UAE Non-Invasive Prenatal Testing Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUAE Non-Invasive Prenatal Testing Market Size & Forecast 2025-2033

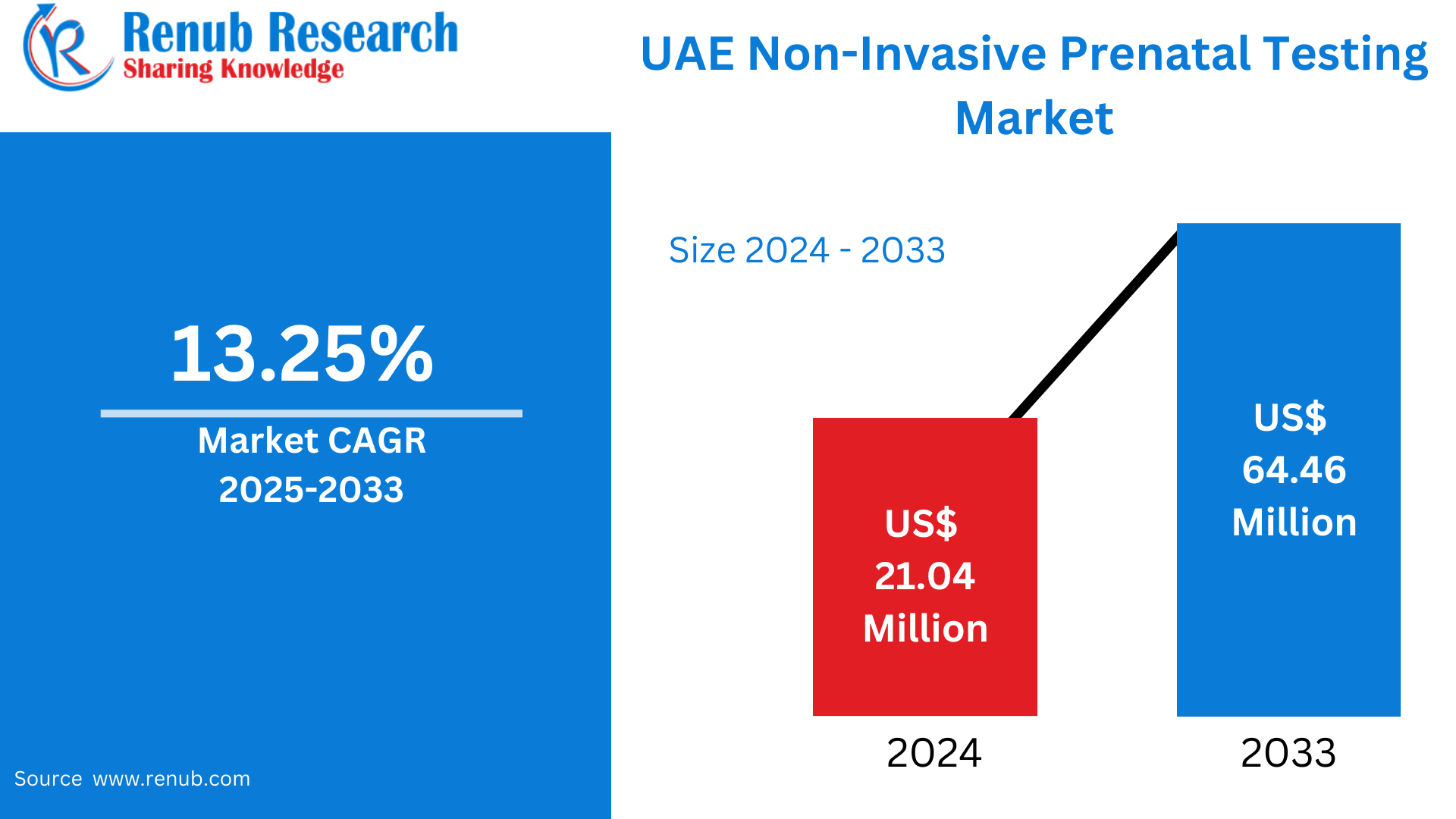

UAE Non-Invasive Prenatal Testing Market is expected to reach US$ 64.46 million by 2033 from US$ 21.04 million in 2024, with a CAGR of 13.25% from 2025 to 2033. The UAE's non-invasive prenatal testing market is growing due to a number of factors, including growing maternal age, better access to healthcare, increasing awareness, government assistance, the need for early fetal screening, and a rise in incidences of genetic disorders.

The report UAE Non-Invasive Prenatal Testing Market & Forecast covers by Component (Instruments, Kits and Reagents, Services), Application (Down Syndrome (Trisomy 21), Edwards Syndrome (Trisomy 18), Patau Syndrome (Trisomy 13), Turner Syndrome, Other Applications), End User (Hospitals, Diagnostic Labs) and Company Analysis, 2025-2033.

UAE Non-Invasive Prenatal Testing Industry Overview

Due to improvements in genetic screening technology and growing awareness among pregnant parents, the non-invasive prenatal testing (NIPT) market in the United Arab Emirates (UAE) is expanding steadily. NIPT uses a straightforward blood test from the mother to safely and effectively identify chromosomal abnormalities in the fetus. Because of its accuracy, early detection potential, and low danger in comparison to more conventional invasive techniques like amniocentesis, it has becoming more and more popular in the United Arab Emirates. Both public and commercial healthcare organizations are implementing NIPT as a common prenatal screening procedure as healthcare standards rise and prenatal care becomes more proactive.

Growing maternal age is a major risk factor for chromosomal abnormalities like Down syndrome, which raises the need for accurate prenatal screening and is one of the main causes driving this industry's rise. Furthermore, expanding insurance coverage, the presence of foreign healthcare practitioners, and the UAE government's initiatives to improve genetic health services all help to increase NIPT's accessibility and acceptability. The market is also supported by the nation's growing medical tourism industry, which draws patients from nearby areas looking for cutting-edge prenatal diagnostics, especially in locations like Dubai and Abu Dhabi.

Notwithstanding its promise, the UAE NIPT industry is beset by issues including low awareness among specific demographic groups and the exorbitant expense of testing for those without insurance. These obstacles are being addressed, meanwhile, by continued public education campaigns, the incorporation of genetics into national healthcare plans, and partnerships with international diagnostics firms. With advancements in bioinformatics and non-invasive technologies anticipated to further improve the precision and reach of prenatal screening services, the NIPT sector in the United Arab Emirates is well-positioned for sustained development as precision medicine continues to advance.

Growth Drivers for the UAE Non-Invasive Prenatal Testing Market

Supportive Government Policies

The UAE's non-invasive prenatal testing (NIPT) sector is expanding thanks in large part to supportive government legislation. As part of its larger national healthcare policy, the government has made maternal and fetal health a top priority, investing heavily in early diagnostic technologies and updating hospital infrastructure. The National Genome Strategy and the UAE's Vision 2031 initiatives center on incorporating cutting-edge genetic technology into standard medical treatment. While regulatory agencies make ensuring that these technologies are used in a safe and moral manner, public health campaigns also seek to increase awareness about prenatal screening. These initiatives, together with advantageous laws and alliances with international biotech companies, are creating a healthcare climate that encourages innovation and the broad use of NIPT throughout the nation.

Medical Tourism Growth

The non-invasive prenatal testing (NIPT) industry in the United Arab Emirates is growing due in large part to the rise of medical tourism, particularly in locations like Dubai and Abu Dhabi. The nation has established itself as a regional center for top-notch, specialized medical treatment, drawing clients from Asia, Africa, and the Middle East. The UAE's highly developed healthcare system, internationally recognized facilities, and access to state-of-the-art diagnostic tools like NIPT attract patients from outside. For pregnant moms looking for early and precise fetal screening, prenatal care facilities that offer individualized attention and minimal wait periods are particularly alluring. The UAE's standing as a destination for cutting-edge prenatal diagnostics is further reinforced by government funding for healthcare tourism and continuous initiatives to enhance service quality.

Entry of Global Diagnostic Companies

One of the main factors propelling the non-invasive prenatal testing (NIPT) industry's expansion in the United Arab Emirates is the arrival of international diagnostic and genomics firms. To increase access to cutting-edge prenatal screening technology, foreign companies are establishing strategic alliances with regional healthcare providers, labs, and governmental organizations. The accuracy, speed, and scope of NIPT services are improved by these partnerships' introduction of cutting-edge technologies including high-throughput sequencing and AI-powered data processing. Furthermore, foreign actors raise the general level of prenatal care in the United Arab Emirates by assisting with knowledge transfer, workforce training, and adherence to international quality standards. The country's larger objectives of becoming a regional leader in precision healthcare and genomic medicine are supported by this infusion of knowledge and technology.

Challenges in the UAE Non-Invasive Prenatal Testing Market

Cultural and Religious Sensitivities

The UAE's adoption of non-invasive prenatal testing (NIPT) is significantly hampered by cultural and religious sensitivities. The ethical ramifications of prenatal testing, especially with regard to possible judgments about pregnancy termination, might restrict acceptability in an area where traditional values and religious views are crucial in family and healthcare decisions. Because of religious beliefs about the sanctity of life, worries about disrupting natural processes, or fears of social disapproval, some families might be reluctant to undergo genetic testing. Even when NIPT is advised by a doctor, these issues may cause reluctance to choose it. Building understanding and confidence in prenatal screening necessitates ethical counseling, culturally relevant public education, and collaboration with community and religious leaders.

Shortage of Genetic Counseling Services

One major obstacle to the efficient use of non-invasive prenatal testing (NIPT) in the United Arab Emirates is the lack of qualified genetic counselors. Even though NIPT's technology is sophisticated and becoming more widely available, many patients may not have the assistance they need to understand complicated genetic data. Expectant parents may misinterpret test findings without the right counseling, which might cause needless worry or poor choices. In a culturally diverse nation like the United Arab Emirates, where language proficiency and cultural awareness are crucial for successful communication, this disparity is especially significant. Existing healthcare providers are likewise strained by the shortage of skilled workers. To remedy this deficiency, it is imperative to integrate remote or tele-counseling services, expand training programs, and provide incentives for genetic counseling expertise.

UAE Non-Invasive Prenatal Testing Market Segments

Component

- Instruments

- Kits and Reagents

- Services

Application

- Down Syndrome (Trisomy 21)

- Edwards Syndrome (Trisomy 18)

- Patau Syndrome (Trisomy 13)

- Turner Syndrome

- Other Applications

End User

- Hospitals

- Diagnostic Labs

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis:

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Invitae Corporation

- Illumina Inc.

- Natera Inc.

- Centogene NV

- Qiagen

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Component, Application and End User |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Arab Emirates (UAE) Non-Invasive Prenatal Testing Market

6. Market Share Analysis

6.1 Component

6.2 Application

6.3 End User

7. Component

7.1 Instruments

7.2 Kits and Reagents

7.3 Services

8. Application

8.1 Down Syndrome (Trisomy 21)

8.2 Edwards Syndrome (Trisomy 18)

8.3 Patau Syndrome (Trisomy 13)

8.4 Turner Syndrome

8.5 Other Applications

9. End User

9.1 Hospitals

9.2 Diagnostic Labs

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Eurofins Scientific

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Financial Insight

12.2 F. Hoffmann-La Roche Ltd

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Financial Insight

12.3 Invitae Corporation

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Financial Insight

12.4 Illumina Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Financial Insight

12.5 Natera Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Financial Insight

12.6 Centogene NV

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Financial Insight

12.7 Qiagen

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com