Global Confectionery Market – Segmentation & Forecast 2025–2033

Buy NowConfectionery Market Size and Forecast 2025-2033

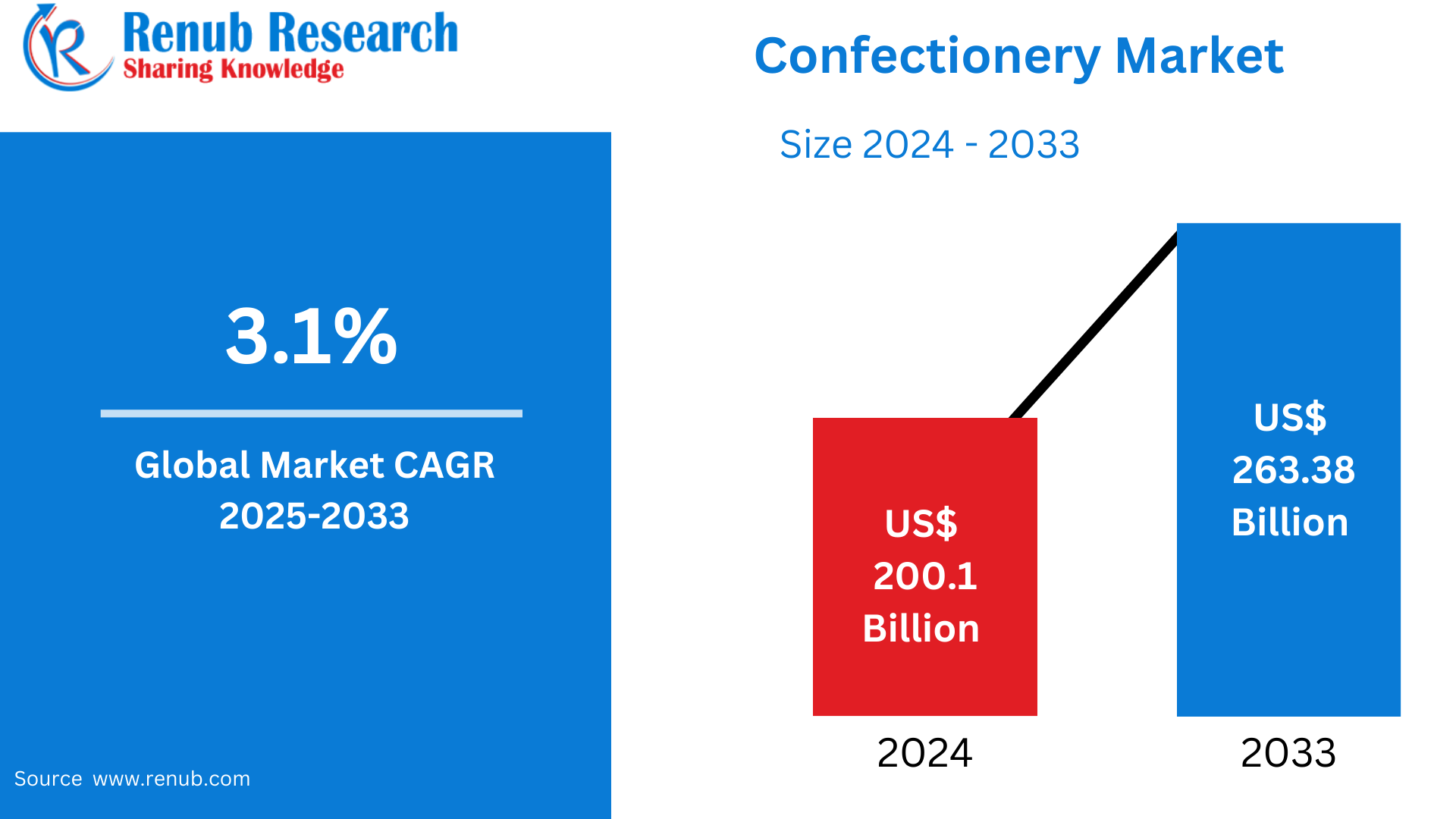

Global Confectionery Market is expected to reach US$ 263.38 billion by 2033 from US$ 200.1 billion in 2024, with a CAGR of 3.1% from 2025 to 2033. The market is growing due to a number of factors, including shifting consumer preferences, increasing disposable incomes, new product offerings, the trend of giving candy as gifts, increasing urbanization, a greater emphasis on health and wellness, the expansion of distribution channels, strategic partnerships, and investments in R&D.

Confectionery Global Market Report by Type (Chocolate, Sugar Confectionery, Cookies, Ice Cream), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceuticals and Drug Stores, Specialty Stores, Online, Others), Countries and Company Analysis, 2025-2033.

Global Confectionery Industry Overview

Chocolates, candies, gums, and other sweet delicacies are all part of the vibrant and varied worldwide confectionery business. The industry is expanding in both established and emerging regions thanks to changing customer tastes, creative flavor combinations, and eye-catching packaging. Sugar-free, organic, and functional confections are becoming more popular as a result of health-conscious trends that are impacting product reformulation. Premium and seasonal goods are also very important for increasing sales. Strong demand, particularly in Asia-Pacific and Latin America, encourages market development despite economic difficulties. The industry's future is being shaped by environmental measures, digital marketing, and strategic branding, which will make it robust and competitive.

Supermarkets and hypermarkets are becoming the primary distribution channels in the confectionery business, which is undergoing a dramatic change in the retail environment. While growing their shop networks to improve accessibility, major retail chains are placing confectionery goods strategically at checkout counters to encourage impulsive purchases. For example, as of 2023, Carrefour has over 2,869 supermarkets in Europe, whereas Lidl has over 3,000 outlets in Germany and 1,500 in France. The convenience shop industry has grown significantly as well; by 2022, companies like 7-Eleven will have over 77,711 locations worldwide, providing a variety of confections and creative marketing techniques.

The distribution landscape of the confectionery market is changing as a result of the digital revolution of retail channels. Because they give customers easy access to a greater selection of goods and customized shopping experiences, e-commerce platforms are becoming more important sales channels. To better understand customer preferences and enhance their product offers, online merchants are utilizing artificial intelligence and data analytics. The explosive expansion of online candy sales is a prime example of the trend towards digital retail, and it is anticipated that this market will continue to expand strongly through 2030 thanks to rising internet usage and changing customer purchasing patterns. The expansion of the confectionery market is largely due to this digital change.

Key Factors Driving the Confectionery Market Growth

Per capita income inflation

One major factor driving the expansion of the worldwide confectionery industry is the increase in disposable incomes, particularly in emerging nations. Consumers who have greater purchasing power are more likely to spend a portion of their anorexic income on a variety of snacks and treats, including confections. The notion of inexpensive pleasures and the culture of inexpensive luxury both fuel industry expansion. Furthermore, customers may spend more on food and beverages (F&B), including confections, thanks to economic expansion, which increases demand for the products covered above. As a result, the market has deliberately broadened its role in creating marketplaces with rising demand, appealing target populations, and more discretionary money.

Development of cutting-edge product lines

Enhancing growth in the global confectionary industry requires innovative product formulations and the integration of successful marketing strategies. In order to draw in customers and set their goods apart from those of rivals, manufacturers are introducing novel tastes, formulas, and package designs. These initiatives are motivated by the need to adapt to shifting customer preferences for premium ingredients, unique tastes, and healthful goods. To increase brand awareness and customer appeal, marketing tactics—such as social media campaigns, advertising, and strategic product placements—are just as important as products. Key businesses may create new strategies to improve their market position, draw in new customers, and expand sustainably in the cutthroat industry based on the two factors.

Changing customer tastes

The worldwide confectionery market has been significantly shaped by the shift in customer preferences toward decadent and handy snacking. The demand for different kinds of confectionery, such as chocolates, candies, and gums, is being driven by consumers' growing need for items that satisfy their taste buds and are convenient. More precisely, the trend is noticeable among those who live hectic lives in cities and prefer to munch while on the go. Furthermore, as shifting consumption patterns brought about by cultural diversity and international cuisines push producers to experiment with new flavors and product variants to accommodate a range of palates, the variety of products keeps growing. In order to keep their goods competitive and appealing, major market players are investing in research and development (R&D) to comprehend and forecast customer behavior.

Challenges in the Confectionery Market

Health and Wellness Trends

Health and wellness trends are greatly impacting the confectionery sector as customers grow more cognizant of the influence of sugar on their health. The need for healthier options is being driven by growing worries about diabetes, obesity, and other related health conditions. Traditional candy companies are thus facing mounting pressure to reformulate their goods by adding natural sweeteners, cutting less on sugar, or providing sugar-free alternatives. Additionally, there is an increase in demand for plant-based, organic, and functional snacks that provide extra health advantages like better digestion or increased immunity. The confectionery sector is changing as a result of these changes, which are forcing firms to innovate and adjust to the changing tastes of health-conscious customers.

Raw Material Costs

In the confectionery sector, fluctuating raw material costs pose a serious problem that affects both production and profitability. Price fluctuations for essential goods like dairy, sugar, and cocoa are caused by supply and demand shifts, geopolitical concerns, and climatic variables. For instance, the production of cocoa is extremely vulnerable to weather-related interruptions, but the pricing of sugar and dairy products can be influenced by global trade policy and agricultural outputs. The cost of manufacturing rises as a result of these price swings, and confectionery companies are forced to either absorb the additional expenses or raise prices for customers. In order to stay competitive, businesses must carefully manage their supply chains and look into cost-effective alternatives. This situation has the potential to reduce profit margins and upset pricing strategy.

Confectionery Market Overview by Regions

While Asia-Pacific and Latin America are seeing significant expansion due to rising incomes, urbanization, and expanding customer bases seeking innovative and reasonably priced sweet treats, Europe and North America lead the confectionery industry in terms of premium and seasonal items. The following provides a market overview by region:

United States Confectionery Market

The confectionery market in the United States is a vibrant industry with a wide variety of goods, such as chocolates, candies, gums, and seasonal sweets. Consumer tastes are changing; in addition to conventional decadent desserts, there is a rising need for healthy choices like sugar-free and plant-based confections. In order to satisfy a range of palates, producers are being prompted by this change to innovate by providing a diversity of tastes, textures, and serving sizes. Limited-edition releases and premium packaging are also becoming more and more popular, particularly with younger consumers looking for distinctive and superior goods. Beyond traditional retail, distribution channels are growing, and internet platforms are becoming more and more important for connecting with customers. Notwithstanding obstacles such as shifting raw material prices and regulatory demands, the US confectionery sector is proving resilient and flexible, setting itself up for long-term expansion in the years to come.

Belgium Confectionery Market

Belgium's confectionery industry is well known for its artisanal workmanship and rich chocolate history. Neuhaus, Guylian, and Vanparys are just a few of the internationally renowned brands that call the nation home, adding to its standing as a leading producer of chocolate. Manufacturers are innovating with organic ingredients, lower sugar content, and eco-friendly packaging as consumer tastes shift toward healthier and more sustainable solutions. To meet the rising desire for distinctive and decadent experiences, the industry is also seeing a trend toward personalized and high-end confectionary items. Belgium's rich confectionery heritage continues to propel its position in the global market despite obstacles including shifting raw material prices and regulatory demands. The nation's sustained dominance in the confectionery sector is guaranteed by its dedication to quality and innovation.

India Confectionery Market

The market for confections in India is expanding rapidly due to changing customer tastes and cultural customs. The middle class has grown as a result of urbanization and growing disposable incomes, which has raised demand for both classic and contemporary confections. Manufacturers are innovating with natural sweeteners and alternative ingredients in response to health-conscious customers' growing need for sugar-free, low-calorie, and functional choices. Customized hampers and high-end packaging are becoming more and more popular, and the gift-giving culture around holidays like Diwali and Raksha Bandhan further increases seasonal sales. Distribution channels are changing as a result of digital platforms and e-commerce, increasing the accessibility of confectionery items in both urban and rural locations. Notwithstanding obstacles including shifting raw material prices and regulatory demands, the market's adaptability and durability put it in a strong position for long-term growth in the years to come.

United Arab Emirates Confectionery Market

The candy industry in the United Arab Emirates (UAE) is distinguished by a fusion of contemporary consumer tastes with classic flavors. Consumption patterns are greatly influenced by cultural customs, such as giving candy during holidays like Eid and Ramadan, which raises demand for both domestic and foreign confections. Consumer demand in sugar-free, organic, and functional treats is driving a change in the market toward healthier alternatives, which is in line with the rising trend of health consciousness. Another indication of premiumization is the growing demand for fine, handmade goods with distinctive tastes and opulent packaging. Due to their convenience and increased reach, e-commerce and digital platforms are becoming more and more important in distribution. The UAE confectionery market continues to show resilience and adaptation in the face of obstacles including shifting raw material prices and regulatory restrictions, setting itself up for long-term growth in the years to come.

Market Segmentations

Type

- Chocolate

- Sugar Confectionery

- Cookies

- Ice Cream

Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceuticals and Drug Stores

- Specialty Stores

- Online

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- August Storck KG

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero International SA

- General Mills Inc.

- HARIBO Holding GmbH & Co. KG

- Kellogg Company

- Lotte Corporation

- Mars Incorporated

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Service Provider, By End User, By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Confectionery Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Confectionery Market Share Analysis

6.1 By Type

6.2 By Distribution Channel

6.3 By Countries

7. Type

7.1 Chocolate

7.2 Sugar Confectionery

7.3 Cookies

7.4 Ice Cream

8. Distribution Channel

8.1 Supermarkets and Hypermarkets

8.2 Convenience Stores

8.3 Pharmaceuticals and Drug Stores

8.4 Specialty Stores

8.5 Online

8.6 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 August Storck KG

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Chocoladefabriken Lindt & Sprüngli AG

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Ferrero International SA

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 General Mills Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 HARIBO Holding GmbH & Co. KG

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Kellogg Company

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Lotte Corporation

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Mars Incorporated

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com