Global Carmine Market Size, Share, Trends, & Forecast 2025- 2033

Buy NowGlobal Carmine Market Size and Forecast 2025-2033

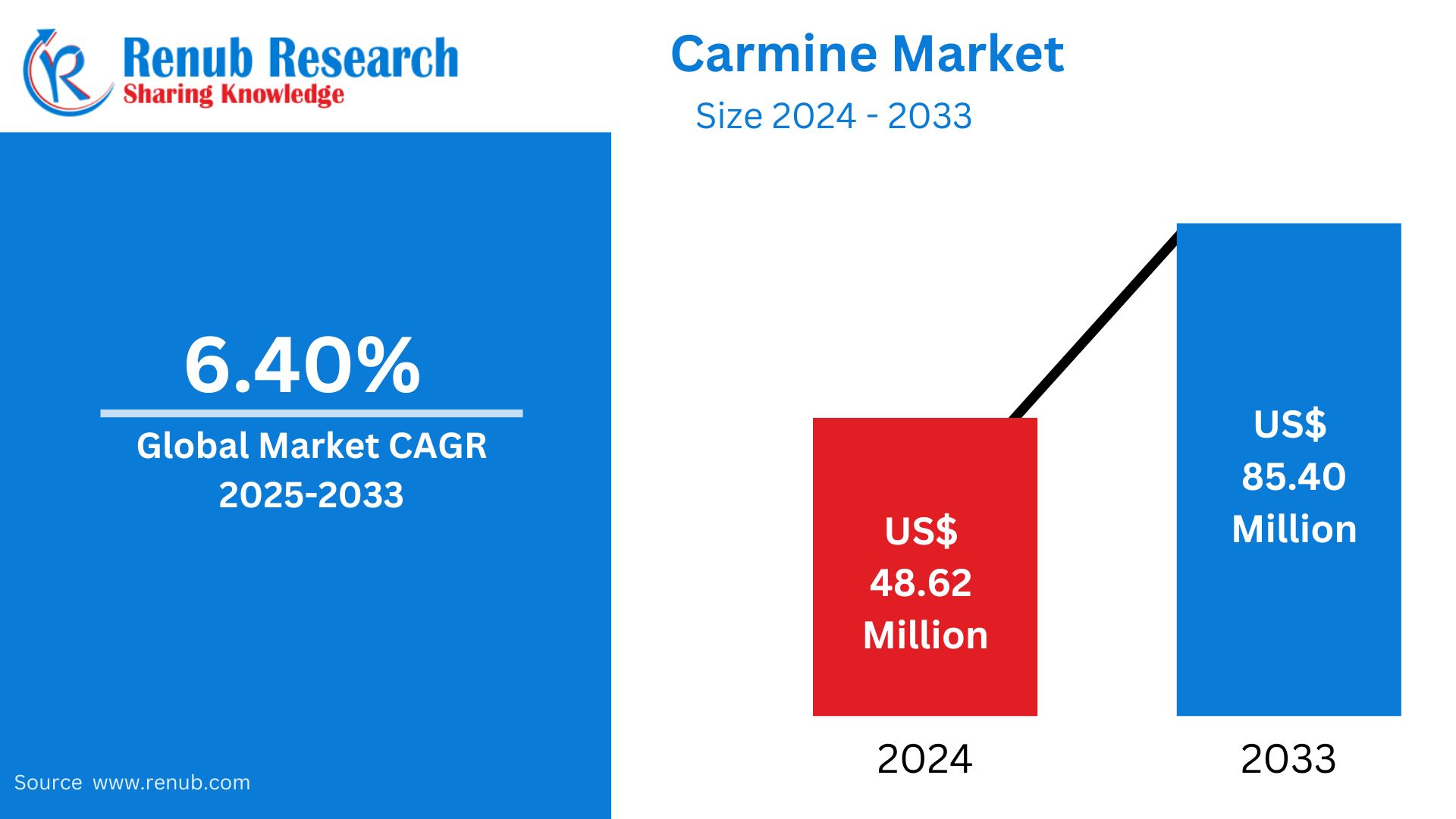

The global carmine market is estimated to grow from US$ 48.62 million in 2024 to approximately US$ 85.40 million by 2033 at a compound annual growth rate of 6.40% during the period 2025 to 2033. The main reasons behind the growth of this market are rising demand for natural food colorants and the wide-ranging use of carmine in food and cosmetic industries.

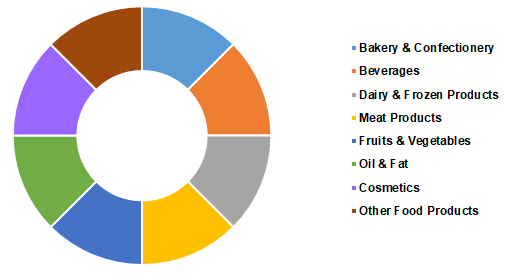

The report Global Carmine Market & Forecast covers by Application (Bakery & Confectionery, Beverages, Dairy & Frozen Products, Meat Products, Fruits & Vegetables, Oil & Fat, Cosmetics, Other Food Products), Form (Liquid, Powder, Crystal), End-Users (Food Processing, Beverage, Catering, Cosmetics & Pharmaceutical Industries), Country and Company Analysis 2025-2033.

Global Carmine Market Overview

Carmine is a red natural pigment. The main sources of these insects are found on cacti in Central and South America. These insects are first dried, crushed, and processed, and carminic acid is extracted to produce the bright red color known as carmine. It is used extensively because it is derived from natural sources, stable, and non-toxic in nature.

One of the major applications of carmine is in the food and beverage industry, where it acts as a natural coloring agent in candies, yogurt, fruit juices, and baked goods. It is usually identified as E120 in ingredient lists. Carmine is widely used in the cosmetics industry for the production of lipsticks, blushes, and other cosmetic products. It is also used in the pharmaceutical industry to color pills and syrups. Although it is widely used, carmine is not vegan-friendly and has sparked ethical debates in the minds of consumers who opt for more plant-based options.

Key Market Drivers Of the Global Carmine Market

Rising Demand for Natural Food Colorants

Growing interest among consumers toward the consumption of natural ingredients in food and beverages is a key driver in the demand for carmine. This natural dye is obtained from cochineal insects and is gaining popularity as awareness grows regarding the potential health risks linked to synthetic colorants. Manufacturers are recognizing this shift and are increasingly choosing safer, organic alternatives. Carmine is particularly valued for its vibrant red color and versatility, finding applications in a variety of food products such as dairy, confectionery, and beverages. This movement towards clean-label products and the incorporation of natural additives is significantly contributing to the expansion of the global carmine market, especially within the food and beverage industry. Nov 2024, Phytolon, an Israeli biotech startup producing natural food colors through precision fermentation, recently received an investment from Rich Products Ventures. This financing will be used to further the commercialization of Phytolon's clean-label food color solutions, as Rich's explores these proprietary colors in some of its products.

Wider Applications in Cosmetics and Pharmaceuticals

The cosmetics and pharmaceutical industries are increasingly using carmine because of its bright and stable color. In cosmetics, carmine is found in lipstick and blushes, among other products, appealing to consumers who prefer natural ingredients. Its non-toxic and hypoallergenic properties make it an ideal choice for people with sensitive skin, which increases its market demand. In the pharmaceutical sector, carmine is used as a colorant in different forms such as tablets, capsules, and syrups. With increasing consumer awareness towards eco-friendly and sustainable products, the demand for carmine in these industries is constantly increasing, thus driving the overall growth of the global carmine market. Jan 2025 Eckart's Syncrystal Very Berry offers intense carmine-free pink color effects and is one of the very best options to get pink or violet shades with water-based formulation, eye product, and vegan cosmetics. This revolutionary ingredient offers intense color representation following the guidelines of vegan and cruelty-free compliance.

Increasing acceptance of natural additives due to better regulatory environment

The regulatory bodies worldwide are encouraging the use of natural food additives, such as carmine, instead of synthetic dyes. Agencies like the FDA (Food and Drug Administration) and the European Food Safety Authority (EFSA) have recognized the safety of carmine as a food additive, which has increased its adoption in different sectors. As consumers become more health-conscious and seek transparency regarding ingredient sourcing, manufacturers are responding by aligning their practices with regulatory guidelines to meet these demands. This supportive regulatory landscape is contributing to the growth of the global carmine market, as industries increasingly turn to carmine to adhere to safety standards and accommodate consumer preferences for natural ingredients. The stringent U.S. regulations on synthetic colorants, such as the FDA's plan to ban Red Dye 40 in school beverages and food by 2027, are forcing the use of carmine across different industries.

Barriers in the Carmine Market

Ethical and Dietary Issues

One significant challenge in the carmine market is the ethical and dietary concerns surrounding its production. Carmine is derived from cochineal insects, making it unsuitable for vegans, vegetarians, and individuals following specific religious dietary restrictions. Growing consumer awareness and demand for cruelty-free, plant-based alternatives have led to a shift away from animal-derived products. This shift has pressured manufacturers to explore synthetic or plant-based colorants, impacting the demand for carmine.

Strict Regulatory Standards

The carmine market also faces challenges due to strict regulations on food and cosmetic colorants. In some regions, detailed labeling requirements mandate disclosure of carmine as an insect-based product, which can deter consumers. Additionally, variations in safety and allergen guidelines across countries complicate global trade. Manufacturers must invest heavily in compliance and testing to meet regulatory standards, increasing production costs and limiting market expansion in regions with stricter laws.

Dairy and frozen carmine market

Dairy and frozen products are likely to become major applications in the global carmine market. This is due to their adaptable color enhancement requirements. Carmine, derived from natural sources, provides strong and vibrant colors, satisfying the visible expectations of consumers in dairy and frozen products. Its efficiency in adding desirable hues to ice cream, yogurt, and other frozen desserts, and also for several other dairy applications. This puts carmine in an ideal natural coloring agent enhancing its use in the specific markets above.

Carmined powder market

This powdered form of the ingredient is most likely enjoying very fast growth within the overall global carmines market. It is easily and flexibly adapted for a variety of uses. Powdered carmine provides comfort in its handling and storage which makes it attractive to manufacturers seeking green manufacturing procedures. It has the lovely texture which allows for homogenous dispersion, hence consistent coloring within a variety of products, including foodstuffs, beverages, and cosmetics. In addition, this powdered carmine ordinarily has a longer shelf life compared to others, which only increases its appeal and hastens its uptake and growth in the global carmine market.

Cosmetics and pharmaceutical carmine market

The cosmetics and pharmaceutical sectors may see an strong growth rate in the global carmine market because of increased consumer demand for natural and sustainable ingredients. Carmine is a bright red dye sourced from cochineal bugs, that is used extensively in cosmetics and prescription drugs. Carmine being an organic ingredient as well, this new push by the cosmetics and pharmaceutical sectors to go green and plant-based supports this rise in carmine demand. Its application for colored shades of lipsticks, blushes, and pharmaceutical coatings makes it quite in demand, thus upgrading the market.

Global Carmine Market Overview by Regions

United States Carmine Market

The United States is one of the prominent players in the global carmine market. The thriving cosmetics and pharmaceutical sector in the United States creates a significant demand for carminated products. Strict regulatory laws help ensure that the quality is maintained and the trust among the buyers about carminated products is maintained. Moreover, the U.S. emphasizes innovation and studies, propelling progress in carmine extraction and application strategies. The nation continues its dominance with a considerable purchaser base and massive purchasing power. A combination of enterprise demand, regulatory rigor, innovation, and market size cemented the United States' distinguished function in the global carmine market. June 2024, Chr. Hansen, the world's largest carmine manufacturer, is merging with biotech company Novozymes to form Novonesis, which is expected to earn USD 4 billion a year. The new company will focus on improving food products and reducing chemical use.

Italy Carmine Market

The Italy Carmine Market is located in the heart of a vibrant community, and it is a great place for locals and tourists alike. Known for its lively atmosphere, the market offers an array of fresh produce, artisanal goods, and traditional Italian delicacies. Stalls brim with colorful fruits and vegetables, while vendors proudly showcase handmade cheeses, cured meats, and baked goods that tantalize the senses. Visitors can immerse themselves in the rich culinary heritage of Italy, sampling everything from vibrant olive oils to decadent pastries. The Carmine Market is not a place to shop but an experience filled with culture and flavor.

India Carmine Market

The India Carmine Market has been witnessing rapid growth in the past few years. The demand for natural coloring agents in food, cosmetics, and textiles has increased over the past few years. Carmine is obtained from cochineal insects, which provides it with its deep red color. It is more in demand than synthetic dyes because of its natural origin. This approach helps uplift consumer awareness about the safety and health impacts associated with artificial additivities. Again, growing demand by the food and beverages sector in conjunction with an increasing organic products sector supports this trend. Sustainability and ethically sourced cochineal will continue to be an issue for market players. The general trend is positive, though. August 2024: Indian nutraceutical start-up ReNewtra enhances product transparency through QR codes on packaging. Scanning the above codes can let consumers have the ingredient list along with scientific supporting evidence.

Saudi Arabia Carmine Market

Saudi Arabia carmine market is developing continuously. Its growing demand is primarily due to its increasing use as a natural food coloring in food and beverages, cosmetics, and pharmaceutical sectors. With consumers gaining awareness over natural ingredients, this color has come into greater focus due to the red appearance along with being safer. The country’s expanding food processing industry, along with government initiatives to support the use of natural additives, further boosts the market. Additionally, the cosmetics sector’s growing preference for organic and eco-friendly products contributes to the increasing adoption of carmine in Saudi Arabia.

Global Carmine Market Share, By Application (Percentage)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

Global Carmine Market Segments

Application

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Products

- Meat Products

- Fruits & Vegetables

- Oil & Fat

- Cosmetics

- Other Food Products

Form

- Liquid

- Powder

- Crystal

End-Users

- Food Processing

- Beverage

- Catering

- Cosmetics & Pharmaceutical Industries

Regional Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Clariant AG

- Chr. Hansen Holding A/S

- Naturex (Givaudan)

- Sensient Technologies Corporation

- The Hershey Company

- Biocon

- Amerilure

- DDW Color House

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Application, Form, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Carmine Market

6. Market Share

6.1 By Application

6.2 By Form

6.3 By End Users

6.4 By Country

7. Application

7.1 Bakery & Confectionery

7.2 Beverages

7.3 Dairy & Frozen Products

7.4 Meat Products

7.5 Fruits & Vegetables

7.6 Oil & Fat

7.7 Cosmetics

7.8 Other Food Products

8. Form

8.1 Liquid

8.2 Powder

8.3 Crystal

9. End Users

9.1 Food Processing Companies

9.2 Beverage Industry

9.3 Catering Industry

9.4 Cosmetics and Pharmaceutical Industry

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players

13.1 Clariant AG

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Naturex (Givaudan)

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 NATUREX (GIVAUDAN)

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Sensient Technologies Corporation

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 The Hershey Company

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

13.6 Biocon

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue

13.7 Amerilure

13.7.1 Overview

13.7.2 Recent Development

13.8 DDW Color House

13.8.1 Overview

13.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com