Global Liquid Biopsy Market: Industry Trends, Growth Analysis, and Forecast (2025–2033)

Buy NowGlobal Liquid Biopsy Market Size

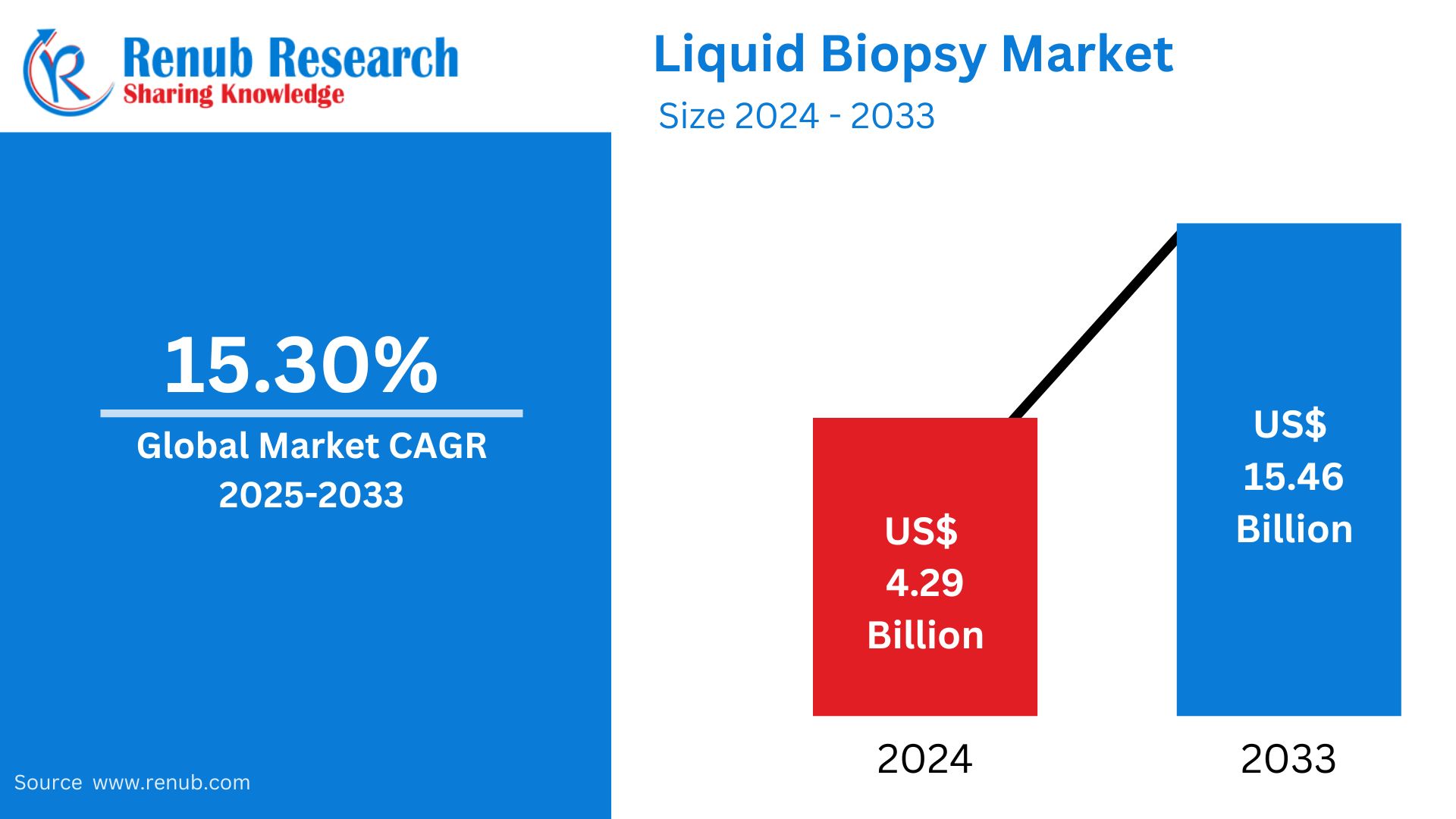

The global liquid biopsy market is expected to grow with a significant size, approximately US$ 15.46 billion in 2033, compared to US$ 4.29 billion in 2024, at a robust CAGR of 15.30% from 2025 to 2033. This growth is because of the increasing demand for non-invasive cancer diagnostics, advancements in biomarker discovery, and rising adoption of personalized medicine.

Global Liquid Biopsy Market Overview

A liquid biopsy is a non-invasive technique of diagnosis that involves analyzing biological fluids, including blood, to detect cancer and other diseases. Liquid biopsies are different from the traditional tissue biopsies, which involve surgical procedures to extract tissue samples. Instead, liquid biopsies use circulating biomarkers, such as cell-free DNA (cfDNA), circulating tumor DNA (ctDNA), circulating tumor cells, or exosomes found in the bloodstream.

Liquid biopsies are widely used for early cancer detection, monitoring disease progression, and evaluating treatment response. They offer several advantages, including reduced risk, quicker results, and the ability to capture real-time insights into tumor dynamics. This method is precious for tracking minimal residual disease and detecting cancer recurrence. Beyond oncology, liquid biopsies are being explored for applications in prenatal testing, organ transplant monitoring, and detecting other genetic or chronic conditions. Their non-invasive nature and growing precision make them a revolutionary tool in personalized medicine.

Key Market Drivers in the Global Liquid Biopsy Market

Increasing Incidence of Cancer and Chronic Diseases

The growing incidence of cancer worldwide is one of the major growth drivers for the fluid biopsy market. Liquid biopsies offer a non-invasive, efficient, and accurate way to detect and monitor the progression of various cancers like lung, breast, and colorectal cancer. As more and more people become aware of their disease, and early detection becomes the need of the hour, liquid biopsies become an integral part of a patient's treatment strategy. Besides this, their newly adopted use in monitoring other chronic diseases like cardiovascular and genetic diseases propels the demand in the market. In 2024, 2,001,140 new cases of cancer and 611,720 cancer deaths are anticipated in the United States.

Advancements in Biomarker Technology

Technological breakthroughs in biomarker discovery and molecular diagnostics have significantly spurred the adoption of liquid biopsies. Next-generation sequencing (NGS) has improved sensitivity and specificity along with circulating tumor DNA (ctDNA) analysis and exosome profiling. These innovations allow for earlier detection of disease, real-time tracking of treatment response, and identification of actionable mutations; hence, they are integrated into clinical workflows across the world. August 2024 – Hitachi High-Tech Corporation and Gencurix, Inc. have announced a strategic partnership in cancer molecular diagnostics. This partnership seeks to establish a testing service that integrates Hitachi High-Tech's strengths in in vitro diagnostic products and digital technology with Gencurix's strength in the discovery of biomarkers and molecular testing services.

Liquid Biopsy Market Shift Towards Non-invasive Diagnostic Techniques

It is one of the leading markets, primarily driven by the preference of patients towards non-invasive diagnostic methods. Liquid biopsies are less risky, allow for minimal recovery time, and can be repeated. Benefits such as these are best suited for patients with advanced-stage cancer, where traditional approaches to biopsy may not be tenable. The shift of diagnostic solutions toward home- and outpatient-based settings serves to further support the adoption of liquid biopsy technologies, supportive of patient-centric healthcare approaches while driving market growth.

United States Liquid Biopsy Market

United States stands at the top in fluid biopsy market globally, due to high incidence of cancer in the region and better medical facility. The country is abounding with biotechnology companies engaged in research on cancer diagnostic services and personalized medicine. High growth in the market, is attributed to the FDA clearance of liquid biopsy technologies which also has gained wide acceptance across different clinical settings. Moreover, the US heavily invests in R&D, which is propelling innovations in liquid biopsy technologies and enhancing the detection and monitoring of cancers and other diseases, thus fueling further market expansion. In February 2024, Myriad Genetics, Inc. (US) agreed to acquire select assets from Intermountain Health, including the Precise Tumor Test, Precise Liquid Test, and IPG's CLIA-certified laboratory from its Intermountain Precision Genomics (IPG) business.

Germany Liquid Biopsy Market

Germany is a leading player in the European fluid biopsy market, mainly due to its well-established healthcare system, high investment in biotechnology, and a strong focus on medical research. Germany is a forerunner in adopting new diagnostic technologies, including liquid biopsy, for cancer and genetic testing. The country's major medical research institutions and collaboration with global pharmaceutical companies have further propelled its market growth. Germany's regulatory support and focus on precision medicine make it an ideal country to adopt innovative diagnostic solutions such as liquid biopsy. Sept. 2024, PreAnalytiX GmbH, a joint venture of QIAGEN N.V. and BD, has introduced the PAXgene Urine Liquid Biopsy Set for reliable analysis of cell-free DNA (cfDNA) from urine using various molecular testing technologies, including qPCR, digital PCR, and NGS.'

China Liquid Biopsy Market

In short, China is one such vast-growing fluid phase biopsy market, driven by rising incidences of cancers and improvements in its infrastructure pertaining to healthcare. Adoption in the country has significantly fastened following the government's commitment toward increasing access to advance diagnosis tools. Furthermore, there is a high number of incidence that occurs in the patients diagnosed for cancer, making this treatment an attractive option to enable early detection and diagnosis among various types of cancerous diagnosis. The country's biotechnology sector has made considerable investments and collaborations with global companies to foster rapid innovation in this field, which would place China as a crucial player in the global fluid biopsy market. August 2023, China's National Medical Products Administration has approved sunvozertinib for adult patients with advanced or metastatic non-small cell lung cancer with EGFR exon 20 insertion mutations who have progressed after platinum-based chemotherapy.

Brazil Liquid Biopsy Market

Brazil is the leader in Latin America for liquid biopsy adoption, with growing healthcare awareness and increased access to novel medical technologies. As the largest economy in the region, Brazil is investing in modernizing its healthcare system and improving cancer diagnostics. Liquid biopsy is an attractive option for early cancer detection and monitoring due to its non-invasive nature, particularly in a country with high cancer prevalence. Other government initiatives to improve healthcare access and investments in biotechnology and research further enhance the growth of liquid biopsy technologies in Brazil, thus becoming a key market in the region.

Recent Development

F. Hoffmann-La Roche Ltd.,

- Approved by the US FDA in October 2020 for use as a companion diagnostic (CDx) for a broader group of therapies to treat non-small cell lung cancer (NSCLC)

- June 2022, F. Hoffmann-La Roche Ltd. partnered with the Lung Cancer Research Foundation (LCRF) and Lung Cancer Mutation Consortium (LCMC) to participate in the LCMC 4th screening trial to evaluate actionable drivers in early-stage lung cancer to offer targeted therapy options for patients.

- November 2022, Thermo Fisher Scientific introduced digital PCR liquid-biopsy assays for its Applied Biosystems absolute Q dPCR system and a custom design tool to simplify cancer research in academics & clinical research institutes.

- Bio-Rad Laboratories,

- Bio-Rad’s ddPCR technology detects cancer subtypes, monitors residual disease, optimizes drug treatment plans, and studies tumor evolution. ddPCR assays have advantages when used in liquid biopsies, enabling measurement of Circulating Tumor Cells (CTCs) and Circulating Nucleic Acids (cfDNA) in blood samples.

Thermo Fisher Scientific Inc.,

- The first assays to measure myeloid measurable residual disease (MRD) using both DNA and RNA were released by Thermo Fisher Scientific in August 2023. This makes it easier for doctors to keep an eye on this particular kind of illness.

- November 2022, Thermo Fisher Scientific tabled digital PCR liquid-biopsy assays for Applied Biosystems absolute Q dPCR system and custom design tool for simplifying cancer research in clinical research and academic institutes.

- September 2021: Thermo Fisher Scientific Inc. collaborated with AstraZeneca to develop NGS-based (CDx) to support AstraZeneca's expanding portfolio of targeted therapies.

- September 2021, Thermo Fisher Scientific launched the Applied Biosystems QuantStudio Absolute Q digital PCR system. The system uses microfluidic array technology and simplified workflows to run liquid biopsy assays to identify genetic and cancer mutations.

Biocept Inc.,

- in July 2021, obtained a South Korean patent for Primer-Switch technology. This technology finds mutations in circulating tumor DNA via real-time PCR and associated methods, which helps identify rare cancer biomarkers.

Guardant Health,

- January 2023, Guardant Health received FDA approval for Guardant360 CDx, a liquid biopsy assay as a companion diagnostic for ESR1 mutant breast cancer diagnosis.

- December 2022, Guardant Health, Inc. entered into a partnership with Susan G. Komen for conducting clinical studies to identify patients suffering from breast cancer through Guardant Reveal, a blood-based test

- May 2021, Guardant Health, Inc., received the U.S. FDA approval for the Guardant360 CDx test as the first and only test for the diagnosis of advanced non-small cell lung cancer.

- In June 2021, Guardant Health, Inc. expanded its product portfolio by adding Guardant360 Response, a blood-based test for immunotherapy and targeted therapy.

- February 2021, Guardant Health, Inc. launched a Guardant reveal test for residual disease and recurrence monitoring in patients with early-stage colorectal cancer. The test detects the residual disease after surgery and recurrence months earlier than current standard-of-care methods.

Illumina, Inc.,

- June 2021 Illumina Inc. and Next Generation Genomic Co., Ltd. launched VeriSeq NIPT Solution v2 in Southeast Asia.

- November 2023, Illumina Inc. announced the launch of TruSight Oncology 500 ctDNA v2, a novel generation of liquid biopsy assay to enable genomic profiling

- May 2022: Guardant Health, Inc. announced that blood sample-based cancer testing services in Europe are operational at the Vall d’Hebron Institute of Oncology (VHIO) liquid biopsy testing facility in Barcelona.

- In 2021, Illumina, Inc. collaborated with Bristol Myers Squibb to innovate and enhance companion diagnostics for therapy selection to further precision oncology. TSO 500 ctDNA is one of the first liquid biopsy assays to enable comprehensive genomic profiling for therapy selection.

QIAGEN N.V

- In 2021, QIAGEN collaborated with Sysmex Corporation for the development and commercialization of cancer companion diagnostics using NGS and Plasma-Safe-SeqS technology.

- In January 2022, QIAGEN's Biotech Grants program winners were announced, displaying the company's dedication to fostering partnerships with biotech and pharma firms. Supporting these businesses, QIAGEN aims to bolster their success in the market, contributing to its revenue growth strategy

- Therascreen EGFR Plus RGQ PCR Kit, a new diagnostic test from QIAGEN, was introduced in May 2023. It is employed to identify sensitive mutations in the EGFR gene, which is significant for several diseases.

- In April 2023, QIAGEN N.V., a provider of molecular test solutions, announced the launch of QIAseq targeted cfDNA ultra panels. It enables the research activities for cancer and other diseases to turn cell-free DNA (cfDNA) liquid-biopsy samples into libraries.

- July 2021: QIAGEN collaborated with Sysmex Corporation to develop cancer companion diagnostics using ultra-sensitive liquid biopsy next-generation sequencer technology.

Exact Sciences Corporation

- In January 2022, Exact Sciences Corporation expanded its cancer diagnostics portfolio by acquiring Prevention Genetics, a genetic testing laboratory. This strategic move enables Exact Sciences to venture into hereditary cancer testing, complementing its existing offerings and enhancing its position in the diagnostics market

- August 2021, a research group at Exact Sciences and UW-Madison started working on liquid biopsies for cancer, including a blood test that helps detect genetic mutations in tumors targeted by drugs. This test can detect recurrence of cancer after treatment as well as help in the early detection of the disease.

Product Segmentation

- Kits & Reagents

- Platforms & Instruments

- Services

Application

- Cancer Therapeutic Application

- Reproductive Health

- Other Therapeutic

Circulating Biomarkers

- Circulating Tumour Cell

- Circulating Tumour DNA

- Cell-free DNA

End-User

- Hospitals

- Diagnostic Laboratories

- Point-of-care Testing

- Academic Institutes

- Others

Regional

Americas

- United States

- Canada

- Mexico

- Brazil

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Netherlands

Asia – Pacific

- China

- Japan

- India

- South Korea

- Australia

Middle East & Africa

- United Arab Emirates

- South Africa

Rest of the World

All companies have been covered from 3 viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories

- Thermo Fisher Scientific Inc.

- Johnson & Johnson

- Biocept Inc.

- Guardant Health

- llumina, Inc.

- Laboratory Corporation of America Holdings

- QIAGEN N.V.

- Exact Sciences Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application, Circulating Biomarker, End User and Countries |

| Countries Covered |

|

| Companies Covered |

1. F. Hoffmann-La Roche Ltd. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Liquid Biopsy Market

6. Market Share Analysis

6.1 By Product

6.2 By Application

6.2.1 By Cancer Type

6.3 By Circulating Biomarker

6.4 By End Users

6.5 By Country

7. Product

7.1 Kits & Reagents

7.2 Platforms & Instruments

7.3 Services

8. Application

8.1 Cancer Therapeutic Application

8.1.1 By Cancer Type

8.1.1.1 Lung Cancer

8.1.1.2 Breast Cancer

8.1.1.3 Colorectal Cancer

8.1.1.4 Prostate Cancer

8.1.1.5 Liver Cancer

8.1.1.6 Other Cancers

8.2 Reproductive Health

8.3 Other Therapeutic

9. Circulating Biomarker

9.1 Circulating Tumor Cell

9.2 Circulating Tumor DNA

9.3 Cell-free DNA (cfDNA)

9.4 Extracellular Vesicles

9.5 Other Biomarkers

10. End User

10.1 Hospitals

10.2 Diagnostic Laboratories

10.3 Point-of-care Testing

10.4 Academic Institutes

10.5 Others

11. Country

11.1 Americas

11.1.1 United States

11.1.2 Canada

11.1.3 Mexico

11.1.4 Brazil

11.2 Europe

11.2.1 United Kingdom

11.2.2 Germany

11.2.3 France

11.2.4 Italy

11.2.5 Spain

11.2.6 Netherlands

11.3 Asia – Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Australia

11.4 Middle East & Africa

11.4.1 United Arab Emirates

11.4.2 South Africa

11.5 Rest of the World

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 F. Hoffmann-La Roche Ltd.

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Financial Insight

14.2 Bio-Rad Laboratories

14.2.1 Overview

14.2.2 Recent Development

14.2.3 Financial Insight

14.3 Thermo Fisher Scientific Inc.

14.3.1 Overview

14.3.2 Recent Development

14.3.3 Financial Insight

14.4 Johnson & Johnson

14.4.1 Overview

14.4.2 Recent Development

14.4.3 Financial Insight

14.5 Biocept Inc.

14.5.1 Overview

14.5.2 Recent Development

14.5.3 Financial Insight

14.6 Guardant Health

14.6.1 Overview

14.6.2 Recent Development

14.6.3 Financial Insight

14.7 Illumina, Inc.

14.7.1 Overview

14.7.2 Recent Development

14.7.3 Financial Insight

14.8 Laboratory Corporation of America Holdings

14.8.1 Overview

14.8.2 Recent Development

14.8.3 Financial Insight

14.9 QIAGEN N.V

14.9.1 Overview

14.9.2 Recent Development

14.9.3 Financial Insight

14.10 Exact Sciences Corporation

14.10.1 Overview

14.10.2 Recent Development

14.10.3 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com