United States Chocolate Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Chocolate Market Size

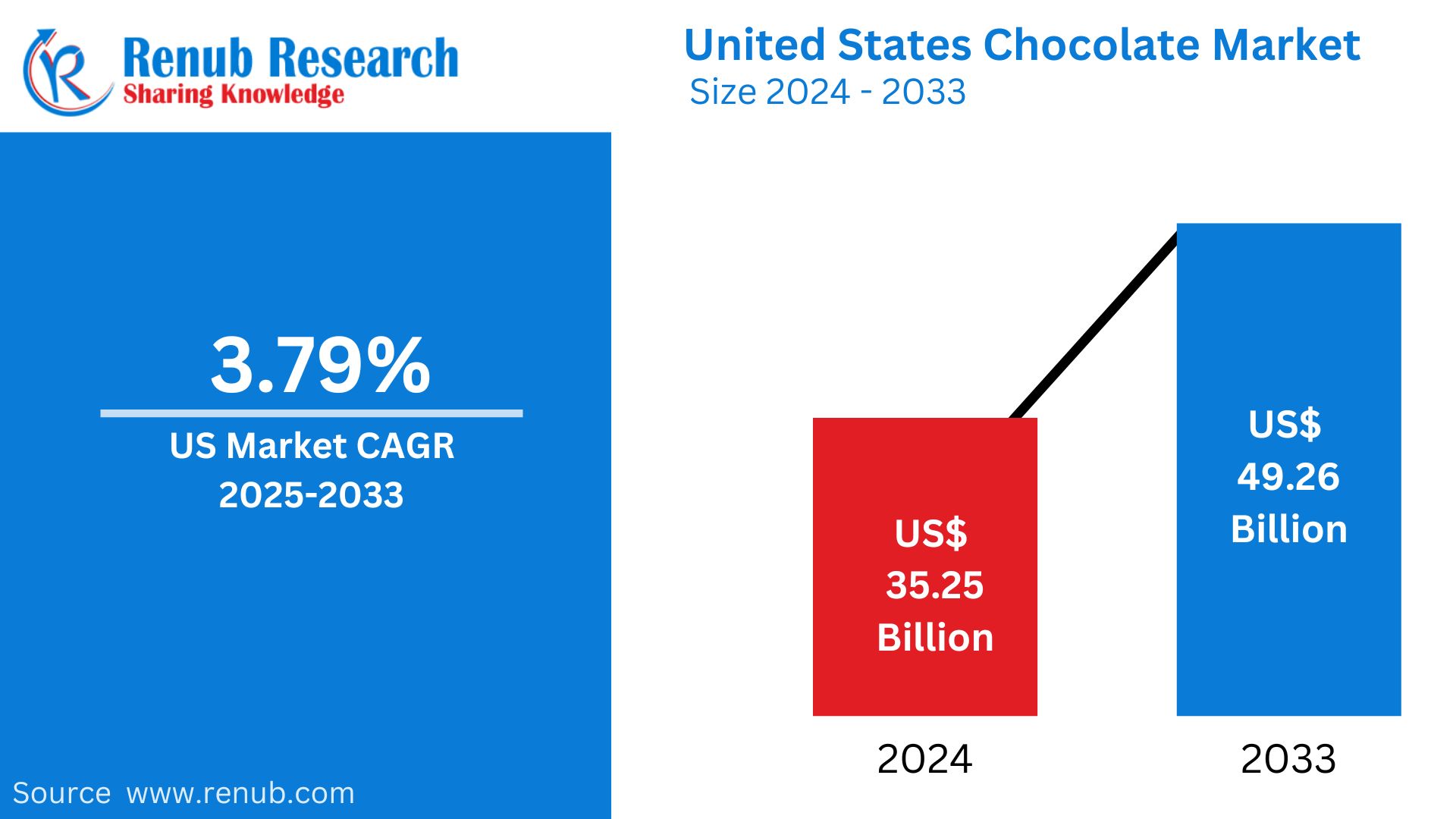

United States chocolate market was US$ 35.25 billion in 2024. As per Renub Research, the market is expected to rise with a CAGR of 3.79% during 2025-2033 and would reach US$ 49.26 billion in 2033. Growth in the market is observed due to increased demand of premium chocolates, healthier chocolate, and rising usage of chocolates as gifts and treats.

The report United States Chocolate Market & Forecast covers by Type (Dark Chocolate and Milk/White Chocolate), Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channel), States and Company Analysis 2024-2033.

United States Chocolate Market Outlooks

Chocolate is a sweet, usually brown food product derived from cocoa beans, sugar, and sometimes milk or other additives to make it savorier and more palatable. It comes in various forms, including bars, truffles, beverages, and coatings. The major types of chocolate are dark, milk, and white, depending on the level of cocoa and other added ingredients.

Chocolate is an extremely popular treat in the USA that is enjoyed in many different forms. It is widely used in desserts, baked goods, candy bars, and snacks. In fact, the convenience factor of chocolate consumption, taste preference for it, and the growing demand for a healthier or premium chocolate option lead chocolate consumption in the United States. Dark chocolate with the higher content of cocoa increases its popularity because it includes antioxidants and less sugar. The chocolate market in the United States experiences a surge in consumption around holidays such as Valentine's Day, Halloween, and Christmas, during which chocolate is most often purchased as a gift. The interest in organic, fair-trade, and sustainably sourced chocolate also continues to grow, which mirrors the overall consumer interest.

United States Chocolate Market Trends

Increasing attraction to Luxury Chocolates

The United States chocolate market is dominated by impulse purchases and increased love for luxurious chocolates. Strong visual attractions in promotion and attractive in-store display significantly influence impulse purchases, increasing revenues. More customers seek hedonistic experiences and enjoy more premium and artisanal brands. The phenomenon also arises from the sensory gratification and the reward feeling about chocolate. The super premium chocolate brands include Lindt, Ghirardelli, and Ferrero Rocher, catering to specialty, high-value product requirements. Premium chocolate is a mass-market favorite, as 67% of consumers say they buy it sometimes and nearly 30% say they prefer it over mainstream or lower-quality versions, according to the National Confectioners Association.

Seasonal chocolate and candy enjoy strong consumer confidence

Chocolate sales in the United States increase dramatically during festive seasons such as Halloween and Christmas. This is a significant increase that will help revitalize the U.S. chocolate market as it builds consumer interest and drives total sales. Chocolates are often given as gifts and consumed as seasonal treats during these events. The National Confectioners Association, NCA, indicates that Valentine's Day, Easter, Halloween, and winter holidays comprise sixty-four percent of revenue from chocolate and candy sales. The association of chocolate with indulgence and tradition for these events promotes consumption, causing sales to increase for makers and retailers.

New Flavours and Ingredients Innovation

United States chocolatiers are innovating new flavours and ingredients in response to changing consumer tastes. In this regard, the consumers' desire for unique flavors is what has led to this change. Manufacturers are experimenting with various substances, including exotic fruits, spices, nuts, and savory elements, to come up with appealing chocolate varieties. For instance, Cacao Barry introduced WholeFruit chocolate in 2021, which has been very well received by artisans. They are catering to modern tastes by incorporating cutting-edge ingredients such as matcha, sea salt, and superfoods like quinoa and goji berries. With competition rising among manufacturers of chocolate in the United States, new products can make a brand stand out from the crowd; for instance, Royce Chocolate green tea chocolate is quite popular. New ideas attract a larger market share and may also lead to more business.

Health Benefits of Chocolates

The growing awareness of the health benefits of dark chocolate, as well as its rich antioxidant content, is driving the growth of the chocolate market in the United States. According to Johns Hopkins Medicine, the antioxidants found in dark chocolate can improve heart health, cognitive functions, and mood. The potential to become an anti-inflammatory product and one that is good at lowering blood pressure also attract health-conscious consumers. With increasing demand, it raises the level of demand for the premium products in the market. With its appeal on health advantage by the manufacturer, high demand supports market growth while offering a sense of indulgence guilt-free.

Rising Challenges in the Chocolate Market

Increasing Cocoa Price with Chain Problems

One of the biggest challenges the chocolate market is facing is the increasing cost of cocoa, mainly due to climate change, supply chain disruption, and political instability in key cocoa-producing regions such as West Africa. The primary ingredient in chocolate is cocoa, so any changes in price have a direct impact on production costs. This makes chocolate manufacturers raise their prices, which might decrease consumer demand or have them absorb the costs, thereby decreasing profit margins. Ensuring a stable and sustainable cocoa supply remains a critical challenge for the industry.

Health Concerns and Shifting Consumer Preferences

Increasing health consciousness among consumers is another challenge for the chocolate market. Rising concerns about sugar content, obesity, and overall dietary health have led to a shift towards healthier alternatives. In order to fulfill such expectations, chocolate manufacturers are forced to lower the sugar content, offer low-calorie products, or introduce chocolates with higher cocoa contents such as dark chocolate. This will follow a healthy trend among consumers. Manufacturers have to invest in new formulations and production lines that will add to their costs and affect market equilibrium.

United States Hypermarkets and Supermarkets Chocolate Market

Hypermarkets and supermarkets may dominate the market because of their extensive presence. This offers comfort and accessibility to purchasers. These retail giants leverage their expansive shelf area to showcase numerous chocolate brands and products, catering to various patron possibilities. Their capacity to offer competitive and promotional pricing also solidifies their position as a primary phase within the chocolate market.

United States Chocolate Market Overview by States

California Chocolate Market

The California chocolate market could develop notably because of its vast population, numerous customer alternatives, and vibrant food culture. The state's popularity for culinary excellence fosters numerous artisanal chocolate makers, improving market vibrancy. Increasing cognizance of dark chocolate's health advantages and demand for quality and natural products align with California's fitness-conscious client base. For example, Navitas, known for its unprocessed raw cacao, now adopts regenerative practices within its delivery chain. Favorable agricultural conditions and strategic distribution further support the booming market.

New York Chocolate Market

The New York chocolate market is among the biggest and most energetic in the United States due to the diverse population that demands high premium, artisanal, and luxury chocolates. Consumers in New York prefer chocolate to be of good quality, organic, and ethically sourced. Seasonal events like Valentine's Day, Halloween, and Christmas contribute to the market by increasing the sales of chocolates. A growing trend of healthier options, such as dark chocolate with high cocoa content or reduced sugar, is also visible. New York's rich food culture and its tourism further increase the demand for unique chocolate offerings and luxury brands.

United States Chocolate Market Company Analysis

Nestlé S.A, The Hershey Company, Mondelez International, Inc. General Mills Inc., Cargill Inc., Saputo Inc., Chocoladefabriken Lindt and Sprungli AG, and Godiva Chocolates are the prime companies in the United States chocolate market.

Puratos acquired the largest Canadian chocolate industry acquisition, Foley's Chocolates, in December 2023 - the Canadian producer. This strengthens the group's position in the US market share and its manufacturing capabilities. Acquisition in line with Puratos' commitment to health, sustainability, and innovation as well as its portfolio of chocolate solutions in plant-based, protein-enhanced, and sugar-free.

In November 2023 - Mars Inc. is to buy UK chocolate retailer Hotel Chocolat for £534 Million with scope for international expansion.

In October 2023 - Mondelēz International will launch new formats of the iconic Toblerone chocolate brand in key markets as part of its refreshed brand signature, "Never Square." The iconic brand, which has been around for 115 years, is investing heavily in premium product offerings, marketing and advertising, and expanded distribution to support its new positioning.

Theo Chocolate, Seattle's only organic and fair-trade chocolate maker, announced its plans to merge with American Licorice Co. of LaPorte, Indiana in July 2023. It forms part of Theo's general restructuring move which includes shutting down the company's Seattle manufacturing facility and reducing the number of office staff.

In May 2023 - Ferrero North America, the fast-growing confectionery manufacturer, will unveil new products and seasonal offerings, including Kinder Chocolate, at the Sweets & Snacks Expo in Chicago. This reinforces Ferrero's category expansion through innovation and extended offerings to build excitement among retailers and customers.

United States Chocolate Market Market Segments

Type

- Dark Chocolate

- Milk/White Chocolate

Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channel

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All the Key players have been covered:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Nestlé S.A.

- The Hershey Company

- Mondelez International, Inc.

- General Mills Inc.

- Cargill Inc.

- Saputo Inc.

- Chocoladefabriken Lindt and Sprungli AG

- Godiva Chocolates

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Distribution Channel and States |

| Countries Covered | 1. California 2. Texas 3. New York 4. Florida 5. Illinois 6. Pennsylvania 7. Ohio 8. Georgia 9. New Jersey 10. Washington 11. North Carolina 12. Massachusetts 13. Virginia 14. Michigan 15. Maryland 16. Colorado 17. Tennessee 18. Indiana 19. Arizona 20. Minnesota 21. Wisconsin 22. Missouri 23. Connecticut 24. South Carolina 25. Oregon 26. Louisiana 27. Alabama 28. Kentucky 29. Rest of the United States |

| Companies Covered | 1. Nestlé S.A. 2. The Hershey Company 3. Mondelez International, Inc. 4. General Mills Inc. 5. Cargill Inc. 6. Saputo Inc. 7. Chocoladefabriken Lindt and Sprungli AG 8. Godiva Chocolates |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the market size of the U.S. chocolate industry in 2024?

-

What is the projected market size of the U.S. chocolate industry by 2033?

-

What is the expected CAGR (Compound Annual Growth Rate) for the U.S. chocolate market from 2025 to 2033?

-

What are the major factors driving the growth of the chocolate market in the U.S.?

-

How does the demand for premium and healthier chocolates impact the market?

-

Which distribution channels are most significant in the U.S. chocolate market?

-

What are the key challenges facing the U.S. chocolate industry?

-

Which states have the largest chocolate markets in the U.S.?

-

What are some of the latest trends in the U.S. chocolate industry, such as flavor innovation and sustainability?

-

Who are the major companies operating in the U.S. chocolate market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Chocolate Market

6. Market Share

6.1 By Type

6.2 By Distribution Channel

6.3 By States

7. Type

7.1 Dark Chocolate

7.2 Milk/White Chocolate

8. Distribution Channel

8.1 Hypermarkets/Supermarkets

8.2 Convenience Stores

8.3 Online Retail Stores

8.4 Other Distribution Channel

9. States

9.1 California

9.2 Texas

9.3 New York

9.4 Florida

9.5 Illinois

9.6 Pennsylvania

9.7 Ohio

9.8 Georgia

9.9 New Jersey

9.10 Washington

9.11 North Carolina

9.12 Massachusetts

9.13 Virginia

9.14 Michigan

9.15 Maryland

9.16 Colorado

9.17 Tennessee

9.18 Indiana

9.19 Arizona

9.20 Minnesota

9.21 Wisconsin

9.22 Missouri

9.23 Connecticut

9.24 South Carolina

9.25 Oregon

9.26 Louisiana

9.27 Alabama

9.28 Kentucky

9.29 Rest of the United States

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Nestlé S.A.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue Analysis

12.2 The Hershey Company

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue Analysis

12.3 Mondelez International, Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue Analysis

12.4 General Mills Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue Analysis

12.5 Cargill inc.

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue Analysis

12.6 Saputo Inc

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue Analysis

12.7 Chocoladefabriken Lindt and Sprungli AG

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue Analysis

12.8 Godiva Chocolates

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com