China Molecular Diagnostics Market is Forecasted to be more than US$ 6.3 Billion by the end of year 2026

01 Apr, 2021

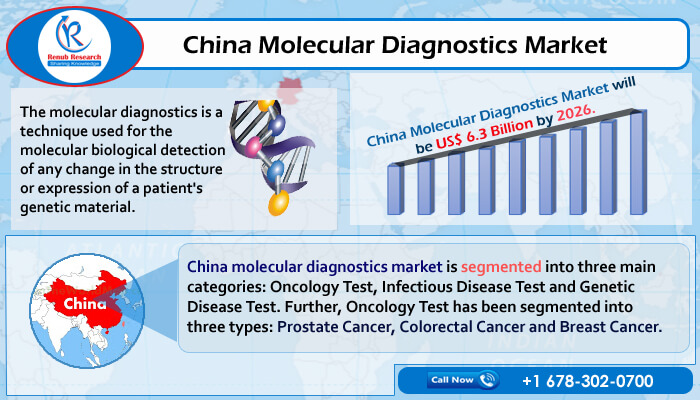

According to the latest report by Renub Research, titled "China Molecular Diagnostics Market & Volume Forecast, by Application [Oncology Testing, Infectious Disease Testing, and Genetic Disease Testing]" China is one of the largest clinical laboratory markets in the Asia-Pacific region and one of the fastest-growing molecular diagnostics markets. The China Molecular Diagnostics Market is forecasted to expand significantly in the future, owing to the increase in the geriatric population & the growing prevalence of chronic diseases such as diabetes, cancer, and CVD diagnosed and monitored with medical devices. According to a 2017 United Nations survey, China is on the brink of an elderly population crisis, with the elderly population projected to hit 25% by 2030. China Molecular Diagnostics Market is forecasted to be US$ 6.3 Billion by 2026.

Molecular diagnostic tests that find specific DNA or RNA sequences may or may not be related to a disease (such as single nucleotide polymorphisms (SNPs), deletions, rearrangements, insertions, and others). Molecular diagnostics is still in its early stages of growth in this Asian country. The majority of molecular diagnostic systems are "open," with instruments supplied by multinational life science firms in China.

China molecular diagnostics market is segmented into 3 main categories: Genetic Disease Test, Oncology Test, and Infectious Disease Test.

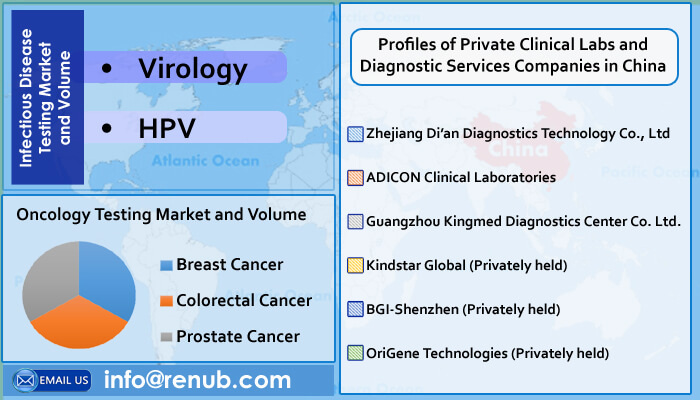

Oncology examinations are further classified into three categories: Colorectal Cancer, Prostate Cancer, and Breast Cancer. Infectious Disease Studies are classified into two categories: HPV and virology. HLA and Blood Screening are two forms of genetic testing. In China's molecular genetic testing industry, blood screening tests are the most common. According to Renub Research analysis, China will conduct nearly 441 million molecular diagnostic tests by the end of 2026, with virology being one of the most common test segments.

The Effect of Coronavirus on the Molecular Diagnostics Industry

Furthermore, COVID-19 has catalyzed China's diagnostics industry. The Chinese government is performing a large number of COVID experiments in order to control the spread of disease. RT-PCR and quick neutralizer tests, also known as serological tests, are two types of tests used to classify the COVID illness. The cutting-edge test RT-PCR is known as having the "highest quality standard." The procedure is completed by collecting a nasal/throat swab from the patient. This test involves extracting ribonucleic acid corrosive, or RNA, which is the infection's inherited material. This is a costly test that necessitates RNA extraction devices, a testing facility, and trained staff. On the other hand, fast counteracting agent tests are adaptable, guided nearby, provide quick results, and are cost-effective.

Market Summary:

By Application: The report studies the market and volume of the following segments in Molecular Diagnostics: Oncology Testing (Colorectal Cancer, Breast Cancer, Prostate Cancer), Infectious Disease Testing (HPV, Virology), and Genetic Disease Testing (HLA and Blood Screening).

By Company: Profiles of Private Clinical Labs and Diagnostic Services Companies in China of the following Companies such as Guangzhou Kingmed Diagnostics Center Co. Ltd., OriGene Technologies (Privately held), Zhejiang Di'an Diagnostics Technology Co., Ltd, Kindstar Global, ADICON Clinical Laboratories, BGI-Shenzhen.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com