Global Chocolate Market Size and Share Analysis – Growth Trends and Forecast Report 2025–2033

Buy NowGlobal Chocolate Market Size and Forecast

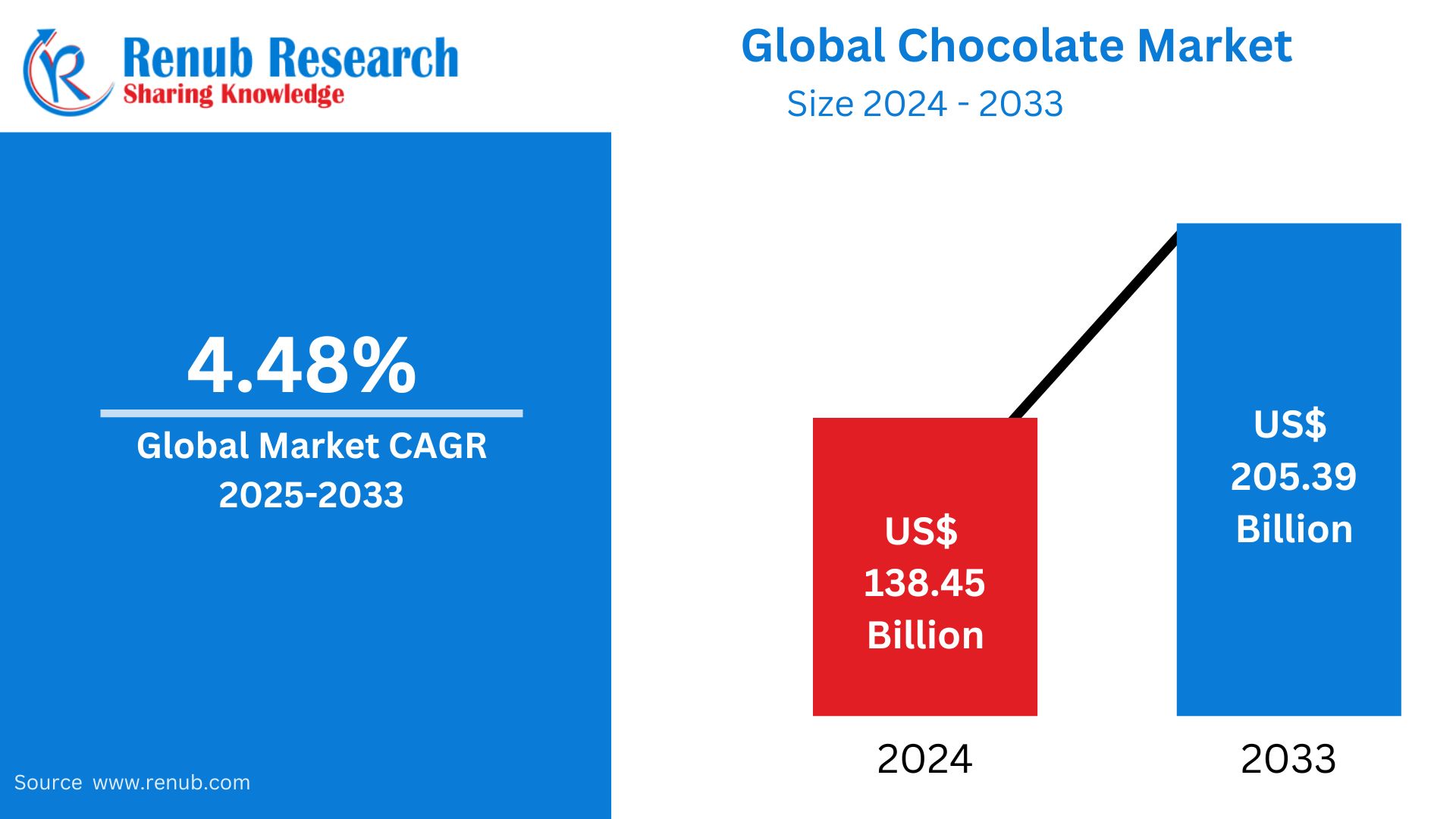

The global chocolate market size was US$ 138.45 billion in 2024. It is estimated to expand at a compound annual growth rate of 4.48% from 2024 to 2033. The global chocolate market is expected to grow to US$ 205.39 billion by 2033. This growth will be based on rising consumer demand, product innovation, and increased applications across the world in confectionery, beverages, and premium gifting segments.

The report Global Chocolate Market & Forecast covers by Type (Dark & Milk/White), Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores & Other Distribution Channel), Country and Company Analysis 2025-2033.

Global Chocolate Market Overview

Chocolate is an almost universally adored product made from cacao beans, the seeds of the tropical Theobroma cacao tree. To make this, fermenting, drying, roasting, and grinding the beans produce cocoa mass, which is the foundation of all forms of chocolate: dark, milk, and white. The type of chocolate results in variations of flavor and texture because of differences in ratios of cocoa solids, cocoa butter, milk, and sugar content.

Chocolate is very versatile and widely used in culinary and non-culinary applications. It is a must-have ingredient in desserts, such as cakes, cookies, brownies, and ice creams, and is also savored in beverages like hot chocolate and milkshakes. It is often linked with gifting and celebrations, playing a huge role in festive occasions and personal milestones. Moreover, dark chocolate is valued for its health benefits, such as antioxidants that help promote heart health and improve mood. Besides food, chocolate is applied in cosmetics due to its nourishing and hydrating properties.

Distribution of Chocolate Worldwide

Chocolate is distributed worldwide by a well-organized channel of producers, exporters, and retailers. Countries producing large amounts of chocolate, such as Switzerland, Belgium, the United States, and Germany, have high-quality products and a variety of offerings. Distribution of chocolate worldwide is based on supply chains between cocoa growers and chocolate producers, selling products via supermarkets, specialty retail outlets, and internet-based sales channels. Cadbury's brands are present in more than a million outlets worldwide, including Australia, the United Kingdom, China, and India. The distribution system has a direct reach to nearly the whole urban population, and the company has made huge investments in establishing such a broad system. In March 2025, Hotel Chocolat, which US chocolate giant Mars bought for £534m ($679m) in January 2024, opened two new Chicago stores. The Hertfordshire business is also growing its UK presence, with 25 more stores to open within the next 12 months. Hotel Chocolat currently has 147 stores in the UK, 68 of which have a Hotel Chocolat café.

Statistics in the Chocolate Industry

- As consumer tastes change, there is a rising need for products that demonstrate a focus on sustainability and individual health. This trend is especially pronounced in the chocolate confectionery sector, where consumers are increasingly opting for products that not only deliver sensory pleasure but also meet mindful consumption standards.

- Switzerland is the per capita market leader, with a consumption of 8–9 kg per capita per year, while the United States is the biggest single market. West Africa, especially Ivory Coast and Ghana, accounts for more than 60% of global cocoa bean production. Dark chocolate sales have increased as a result of health phenomena, while premium and sustainable chocolate segments continue to grow, mirroring shifting consumer taste on a global scale.

- Nestlé India Ltd aims to invest ₹4,200 crore by 2025 to increase noodles, coffee, and chocolate-making capacity to target mass and premium segments.

- Nestlé Australia will spend A$30 million (around $18.8 million) in January 2025 to boost digital and AI technology at its KitKat plant in Victoria.

- In 2018, organizations signed in Antwerp an agreement for chocolate manufacturing to become 100% sustainable by 2025 with the "Beyond Chocolate" alliance, which also increases cocoa producers' incomes.

- Ferrero North America unveiled in October 2024 a $214 million Kinder Bueno plant in Bloomington, its first outside of Europe.

- ALDI launched in 2024 the Choceur Choco Changer chocolate bar, engaging in ethical procurement with Fairtrade certification.

- Italian startup Foreverland attracted €3.4 million in a Seed round to introduce its sustainable carob-based chocolate alternative and scale up in Europe.

- In 2023, an Italian Master Chocolatier partnered with Da Vittorio restaurant to present the upscale "Carats" praline range, with distinctive flavors.

- In November 2022, Bühler launched plans for a smart factory for Kägi Söhne, a Swiss chocolate wafer manufacturer, following a performance evaluation in 2019.

Growth Driver in the Global Chocolate Market

Increasing Demand for Premium and Artisanal Chocolates

Growing demand for high-quality premium chocolates is a key growth driver in the global chocolate market. Unique flavors, organic ingredients, and ethical sourcing practices are attracting consumers to artisanal products. Premium chocolates, sold as indulgent and luxurious, reflect the growing demand for experiential and gift-worthy items. The increase in disposable incomes and awareness about fair trade practices further accelerate this trend. Brands are innovating with limited-edition offerings, health-conscious formulations, and aesthetically pleasing packaging to attract a broad demographic, including millennials and Gen Z consumers who look for quality and social responsibility in their purchases. Oct. 2024, GODIVA has introduced its limited-edition Belgian Heritage Collection, which includes 12 unique chocolates and confections available only in the U.S. Made in Brussels, the collection features some of the brand's most treasured recipes, celebrating nearly 100 years of history.

Health Benefits of Dark Chocolate

Dark chocolate, known for having antioxidant-rich properties, has quickly become popular with health-conscious consumers. Its advantages -- improving heart health, reducing inflammation, and enhancing mood -- have been widely released. This has paved the way for placing such product lines in the market, including functional chocolates containing vitamins, minerals, or adaptogens. This increased awareness about moderate consumption for health benefits has been driving demand, especially among older demographics and fitness enthusiasts. Companies are now capitalizing on this trend by introducing lower-sugar, vegan, and high-cocoa-percentage options, making dark chocolate a staple in the health and wellness market and contributing significantly to overall market growth. Feb 2023, Mars Wrigley India announced a launch and country-specific manufacturing for GALAXY FUSIONS Dark with 70% cocoa in the Indian market.

Emerging Market Expansion

Chocolate demand is increasingly witnessed in the developing economies of China, India, and Brazil. Urbanization increases, along with disposable income levels, has propelled chocolate consumption. Premium and mass-market chocolate products have become much more accessible through the development of new distribution networks and modern retailing outlets. Chocolate also helps festivals and cultural events demand increase due to the popularity of using chocolates as gift items. Global players target these markets and provide regionalized flavors along with lower product lines for sustained growth while expanding the markets in such potential regions. October 2023. Mondelēz International revamps the Toblerone brand as a luxury chocolate through its "Never Square" campaign, just like high-end brands. A new generation of formats and gift ideas, for instance Toblerone Truffles - smooth truffle center in an original diamond-shaped shell.

Challenges of Global Chocolate Market

Raw Material Fluctuation Price

There will always be unstable raw material input prices, cocoa, sugar, and dairy on the global marketplace. Climate conditions impacting cocoa crops include pests and diseases, while conflict in major world cocoa-producing markets-africa-actually affects supply chain and pricing processes. These instabilities actually stretch profit lines, especially by small and middle-sized manufacturers and producers. Increases in demand towards ethically produced and sustainable produce increase production expenses. Companies need to balance affordability with sustainability, a challenging task that limits market growth and innovation while pushing manufacturers to maintain competitive pricing strategies.

Growing Health and Environmental Concerns

Health-conscious consumers are now questioning the high sugar and fat content in traditional chocolate products, which negatively impacts demand for traditional products. Moreover, environmental concerns over deforestation, carbon emissions, and unethical labor practices in cocoa farming have raised the scrutiny of the chocolate industry. Increasing regulatory pressures and consumers' call for transparency and sustainability force companies to embrace more sustainable practices and change product formulations. Changes in formulation require significant research investments, sourcing changes, and modification of the production process. It is resource intensive and may be expensive in terms of cost and time. Without such reformulations, brands stand to suffer at the hands of competitors focusing on ethical and sustainable practices.

Dark Chocolate Market

The Dark Chocolate Market is growing at a very healthy rate due to increased consumer awareness of its health benefits, such as antioxidants, heart health, and mood enhancement. Dark chocolate with higher cocoa content and less sugar appeals to the health-conscious and premium indulgence seekers. The key drivers include product innovation in the form of functional dark chocolates infused with superfoods and increased demand in emerging markets. The market is backed by growing applications in confectionery, baking, and beverages. Fluctuating cocoa prices and sustainability standards pose challenges, but continuous innovation and consumer preferences will help the dark chocolate market grow into a promising future. June 2024, Mondelez International acquired Hu Master Holdings, a fast-growing luxury chocolate company that has gained recognition for its organic, paleo, and vegan dark chocolate. This step is aligned with Mondelez's strategic ambition to enhance its presence in the premium and healthier chocolate markets. Hu shares Mondelez's vision for healthy snacking through clean ingredients and sustainable sourcing.

Hypermarkets/Supermarkets Chocolate Market

Hypermarkets/Supermarkets Chocolate Market is still a leading distribution channel that caters to the growing demand for chocolates around the world. These retailers provide different types of chocolates, such as premium, mass-market, and seasonal, at convenience stores with competitive prices. Hypermarkets and supermarkets attract customers through promotions, discounts, and in-store experiences. One-stop shopping and urbanization are the primary growth drivers for this segment. The growth in organized retailing in the Asia-Pacific region is a major growth driver for the emerging markets. Innovations of packaging, brand, and environmental sustainability add new consumer appeal through these retail landscapes and help propel market growth from the same line.

United States Chocolate Market

United States is one of the major producers in the region, North American chocolate market primarily due to excellent consumer demand there and high consumer market presence enjoyed by international powerhouses like Hershey's, Mars, and Nestlé. Emphasis is provided to premium/artisanal; interest in organic fair trade, with an ethical, sourced product. Sales get a huge boost during holidays such as Valentine's Day, Easter, and Christmas. The trend of health-consciousness has also increased the intake of dark chocolates, which is rich in antioxidants. Furthermore, the use of chocolates in bakery, confectionery, and beverages helps drive the market. Thus, the U.S. becomes a prime location for chocolate innovation and consumption. Dec 2024, For the holiday season, Lindt & Sprüngli (USA) promised to shine brighter when the company announced its very first U.S. debut of Lindt Dubai Chocolate in stores where New York City locals and visitors can now go and taste and buy during a special in-store celebration.

Switzerland Chocolate Market

Switzerland is considered to be the "home of chocolate" in the European chocolate market. Switzerland is known for its quality products and famous brands such as Lindt, Toblerone, and Nestlé. It is the birthplace of milk chocolate and still dominates the premium segment. Swiss chocolate is associated with luxury and artisanship, which attracts tourists and consumers worldwide. Sustainability is now more important, and the emphasis is on sourcing ethical cocoa. Though Switzerland is a small country, it reports one of the highest per capita consumption rates for chocolate in Europe. In September 2023, Oro de Cacao's FrEAK chocolate bar will be available at Swiss avec, k kiosk, and Press & Books branches. Valora is committed to answering the demand for fair, organic, and lower-sugar local snacks.

India Chocolate Market

India is becoming one of the significant markets in the Asia-Pacific chocolate industry, due to the rising urbanization, increasing disposable incomes, and growing middle-class population. India has not traditionally been a chocolate-consuming country, but there has been a shift in preference due to Western influence and changes in dietary habits. Global players such as Cadbury (Mondelez) and Nestlé are the major players, and local players are increasingly expanding their presence. Festive and celebratory events drive demand as chocolates are gaining the place of traditional sweets. Affordable products drive mass consumption, while premium and imported chocolates find a market among urban consumers. India has huge growth potential as it has a young population and still untapped rural markets.

Brazil Chocolate Market

Brazil is the largest chocolate market in Latin America, driven by a rich cocoa production base and a strong domestic market. The country is an important producer and consumer, and its chocolate portfolio is diverse from mass-market brands to artisanal products. During festivals like Easter, sales boom as chocolate eggs become a cultural tradition. Health awareness has increased, which has raised demand for dark and sugar-free chocolates. Sustainability through UTZ and Rainforest Alliance: Brazil can easily boast of itself for sustainable cocoa production and strengthening the market in this way, since evolving consumer expectation focuses more on ethical products.

Chocolate Market Segmentation

Type

- Dark Chocolate

- Milk/White Chocolate

Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channel

Regional Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherland

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Nestlé S.A.

- Mondelez International, Inc.

- AMUL Industries Pvt Ltd.

- The Hershey Company

- Meiji Holdings Co. Ltd.

- Saputo Inc.

- Chocoladefabriken Lindt, and Sprungli AG

- Hotel Chocolat Group plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Distribution Channel, and Countries |

| Countries Covered |

|

| Companies Covered | 1. Nestlé S.A. 2. Mondelez International, Inc. 3. AMUL Industries Pvt Ltd. 4. The Hershey Company 5. Meiji Holdings Co. Ltd. 6. Saputo Inc. 7. Chocoladefabriken Lindt, and Sprungli AG 8. Hotel Chocolat Group plc |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Chocolate Market

6. Global Chocolate – Market Share Analysis

6.1 By Type

6.2 By Distribution Channel

6.3 By Countries

7. Type

7.1 Dark Chocolate

7.2 Milk/White Chocolat

8. Distribution Channel

8.1 Hypermarkets/Supermarkets

8.2 Convenience Stores

8.3 Online Retail Stores

8.4 Other Distribution Channel

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherland

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Nestlé S.A.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue Analysis

12.2 The Hershey Company

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue Analysis

12.3 Mondelez International, Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue Analysis

12.4 AMUL Industries Pvt Ltd

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue Analysis

12.5 Meiji Holdings Co. ltd

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue Analysis

12.6 Saputo Inc

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue Analysis

12.7 Chocoladefabriken Lindt and Sprungli AG

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue Analysis

12.8 Hotel Chocolat Group plc

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com