Global Candy Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Candy Market Size

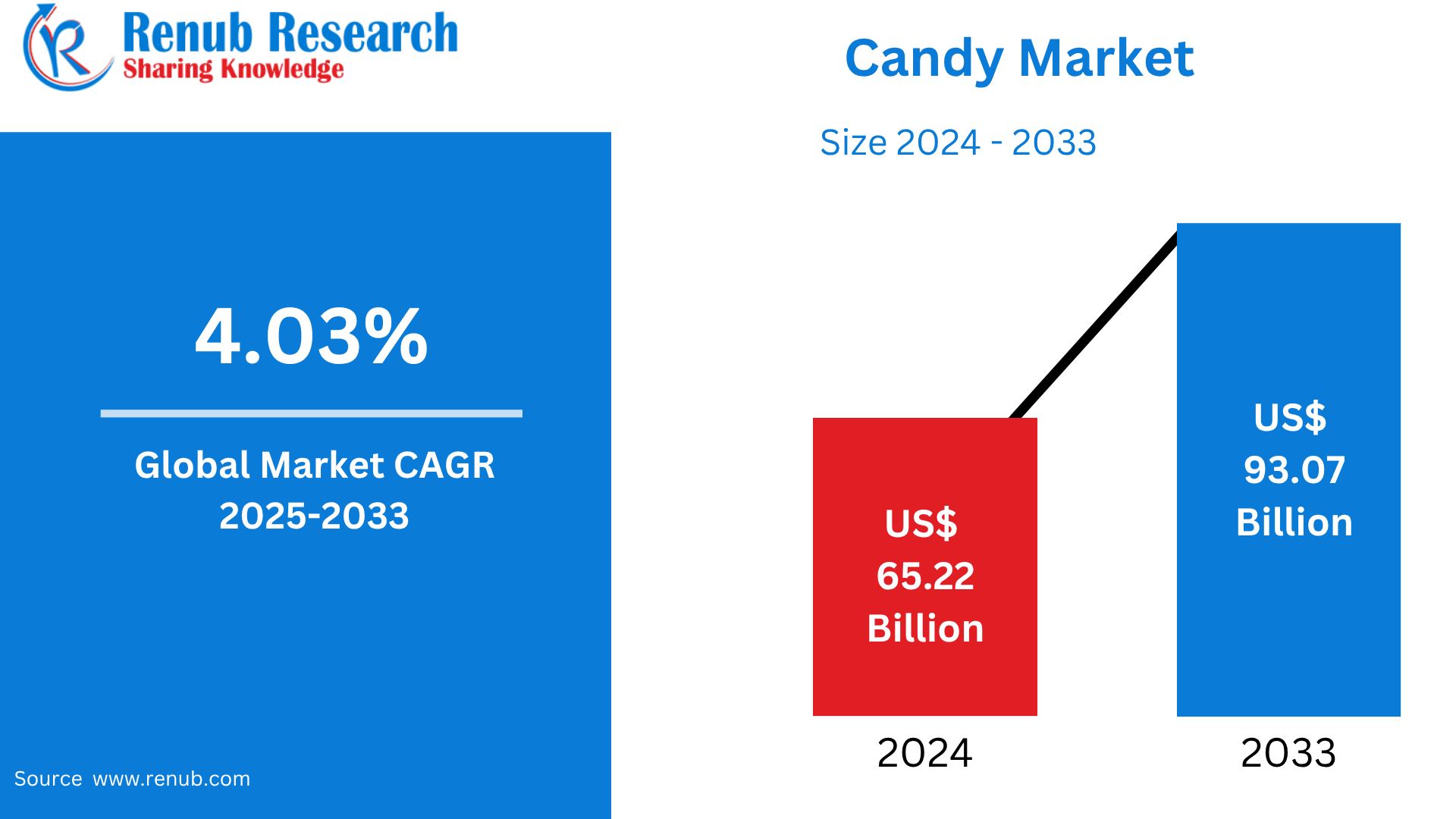

Global Candy Market is anticipated to grow considerably, increasing from USD 65.22 billion in 2024 to USD 93.07 billion by 2033, with a CAGR of 4.03%. This growth is influenced by increasing consumer demand for confectionery products, innovation in flavors and packaging, and the growing popularity of premium and sugar-free products. Emerging markets, seasonal, and gifting trends are anticipated to further drive the candy industry globally.

Global Candy Market Report by Type (Chocolate Candy, Non-chocolate Candy), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specalist Retailers, Online Retail, Other Distribution Channels), Countries and Company Analysis, 2025-2033.

Global Candy Market outlooks

Candy is a sweet confection usually created from sugar, chocolate, or a mixture of ingredients such as fruits, nuts, and flavorings. It exists in the form of hard candies, gummies, chocolates, caramels, and licorice.

Worldwide, candy is extremely popular among people of all ages and is used as a treat, a celebratory item, or a mere indulgence. Candy is most commonly linked with celebrations such as Halloween, Christmas, and Valentine's Day, where candies are given as gifts as a beloved tradition. Apart from individual consumption, candy contributes greatly to the global food and beverage sector, benefiting industries such as tourism, entertainment, and retail.

As there is increased innovation in taste, packaging, and health-friendly options like sugar-free and organic sweets, sweets continue to grow and spread their influence. Rising disposable incomes, globalizing brands, and innovative marketing have been some of the factors that have made sweets popular across the globe. Sweets also represent hospitality, joy, and sharing across cultures, which makes them a global product to be consumed universally.

Growth Drivers in the Global Candy Market

Growing Demand for Premium and Healthier Options

Consumers are looking for premium candy that contains organic, low-sugar, and artisanal-flavored offerings. The market is being transformed by the demand for healthier options in the form of sugar-free, gluten-free, and vegan candies. The trend is particularly prevalent among millennials and Gen Z consumers, who want to be healthy without sacrificing taste. Companies are reacting with innovative products that address health-conscientious attitudes while providing indulgence, playing with a major role in market growth. April 2025, Hormbles Chormbles introduced its inaugural product line: zero-sugar, high-protein candy bars. The 33g bars pack 10g of protein and only 100 calories, providing a better-for-you alternative in the confectionery industry.

Expanding Middle-Class Population and Urbanization

As the middle class expands, especially in emerging markets such as India, China, and Brazil, so does disposable income. Urbanization brings greater access to global brands, premium products, and organized retail, making candies more accessible and desirable. Additionally, impulse buying behaviors, strengthened by attractive packaging and brand marketing, are boosting candy sales in urban areas, creating lucrative opportunities for manufacturers and distributors worldwide. More than half of the world’s countries are middle-income countries, which display a diverse range of regions, sizes, populations, and cultures.

Innovative Advertising and Seasonal Promotions

Creative advertising initiatives, social media endorsements, and focused marketing initiatives have increased global penetration of confectionery brands. Seasonal promotions based on events such as Halloween, Valentine's Day, and Christmas cause demand spikes. Innovative packaging and limited-edition products draw consumer focus, boosting volumes of sales. Partnerships with pop culture figures, film franchises, and influencer associations further increase brand visibility and build consumer buzz for candy products. February 2025, Tic Tac has introduced a new marketing campaign for its new product, Tic Tac Chewy! This is a crunchy-shelled, chewy-centered fruity candy. There are four brief videos filmed at different locations, such as a courtroom, tattoo parlor, and biker bar, demonstrating its attractiveness to a variety of consumers.

Issues in the International Candy Industry

Increased Health Issues and Regulatory Pressure

Increased recognition of obesity, diabetes, and other conditions is inducing consumers to decrease sugar intake. Governments globally are enacting tough regulations in the form of sugar taxes and labelling, challenging manufacturers to rebalance candy through reformulation while not impacting flavour. The threat to meet consumer demands to marry indulgence and health is daunting and expensive, compelling brands to spend lavishly on R&D while retaining prices competitive.

Supply Chain Disruptions and Raw Material Costs

The international candy industry is confronted with substantial challenges in terms of volatile raw material costs, particularly cocoa, sugar, and milk. Furthermore, supply chain issues brought about by geopolitical tensions, global warming, and bottlenecks in logistics affect production schedules and inputs. Such challenges could result in decreased profit margins and stock shortages, influencing the availability and price of confectionery in different regions, thereby presenting challenges to consistent market expansion.

Global Chocolate Candy Market

Chocolate candy has a commanding position in the global candy market because it is popular and emotionally appealing on a global level. Ranging from dark chocolate to milk chocolate and white chocolate types, customers perceive chocolate as a treat as well as comfort food. The trend of premiumization has also resulted in artisanal chocolates and new flavors such as sea salt, chili, and tropical fruits. Organic certification and ethical sourcing are becoming increasingly significant, with sustainability being more and more emphasized by brands. Chocolate candies are closely associated with gifting occasions and holiday celebrations, which increases their demand in the global market.

Global Hard Boiled Candy Market

Hard boiled candies, because of their long shelf life and bright color appeal, continue to hold a firm position in the global candy industry. The candies appeal to a wide demographic, providing nostalgic value in addition to price point. With several flavors such as fruit, mint, and spice, they are especially favored in emerging markets and among older age groups. Such innovations as sugar-free and natural coloring are ensuring their continued salience in the face of evolving health trends. Their convenience packaging and low manufacturing cost make them a desirable category for manufacturers with mass market aims.

Global Mints Candy Market

The international mints candy market enjoys the double utility of the product as a breath freshener as well as a confectionary product. Buyers tend to buy mints to refresh themselves every day, post-meals, or at social gatherings. Variants with sugar-free and natural ingredients have gained traction, particularly among health-focused buyers. Convenience products are further in demand with the increasing usage of pocket-friendly and resealable packages. Mints are also attractive to corporate and travel retail channels, extending distribution beyond the traditional retail stores.

Global Candy Convenience Stores Market

Convenience stores are a significant player in the international candy market, taking advantage of impulse purchasing habits. Strategically located next to checkout counters, candies at convenience stores have high visibility and high-frequency consumer exposure. Variety packs and small, economical packaging stimulate rapid purchase. With increasing on-the-go consumption and urbanization, convenience stores are increasingly gaining candy sales share, especially in highly populated cities and transportation centers.

Global Candy Online Shop Market

The internet retailing segment is revolutionizing candy sales globally. Online shopping websites offer customers access to a greater range of products, such as international and specialty candies that might not be locally available. Subscription boxes, gift options, and special online promotions further fuel sales. Digital marketing campaigns, tailored recommendations, and mobile-optimized websites are improving the customer shopping experience, fueling the explosive growth of online candy sales.

United States Candy Market

The United States is the world's largest candy consumer, with a confectionery consumption culture deeply ingrained. Holidays such as Halloween, Easter, and Christmas are responsible for generating huge sales boosts. Consumers in America are increasingly looking at premium, organic, and innovative flavor profiles, in addition to time-honored favorites. Trends around health are compelling brands to provide sugar-free and plant-based options. Retail channels like supermarkets, convenience stores, and online all contribute significantly to candy sales nationwide. November 2024, Goodis, a Swedish candy maker, has opened its U.S. online shop. With production in the New York metropolitan area and quick delivery across the country, Goodis makes it convenient for Americans to "sweeden" their day.

France Candy Market

France boasts a historic confectionery tradition with an emphasis on quality sweets, sophisticated chocolates, and high-end candy products. Consumers in France expect quality, ingredient authenticity, and taste integrity, driving a steady market for superior candies. Market growth is assisted by seasonal gifts, especially for Christmas and Easter. In addition, the trend towards organic and sugar-free versions is increasing. Both local and international brands dominate France's fast-paced, highly competitive candy marketplace. Ricola opened its inaugural French shop in Paris's Marais district in November 2022, presenting its famous plant-based sweets and new items.

India Candy Market

The Indian candy market is growing fast because of India's huge youth population, urbanization, and growing disposable incomes. Economical prices, new tastes, and the popularity of confectionery among kids are major drivers of growth. Old sweets are also being re-formulated in candy form. Both domestic and multinational brands are spending heavily in distribution channels and marketing to access rural and urban markets. Online shopping is also becoming a key sales channel. Aug 2024, Mondelez India has introduced a new range of desserts called 'Cadbury Silk Desserts' with two variants: 'Cadbury Silk Dessert Brownie' and 'Cadbury Silk Dessert Plum Cake.' This range is an extension of Cadbury Silk chocolate with a cake-like core.

Mexico Candy Market

Mexico's confectionery market is marked by a distinctive blend of traditional and contemporary sweets, with tamarind, chili, and tropical fruits being commonly used flavors. Urbanization, increasing disposable incomes, and cultural habits involving candy in festivities contribute to market expansion. Consumers' rising health consciousness is encouraging producers to launch low-sugar and fortified candies. Local brands lead the market, but foreign firms are slowly making their presence felt.

Saudi Arabia Candy Market

Saudi Arabia's confectionery market is experiencing strong growth based on its young population and increased demand for Western-style confectionery products. Holiday celebrations during Ramadan and Eid stimulate greater candy consumption, traditionally utilized for gifts and hospitality. Increased tourism and retail sector growth, particularly within malls and airports, are additional drivers. Demand is also fueled by increasing interest in premium and health-oriented candy forms, following overall global trends.

Market Segmentation

Type

- Chocolate Candy

- Non-chocolate Candy

- Hard Boiled Candies

- Pastilles, Gums, Jellies, and Chews

- Toffees, Caramels, and Nougat

- Mints

- Other Non-chocolate Candies

Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specalist Retailers

- Online Retail

- Other Distribution Channels

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Argentina

- Mexico

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis

- Perfetti Van Melle Group BV

- The Topps Company Inc.

- Mondelez International Inc.

- Haribo GmbH & Co. KG

- Mars Incorporated

- Ferrero Group

- Nestle SA

- The Hershey Company

- Grupo Arcor

- Cloetta Ab

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Candy Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Distribution Channel

6.3 By Countries

7. Type

7.1 Chocolate Candy

7.2 Non-chocolate Candy

7.2.1 Hard Boiled Candies

7.2.2 Pastilles, Gums, Jellies, and Chews

7.2.3 Toffees, Caramels, and Nougat

7.2.4 Mints

7.2.5 Other Non-chocolate Candies

8. By Distribution Channel

8.1 Supermarkets/Hypermarkets

8.2 Convenience Stores

8.3 Specalist Retailers

8.4 Online Retail

8.5 Other Distribution Channels

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 United Arab Emirates

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Perfetti Van Melle Group BV

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 The Topps Company Inc.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Mondelez International Inc.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Haribo GmbH & Co. KG

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Mars Incorporated

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Ferrero Group

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Nestle SA

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 The Hershey Company

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Grupo Arcor

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

12.10 Cloetta Ab

12.10.1 Overviews

12.10.2 Key Person

12.10.3 Recent Developments

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com