Europe Non-Invasive Prenatal Testing Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Non-Invasive Prenatal Testing Market Size & Forecast 2025-2033

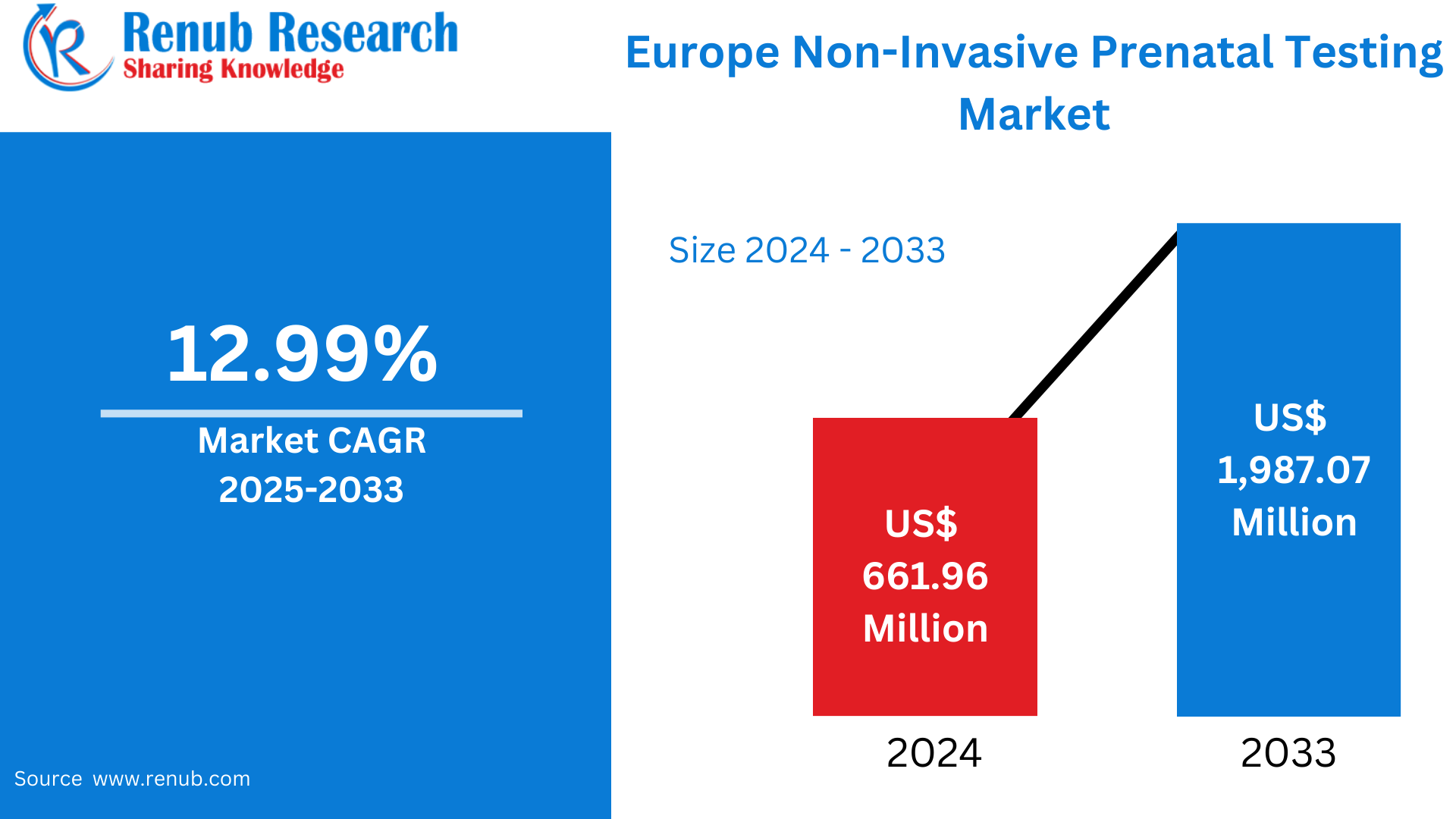

Europe Non-Invasive Prenatal Testing Market is expected to reach US$ 1,987.07 million by 2033 from US$ 661.96 million in 2024, with a CAGR of 12.99% from 2025 to 2033. Rising maternal age, sophisticated healthcare systems, growing awareness, encouraging laws, the need for early diagnosis, and the broad use of customized treatment are the main factors propelling the NIPT market in Europe.

The report Europe Non-Invasive Prenatal Testing Market & Forecast covers by Component (Instruments, Kits and Reagents, Services), Application (Down Syndrome (Trisomy 21), Edwards Syndrome (Trisomy 18), Patau Syndrome (Trisomy 13), Turner Syndrome, Other Applications), End User (Hospitals, Diagnostic Labs), Countries and Company Analysis, 2025-2033.

Europe Non-Invasive Prenatal Testing Industry Overview

Increased mother age, technological developments, and greater awareness of prenatal care are driving the non-invasive prenatal testing (NIPT) market's continuous growth in Europe. Using a straightforward maternal blood sample, NIPT provides a safe and reliable way to identify chromosomal abnormalities such trisomy 21 (Down syndrome), trisomy 18, and trisomy 13. Due to its great sensitivity and low danger, this technique is being used more and more in Europe's public and private healthcare systems for regular prenatal care. Clinical recommendations and patient demand are driving the use of NIPT in nations with robust public health systems, including the UK, Germany, France, and the Netherlands.

The aging mother population in Europe is one of the main factors driving development in the continent. NIPT is the recommended choice for early screening as the risk of genetic abnormalities rises as more women decide to postpone having children. Additionally, as pregnant parents look for more precise, customized, and non-invasive solutions, the increased emphasis on personalized care has coincided with an increase in the usage of NIPT. Its accessibility and uniformity are further supported by the inclusion of NIPT in national prenatal care recommendations and the availability of government-funded screening programs in some nations.

Notwithstanding these encouraging developments, the European market continues to face difficulties. Access is inconsistent throughout the continent due to variations in national healthcare policies, reimbursement schemes, and regulatory frameworks. The availability of NIPT may be limited in many Eastern and Southern European nations due to a lack of established protocols and a lack of governmental financing. Nonetheless, the European NIPT market is anticipated to continue growing strongly with ongoing investments in healthcare innovation, the increase of private diagnostic providers, and cross-border partnerships. NIPT is on track to become a common part of prenatal screening in the area as clinician support and public awareness grow.

A DNA test of the mother's blood is called non-invasive prenatal testing (NIPT), and it is used to identify pregnancies for the most prevalent fetal chromosomal abnormalities, including Patau trisomy 13, Edwards' trisomy 18, Down syndrome, and trisomy 21. Although NIPT can also identify the fetus's sex, it is very accurate in more than 99% of cases of Down syndrome. About 47% of women in the European Union who gave birth to their first child in 2019 were in the average age range of 28.4 years, according to Eurostat.

In addition, it was stated that 82,372 women over 45 gave birth to their first child in the same year. Between 2016 and 2019, the average age of new moms in England decreased from 28.6 to 29.4 years. In an effort to broaden access and boost sales of non-invasive goods in Germany, BGI Genomics introduced the NIFTY test with Eluthia in June 2020 under the brand name Previa Test. The test has a sensitivity rate of above 99%.

Growth Drivers for the Europe Non-Invasive Prenatal Testing Market

Cross-Border Healthcare and Medical Tourism

The European market for non-invasive prenatal testing (NIPT) is seeing significant expansion due to cross-border healthcare and medical tourism. Due to freedom of movement throughout the EU, pregnant parents can visit nations that provide more sophisticated, quick, or affordable NIPT services. Patients, especially those from low-access or high-cost nations, are encouraged to seek care in better-equipped regions like Germany, the Netherlands, or Belgium due to differences in healthcare legislation, test availability, and price among member states. Demand is also raised by certain private clinics that aggressively market NIPT services to patients from outside. In addition to encouraging market expansion, intra-European medical mobility also promotes competitive innovation and cross-border testing standards, enhancing access to high-quality prenatal care generally.

Regulatory Support and Clinical Guidelines

The non-invasive prenatal testing (NIPT) industry in Europe is growing, mostly due to regulatory backing and clear clinical recommendations. Since NIPT is a dependable, evidence-based test, several European nations have included it in their national prenatal screening programs, especially for high-risk pregnancies. Clinicians and patients have greater faith in the technology because regulatory agencies have put in place stringent frameworks to monitor test accuracy, laboratory standards, data privacy, and ethical issues. These steps support the proper use of genetic testing, guarantee informed consent, and guard against abuse. Because of this, NIPT is now more widely accepted in both the public and commercial healthcare sectors, which makes it easier to provide consistent access, higher-quality treatment, and long-term integration into standard prenatal services throughout the continent.

Shift Toward Personalized Medicine

The acceptance of non-invasive prenatal testing (NIPT) is being greatly impacted by Europe's rising trend toward customized treatment. NIPT fits in well with the growing emphasis on risk-based decision-making, personalized treatment, and early detection in healthcare systems. Pregnant parents and medical professionals may make well-informed decisions early in pregnancy with the help of NIPT, which provides individualized, precise insights about the possibility of chromosomal disorders by examining fetal DNA from a maternal blood sample. This is in line with Europe's larger shift toward preventative, predictive healthcare that enhances results and lessens the need for intrusive operations. Both the public and commercial sectors are using NIPT as a crucial part of contemporary prenatal screening in response to growing demands for individualized medical treatment, which is improving patient confidence and medical accuracy throughout the area.

Challenges in the Europe Non-Invasive Prenatal Testing Market

Uneven Access Across Countries

In Europe, unequal access to non-invasive prenatal testing (NIPT) is still a major problem. NIPT has been effectively incorporated into public healthcare systems in Western European nations including Germany, the United Kingdom, and France. For high-risk pregnancies, these nations frequently provide the test at little or no cost. However, due to a lack of standardized screening procedures, underfunded healthcare systems, and financial limitations, access is still restricted in many countries in Eastern and Southern Europe. Because of these differences, pregnant women in less developed areas would not be able to take advantage of early, non-invasive genetic screening, leading to serious inequities in prenatal care. It will take more funding for healthcare infrastructure and concerted efforts to put national policies that support fair access to NIPT services into place in order to close this access gap.

Public Misunderstanding or Misinformation

Even though non-invasive prenatal testing (NIPT) is becoming more widely known throughout Europe, there are still several major obstacles due to public misconception and disinformation. NIPT is generally viewed as a thorough diagnostic tool rather than a highly accurate screening test, and many pregnant parents are unaware of its entire range of capabilities and limits. This fallacy, particularly when it comes to positive or ambiguous findings, might result in inflated expectations, a misunderstanding of the data, and an increase in emotional stress. Patients can find it difficult to comprehend the ramifications of their results or make wise decisions for additional testing if they lack the necessary knowledge or access to genetic counseling. Standardized patient education materials, improved communication from healthcare practitioners, and larger public health initiatives to guarantee accurate, easily available prenatal screening information are all necessary to address this problem.

France Non-Invasive Prenatal Testing Market

The market for non-invasive prenatal testing (NIPT) in France is expanding rapidly due to rising prenatal care awareness and the need for safer, more precise screening methods. Because it provides an early, non-invasive technique for more accurately and safely identifying chromosomal abnormalities like trisomy 18 and Down syndrome, NIPT is becoming more and more popular. Wider access to the test has been made possible by the French healthcare system's growing integration of NIPT into normal prenatal care, particularly for high-risk pregnancies. There are still issues, though, including as making sure that everyone has fair access, especially in rural areas, and dealing with the shortage of qualified genetic counselors who can help patients comprehend the results and make wise decisions.

Germany Non-Invasive Prenatal Testing Market

The German market for non-invasive prenatal testing (NIPT) is increasing quickly due to improvements in genetic testing technology and rising need for more precise and safe prenatal screening techniques. With NIPT incorporated into its healthcare system, Germany, one of Europe's top healthcare markets, has made it more accessible to pregnant women, especially those in high-risk categories. Because it may identify chromosomal abnormalities like Down syndrome with little harm to the fetus, the test is becoming more and more popular. There are still issues to be resolved, such as filling in the gaps in genetic counseling services and guaranteeing fair access for people from all socioeconomic backgrounds. Sustained investment in healthcare infrastructure and public health education is essential for future market expansion.

United Kingdom Non-Invasive Prenatal Testing Market

The market for non-invasive prenatal testing (NIPT) in the UK is expanding significantly due to improvements in genetic testing technology and growing awareness among pregnant parents. Without the dangers of intrusive procedures like amniocentesis, NIPT offers a reliable and safe way to identify chromosomal abnormalities early in pregnancy. NIPT is now a crucial component of prenatal treatment in the UK, particularly for women who are deemed to be at greater risk. Although the test is accessible through both public and commercial healthcare systems, issues including cost, geographical access disparities, and the requirement for sufficient genetic counseling assistance still exist. To remove these obstacles and guarantee greater accessibility, legislative support and infrastructure investments in the healthcare industry must continue.

Europe Non-Invasive Prenatal Testing Market Segmentation

Countries

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Component

- Instruments

- Kits and Reagents

- Services

Application

- Down Syndrome (Trisomy 21)

- Edwards Syndrome (Trisomy 18)

- Patau Syndrome (Trisomy 13)

- Turner Syndrome

- Other Applications

End User

- Hospitals

- Diagnostic Labs

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis:

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Invitae Corporation

- Illumina Inc.

- Natera Inc.

- Centogene NV

- Qiagen

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Component, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Non-Invasive Prenatal Testing Market

6. Europe – Countries Non-Invasive Prenatal Testing Market

6.1 France

6.2 Germany

6.3 Italy

6.4 Spain

6.5 United Kingdom

6.6 Belgium

6.7 Netherlands

6.8 Turkey

7. Market Share Analysis

7.1 Component

7.2 Application

7.3 End User

8. Component

8.1 Instruments

8.2 Kits and Reagents

8.3 Services

9. Application

9.1 Down Syndrome (trisomy 21)

9.2 Edwards Syndrome (trisomy 18)

9.3 Patau Syndrome (trisomy 13)

9.4 Turner Syndrome

9.5 Other Applications

10. End User

10.1 Hospitals

10.2 Diagnostic Labs

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Eurofins Scientific

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Financial Insight

13.2 F. Hoffmann-La Roche Ltd

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Financial Insight

13.3 Invitae Corporation

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Financial Insight

13.4 Illumina Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Financial Insight

13.5 Natera Inc.

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Financial Insight

13.6 Centogene NV

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Financial Insight

13.7 Qiagen

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com