Saudi Arabia Chocolate Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Chocolate Market Trends & Summary

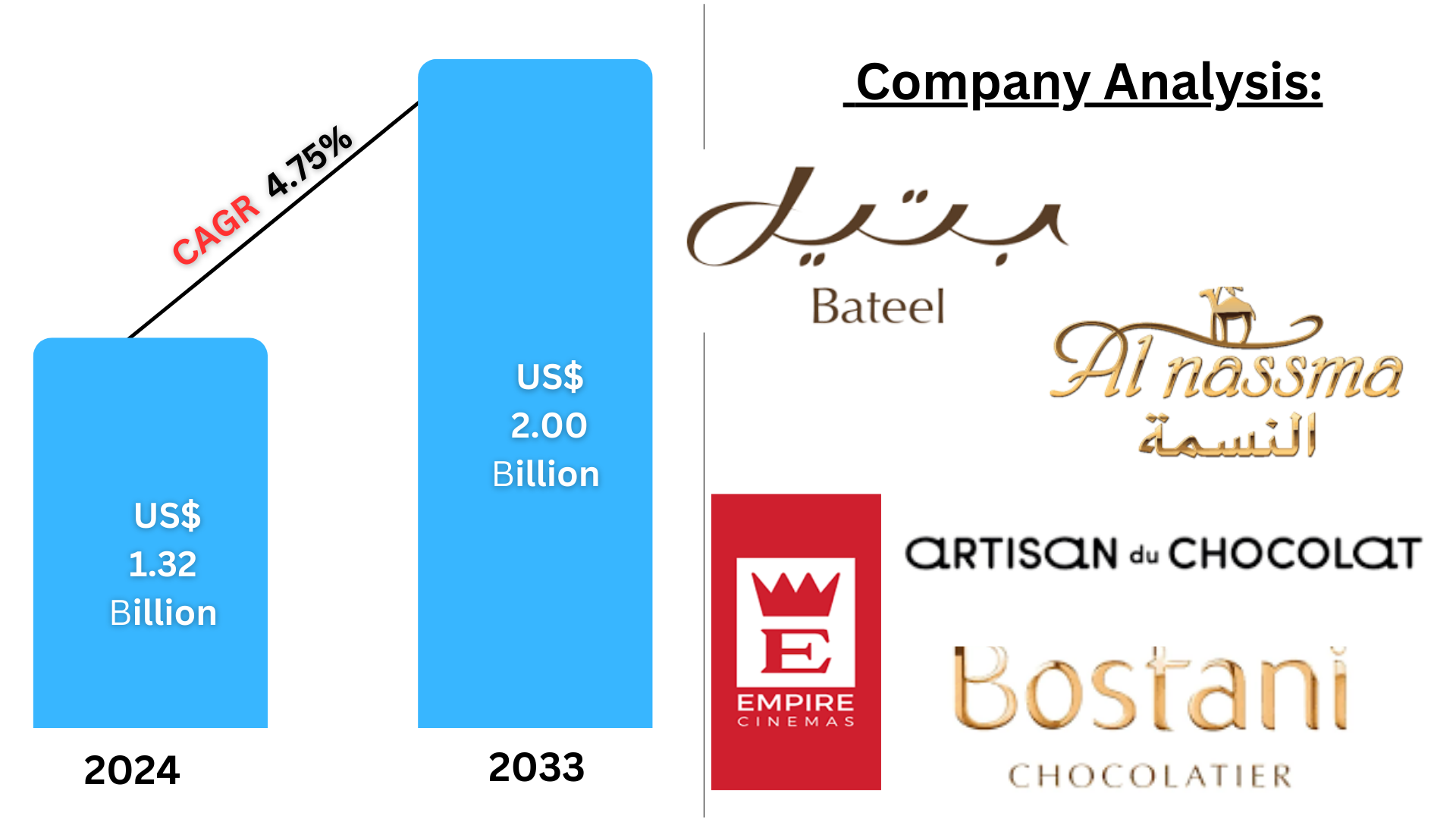

The Saudi Arabia chocolate market was valued at US$ 1.32 billion in 2024. It is expected to grow at a CAGR of 4.75% from 2025 to 2033, reaching US$ 2.00 billion by 2033. This growth is driven by rising consumer demand for premium chocolates, increasing disposable incomes, and the growing popularity of chocolate as a gifting and indulgence option during holidays and celebrations.

The report Saudi Arabia Chocolate Market & Forecast covers by Type (Dark Chocolate and Milk/White Chocolate), Ingredients (Cocoa Beans, Cocoa Butter, Sweeteners, Chocolate Liquor, and Others), Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channel), Region and Company Analysis 2025-2033.

Saudi Arabia Chocolate Market Outlooks

Chocolate is a sweet delicacy prepared from cocoa beans, sugar, and milk or other ingredients, available in forms ranging from bars, truffles, and beverages. The prime types are dark, milk, and white chocolate, along with variations in cocoa content and added flavors. Such versatility makes it a most sought-after dessert, snack item, and gift item.

The demand for chocolates is growing sharply in Saudi Arabia, given the shift in consumer trends and increased disposable incomes. Chocolates are mainly consumed for gifting purposes and personal treat during weddings, Ramadan, Eid celebrations, among others. The market for premium and super-premium chocolates is being driven by healthy options with higher cocoa content. A younger population and urbanization support the demand for chocolates as a luxury or snack product. There has been increasing diversification of international brands and local artisanal chocolates that are trying to cope with the changing palate of the Saudi consumer.

Saudi Arabia Chocolate Trends

- Waw Chocolate, a Saudi company that specializes in manufacturing chocolate bars infused with the Kingdom's regional flavors, is a prime example of the increasing demand for chocolate in Saudi Arabia. Being the region's largest market for chocolates, the Kingdom imported a whopping 123 million kg of chocolate in 2024, reflecting high consumer interest in both daily treats and luxury gifts.

- The population structure is key to determining this market. With more than half of the population being below 25 years of age as of 2023, younger consumers, who are generally more health-oriented, still exhibit robust trends of chocolate consumption. Studies show that two-thirds of Saudi children ate chocolate twice a day in 2023, indicating a distinct consumption pattern.

- The arrival of tourists and pilgrims, particularly during Hajj and Umrah, has increased the demand for chocolates as presents and mementos. Approximately 2-3 million Muslims undertake Hajj every year, with overall pilgrimage numbers permissible to expand post-pandemic, up to 18.5 million in the year 2024. This increase in visitors has brought a thriving market into being, prompting local confectionery companies to serve the increased demand for high-quality and varied chocolate products.

- On the export side, Saudi Arabia exported $62.5 million worth of chocolates in 2023, making it the 48th largest export nation in the world. Saudi also has more than 1,000 chocolate-making factories, with about 35% based in Riyadh. This firm manufacturing foundation allows Saudi Arabia to manufacture nearly 50% of its chocolate needs locally, seeking to reduce import dependence without compromising on quality.

- The average yearly spend on chocolate per individual in Saudi Arabia amounted to USD 41 in 2023, far exceeding the Middle Eastern average of USD 4. Interestingly, more than 66% of Saudi consumers expressed a desire to pay more for quality products as of 2022.

- With an impressive 99% internet penetration rate as of July 2023, the expansion of online chocolate sales has been spurred. The conventional retail channels are also changing, with convenience stores and supermarkets adopting integrated technologies and digital signage to enhance the shopping experience. This shift is especially pertinent since almost 60% of Saudi adults are estimated to be overweight or obese as of 2023, leading to a heightened need for healthier chocolate products.

- More than 50% of Saudi Arabian consumers in 2023 opted for premium chocolate products. Dark chocolates, being considered premium chocolates in most cases, are generally regarded as overvalued in relation to milk and white chocolates.

- Significant investments in the sector include Nestlé’s announcement in November 2022 to invest SAR 7 billion in Saudi Arabia over the next decade, starting with an investment of up to USD 99.6 million to establish a modern manufacturing plant expected to open in 2025.

- Additionally, Barry Callebaut introduced its 100% dairy-free and plant-based chocolate NXT in Saudi Arabia, addressing the growing interest in plant-based products in the country.

Growth Driver in the Saudi Arabia Chocolate Market

Growing Chocolate Consumption in Saudi Arabia

The market for chocolates in Saudi Arabia is highly growing. In Saudi Arabia, chocolates during festivals go like hotcakes. Cultural festivals play a very important role in the society. These festivals, usually, are marked with the gatherings and the gifting tradition where chocolates have been perceived to be the symbols of pleasures and benevolence. As a result of this adaptation of the old customs with western influence, the demand for chocolates increases during these events. Some of the other major brands responding to this trend include Patchi, Godiva, Bostani, Aani & Dani, and Bateel. Such chocolate brands offer an assortment of attractive flavors of chocolate, besides specialty packs available during special occasions such as Eid. Such strategies cater not only to consumer tastes but also aid in the total growth of the chocolate market within the region.

Demand is influenced by the desire for high quality and personalized products

The demand for chocolates in Saudi Arabia is increasingly influenced by customers' evolving preferences, particularly towards premium quality and customization. As consumers become more health-conscious, there is a marked shift towards premium chocolates that prioritize quality. Additionally, the interest in personalized options is on the rise, with consumers seeking unique flavors, designs, and packaging tailored for special occasions and gifts. Naeem Foods, for example, deals with luxury chocolates and provides customization services to cater to such requirements. In addition, as the market grows, consumers are becoming more inquisitive about authenticity and artisanal craftsmanship. To capitalize on this growing interest, Salon du Chocolate hosted its first event in Riyadh in November 2023, targeting chocolate connoisseurs.

Health benefits on Consumers

Increased health consciousness among Saudi Arabian consumers is highly boosting the chocolate market, particularly dark chocolate. Dark chocolate has been highlighted through media and online sources as having several health benefits, including rich antioxidant content and mood enhancement. Thus, many people are becoming more diet-conscious, looking for indulgent treats that have added health benefits. Dark chocolate, when consumed in moderation, offers a unique combination of indulgence and nutritional advantages, making it an attractive option for health-conscious consumers looking for a guilt-free indulgence.

Challenges in the Saudi Arabia Chocolate Market

Dependence on Imported Cocoa and Raw Materials

One significant challenge in the Saudi Arabia chocolate market is its reliance on imported cocoa and other raw materials. Since the country does not produce cocoa domestically, it is very dependent on international suppliers. This situation exposes the market to international price fluctuations, supply chain disruptions, and trade restrictions that can elevate production costs. Furthermore, geopolitics or economic instability within cocoa-producing countries may further challenge the supply chain. These factors are challenges to local manufacturers and make the final cost of the product higher for the consumer, which may be a restraint on market growth in price-sensitive segments.

Changing Consumer Preferences towards Healthier Choices

Increasing health awareness among Saudi consumers is creating problems for traditional chocolate products. Increased awareness about the ill effects of excessive sugar and fat intake has increased the demand for healthier options such as sugar-free or organic chocolates. This trend gives rise to an opportunity for growth, yet, for manufacturers, it involves a lot of innovation and re-formulation of the product that is time-consuming and expensive. Companies failing to shift along with this trend face market share losses in the more competitive marketplace.

Saudi Arabia Cocoa Beans Chocolate Market

The importance of cocoa beans in Saudi Arabia is much because they are critical for the production of traditional chocolate. Consumers often prefer cocoa beans for their rich flavor and texture, especially in darker and more premium chocolate varieties. These beans, traded globally, contribute to a reliable supply chain. Saudi Arabia imported over 37 million kilograms of cocoa during the first quarter of 2023, a volume surpassing the total imports for the whole of 2022. Robust import activity like this would present chocolate manufacturers with some low-cost sourcing options. Particularly benefiting the milk chocolate, the most popular type of chocolate in the market.

Saudi Arabia Dark Chocolate Market Overview

The Saudi Arabia dark chocolate market is growing at a fast pace due to the increasing awareness of consumers about the health benefits associated with dark chocolate. Dark chocolate is known for its high cocoa content and low sugar levels, which is rich in antioxidants and has been linked to improved heart health and cognitive function. Therefore, this is making it a preferred choice among health-conscious consumers in Saudi Arabia. Other driving forces include premium and artisanal chocolate popularity, where focus lies on quality and distinctive tastes. International and local brands of dark chocolate have introduced new items and flavors such as organic and vegan to keep pace with consumers' changing tastes. In terms of demand, Northern and Central Saudi Arabia show considerable demand during festive seasons, especially Ramadan and Eid. People tend to use dark chocolates in gifting during this season.

Northern and Central Saudi Arabia Chocolate Market

The chocolate market in Northern and Central Saudi Arabia is growing due to urbanization, increasing affluence, and cultural changes that favor Western life. According to UN-Habitat, Saudi Arabia, one of the most urbanized countries in the world, is likely to reach over 90% urbanization by 2030. The disposable incomes are increasing, and people are demanding indulgent treats such as chocolates, with many local and international manufacturers catering to different choices. The products of chocolate are mostly shared on festive and social functions. The emerging market creates the conducive opportunity for large as well as medium enterprise, representing changing patron choices and economic well-being. In this context, the International Coffee and Chocolate Exhibition introduced the 9th edition to Riyadh, Saudi Arabia that has seen growth of business in the region.

Western region of Saudi Arabia Chocolate Market

The Western region of Saudi Arabia, which includes cities like Jeddah, Mecca, and Medina, is a considerable share of the country's chocolate market. This region has strong cultural and economic activities due to tourism and religious events, which boost chocolate consumption. Pilgrims visiting Mecca and Medina often buy chocolates as gifts, contributing to seasonal spikes in demand during Hajj and Ramadan. Premium, artisanal, and imported chocolates are growing in popularity in the urban areas of Western Saudi Arabia, especially in cities like Jeddah. The regional demographics, with a blend of local flavors and international trends, determine the demand.

Saudi Arabia Chocolate Company

Aani& Dani, Artisan du Chocolat, Bateel, Al Nassama, and Bostani Chocolate are some of the prominent players in the Saudi Arabia Chocolate Market.

In October 2024, Saudi Arabia's Vlinder Chocolate entered South Korea with its "Dubai chocolate-style" products as part of a viral food trend.

NXT plant-based chocolates from Callebaut promise the same rich flavor, creamy texture, and quality as traditional chocolate. Nestlé will be investing seven billion Saudi Riyals in Saudi Arabia over the next decade to enhance its presence in the country. This will begin with an investment of up to SAR 375 million for an advanced manufacturing facility, which will commence operations in 2025.

16 - 19 September 2024, Chocolate Art Salon is the first authentic event in Saudi Arabia, where art and sculptures of chocolate have been introduced, bringing around the globe cultures and chocolate artistry together.

Saudi Arabia Chocolate Market Segments

Type – Market breakup in 2 viewpoints:

1. Dark Chocolate

2. Milk/White Chocolate

Ingredients – Market breakup in 5 viewpoints:

1. Cocoa Beans

2. Cocoa Butter

3. Sweeteners

4. Chocolate Liquor

5. Others

Distribution Channel – Market breakup in 4 viewpoints:

1. Hypermarkets/Supermarkets

2. Convenience Stores

3. Online Retail Stores

4. Other Distribution Channel

Region – Market breakup in 4 viewpoints:

1. Western

2. Northern & Central

3. Eastern

4. Southern

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Aani & Dani

2. Artisan du Chocolat

3. Bateel

4. Al Nassama

5. Bostani Chocolate

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Ingredients, Distribution Channel and Region |

| Ingredients Covered | 1. Cocoa Beans 2. Cocoa Butter 3. Sweeteners 4. Chocolate Liquor 5. Others |

| Companies Covered | 1. Aani & Dani 2. Artisan du Chocolat 3. Bateel 4. Al Nassama 5. Bostani Chocolate |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Chocolate Market

6. Market Share

6.1 By Type

6.2 By Ingredients

6.3 By Distribution Channel

6.4 By Region

7. Type

7.1 Dark Chocolate

7.2 Milk/White Chocolate

8. Ingredients

8.1 Cocoa Beans

8.2 Cocoa Butter

8.3 Sweeteners

8.4 Chocolate Liquor

8.5 Others

9. Distribution Channel

9.1 Hypermarkets/Supermarkets

9.2 Convenience Stores

9.3 Online Retail Stores

9.4 Other Distribution Channel

10. Region

10.1 Western

10.2 Northern & Central

10.3 Eastern

10.4 Southern

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Aani & Dani

13.1.1 Overview

13.1.2 Recent Development

13.2 Artisan du Chocolat

13.2.1 Overview

13.2.2 Recent Development

13.3 Bateel

13.3.1 Overview

13.3.2 Recent Development

13.4 Al Nassama

13.4.1 Overview

13.4.2 Recent Development

13.5 Bostani Chocolate

13.5.1 Overview

13.5.2 Recent Development

13.6 Said Dal 1923

13.6.1 Overview

13.6.2 Recent Development

13.7 Juhaina-Al Daajan Holding

13.7.1 Overview

13.7.2 Recent Development

13.8 Neuhaus

13.8.1 Overview

13.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com