GCC Dark Chocolate Market – Size, Share, Trends, and Forecast 2025-2033

Buy NowGCC Dark Chocolate Market Size and Forecast 2025-2033

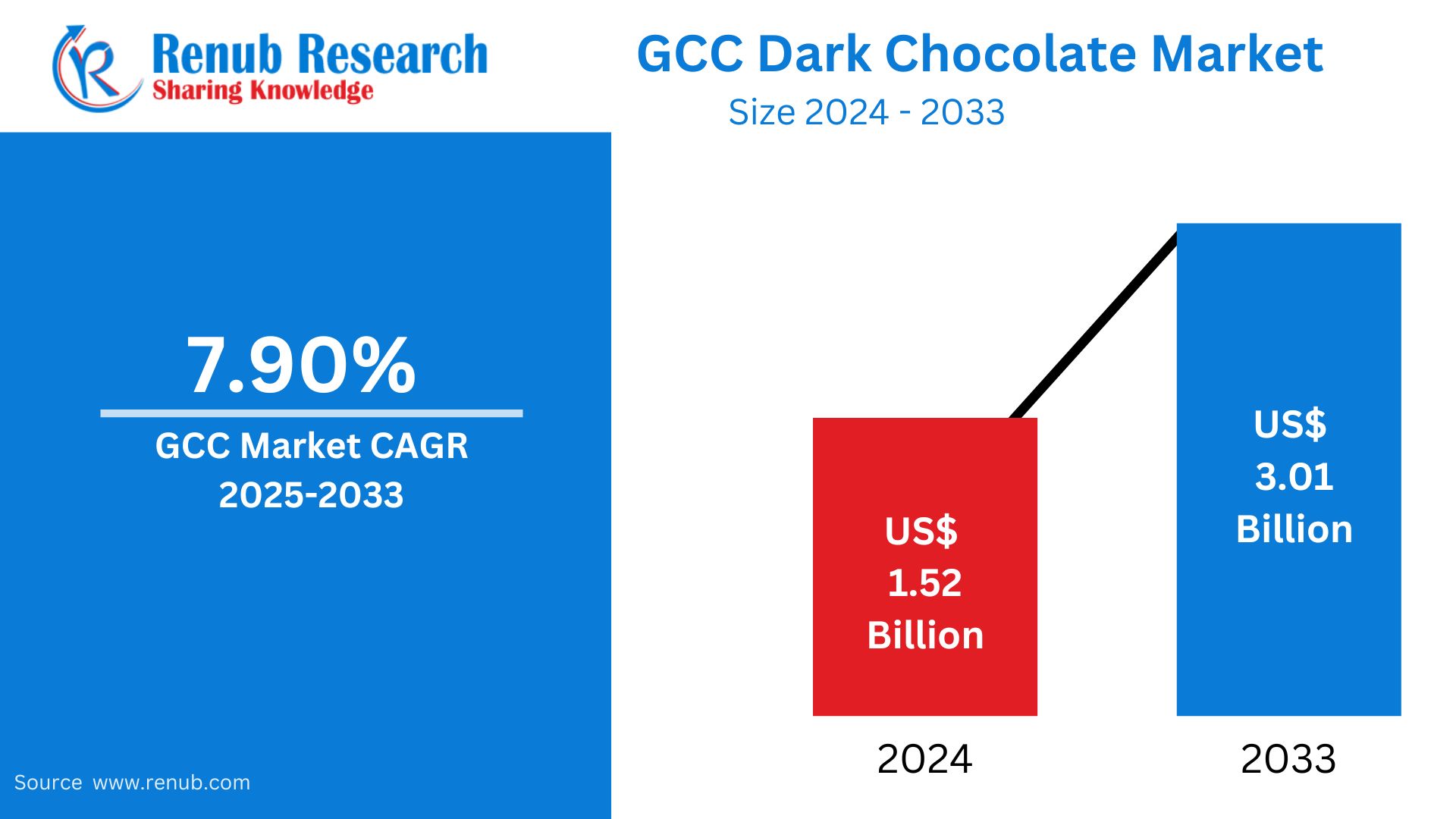

GCC Dark Chocolate Market is expected to reach US$ 3.01 billion by 2033 from US$ 1.52 billion in 2024, with a CAGR of 7.90% from 2025 to 2033. Growing health awareness, the need for premium products, growing disposable incomes, growth in retail channels, and greater awareness of the health benefits of dark chocolate—like its reduced sugar content and antioxidant content—are the key drivers of the GCC dark chocolate market.

GCC Dark Chocolate Market Report by Type (70% Cocoa Dark Chocolate, 75% Cocoa Dark Chocolate, 80% Cocoa Dark Chocolate, and 90% Cocoa Dark Chocolate), Application (Confectionery, Functional Food & Beverage, Pharmaceuticals, and Cosmetics), Distribution Channel (Convenience Stores, Supermarkets and Hypermarkets, Non-Grocery retailers, and Others), Countries and Company Analysis 2025-2033.

GCC Dark Chocolate Market Overview

Greater cocoa content and less addition of sugar and milk solids are features of dark chocolate. The primary ingredients of dark chocolate are sugar, cocoa butter, and cocoa solids. The dark color and intense flavor of the chocolate are due to the presence of cocoa solids. They are derived from ground cocoa beans, fermented cocoa beans, and roasted cocoa beans used to produce cocoa liquor. The cocoa solids and cocoa butter are then separated from each other by pressing the cocoa liquor. Dark chocolate contains a variable percentage of cocoa solids, typically ranging between 70% and 90% or even higher. Dark chocolate tastes deep and rich, with an underlying bitterness and earthy tone. A richer flavor of cocoa is facilitated through less sugar, whereas a more profound chocolate taste is facilitated by higher cocoa levels. Dark chocolate may contain minerals such as copper, magnesium, and iron. Dark chocolate is renowned for its distinctive taste as well as potential health benefits. Flavonoids and other antioxidants contained in it have been associated with various health benefits, including reduced risk of cardiovascular diseases and improved cognitive function.

Several factors are propelling the significant growth in the GCC dark chocolate market. Since dark chocolate is highly recognized for its antioxidant properties and potential cardiovascular benefits, growing consumer health awareness is a significant driver. Because of the region's economic growth, individuals now have greater disposable income, and this enables them to buy high-quality products such as dark chocolate. Consumption of chocolate is also boosted by its cultural value, particularly when presenting it as a gift during celebrations and religious ceremonies. Moreover, product innovation serves different tastes of consumers by providing organic options and unique local flavorings. By distributing dark chocolate more extensively, the growing e-commerce sector also assists the market in thriving.

Growth Drivers for the GCC Dark Chocolate Market

Rising Disposable Incomes

Demand for dark chocolate is projected to increase dramatically in the GCC with increasing disposable incomes. Sustained economic growth in the region boosted consumer purchasing power, allowing them to afford upmarket, indulgent products such as dark chocolate. Individuals with higher discretionary income tend to try out different varieties of dark chocolates, ranging from upscale to craft brands. As discretionary incomes increase, overall demand for dark chocolate also grows. An increasing demand for healthier, high-quality snacks is fueling the shift in behavior among consumers. Premium chocolates now come at affordable prices, a factor that helps companies cater to more customers and expand the business. The region's increasing need for health-orientated goodies is also a result of greater customer willingness to pay for chocolate with health benefits such as antioxidants and lower sugar levels.

Product Innovation

Product innovation is one of the main drivers driving the GCC dark chocolate market's growth. Companies are constantly launching new and diversified products to suit different tastes and dietary needs as consumer tastes evolve. The launch of NXT by Barry Callebaut in Saudi Arabia in November 2022 is an example of this. Being the first allergen-free, vegan dark and milk chocolate in the region, NXT is a 100% plant-based, dairy-free chocolate that is groundbreaking. This breakthrough is a manifestation of wider global health and sustainability trends and aligns with the growing demand for plant-based, lactose-free, and allergy-free food products. By introducing such specialty products, chocolate firms can reach niche consumers such as vegans and health-focused consumers, enhancing the popularity and scope of dark chocolate within the GCC. Such continuous innovation enhances customer interaction and advances market diversification.

E-commerce Growth

The GCC dark chocolate market is primarily fueled by the growth of e-commerce, which is revolutionizing the way customers engage with and purchase chocolate brands. Dark chocolate is easier to find now, especially among the tech-conscious, convenience-seeking residents, due to the expansion of online shopping platforms and meal delivery companies. The COVID-19 pandemic has accelerated the drift towards online shopping, which in turn has prompted companies to invest in digital infrastructure and enhancing the online presence. Two such digital marketing strategies that have raised customer engagement and brand perception are influencer partnerships and sponsored advertising. This has enhanced the range of dark chocolate available from high-end luxuries to handmade products, diversifying the market's base and driving its growth.

Challenges in the GCC Dark Chocolate Market

Supply Chain Issues

In the GCC dark chocolate market, fierce rivalry is a significant obstacle. Due to competition for market share from both domestic and foreign businesses, it is challenging for newcomers to make an impression. Established companies frequently control the market by utilizing marketing power, distribution networks, and brand loyalty. Smaller firms are forced to constantly innovate and differentiate their products due to the pressure from the competition, which raises operating expenses and makes it harder to attract customers.

Intense Competition

In the GCC dark chocolate market, fierce rivalry is a significant obstacle. Due to competition for market share from both domestic and foreign businesses, it is challenging for newcomers to make an impression. Established companies frequently control the market by utilizing marketing power, distribution networks, and brand loyalty. Smaller firms are forced to constantly innovate and differentiate their products due to the pressure from the competition, which raises operating expenses and makes it harder to attract customers.

Saudi Arabia Dark Chocolate Market

The market for dark chocolate in Saudi Arabia is expanding rapidly due to customers' growing health concern. Health-conscious people prefer dark chocolate because of its alleged health benefits, which include antioxidant qualities and a lower sugar level. The increasing demand for high-end, artisanal dark chocolate products—often flavored with distinctive flavors—is indicative of this change. A robust gifting culture during holidays like Ramadan and Eid, when dark chocolate is a popular choice, also supports the business. Furthermore, consumers can now buy a wide variety of dark chocolate goods online thanks to the growth of e-commerce platforms.

UAE Dark Chocolate Market

Due to a strong gift-giving culture, rising disposable incomes, and growing health consciousness, the dark chocolate market in the United Arab Emirates is expanding significantly. Dark chocolate is becoming more popular among consumers due to its alleged health advantages, including its decreased sugar level and antioxidant qualities. Demand for high-end, artisanal dark chocolate products—which frequently have distinctive flavors and ethical sourcing—has increased as a result of this change. The market's growth is further supported by the UAE's wealthy customer base and cosmopolitan population. Furthermore, the emergence of e-commerce platforms has improved accessibility, enabling customers to browse a wide variety of dark chocolate products online. The dark chocolate market in the United Arab Emirates is expected to grow steadily with ongoing product innovation and an emphasis on quality.

Oman Dark Chocolate Market

The market for dark chocolate in Oman is expanding gradually due to changing consumer preferences and growing health consciousness. Dark chocolate is becoming more and more popular among consumers because of its alleged health advantages, which include its lower sugar level and antioxidant qualities. The growing demand for high-end, artisanal dark chocolate products—often flavored with distinctive flavors—reflects this change. Dark chocolate is a popular choice for gifts during festive seasons, which further supports the industry. Furthermore, the growth of e-commerce platforms has improved accessibility, enabling customers to browse a wide variety of dark chocolate products online. The dark chocolate market in Oman is well up for long-term growth with consistent product innovation and an emphasis on quality.

GCC Dark Chocolate Market Type:

Type

- 70% Cocoa Dark Chocolate

- 75% Cocoa Dark Chocolate

- 80% Cocoa Dark Chocolate

- 90% Cocoa Dark Chocolate

Application

- Confectionery

- Functional Food & Beverage

- Pharmaceuticals

- Cosmetics

Distribution Channel

- Convenience Stores

- Supermarkets and Hypermarkets

- Non-Grocery retailers

- Others

Countries

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Oman

- Bahrain

All companies have been covered from 4 viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Company Analysis

- Nestlé S.A.

- The Hershey Company

- Mondelez International, Inc.

- Ferrero Group

- Meiji Holdings Co. ltd

- Bateel International LLC

- Al-Seedawi Sweets Factories Co

- AANI & DANI

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Application, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. GCC Dark Chocolate Market

5.1 Historical Market Trends

5.2 Market Forecast

6. GCC Dark Chocolate Market Share Analysis

6.1 By Type

6.2 By Application

6.3 By Distribution Channel

6.4 By Countries

7. Type

7.1 70% Cocoa Dark Chocolate

7.2 75% Cocoa Dark Chocolate

7.3 80% Cocoa Dark Chocolate

7.4 90% Cocoa Dark Chocolate

8. Application

8.1 Confectionery

8.2 Functional Food & Beverage

8.3 Pharmaceuticals

8.4 Cosmetics

9. Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Convenience Stores

9.3 Non-Grocery Retailers

9.4 Others

10. Countries

10.1 Saudi Arabia

10.2 UAE

10.3 Kuwait

10.4 Qatar

10.5 Oman

10.6 Bahrain

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Nestlé S.A.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments & Strategies

13.1.4 Revenue Analysis

13.2 The Hershey Company

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments & Strategies

13.2.4 Revenue Analysis

13.3 Mondelez International, Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments & Strategies

13.3.4 Revenue Analysis

13.4 Ferrero Group

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments & Strategies

13.4.4 Revenue Analysis

13.5 Meiji Holdings Co. ltd

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments & Strategies

13.5.4 Revenue Analysis

13.6 Bateel International LLC

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments & Strategies

13.7 Al-Seedawi Sweets Factories Co

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments & Strategies

13.8 AANI & DANI

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments & Strategies

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com