Global Cosmetics Market Size, Trends & Forecast 2025-2033

Buy NowGlobal Cosmetics Market Size and Forecast 2025-2033

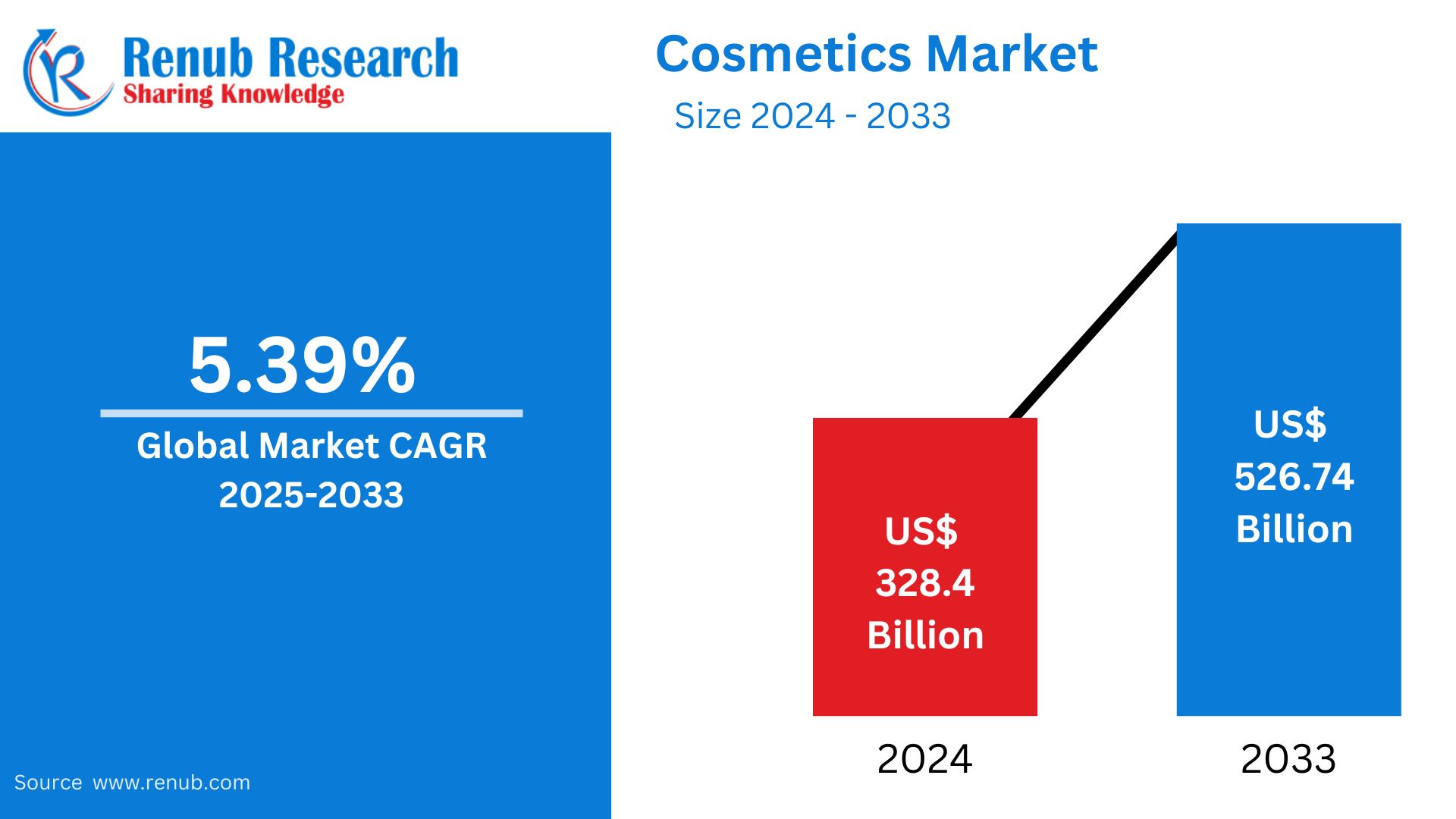

Global Cosmetics market is expected to reach US$ 526.74 billion by 2033 from US$ 328.4 billion in 2024, with a CAGR of 5.39% from 2025 to 2033. Some of the main reasons driving the market include the increasing demand for vegan cosmetics, the launch of sophisticated product varieties, the growing emphasis on personal grooming, and the increasing availability of products on e-commerce platforms.

The report Cosmetics Market & Forecast covers by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets/hypermarkets, Specialty Stores, Pharmacies, Online Sales), Countries and Company Analysis 2025-2033.

Overview of the Global Cosmetics Industry

Since cosmetics not only improve one's outward look but are also closely related to the development of one's general personality and self-confidence, they have become an indispensable aspect of a person's life. One of the main factors propelling the global cosmetics market has been the emphasis on maintaining one's complexion, hair, and general exterior grooming, as well as one's own consciousness. The market for cosmetics has grown thanks in large part to the introduction and development of novel formulations such as anti-aging products, eye creams, serums, sunscreens, and hair color, as well as increased awareness of key ingredients like vitamin C, retinol, and hyaluronic acid. Another factor that has drawn in customers is the manufacturers' emphasis on product packaging that is convenient and useful. For example, when washing the face or applying roll-on eye treatments, specialized facewash pumps are employed as brushes to create a massage-like effect.

Additionally, social media platforms have helped businesses become more well-known and visible, which has accelerated the expansion of the cosmetics industry. Because consumers prefer natural goods with minimal negative effects on the environment and skin, the usage of natural products or products containing natural substances has increased significantly. Furthermore, the market for organic products is expected to rise, which would help the cosmetics industry as a whole. This has forced well-known producers to introduce natural versions of their goods to the market. Men's growing awareness of skin and hair care issues and women's growing spending power are said to be the main causes of the rise in demand for cosmetics.

In 2023, 78% of consumers emphasize sustainability, and approximately 55% of consumers are willing to pay more for eco-friendly companies, according to TheRoundup.org, an environmental awareness website.

Growth Drivers for the Cosmetics Market

Introduction of sophisticated product variations

Advanced product variations are made to address certain makeup preferences, haircare problems, or skincare concerns. Formulations that target issues like aging, acne, hyperpigmentation, dryness, and sensitivity are being developed by brands. To reveal bright skin, L'Oréal Paris, for example, recently introduced its Glycolic Bright Day Cream with SPF 17, which seeks to minimize dark spots and protect skin from damaging UV rays. Additionally, a variety of manufacturers offer options for coverage levels, finishes, and hues, and even let customers mix and match items to fit their tastes. For example, the beauty and personal care company The Body Shop introduced their line of "activist" products to the Indian market in April 2023. With a range of skin care products and color cosmetics, the new line bolsters the brand's sustainable commitment in the nation.

Additionally, the market is expanding because to the continuous development of customized cosmetics to improve the customer experience. For example, the L'Oréal Groupe introduced Perso, a 6.5-inch beauty tech gadget that provides customized skincare and makeup formulae instantly. As the system collects more information on the customer's skin and preferences, it uses artificial intelligence to maximize the degree of personalization.

Product availability on e-commerce platforms is increasing

Geographical restrictions have been removed by e-commerce platforms, allowing customers to access a large selection of cosmetics from anywhere in the world. Selena Gomez's Rare Beauty was introduced in June 2023 at Sephora India and is currently accessible statewide at all 26 Sephora locations as well as online at Sephora.nnnow.com, according the cosmetics market data. Brands and products that were previously unavailable in local retailers are now accessible to consumers. The cosmetic brands have been able to reach a wider audience and enter new markets as a result of this.

For example, the popular beauty and fashion portal in India, Nykaa, made Natasha Moor Cosmetics' high-performing line available. Furthermore, these platforms offer comprehensive product details, such as ingredient lists, usage guidelines, and user reviews, which is expected to boost the entire cosmetics market's earnings in the next years.

An increasing focus on personal grooming

The main variables influencing the cosmetics market outlook are the growing number of working women and millennial women's growing awareness of their physical appearance. The average Australian woman spends almost USD 3,600 a year on cosmetics and personal care items, according to financial comparison website Mozo. Furthermore, the market for natural and organic face cosmetics is expanding as a result of growing consumer awareness of the negative effects of chemicals like paraben and aluminum. In order to draw clients from all over the world, a number of global brands, like Revlon, Elle18 MAC, Sephora, L'Oreal, and Oriflame, are expanding their market share by launching additional products, especially those with vegan ingredients and accessible, eye-catching packaging.

Demand for cosmetic items in a variety of areas is rising as personal grooming gains importance. Customers are choosing natural and organic products with fewer synthetic ingredients, and major market participants are making significant investments to meet this demand. For example, Shiseido unveiled Ulé, a new skincare line, in April 2022. It purchases botanicals from nearby vertical farms without the use of pesticides. Customers are also looking for natural, sustainable, and eco-friendly products with more transparent ingredients. The need for hair care products in the cosmetics market is subsequently being stimulated by this.

Challenges in the Cosmetics Market

Intense Competition

In the cosmetics industry, where numerous brands vie for consumers' attention, fierce rivalry is a major obstacle. As businesses compete to draw in price-conscious customers, this saturation fosters a fiercely competitive atmosphere that frequently results in price wars. In order to set themselves apart from the competition, brands must constantly innovate, whether it is through marketing tactics, distinctive packaging, or new product compositions. Because brand recognition is sometimes short-lived and customer loyalty is difficult to sustain, there is tremendous pressure to stand out in a competitive marketplace. Competition has also increased as a result of the emergence of niche and independent firms, social media, and beauty influencers. Established businesses must constantly change to stay relevant, adjusting to consumer preferences and trends while upholding high standards of quality.

Sustainability Concerns

As customers grow more environmentally conscious, sustainability issues are becoming more significant in the cosmetics sector. One of the main concerns is the effect that packaging waste and ingredient procurement have on the environment. Conventional cosmetic packaging, which is frequently composed of single-use plastics, adds to the growing waste issues and raises the desire for packaging options that are recyclable, biodegradable, or environmentally friendly. Ingredient sourcing is also being examined, especially when it comes to non-renewable or endangered sources. Customers are pressuring firms to embrace more ethical practices by requesting items manufactured with natural, cruelty-free, and sustainably sourced ingredients. In addition to customer demand, legal challenges and the growing requirement that brands exhibit corporate social responsibility are also driving this shift towards sustainability. To satisfy these aspirations, numerous cosmetics companies are making investments in eco-friendly packaging, transparency, ethical sourcing, and sustainable supply chains.

Products for skin and sun care could lead the cosmetics market

Skin and sun care products might dominate the global cosmetics market. This is due to the escalating focus on skin care's important position in health and beauty. These products are in high demand with a growing emphasis on sun protection to save skin harm. The ever-increasing occurrence of skin-related worries and an ever-increasing older population searching for anti-aging solutions similarly contribute to their dominance. Continuous innovation in formulations and an increasing purchaser base looking for effective skincare routines. This solidifies the placement of skin and sun care products at the vanguard of the global cosmetics market.

Women may account for a sizable share of the worldwide cosmetics market

Women dominate a significant share of the global cosmetics market. Societal norms emphasizing women's looks propel increased investment in beauty merchandise. Women's ancient inclination towards skincare and makeup as a part of self-care rituals contributes to this dominance. Moreover, the cosmetics industry strategically designs diverse products for women's distinctive needs and prospects. Consequently, their considerable cosmetic market presence results from cultural effects and centered advertising methods to satisfy their beauty aspirations.

The global cosmetics business could be significantly dominated by supermarkets and hypermarkets

Supermarkets and hypermarkets might proclaim a significant share of the global cosmetics market. This is owed to their accessibility and comprehensive purchaser reach. These retail giants offer a range of cosmetic merchandise under one roof, supplying convenience to consumers. Also, their competitive pricing strategies and promotional activities attract finance-conscious purchasers. With an in-depth presence in urban and suburban regions, supermarkets and hypermarkets serve as key distribution channels. This captures a good-sized part of the cosmetics market and solidifies their function as industry leaders.

Cosmetics Market Overview by Regions

By countries, the global Cosmetics market is divided into United States, Canada, France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Turkey, China, Japan, India, South Korea, Thailand, Malaysia, Indonesia, Australia, New Zealand, Brazil, Mexico, Argentina, Saudi Arabia, United Arab Emirates, and South Africa.

United States Cosmetics Market

The increased emphasis on wellness, self-care, and beauty has made the US cosmetics sector one of the biggest and most vibrant in the world. Growing disposable incomes, growing consumer awareness of personal grooming, and a move toward natural, organic, and cruelty-free goods are the main drivers of the industry. E-commerce platforms, social media, and beauty influencers are all vital in influencing customer behavior and increasing sales. Consumers who are concerned about their health are being drawn to product formulation innovations like clean beauty and multipurpose items. The industry is also expanding as a result of the growing demand for skincare and anti-aging products as well as men's grooming items. Nonetheless, the sector must contend with issues like fierce rivalry, governmental oversight, and demands for more environmentally friendly sourcing and packaging methods.

United Kingdom Cosmetics Market

The increased emphasis on wellness, self-care, and beauty has made the US cosmetics sector one of the biggest and most vibrant in the world. Growing disposable incomes, growing consumer awareness of personal grooming, and a move toward natural, organic, and cruelty-free goods are the main drivers of the industry. E-commerce platforms, social media, and beauty influencers are all vital in influencing customer behavior and increasing sales. Consumers who are concerned about their health are being drawn to product formulation innovations like clean beauty and multipurpose items. The industry is also expanding as a result of the growing demand for skincare and anti-aging products as well as men's grooming items. Nonetheless, the sector must contend with issues like fierce rivalry, governmental oversight, and demands for more environmentally friendly sourcing and packaging methods.

Technological innovations like skincare analysis apps and augmented reality (AR) for virtual makeup try-ons have improved the shopping experience for customers and increased demand for cutting-edge cosmetics in the area. For example, the American firm Proven Skincare announced in July 2022 that it was expanding internationally into the United Kingdom and the European Union. Utilizing its proprietary Skin Genome Project, a beauty database, the company uses artificial intelligence (AI) and big data to develop its five-product range of customized skincare products.

India Cosmetics Market

The burgeoning middle class, rising disposable incomes, and shifting beauty standards are driving the fast growth of the Indian cosmetics sector. As people grow more aware of personal grooming and self-care, there is an increasing need for skincare products as well as color cosmetics. Growing consumer demand for safer, more environmentally friendly, and cruelty-free cosmetics has resulted in a notable shift towards natural, organic, and Ayurvedic-based products. Influencers in the beauty industry, digital platforms, and social media are all significantly influencing customer tastes and increasing the visibility of products. The market is expanding as a result of men's grooming products' growing appeal. Price sensitivity, complicated regulations, and the requirement for sustainable packaging and ingredient sourcing to meet consumer expectations are some of the market's obstacles, though.

In June 2023, Just Herbs partnered with Bollywood actress Athiya Shetty to promote natural makeup products, including as foundations, lip gloss, and lipsticks made with ghee. The brand may be found online on sites and e-commerce platforms such as Myntra, Amazon, Nykaa, and Flipkart. Additionally, as the trend of online shopping gains traction, third-party e-retailers are seeing an increase in sales. Additionally, the UK clean beauty brand Dr. PAWPAW, which offers multipurpose lip and skin care products, was introduced to the Indian market by the e-commerce portal Purplle in June 2023.

United Arab Emirates Cosmetics Market

A diversified and well-off populace, growing disposable incomes, and growing knowledge of skincare and beauty are all contributing factors to the United Arab Emirates' booming cosmetics sector. Premium, high-end beauty products are becoming more and more popular, especially in cities like Dubai and Abu Dhabi. High-quality, natural, and organic cosmetics are becoming more and more sought after by consumers, who are making more environmentally responsible and health-conscious decisions. Additionally, because of the region's severe climate and emphasis on personal grooming, skincare products—such as anti-aging, whitening, and sunscreen items—are becoming more and more popular. Men's grooming products are becoming more and more popular, and social media, influencers, and beauty trends all have a big impact on how people buy. The UAE continues to be a significant market in the global cosmetics sector despite competition and the need for sustainable practices.

Cosmetics Market Players News

- The cosmetics market is going strong with sustainability, with the leading players taking the charge. Interestingly, L'Oréal has unveiled its "L'Oréal For The Future" commitments, that look to reduce greenhouse gas emissions per product by 50% by 2030. The effort reflects the brand's emphasis on biodiversity and circular economy principles.

- In addition, Garnier launched its Green Beauty Initiative, which has ambitious aims for the sustainable sourcing of materials, water conservation, and minimizing waste. The initiative targets 100% renewable energy usage and eradicating plastic pollution by 2025. These initiatives demonstrate increased momentum in the beauty industry to transition to sustainable practice and highlight the importance of the leadership role of key companies in driving ecological sustainability.

- In February 2025, L'Oréal Groupe announced a long-term, exclusive partnership with fashion house Jacquemus, involving a minority investment that will be used to finance the brand's autonomous growth. Through this partnership, the two entities intend to combine L'Oréal's wide range of experience in product development with its worldwide market presence in order to support Jacquemus' entry into the beauty segment and present the brand's innovative and forward-looking attitude to high fashion.

- During January 2025, The Estée Lauder Companies announced it was joining hands with the Langer and Jaklenec Labs at the Massachusetts Institute of Technology (MIT). The agreement will be directed at furthering the research in materials science and biotechnology and eventually creating novel solutions for the beauty sector. Together, they wish to uncover some of the newer technologies that may improve the product efficacy, the sustainability aspect, and the total consumer experience across the cosmetic domain.

- Beiersdorf and Rubedo Life Science signed a multi-year strategic alliance in April 2024 to develop a pioneering anti-aging solution for the international face care market. This partnership brings Beiersdorf's skin care innovation expertise together with Rubedo's cellular senescence research. Beiersdorf also joined Rubedo's Series A financing round recently through its Oscar & Paul Corporate Venture Capital Fund as part of this deal.

- In August 2024, L’Oréal Groupe announced the acquisition of a 10% stake in Galderma, a prominent dermatology company. This strategic investment signifies L’Oréal’s reintegration into the aesthetic dermatology market and bolsters its position in skincare and medical beauty, while also expanding its portfolio in advanced dermatological solutions.

Segment Analysis

Product Type

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Gender

- Men

- Women

- Unisex

Distribution Channel

- Supermarkets/hypermarkets

- Specialty Stores

- Pharmacies

- Online Sales

- Others

Regional Outlook and Opportunities

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

All the Key players have been covered

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Coty Inc.

- Procter & Gamble

- The Estee Lauder Companies Inc.

- Colgate-Palmolive Company

- Johnson & Johnson Services Inc.

- Revlon, Inc.

- Beiersdorf Group

- Kao Corporation

- LVMH

- Mary Kay Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Gender, Distribution Channel, and Countries |

| Countries Covered |

|

| Companies Covered | 1. Coty Inc. 2. Procter & Gamble 3. The Estee Lauder Companies Inc. 4. Colgate-Palmolive Company 5. Johnson & Johnson Services Inc. 6. Revlon, Inc. 7. Beiersdorf Group 8. Kao Corporation 9. LVMH 10. Mary Kay Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Cosmetics Market

6. Market Share

6.1 By Products Types

6.2 By Gender

6.3 By Distribution Channels

6.4 By Countries

7. Products Types

7.1 Skin and Sun Care Products

7.2 Hair Care Products

7.3 Deodorants and Fragrances

7.4 Makeup and Color Cosmetics

7.5 Others

8. Gender

8.1 Men

8.2 Women

8.3 Unisex

9. Distribution Channels

9.1 Supermarkets/hypermarkets

9.2 Specialty Store

9.3 Pharmacies

9.4 Online Sales

9.5 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Coty Inc.

13.1.1 Overviews

13.1.2 Recent Developments

13.1.3 Revenues

13.2 Procter & Gamble

13.2.1 Overviews

13.2.2 Recent Developments

13.2.3 Revenues

13.3 The Estee Lauder Companies Inc.

13.3.1 Overviews

13.3.2 Recent Developments

13.3.3 Revenues

13.4 Colgate-Palmolive Company

13.4.1 Overviews

13.4.2 Recent Developments

13.4.3 Revenues

13.5 Johnson & Johnson Services Inc.

13.5.1 Overviews

13.5.2 Recent Developments

13.5.3 Revenues

13.6 Revlon, Inc.

13.6.1 Overviews

13.6.2 Recent Developments

13.6.3 Revenues

13.7 Beiersdorf Group

13.7.1 Overviews

13.7.2 Recent Developments

13.7.3 Revenues

13.8 Kao Corporation

13.8.1 Overviews

13.8.2 Recent Developments

13.8.3 Revenues

13.9 LVMH

13.9.1 Overviews

13.9.2 Recent Developments

13.9.3 Revenues

13.10 Mary Kay Inc

13.10.1 Overviews

13.10.2 Recent Developments

13.10.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com