Oatmeal Market Size, Share & Trends Analysis – Global Forecast 2025-2033

Buy NowGlobal Oatmeal Market Size and Forecast 2025-2033

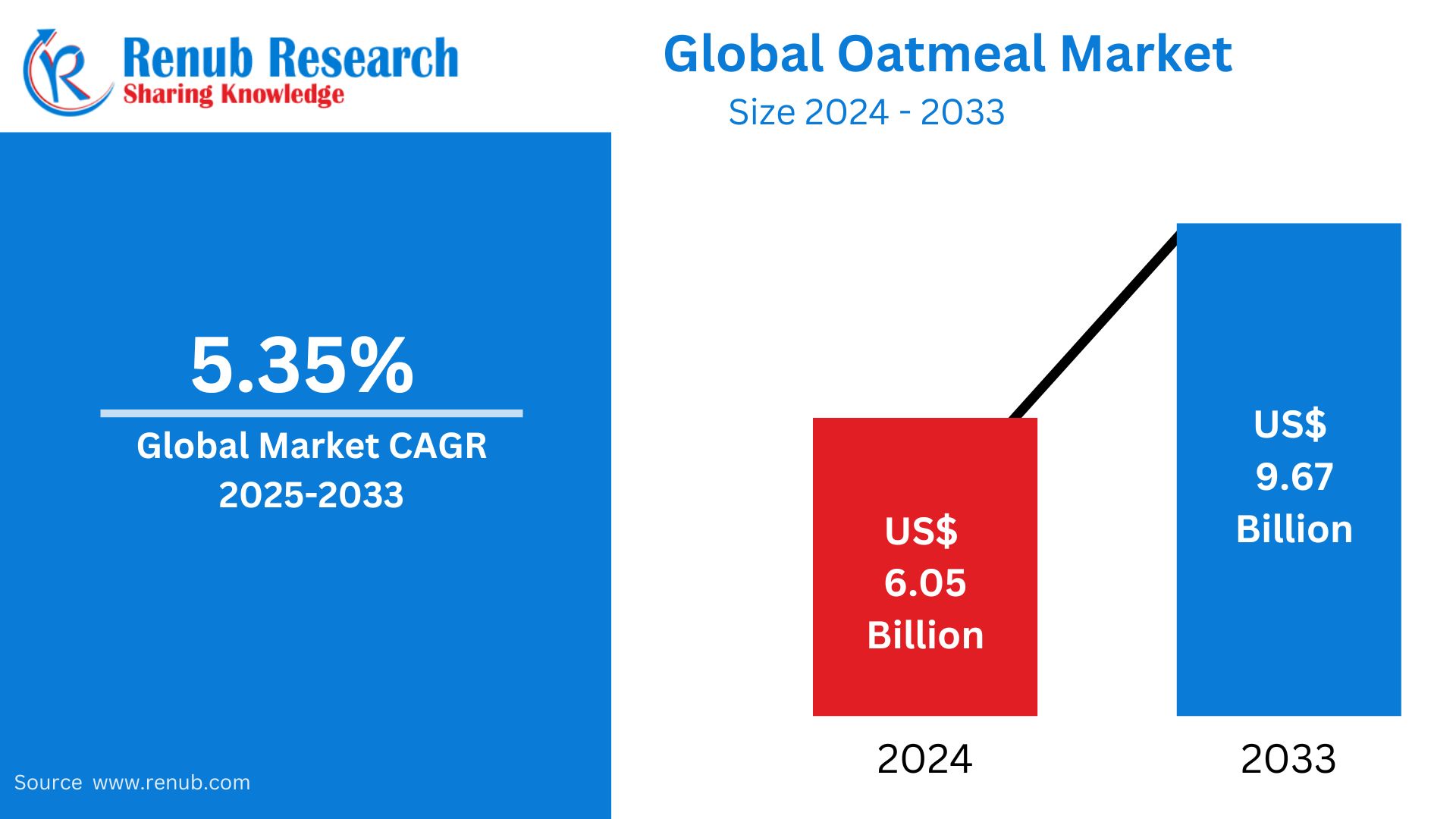

Oatmeal Market is expected to reach US$ 9.67 billion 2033 from US$ 6.05 billion in 2024, with a CAGR of 5.35% from 2025 to 2033. The market for oatmeal is expected to develop due to factors such as growing health consciousness, rising demand for quick and wholesome breakfast options, increased knowledge of oatmeal's heart-healthy advantages, and growing availability in emerging economies.

Oatmeal Market Global Report by Type (Instant Rolled Oat, Whole Oat Grain, Regular Oats, Steel Cut Oats, Others), Form (Conventional, Organic), Distribution Channel (Hyper Market, Super Market, Specialty Stores, Convenience Stores, Independent Retailers, Others), Countries and Company Analysis 2025-2033.

Oatmeal Market Overview

Made from ground oats, oatmeal is a common breakfast item that is usually eaten hot as a porridge. Because of its high fiber content, especially beta-glucan, which lowers cholesterol and promotes heart health, it is well known for its health advantages. Additionally rich in vitamins, minerals, and antioxidants, oatmeal supports digestive health and gives you sustained energy. It can be personalized with fruits, nuts, seeds, or sweeteners and comes in a variety of forms, including steel-cut, rolled, and instant oats. Growing health consciousness and a desire for wholesome, quick meal options are the main drivers of oatmeal's rising appeal.

Since oatmeal is high in fiber, vitamins, and minerals that promote digestion, weight management, and heart health, rising consumer health consciousness is fueling the market's expansion. The growing need for quick and wholesome breakfast options, particularly among families and working professionals, propels market expansion. The growth of clean-label products and plant-based diets is also boosting oatmeal's appeal. Because of its many uses and health advantages, oatmeal is becoming more and more popular as customers look for natural, healthful foods.

Key Drivers of Oatmeal Market Growth

Rising Health Consciousness

One of the main factors propelling the oatmeal market's expansion is growing health consciousness. Oatmeal has grown in popularity because of its many health advantages as people become more conscious of the advantages of a balanced diet and the significance of whole, nutrient-dense meals. Oatmeal, which is high in fiber, antioxidants, and vital vitamins, helps with digestion, weight control, and heart health. Additionally, it is regarded as a flexible, low-calorie lunch choice that is simple to alter with fruits, seeds, and nuts. Oatmeal is becoming more and more popular as a wholesome and practical breakfast option as the demand for cleaner, healthier foods keeps growing.

Plant-Based Diets

One of the main factors propelling the oatmeal market's expansion is plant-based diets. Oatmeal is a great fit for the plant-based, vegan, and vegetarian diets that are becoming more and more popular. It is a healthy, plant-based cuisine that is free of animal products and offers vital nutrients like fiber, vitamins, and minerals. Because of its adaptability, oatmeal may be used in a wide range of plant-based recipes, including smoothies, baked products, and breakfast bowls. Oatmeal's popularity among health-conscious groups around the world is being fueled by the growing desire for plant-based alternatives and its gaining recognition as a wholesome, ethical, and sustainable option.

In Aug 2022, Kreatures of Habit, a well-known functional food firm, created the Protagonist, a plant-based, gluten-free oatmeal with a variety of nutrients and compositions. Three additional flavors—chocolate, blueberry banana, and vanilla—should also be offered. Each of the seven single-serve packages costs $34.99.

New Product Launch

As businesses consistently launch new types and formulations to satisfy changing consumer tastes, product innovation is a key growth driver in the oatmeal industry. To accommodate a variety of palates, innovations include flavored oatmeals, such as chocolate, berry, or cinnamon. Additionally, oatmeal alternatives that are organic, gluten-free, and fortified are becoming more popular because they appeal to people who are health-conscious and follow particular diets. Convenience for hectic lives is increased with single-serve packs, quick oats, and on-the-go choices. Oatmeal can now accommodate contemporary trends like plant-based diets and clean-label requirements thanks to these advancements, which increases its customer base and propels the market's expansion.

In Jan 2022, According to Path of Life, two varieties of frozen steel-cut oats debuted. Organic apple cinnamon steel-cut oatmeal and organic berry steel-cut oatmeal are the two items.

Challenges in the Oatmeal Market

The presence of alternatives could impede market expansion

The availability of alternatives like quinoa, buckwheat, brown rice, and others with comparable nutritional qualities is impeding the market's growth, despite the fact that consumers' intake of oats has increased due to its advantageous qualities. There are now more nutritious breakfast options available due to the growing popularity of quinoa and buckwheat as sources of fiber and protein and as a gluten-free substitute for whole grains. Additionally, the lengthier cooking time of oats combined with the abundance of alternatives available at handy stores in the ready-to-eat food segment may serve as barriers to market expansion.

Price Volatility

In the oatmeal market, price volatility is a major problem. Price changes can result from oats' sensitivity to environmental factors like weather, crop yields, and disruptions in the worldwide supply chain. While an abundance of crops may result in cheaper costs, poor harvests, droughts, or floods can restrict supply and raise prices. Both producers and consumers are impacted by these price swings, which make it challenging for manufacturers to maintain steady profit margins and prices while also possibly affecting consumer purchasing decisions.

Oatmeal Market Overview by Regions

The market for oatmeal is expanding in many different geographical areas. The greatest demand for healthy breakfast options is found in North America and Europe. Growth is being driven by dietary changes and growing health consciousness in Asia-Pacific, where nations like China and India are embracing oatmeal as a wholesome substitute. Oatmeal is also becoming more popular in Latin America as a result of shifting consumer preferences and an increase in the need for quick, healthful meals.

United States Oatmeal Market

The market for oatmeal in the US is thriving due to rising consumer demand for quick and healthful breakfast options. Oatmeal's high fiber content, antioxidants, and other nutrients make it a popular choice for people who are health-conscious. The growing demand for plant-based and clean-label products is another factor driving the market. Busy consumers are drawn to new flavor innovations, gluten-free options, and handy packaging, like instant and on-the-go variants. The oatmeal market in the United States is anticipated to increase steadily as long as these trends persist.

Germany Oatmeal Market

The market for oatmeal in Germany is expanding due to the growing desire for wholesome, nutrient-dense breakfast options. The advantages of oatmeal, such as its high fiber content and heart-healthy qualities, are becoming more well-known as people grow more health-conscious. Oatmeal usage is further increased by the popularity of clean-label products and plant-based diets. Furthermore, new product developments including flavored, gluten-free, and organic oatmeal types are drawing in a wide range of customers. The market for oatmeal in Germany is anticipated to continue growing as a result of these factors.

India Oatmeal Market

As customers' awareness of health issues grows, the oatmeal market in India is growing quickly. Demand is being driven by growing knowledge of oatmeal's nutritional advantages, including its high fiber content and heart-healthy properties. The industry is growing as a result of urbanization, hectic lives, and a move toward quick, prepared breakfast options. Additionally, oatmeal consumption is increasing due to the popularity of plant-based diets. Innovations like as organic, gluten-free, and flavored oats are drawing in a wide range of customers. The market for oatmeal in India is expected to rise in the upcoming years due to rising disposable income and the need for wholesome, fast meals.

Saudi Arabia Oatmeal Market

The market for oatmeal in Saudi Arabia is expanding due to rising consumer demand for quick and healthful breakfast options. Oatmeal's nutritional advantages—such as its high fiber content and heart-healthy role—are becoming more widely acknowledged as people grow more health conscious. The need for quick, ready-to-eat meals is also being fueled by the growing urbanization and hectic lifestyles of people. Oatmeal consumption in the area is further supported by the rising acceptance of plant-based diets and clean-label products, which helps to sustain the market's steady expansion.

Oatmeal Market Segmentation by Type, Distribution Channel, and Region

Type

- Instant Rolled Oat

- Whole Oat Grain

- Regular Oats

- Steel Cut Oats

- Others

Form

- Conventional

- Organic

Distribution Channel

- Hyper Market

- Super Market

- Specialty Stores

- Convenience Stores

- Independent Retailers

- Others

Regional Insights: North America, Europe, Asia Pacific

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- PepsiCo, Inc.

- Nestlé S.A.

- The Kellogg Company

- The Hain Celestial Group, Inc.

- Marico Limited

- The Unilever Group (Pukka Herbs)

- Post Holdings Inc.

- General Mills Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Form, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Oatmeal Market

6. Market Share Analysis

6.1 By Type

6.2 By Form

6.3 By Distribution Channel

6.4 By Countries

7. Type

7.1 Instant Rolled Oat

7.2 Whole Oat Grain

7.3 Regular Oats

7.4 Steel Cut Oats

7.5 Others

8. Form

8.1 Conventional

8.2 Organic

9. Distribution Channel

9.1 Hyper Market

9.2 Super Market

9.3 Specialty Stores

9.4 Convenience Stores

9.5 Independent Retailers

9.6 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherland

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 PepsiCo, Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Nestlé S.A.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 The Kellogg Company

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 The Hain Celestial Group, Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Marico Limited

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 The Unilever Group (Pukka Herbs)

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Post Holdings Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 General Mills Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com