Global Cocoa Processing Market – Industry Analysis 2025–2033

Buy NowCocoa Processing Market Size and Forecast 2025-2033

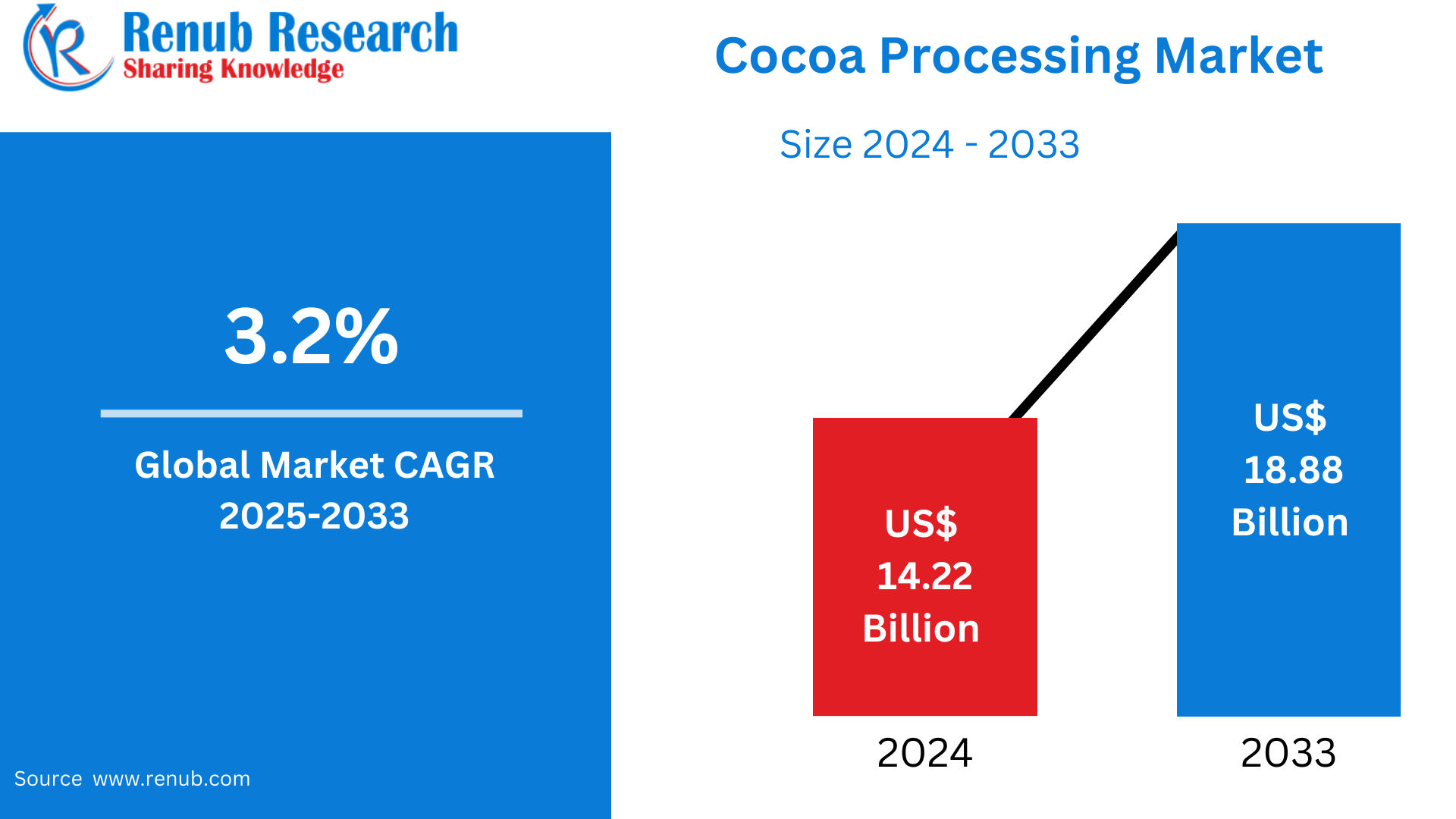

Global Cocoa Processing Market is expected to reach US$ 18.88 billion by 2033 from US$ 14.22 billion in 2024, with a CAGR of 3.2% from 2025 to 2033. Some of the factors driving the market include the move toward healthier chocolate formulations, growing awareness of the bean-to-bar concept, increased use of supply chains and trade for cocoa, the expansion of artisanal and craft chocolate production, and the use of cocoa in savory dishes.

Cocoa Processing Global Market Report by Type (Cocoa Powder, Cocoa Butter, Cocoa Liquor, Specialty Fats, Others), Application (Confectionery, Functional Foods & Beverages, Pharmaceuticals, Cosmetics), Countries and Company Analysis, 2025-2033.

Global Cocoa Processing Industry Overview

The methods used to turn cocoa beans into a variety of goods, such as chocolate, cocoa powder, and cocoa butter, are referred to as cocoa processing. Sorting, roasting, winnowing, grinding, refining, and conching are the steps that make up the process. Unwanted materials such as twigs, leaves, and stones are removed from the cocoa beans during the sorting process. The beans are then roasted, which intensifies their flavor and scent. Winnowing removes the husks and shells after roasting, leaving only the nibs. After that, these nibs are mashed into a paste called cocoa liquor. Alkali addition to reduce acidity, pressing to extract cocoa butter from solids, and grinding to create cocoa powder are possible steps in further refining this liquid. Conching, the last step, improves the flavor, texture, and shelf life of chocolate by combining, aerating, and refining it with other additives. As a consequence, chocolate lovers get an unmatched flavor experience thanks to this method, which is acclaimed worldwide.

The growing demand for chocolate goods is the main factor propelling the global market. Accordingly, the industry is being greatly influenced by consumers' growing taste for high-end chocolates. Additionally, the market is being favorably impacted by the growing applications in the food industry as well as rising disposable incomes. In addition, the market is being stimulated by the quick technical developments in cocoa processing equipment and the expanding use of environmentally friendly and sustainable processing techniques. There are a lot of chances for the market due to the expansion of the confectionery sector and the introduction of novel and inventive chocolate tastes.

The industry is also being stimulated by the growing need for cocoa-derived components in cosmetics and medications, as well as the growing appeal of organic and functional chocolates. In addition, the market is being driven by the growth of the baking and pastry industry as well as the rising popularity of beverages made with cocoa. The market is also being boosted by the growing demand for specialty chocolates as gifts and the growing usage of cocoa powder in wellness and health goods.

Key Factors Driving the Cocoa Processing Market Growth

The expansion of the chocolate tourist sector

The market is expected to develop as a result of the expansion of the chocolate tourism sector. Chocolate tourism takes use of people's interest in chocolate production, from cocoa beans to delicious confections. Visitors look for immersive experiences that let them view the complex steps of cocoa processing up close; they frequently include trips to chocolate museums, processing facilities, and cocoa plantations. Growing interest in cocoa and its transformation into chocolate is fueled by this trend. The growing interest in chocolate tourism is driving up demand for premium, ethically sourced, and professionally processed cocoa. Because visitors' experiences have a direct impact on their preferences and purchase decisions, this expanding market sector encourages cocoa processors to uphold the highest production and quality standards. Chocolate tourism and cocoa processing have a mutually beneficial connection that guarantees the latter's constant pursuit of innovation, quality, and sustainable methods. The market benefits greatly from this dynamic interaction, which also fosters an appreciation for the complex skill of chocolate making while satisfying the changing expectations of tourists.

Creation of novel chocolate-based candies and snacks

The industry has a lot of prospects thanks to the creation of creative cocoa-based snacks and confections. Beyond classic chocolates, a variety of cocoa-infused goods have been developed in response to consumers' constantly changing demands for unique and decadent experiences. The variety of chocolate-based snacks and treats is growing, ranging from protein bits and energy bars to luxury truffles and cocoa-dusted almonds. The demand for premium cocoa components is being fueled by this trend, making it difficult for cocoa processors to guarantee a steady supply and uphold strict standards. The need to develop distinctive tastes, textures, and forms keeps cocoa processors on the cutting edge of innovation, driving improvements in technology and methods for processing cocoa.

Additionally, these cutting-edge cocoa-based treats and snacks appeal to rising premium and health-conscious consumers. The market for cocoa processing reacts to customer demands for finer confections and healthier options by creating goods that suit these tastes. The mutually beneficial link between changing customer preferences and innovative product creation propels market expansion, encouraging culinary innovation and broadening the industry's perspectives.

Growing demand for certified and ethically sourced cocoa

The industry is expanding due to the growing demand for verified and ethically sourced cocoa. Customers are moving toward goods that support ethical practices as they become more aware of the social and environmental effects of their purchases. Customers who purchase ethically sourced and certified cocoa are reassured that the raw material has been produced sustainably and responsibly, which includes using child labor-free labor, fair labor practices, and ecologically friendly growing techniques. Cocoa processing businesses aggressively look for alliances with certified producers and uphold strict ethical standards in response to this demand. In addition to giving businesses access to upscale markets and demonstrating their dedication to social responsibility, these methods are in line with consumer ideals. The need for certified and ethically sourced cocoa propels market expansion as ethical concerns become more important in purchasing decisions, encouraging favorable changes in the sector and charting a path for long-term success.

Challenges in the Cocoa Processing Market

Sustainability and Ethical Sourcing

Due to problems like child labor, deforestation, and subpar working conditions on cocoa fields, particularly in West Africa, sustainability and ethical sourcing are significant concerns in the market for cocoa processing. Companies are being pushed to implement more sustainable practices as a result of the intense attention that these ethical issues have received from customers, NGOs, and regulatory agencies. As a result, cocoa processors are under more and more pressure to obtain certified cocoa (such as Fair Trade and Rainforest Alliance) and guarantee traceability across their supply chains. Complex logistics, increased operating expenses, and investments in community development and farmer training are frequently required to implement these approaches. These standards, which are crucial for long-term sustainability and brand reputation, can impose a burden on resources, especially for smaller processors, and necessitate tight coordination with value chain partners.

High Energy and Water Usage

Processing cocoa uses a lot of water and energy, particularly in important steps like roasting, grinding, and conching. High operating expenses are a result of these operations' substantial demands for heat and energy as well as water for cooling and cleaning. As environmental sustainability becomes more widely recognized, cocoa processors are being scrutinized more closely for their water and carbon footprint. Stricter environmental laws and customer demand for environmentally responsible production are adding to this strain. Businesses are now expected to make investments in water recycling systems, renewable energy sources, and energy-efficient technology. The initial expenditures are high, which presents a problem for many processors, particularly in areas with limited access to clean energy or contemporary infrastructure, even if these advancements can lower long-term costs and environmental effect.

Cocoa Processing Market Overview by Regions

The majority of raw cocoa beans come from West Africa (Ivory Coast, Ghana), which dominates the cocoa processing industry. Processing is dominated by Europe, with Germany and the Netherlands serving as important centers. Latin America and Asia-Pacific are growing as a result of increased investment and demand. The following provides a market overview by region:

United States Cocoa Processing Market

Strong demand from the beverage, baking, and confectionery sectors has made the US cocoa processing industry a well-established and mature area. A strong supply chain, cutting-edge processing techniques, and an emphasis on premium, value-added cocoa goods like cocoa butter, powder, and liquor all help the industry. Sustainability and ethical sourcing are top concerns, with a growing focus on traceability and certifications such as Rainforest Alliance and Fair Trade. Environmental issues, regulatory compliance, and shifting cocoa prices throughout the world are additional difficulties for U.S. processors. Notwithstanding these obstacles, market expansion is supported by innovative product formulations, such as those that are organic and plant-based. Additionally, the demand for high-end, low-sugar cocoa-based goods is still influenced by growing consumer awareness of wellness and health trends.

Additionally, the demand for cocoa processing is rising due to the rising sales of baked goods and confections. For example, the total retail sales of confectionery in the United States grew by a compound annual growth rate (CAGR) of 6.7% from USD 34.5 million (2,812.7 thousand tonnes) in 2018 to USD 44.8 million (2,981.2 thousand tonnes) in 2022, according to statistics released by Agriculture and Agri-Food Canada in November 2023. Therefore, global market trends are being driven by the rising sales of bakery and confectionery items.

Germany Cocoa Processing Market

Due to its substantial processing capacity and sophisticated infrastructure, Germany is a major player in the worldwide cocoa processing business. Germany is the second-largest cocoa grinder in Europe because to a combination of well-established domestic companies and global organizations that make up the country's cocoa sector. The sector exhibits resilience via technical innovations and judicious sourcing, even in the face of obstacles like supply chain interruptions and fluctuating cocoa prices. One noteworthy development is the growing demand from consumers for sustainable and ethically sourced chocolate goods, which has led businesses to embrace certifications such as Rainforest Alliance and Fair Trade. This change is indicative of a larger dedication to ethical and sustainable standards in Germany's cocoa processing industry.

India Cocoa Processing Market

The market for cocoa processing in India is expanding significantly due to rising demand from the beverage, bread, and confectionery industries. With locations like Kerala and Karnataka becoming as important cocoa-growing regions, the growth of the bean-to-bar movement has promoted a closer bond between customers and locally manufactured chocolates. Notwithstanding obstacles like fluctuating cocoa prices worldwide and low domestic output, the Indian market is adjusting by introducing new products and sourcing techniques. By giving farmers financial support and encouraging value addition in the cocoa industry, government programs like the Cocoa Development Program seek to improve local production and processing capacities. India is positioned as a rising force in the world's cocoa processing market because to these initiatives.

Saudi Arabia Cocoa Processing Market

The growing local chocolate business and changing customer demands are driving the fast evolution of the Saudi Arabian cocoa processing sector. The Kingdom imports large amounts of cocoa beans to suit the rising demand for chocolate goods, even though it does not yet produce any cocoa domestically. The market is distinguished by a significant preference for artisanal and luxury chocolates, as customers show a growing preference for genuine, high-quality products. This tendency is especially noticeable among Gen Z and urban millennials, who are more likely to choose natural, outstanding meals with distinctive flavors. The government's Vision 2030 program, which emphasizes food security and economic diversification, has encouraged investments in regional chocolate production capacities. These changes point to a bright future for Saudi Arabia's cocoa processing industry, one that is full of room for expansion and creativity.

Market Segmentations

Type

- Cocoa Powder

- Cocoa Butter

- Cocoa Liquor

- Specialty Fats

- Others

Application

- Confectionery

- Functional Foods & Beverages

- Pharmaceuticals

- Cosmetics

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Guan Chong Bhd

- Ecom Agroindustrial Corp. Limited

- Nestlé SA

- Barry Callebaut Group

- Blommer Chocolate Company

- Mondelez International, Inc.

- Cargill Incorporated

- Olam International

- Touton S.A.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Cocoa Processing Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Cocoa Processing Market Share Analysis

6.1 By Type

6.2 By Application

6.3 By Countries

7. Type

7.1 Cocoa Powder

7.2 Cocoa Butter

7.3 Cocoa Liquor

7.4 Specialty Fats

7.5 Others

8. Application

8.1 Confectionery

8.2 Functional Foods & Beverages

8.3 Pharmaceuticals

8.4 Cosmetics

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Guan Chong Bhd

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Ecom Agroindustrial Corp. Limited

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Nestlé SA

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Barry Callebaut Group

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Blommer Chocolate Company

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Mondelez International, Inc.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Cargill Incorporated

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Olam International

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

12.9 Touton S.A.

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development & Strategies

12.9.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com