Saudi Arabia Non-Invasive Prenatal Testing Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Non-Invasive Prenatal Testing Market Size & Forecast 2025-2033

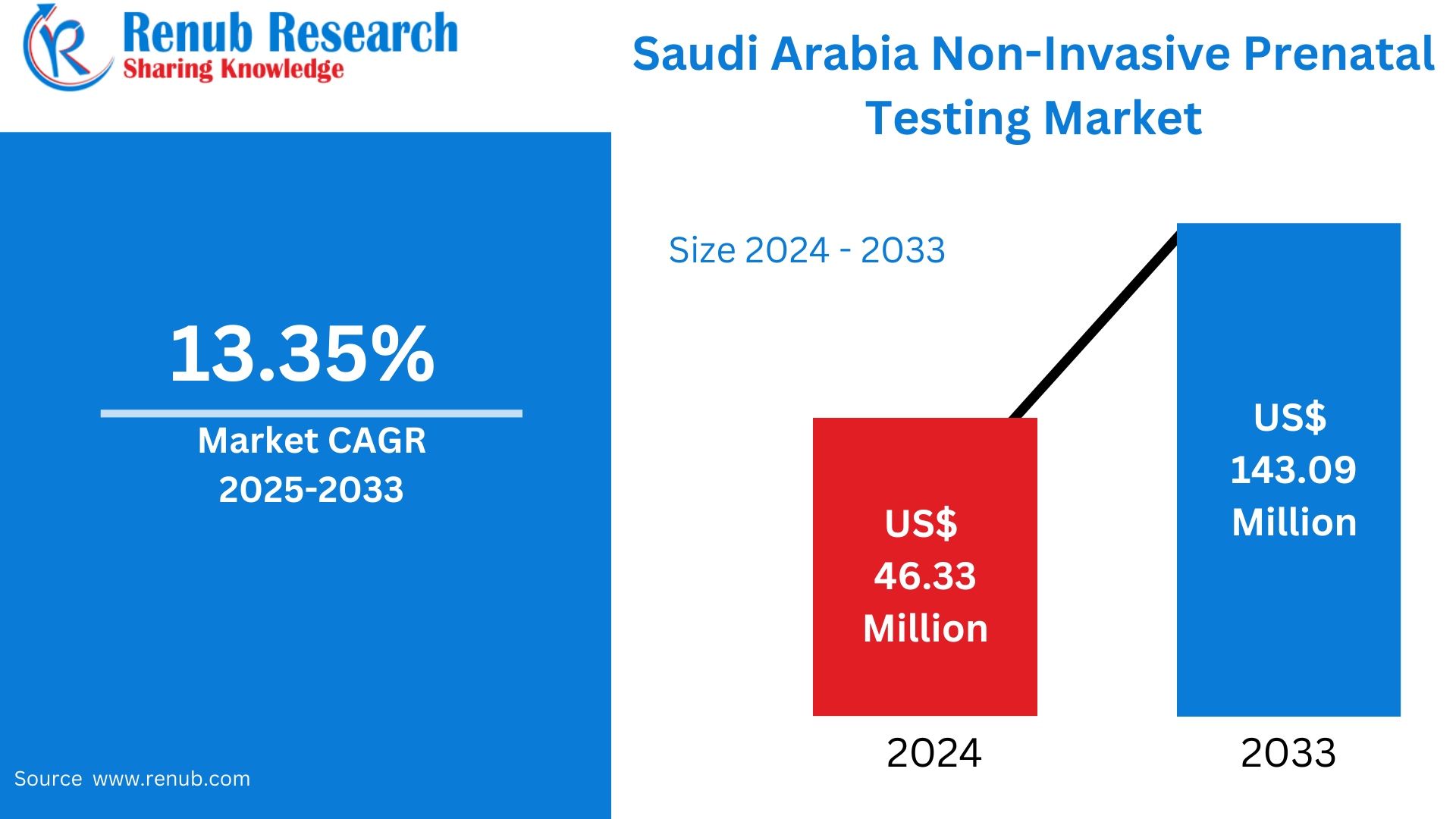

Saudi Arabia Non-Invasive Prenatal Testing Market is expected to reach US$ 143.09 million by 2033 from US$ 46.33 million in 2024, with a CAGR of 13.35% from 2025 to 2033. Advances in technology, greater knowledge, better insurance coverage, safety, and the growing incidence of genetic abnormalities are the main factors propelling the non-invasive prenatal testing industry in Saudi Arabia.

The report Saudi Arabia Non-Invasive Prenatal Testing Market & Forecast covers by Component (Instruments, Kits and Reagents, Services), Application (Down Syndrome (Trisomy 21), Edwards Syndrome (Trisomy 18), Patau Syndrome (Trisomy 13), Turner Syndrome, Other Applications), End User (Hospitals, Diagnostic Labs) and Company Analysis, 2025-2033.

Saudi Arabia Non-Invasive Prenatal Testing Industry Overview

Recent developments in genetic testing technology and growing awareness among medical professionals and pregnant parents have propelled the non-invasive prenatal testing (NIPT) sector in Saudi Arabia. By screening for chromosomal disorders including Down syndrome, trisomy 18, and trisomy 13 by examining fetal DNA in a mother's blood sample, NIPT provides a safer option to conventional prenatal diagnostics like amniocentesis. For many pregnant women, NIPT is an attractive option due to its non-invasive nature and zero chance of miscarriage. As a result, NIPT is increasingly being used as the recommended screening method in prenatal treatment.

The availability of cutting-edge diagnostic technologies and the growing emphasis on healthcare modernization are two major factors propelling NIPT's expansion in Saudi Arabia. Saudi Arabia has been making significant investments in its healthcare system as part of Vision 2030, which involves expanding access to cutting-edge medical technology. As a result of this emphasis on healthcare development, NIPT is now more widely available, with more clinics and hospitals implementing the technology to provide patients with a safe, accurate, and dependable prenatal screening choice. Additionally, pregnant moms now have better access to these essential therapies because to the government's initiatives to provide healthcare services throughout the whole nation.

Another important element driving the use of NIPT in Saudi Arabia is growing knowledge of genetic abnormalities and the advantages of early prenatal screening, in addition to advances in healthcare and technology. The need for trustworthy prenatal diagnostics has increased due to the rising prevalence of congenital disorders and chromosomal abnormalities. The public and medical professionals are therefore increasingly cognizant of the significance of genetic testing. It is anticipated that this knowledge, together with enhanced insurance coverage and the expanding availability of NIPT, would continue to propel market expansion in Saudi Arabia. Saudi Arabia's NIPT sector is expected to grow further as NIPT technologies continue to progress and are included into routine prenatal treatment.

Growth Drivers for the Saudi Arabia Non-Invasive Prenatal Testing Market

Technological Advancements

The precision and dependability of genetic screening have been greatly enhanced by technological developments in non-invasive prenatal testing (NIPT). More accurate fetal DNA analysis is made possible by advancements in next-generation sequencing (NGS) and bioinformatics, which make it possible to identify a wider variety of genetic disorders. These developments have given expecting parents and medical professionals a more thorough screening tool by extending NIPT's capabilities beyond common chromosomal diseases like Down syndrome, trisomy 18, and trisomy 13 to encompass microdeletions and single-gene disorders. Because it enables the earlier, safer, and more accurate diagnosis of any genetic disorders without the hazards associated with intrusive testing procedures, NIPT has become the preferred option in prenatal care due to the integration of sophisticated technology.

Rising Maternal Age

One major factor contributing to the rising need for non-invasive prenatal testing (NIPT) is the aging of mothers. The chance of genetic abnormalities like Down syndrome rises as more women, especially those over 35, put off having children. Because older women are more likely to seek out sophisticated prenatal screening alternatives like NIPT, this demographic change has resulted in a greater prevalence of pregnancies among these women. A safer, non-invasive substitute for conventional invasive testing, NIPT offers precise early genetic problem diagnosis without the dangers of amniocentesis or CVS. Pregnant women are choosing NIPT more frequently as a result of growing knowledge of these advantages, which is driving up demand for these secure and trustworthy prenatal screening techniques.

High Prevalence of Genetic Disorders

Genetic problems, such as Down syndrome and other chromosomal abnormalities, are very common in Saudi Arabia. The increasing need for trustworthy prenatal screening techniques, such non-invasive prenatal testing (NIPT), has been greatly influenced by this. Without the danger of miscarriage that comes with intrusive tests like amniocentesis, NIPT provides a safer, more reliable method of identifying genetic abnormalities early in pregnancy. As more medical professionals and expecting parents become aware of the advantages of NIPT, it has emerged as a favored screening method, particularly for those who are more vulnerable because of advanced maternal age or a family history of genetic abnormalities. Therefore, the necessity for sophisticated, non-invasive testing like NIPT to promote improved prenatal care has increased due to the growing frequency of chromosomal disorders.

Challenges in the Saudi Arabia Non-Invasive Prenatal Testing Market

Limited Awareness and Knowledge

In Saudi Arabia, a major obstacle is the lack of knowledge and comprehension regarding non-invasive prenatal testing (NIPT). The goal, advantages, and limits of NIPT are not well known to many expectant mothers. According to a poll done between December 2023 and February 2024, 93.3% of respondents gave inaccurate answers to knowledge-related questions, while 64.6% of respondents were not aware of NIPT. Many women may not think of NIPT as a good choice for prenatal screening because of this ignorance, which can lead to poor decision-making. Lack of awareness may prevent pregnant moms from completely appreciating the advantages of NIPT, such as its accuracy in identifying genetic disorders and non-invasive nature, which ultimately restricts its population acceptance.

High Cost and Limited Insurance Coverage

One of the biggest problems in Saudi Arabia is the high expense of non-invasive prenatal testing (NIPT). Although NIPT has advantages over conventional invasive testing, many pregnant women cannot afford it since it is frequently not covered by insurance. According to research, just 30% of participants were prepared to spend 1,500 SAR (about $400 USD), whereas 74.1% of participants would be willing to undergo NIPT if it were free. Access to NIPT is restricted by this cost burden, especially for those with lower incomes. Because of this, a lot of women could choose more risky or less accurate screening techniques, which would further exacerbate the disparity in access to high-quality prenatal care.

Saudi Arabia Non-Invasive Prenatal Testing Market Segments

Component

- Instruments

- Kits and Reagents

- Services

Application

- Down Syndrome (Trisomy 21)

- Edwards Syndrome (Trisomy 18)

- Patau Syndrome (Trisomy 13)

- Turner Syndrome

- Other Applications

End User

- Hospitals

- Diagnostic Labs

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis:

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Invitae Corporation

- Illumina Inc.

- Natera Inc.

- Centogene NV

- Qiagen

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Component, Application and End User |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Non-Invasive Prenatal Testing Market

6. Market Share Analysis

6.1 Component

6.2 Application

6.3 End User

7. Component

7.1 Instruments

7.2 Kits and Reagents

7.3 Services

8. Application

8.1 Down Syndrome (Trisomy 21)

8.2 Edwards Syndrome (Trisomy 18)

8.3 Patau Syndrome (Trisomy 13)

8.4 Turner Syndrome

8.5 Other Applications

9. End User

9.1 Hospitals

9.2 Diagnostic Labs

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Eurofins Scientific

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Financial Insight

12.2 F. Hoffmann-La Roche Ltd

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Financial Insight

12.3 Invitae Corporation

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Financial Insight

12.4 Illumina Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Financial Insight

12.5 Natera Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Financial Insight

12.6 Centogene NV

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Financial Insight

12.7 Qiagen

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com