The industry has grown as a result of farmers being pushed to use organic methods. Consumption of organic food has increased nationwide as a result of urbanization, the growing middle class, and better distribution methods like e-commerce.

India is a major exporter of organic food worldwide in addition to being a developing consumer for organic food. The wide range of commodities grown organically in the nation, including tea, oilseeds, and spices, are becoming more and more well-known due to their high demand worldwide. Strict certifications and conformity to international norms have supported organic product exports. Notwithstanding obstacles including increased production costs and the requirement for improved certification procedures, India's organic food market is expected to expand further and present substantial prospects for growers, producers, and enterprises. India's organic food industry is poised to become a major player in the global organic product market as consumer tastes shift toward sustainable living.

Additionally, the Indian government is promoting organic farming by providing incentives to growers of organic food products through the National Horticulture Mission (NHM) at a rate of Rs. 10,000/-per hectare, up to a maximum area of four hectares per beneficiary, and organic farming certification at a rate of Rs. 5.00 lakh for a group of farmers in India that cover 50 hectares. Conventional farming methods have had considerably more detrimental effects than beneficial ones. Along with pesticide-resistant pests, declining soil fertility, widespread human illnesses, costly cleanups, and dead zones, traditional farming also has the unintended consequence of contaminating ocean water. Long-term market growth is anticipated to benefit from supply trade laws and regulatory support for biological farming.

Growth Drivers for the India Organic Food Market

Rural to Urban Transition

India's rural-to-urban migration has greatly increased demand for high-end organic food items. Due to an urban lifestyle that prioritizes sustainability and well-being, there is a growing need for high-quality, healthier food alternatives as more people relocate to cities. Organic food is more likely to be purchased by urban customers, who are often more health-conscious and prepared to spend money on high-end goods. As a result of this change, organic products are now more widely available because to the expansion of specialty organic shops, supermarkets, and internet marketplaces. Furthermore, a greater percentage of educated and well-off customers reside in metropolitan areas, which fuels demand for organic food as a component of a sustainable, healthful lifestyle.

Global Export Opportunities

Tea, spices, oilseeds, and other organic food items from India are becoming more well-known abroad, opening up new export markets. The nation's wide range of organic products satisfy the rising demand for natural, chemical-free goods across the world. India is well-known for its high-quality organic tea, and its spices, such as cumin and turmeric, are prized in international markets for their health benefits and purity. India's standing in the worldwide organic market has improved as a result of the government's promotion of organic cultivation and international certification. Trade agreements, international trade shows, and rising global consumer awareness all contribute to increased export potential. India's economy is strengthened by this rising demand, which also reaffirms its position as a major participant in the world market for organic foods.

Better Certification and Standards

Strict international certifications and regulations that improve marketability and customer trust are supporting India's rising demand for organic food. Customers may be sure that the items they are buying adhere to established organic agricultural and production standards when they see certifications like India Organic, USDA Organic, and EU Organic. Gaining access to more domestic and foreign markets requires these qualifications. By following these guidelines, the items are guaranteed to be devoid of dangerous chemicals, pesticides, and genetically modified organisms (GMOs). Both domestic consumption and exports of certified organic products from India are being driven by consumers' growing desire for certified organic products as knowledge of the value of organic food rises.

Challenges in the India Organic Food Market

Pest and Disease Management

Since synthetic pesticides are not used in organic farming by design, managing pests and diseases is extremely difficult. Organic farmers are forced to adopt natural techniques like crop rotation, companion planting, and the application of biological control agents in the absence of these chemical interventions. However, particularly during insect or disease outbreaks, these methods frequently prove less successful than traditional pesticides. Profitability may be impacted by lower yields, crop losses, or more frequent infestations for organic farms. Costs may rise even more if farmers are forced to spend money on other pest control methods. This difficulty managing pests might hinder market expansion by making organic farming less dependable and discouraging some farmers from using organic techniques.

Inconsistent Quality and Standards

The absence of a clear regulatory structure in some areas, which results in uneven quality and standards, is one of the main issues facing the Indian organic food sector. Although there are certifying organizations such as the National Program for Organic Production (NPOP), not all areas or farmers can regularly meet these requirements. Some producers might not strictly adhere to organic methods, which could result in differences in the quality of organic products if regulation is lax. Confusion in the marketplace and a decline in customer trust might result from this discrepancy. Consequently, customers may be dubious about the genuineness of organic products, impeding market expansion and the legitimacy of India's organic food industry.

East India Organic Food Market

Growing health consciousness and a move toward sustainable eating habits are fueling the organic food market's slow but steady expansion in East India. Organic farming is becoming more popular in states like West Bengal, Odisha, and Bihar as a result of government initiatives like the Paramparagat Krishi Vikas Yojana (PKVY), which promotes organic farming. As urban populations become more health aware, there is an increasing demand for organic items, such as vegetables, grains, tea, and spices. However, the market confronts obstacles like as uneven supply, distribution problems, and restricted access to organic certification, particularly in rural regions. With more farmers adopting organic methods and more customers looking for healthier, chemical-free food alternatives, the East India organic food industry is growing in spite of these challenges.

West India Organic Food Market

West India's organic food industry, which includes states like Maharashtra, Gujarat, and Goa, is expanding quickly due to rising urbanization and health consciousness. With growing disposable incomes and a trend toward better lives, cities like Mumbai, Pune, and Ahmedabad are important hubs for the consumption of organic food. Fruits, vegetables, dairy products, and processed meals are all in great demand as organic items. These items are becoming more widely available to urban customers through supermarkets, specialized shops, and internet platforms. Government programs encouraging organic farming and better farming methods have also helped the industry expand. The West India organic food market is still a vibrant and attractive area of India's organic food sector, despite obstacles including price sensitivity, supply chain complexity, and certification concerns.

India Organic Food Market Segments

Product Type

- Organic Fruits and Vegetables

- Organic Meat

- Poultry and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Beverages

- Organic Cereal and Food Grains

- Others

Distribution Channel

- Supermarkets/ Hypermarkets

- Specialty Stores

- Convenient Stores

- Online Retail Stores

- Others

Application

- Bakery and Confectionery

- Ready-to-Eat Food Products

- Breakfast Cereals

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Key Person

- Overview

- Recent development

- Revenue Analysis

Company Analysis:

- Suminter India Organics Private Limited

- Nature Bio-Foods Limited

- Organic India Private Limited

- Sresta Natural Bioproducts Pvt.Ltd

- Phalada Agro Research Foundations Pvt.Ltd

- Mehrotra Consumer Products Pvt.Ltd

- Morarka Organic Foods Pvt.Ltd

- Nature Pearls Pvt Ltd

- Conscious Food Private Limited

- Nourish Organics Foods Pvt Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product Type, By Distribution Channel, By Application and By Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Organic Food Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Product Type

6.2 By Distribution Channel

6.3 By Application

6.4 By Region

7. Product Type

7.1 Organic Fruits and Vegetables

7.2 Organic Meat

7.3 Poultry and Dairy

7.4 Organic Processed Food

7.5 Organic Bread and Bakery

7.6 Organic Beverages

7.7 Organic Cereal and Food Grains

7.8 Others

8. Distribution Channel

8.1 Supermarkets/ Hypermarkets

8.2 Specialty Stores

8.3 Convenient Stores

8.4 Online Retail Stores

8.5 Others

9. Application

9.1 Bakery and Confectionery

9.2 Ready-to-Eat Food Products

9.3 Breakfast Cereals

9.4 Others

10. Region

10.1 East

10.2 West

10.3 North

10.4 South

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Suminter India Organics Private Limited

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development

13.1.4 Revenue

13.2 Nature Bio-Foods Limited

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development

13.2.4 Revenue

13.3 Organic India Private Limited

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development

13.3.4 Revenue

13.4 Sresta Natural Bioproducts Pvt.Ltd

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development

13.4.4 Revenue

13.5 Phalada Agro Research Foundations Pvt.Ltd

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development

13.5.4 Revenue

13.6 Mehrotra Consumer Products Pvt.Ltd

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development

13.6.4 Revenue

13.7 Morarka Organic Foods Pvt.Ltd

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development

13.7.4 Revenue

13.8 Nature Pearls Pvt Ltd

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development

13.8.4 Revenue

13.9 Conscious Food Private Limited

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development

13.9.4 Revenue

13.10 Nourish Organics Foods Pvt Ltd.

13.10.1 Overview

13.10.2 Key Persons

13.10.3 Recent Development

13.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com