Global Vegetable Seeds Market Size, Share & Forecast 2025–2033

Buy NowVegetable Seeds Market Size and Forecast 2025-2033

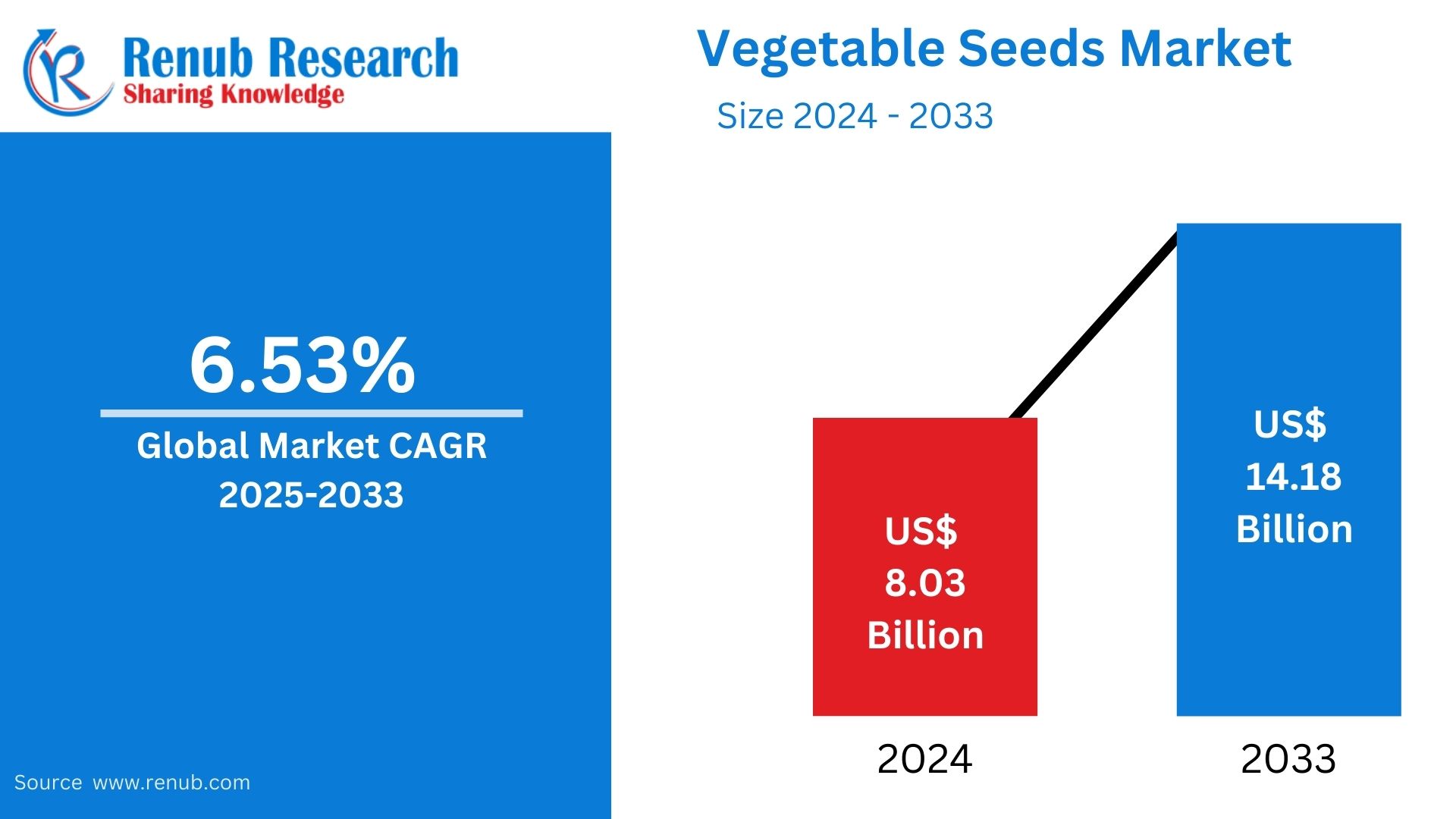

The vegetable seeds market was valued at US$ 8.03 billion in 2024 and is expected to reach US$ 14.18 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.53% from 2025 to 2033. It is driven by the growing demand for high-quality seeds, advancements in agricultural technology, and increased awareness among farmers about the benefits of hybrid and genetically improved vegetable seeds.

Vegetable Seeds Industry Outlooks

Vegetable seed are the reproductive units of plants used to grow various vegetables, such as tomatoes, cucumbers, carrots, and peppers. These seeds come in different forms, including hybrid, open-pollinated, and genetically modified (GM) varieties, each catering to specific agricultural needs. High-quality seeds determine crop yield, disease resistance, and nutritional value.

They are necessary for both commercial agriculture and home gardening. Farmers and horticulturists choose seeds according to soil compatibility, climate, and yield. Hybrid seeds are widely consumed in commercial farming because they produce higher yields and resist pests. Organic and open-pollinated seeds are preferred for sustainable and eco-friendly farming practices. Global consumption trends are influenced by the increased population, increased demand for fresh and processed vegetables, and increased health and nutrition awareness. Vegetable seed consumption is likely to increase as food security and agricultural sustainability become important issues.

Driver in the Vegetable Seeds Market

Growing Demand for High-Yielding and Disease Resistant Crops

Farming and producing entities have a need for seeds which will provide higher yields and better produce quality in order to accommodate the increased demand for food. Hybrid vegetable seeds are in great demand as they resist diseases, pests, and environmental stress, thus reducing crop losses. These seeds also give consistent performance, making them a reliable choice for large-scale farming. Growth in the global population and urbanization further drive the need for high-yield seeds to maintain food security, fueling growth in this market. In April 2023, the University of California announced five new strawberry varieties that are resistant to soilborne disease and offer a high yield, along with improved fruit quality.

Advancements in Technology in Seed Production

Vegetable seed quality has significantly improved because of biotechnological innovation, such as genetic modification and CRISPR gene editing. These technologies enhance characteristics such as drought tolerance, pest resistance, and nutritional content to accommodate various types of farming conditions. The new seeds' longevity and germination are enhanced through improvements in seed coating and treatment methods. These advancements support sustainable farming and decrease reliance on chemical inputs, further increasing adoption and driving growth in the market. In September 2024, India released 109 new seed varieties developed by the Indian Council of Agricultural Research (ICAR) to enhance agricultural productivity, resilience to climate change, and food security. This is an effort by the government to prepare farmers for the current agricultural challenges.

Growing Demand for Organic and Non-GMO Farming

Organic farming has gained popularity, making the demand for non-GMO and open-pollinated seeds increase. Consumers buy organic produce because of health reasons, which makes farmers consider the environment-friendly cultivation processes. Governments and NGOs have encouraged organic farming through subsidies and awareness programs, thereby creating a conducive environment for the vegetable seed market. This trend is in line with the increasing consumer interest in sustainability, which is driving the growth of the market. In 2022, organic farming was practiced in 188 countries, which account for more than 96 million hectares of land. The area has increased by more than 20 million hectares over the previous year.

Problems in Vegetable Seeds Market

Hybrid and Genetically Modified Seeds are Too Expensive

While hybrid and genetically modified (GM) seeds have better advantages such as higher yields and resistance to diseases, they are expensive compared to the traditional ones. This high initial cost is a challenge to the small-scale and resource-limited farmers, especially in the developing regions. Moreover, these seeds often require specific inputs for farming, such as fertilizers and irrigation systems, which increase the costs of production. This financial barrier limits the adoption of advanced seeds, slowing market growth and creating disparities in agricultural productivity across different regions.

Regulatory and Environmental Concerns

The approval, production, and distribution of genetically modified seeds are strictly regulated in the vegetable seeds industry. The processes can be lengthy and expensive, thus delaying innovation and market entry for new products. Public opposition also arises from the potential environmental effects of GM seeds, including biodiversity loss and cross-contamination with non-GM crops. These factors make it uncertain for seed producers and limit the adoption of advanced technologies, especially in areas with strict policies and a skeptical consumer base.

Canada Vegetable Seeds Market

The demand for fresh, locally produced produce and sustainable farming is fueling the growth of the market for vegetable seed in Canada. Hybrid and disease-resistant seeds are also being embraced due to the high yield and adaptability in diverse Canadian climatic conditions. Consumers are increasingly demanding healthier and environmental-friendly options as organic and non-GMO seeds gather popularity. Government initiatives supporting agricultural innovation and advanced farming technologies, such as greenhouse cultivation, further propel the market. Canada’s emphasis on food security and sustainable agriculture makes it a key market for vegetable seed development. August 2024, Syngenta announces its largest NK Seeds corn portfolio in over 10 years, adding eight new hybrids for the 2025 growing season. The company invests around $1.4 billion every year in R&D. In total, the company is supported by 6,500 employees globally.

Denmark Vegetable Seeds Market

Denmark's vegetable seeds market is very concerned with eco-friendly and organic farming techniques. Danish farmers emphasize on protecting the environment, hence require high-quality, open-pollinated, and organic seeds that support green farming standards. The increasing demand for fresh, locally grown vegetables has fueled the use of high-quality seeds, which yield better and are resistant to pests. The government also promotes organic farming and regulates the use of GMOs, thus propelling the market. Denmark is taking its steps to boost sustainability through special programs such as "Særpuljer" or, in other words, "Special Pools," announced in 2024, which focuses on funding specific projects with innovation and sustainability solutions in areas like biosolutions, climate-friendly food, and reducing food waste.

Chinese Vegetable Seeds Market

As one of the largest global vegetable seeds markets, this market in China is motivated by a huge population and high demand for fresh as well as processed vegetables. The country heavily relies on hybrid seeds because they produce higher yields, have resistance to pests, and are highly adaptable to varied growing conditions. Technological advancement through genetic research and precision farming improves seed quality and productivity. Government policies aimed at agricultural modernization and subsidies on improved seed varieties contribute to market growth. The increasing consumer awareness of nutrition and food safety has driven up the demand for high-quality organic vegetable seeds in China. China is one of the world's major vegetable-producing countries, with a majority of vegetables being grown with the largest area under cultivation in the world. In 2022, the area under cultivation of vegetables in the country was 22.7 million hectares, which was up by 3.9% between 2017 and 2022.

Brazil Vegetable Seeds Market

The market in Brazil is growing steadily, driven by the increasing demand for fresh and processed vegetables. The country's favorable climatic conditions and vast agricultural land make it a significant player in vegetable production. Hybrid seeds are being increasingly used by farmers because of their higher yields and resistance to pests and diseases. Increasing urbanization and a move towards healthier diets have also increased demand for diverse vegetable varieties. The government's initiatives in support of advanced agricultural technologies and sustainable farming practices further drive market growth, making Brazil a significant contributor to the global vegetable seeds industry. The government approved a record R$ 475.5 billion (US$ 88.2 billion) in the 2024/2025 Crop Plan, the primary public policy for agricultural credit.

Market Segmentation

Type – Market breakup in 2 viewpoints:

1. Open Pollinated Varities

2. Hybrid

Crop Type – Market breakup in 6 viewpoints:

1. Solanaceae

2. Root & Bulb

3. Cucurbut

4. Brassica

5. Leafy

6. Others

Cultivation Method – Market breakup in 2 viewpoints:

1. Protected

2. Open Field

Regional Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherland

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- BASF A.G.

- Syngenta AG

- Groupe Limagrain

- Bayer AG

- Sakata Seeds Corporation

- UPL Lmt.

- Gansu Dunhuang Seeds Co., Ltd.

- JK Agri Genetics Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Crop Type, Cultivation Method, and Countries |

| Countries Covered |

|

| Companies Covered | 1. BASF A.G. 2. Syngenta AG 3. Groupe Limagrain 4. Bayer AG 5. Sakata Seeds Corporation 6. UPL Lmt. 7. Gansu Dunhuang Seeds Co., Ltd. 8. JK Agri Genetics Ltd. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Vegetable Seeds Market

6. Market Share

6.1 By Type

6.2 By Crop Type

6.3 By Cultivation Method

6.4 Country

7. Type

7.1 Open Pollinated Varities

7.2 Hybrid

8. Crop Type

8.1 Solanaceae

8.2 Root & Bulb

8.3 Cucurbut

8.4 Brassica

8.5 Leafy

8.6 Others

9. Cultivation Method

9.1 Protected

9.2 Open Field

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherland

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 BASF A.G.

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue Analysis

13.2 Syngenta AG

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue Analysis

13.3 Groupe Limagrain

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue Analysis

13.4 Bayer AG

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue Analysis

13.5 Sakata Seed Corporation

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue Analysis

13.6 UPL Lmt.

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue Analysis

13.7 Gansu Dunhuang Seed Co., Ltd.

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue Analysis

13.8 JK Agri Genetics Ltd.

13.8.1 Overview

13.8.2 Recent Development

13.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com