United States Vaccine Market By Type (Influenza, Retrovirus, Hepatitis, Polio, DTap, HIB, Pneumococcal Conjugate, Varicella, MMR and HPV), Products and Pipeline, Companies

Buy NowGet Free Customization in this Report

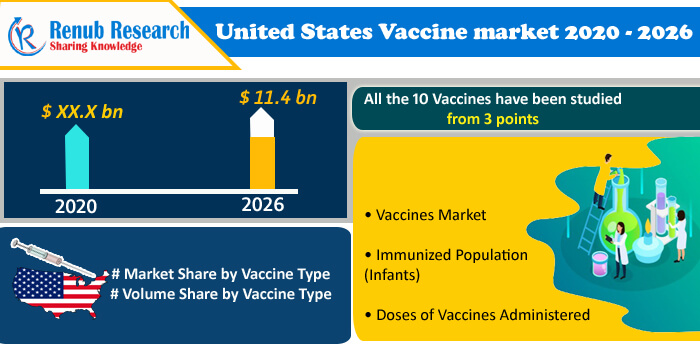

The average human life span has grown significantly primarily due to vaccination. Vaccines have transformed public health throughout the world, especially for children. In the United States, among the various diseases like Influenza, Rotavirus, Hepatitis (Hepatitis A and Hepatitis B), Polio, DTap, HIB, Pneumococcal conjugate, Varicella, MMR and HPV, influenza is the most common viral infection. Quadrivalent is the most common flu vaccines in the United States, which was licensed in the year 2012. According to Renub Research, United States Vaccine Market is poised to reach US$ 11.4 Billion by 2026.

Although influenza can catch anyone anytime in the year, usually it spreads between May to October. So in August National Immunization Awareness day is being celebrated to increase the awareness and the importance of vaccination in the nation. These immunizations awareness and government initiatives have helped to prevent 2-3 million deaths annually according to the World Health Organisation. There is no other health intervention as simple, powerful, and cost-effective as a ‘vaccine’.

In this report, we have studied key players like GlaxoSmithKline, plc, Merck & Co, Sanofi Pasteur and Pfizer, Inc their trends and implication which has given these companies to view in a strategic way. Apart from that, companies are evaluated on parameters like

• Overviews

• Recent Developments

• Revenues

• Vaccinations Pipeline & Clinical Trials

Renub Research report titled “United States Vaccine Market By Vaccine Type (Vaccines Market, Immunized Population and Administered Doses), Influenza (Trivalent Flu Vaccine and Quadrivalent Flu Vaccine), Retrovirus, Hepatitis (Hepatitis A and B), Polio, DTap, HIB, Pneumococcal Conjugate, Varicella, MMR and HPV) Vaccines Products and Pipeline, Company Analysis (GlaxoSmithKline, plc, Merck & Co, Sanofi Pasteur and Pfizer, Inc.)” provides an all-encompassing analysis on the United States Vaccine Industry.

All the 10 Vaccines have been studied from 3 points

• Vaccines Market

• Immunized Population (Infants)

• Doses of Vaccines Administered

Vaccine Type - The Report Covers the Market, Immunized Population and Administered Doses of all the 10 diseases

1. Influenza Vaccines

2. Retrovirus

3. Hepatitis A & B

4. Polio

5. DTaP

6. HIB

7. Pneumococcal conjugate

8. Varicella

9. MMR

10. HPV

All the company analysis has been covered from 4 Viewpoints

• Overview

• Recent Developments

• Revenue Analysis

• Vaccinations Pipeline & Clinical Trials

Company Analysis

• GlaxoSmithKline, plc

• Merck & Co

• Sanofi Pasteur

• Pfizer, Inc.

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Vaccine Analysis

5.1 Vaccine Market

5.2 Immunized Population

5.3 Doses of Vaccines Administered

6. Share Analysis

6.1 Market Share by Vaccine Type

6.2 Volume Share by Vaccine Type

7. Disease wise – Vaccines Market& Volume and Forecast

7.1 Influenza Vaccines Market & Types

7.1.1 Trivalent Flu Vaccine

7.1.2 Quadrivalent Flu Vaccine

7.1.3 Administered Doses

7.2 Rotavirus

7.2.1 Vaccines Market

7.2.2 Immunized Population (Infants)

7.2.3 Administered Doses

7.3 Hepatitis B

7.3.1 Vaccines Market

7.3.2 Immunized Population (Infants)

7.3.3 Administered Doses

7.3.4 Hepatitis A

7.4 Polio

7.4.1 Vaccines Market

7.4.2 Immunized Population (Infants + Children)

7.4.3 Administered Doses

7.5 DTaP

7.5.1 Vaccines Market

7.5.2 Immunized Population

7.5.3 Administered Doses

7.6 HIB

7.6.1 Vaccines Market

7.6.2 Immunized Population (Infants)

7.6.3 Administered Doses

7.7 Pneumococcal conjugate

7.7.1 Vaccines Market

7.7.2 Immunized Population (Infants)

7.7.3 Administered Doses

7.8 Varicella

7.8.1 Vaccines Market

7.8.2 Immunized Population (Infants + 4-6 years old)

7.8.3 Administered Doses

7.9 MMR

7.9.1 Vaccines Market

7.9.2 Immunized Population (Infants + 4-6 years old)

7.9.3 Administered Doses

7.10 HPV

7.10.1 Vaccines Market

7.10.2 Immunized Population (Immunized Girl)

7.10.3 Administered Doses

8. Vaccines – Products and Pipeline

8.1 GlaxoSmithKline, plc

8.2 Merck & Co

8.3 Sanofi Pasteur

8.4 Pfizer, Inc.

9. Top Mergers and Acquisitions in the Vaccine Industry

10. Key Players

10.1 GlaxoSmithKline, plc.’s Vaccines Sales

10.2 Merck & Co. Vaccines Sales

10.3 Sanofi Pasteur’s Vaccines Sales

10.4 Pfizer, Inc.’s Vaccines Sales

List of Figures:

Figure-01: United States – Vaccine Market (Million US$), 2016 – 2019

Figure-02: United States – Forecast For Vaccine Market (Million US$), 2020 – 2026

Figure-03: United States – Immunized Population (Million), 2016 – 2019

Figure-04: United States – Vaccine Market (Million US$), 2016 – 2019

Figure-05: United States – Forecast For Vaccine Market (Million US$), 2020 – 2026

Figure-06: United States – Immunized Population (Million), 2016 – 2019

Figure-07: United States – Forecast for Immunized Population (Million) - 2020-2026

Figure-08: United States – Doses of Vaccines Administered (Million), 2016 – 2019

Figure-09: United States – Forecast For Doses of Vaccines Administered (Million), 2020 – 2026

Figure-10: United States – Influenza Vaccines Market (Million US$), 2015 – 2019

Figure-11: United States – Forecast For Influenza Vaccines Market (Million US$), 2020 – 2026

Figure-12: United States – Trivalent flu Vaccines (Million US$), 2014 – 2019

Figure-13: United States – Forecast For Trivalent flu Vaccine (Million US$), 2020 – 2026

Figure-14: United States – Quadrivalent flu Vaccine (Million US$), 2017– 2019

Figure-15: United States – Forecast For Quadrivalent flu Vaccine (Million US$), 2020 – 2026

Figure-16: United States – Administered Doses (Million), 2017 – 2019

Figure-17: United States – Forecast For Administered Doses (Million), 2020 – 2026

Figure-18: United States – Rotavirus Vaccines Market (Million US$), 2015 – 2019

Figure-19: United States – Forecast For Rotavirus Vaccines Market (Million Pound), 2020 – 2026

Figure-20: United States – Rotavirus Immunized Infants (Million), 2015 – 2019

Figure-21: United States – Forecast For Rotavirus Immunized Infants (Million), 2020 – 2026

Figure-22: United States – Rotavirus Administered Doses (Million), 2015 – 2019

Figure-23: United States – Forecast For Rotavirus Administered Doses (Million), 2020 – 2026

Figure-24: United States – Hepatitis B Vaccines Market (Million US$), 2015 – 2019

Figure-25: United States – Forecast For Hepatitis B Vaccines Market (Million US$), 2020 – 2026

Figure-26: United States – Hepatitis B Immunized Population (Million), 2015 – 2019

Figure-27: United States – Forecast For Hepatitis B Immunized Population (Million), 2020 – 2026

Figure-28: United States – Hepatitis B Administered Doses (Million), 2015 – 2019

Figure-29: United States – Forecast For Hepatitis B Administered Doses (Million), 2020 – 2026

Figure-30: United States – Hepatitis A Vaccines Market (Million US$), 2015 – 2019

Figure-31: United States – Forecast For Hepatitis A Vaccines Market (Million US$), 2020 – 2026

Figure-32: United States – Hepatitis A Immunized Infants (Million), 2015 – 2019

Figure-33: United States – Forecast For Hepatitis A Immunized Infants (Million), 2020 – 2026

Figure-34: United States – Hepatitis B Administered Doses (Million), 2015 – 2019

Figure-35: United States – Forecast For Hepatitis B Administered Doses (Million), 2020 – 2026

Figure-36: United States – Polio Vaccine Market (Million US$), 2015 – 2019

Figure-37: United States – Forecast For Polio Vaccine Market (Million US$), 2020 – 2026

Figure-38: United States – Polio Immunized Infants (Million), 2015 – 2019

Figure-39: United States – Forecast For Polio Immunized Infants (Million), 2020 – 2026

Figure-40: United States – Polio Administered Doses (Million), 2015 – 2019

Figure-41: United States – Forecast for Polio Administered Doses (Million), 2020 – 2026

Figure-42: United States – DTaP Vaccines Market (Million US$), 2015 – 2019

Figure-43: United States – Forecast For DTaP Vaccines Market (Million US$), 2020 – 2026

Figure-44: United States – DTaP Immunized Population (Million), 2015 – 2019

Figure-45: United States – Forecast For DTaP Immunized Population (Million), 2020 – 2026

Figure-46: United States – DTaP Administered Doses (Million), 2015 – 2019

Figure-47: United States – Forecast For DTaP Administered Doses (Million), 2020 – 2026

Figure-48: United States – HIB Vaccine Market (Million US$), 2015 – 2019

Figure-49: United States – Forecast For – HIB Vaccine Market (Million US$), 2020 – 2026

Figure-50: United States – HIB Immunized Infants (Million), 2015 – 2019

Figure-51: United States – Forecast For HIB Immunized Infants (Million ), 2020 – 2026

Figure-52: United States – HIB Administered Doses (Million), 2015 – 2019

Figure-53: United States – Forecast For HIB Administered Doses (Million), , 2020 – 2026

Figure-54: United States – Pneumococcal conjugate Vaccines Market (Million US$), 2015 – 2019

Figure-55: United States – Pneumococcal conjugate Vaccines Market (Million US$), 2020 – 2026

Figure-56: United States – Pneumococcal conjugate Immunized Population (Million), 2015 – 2019

Figure-57: United States – Forecast For Pneumococcal conjugate Immunized Population (Million), 2020 – 2026

Figure-58: United States – Pneumococcal conjugate Administered Doses (Million), 2015 – 2019

Figure-59: United States – Forecast For Pneumococcal conjugate Administered Doses (Million), 2020 – 2026

Figure-60: United States – Varicella Vaccines Market (Million US$), 2015 – 2019

Figure-61: United States – Forecast For Varicella Vaccines Market (Million US$), 2020 – 2026

Figure-62: United States – Varicella Immunized Infants (Million), 2015 – 2019

Figure-63: United States – Forecast For Varicella Immunized Infants (Million), 2020 – 2026

Figure-64: United States – Varicella Administered Doses (Million), 2015 – 2019

Figure-65: United States – Forecast For Varicella Administered Doses (Million), 2020 – 2026

Figure-66: United States – MMR Vaccine Market (Million US$), 2015 – 2019

Figure-67: United States – Forecast For MMR Vaccine Market (Million US$), 2020 – 2026

Figure-68: United States – MMR Immunized Population (Million), 2015 – 2019

Figure-69: United States – Forecast For MMR Immunized Population (Million ), 2020 – 2026

Figure-70: United States – Administered Doses (Million), 2015 – 2019

Figure-71: United States – Forecast For Administered Doses (Million), 2020 – 2026

Figure-72: United States – HPV Vaccine Market (Million US$), 2015 – 2019

Figure-73: United States – Forecast For HPV Vaccine Market (Million), 2020 – 2026

Figure-74: United States – HPV Immunized Girl (Million), 2015 – 2019

Figure-75: United States – Forecast For HPV Immunized Girl (Million), 2020 – 2026

Figure-76: United States – HPV Administered Doses (Million), 2015 – 2019

Figure-77: United States – Forecast For HPV Administered Doses (Million ), 2020 – 2026

Figure-78: Global – GlaxoSmithKline, plc.'s Vaccine Revenue (Million US$), 2015 – 2019

Figure-79: Global – Forecast For GlaxoSmithKline plc.'s Vaccine Revenue (Million US$), 2020 – 2026

Figure-80: Global – Merck & Co. Vaccine Revenue (Million US$), 2015 – 2019

Figure-81: Global – Forecast For Merck & Co. Vaccine Revenue (Million US$), 2020 – 2026

Figure-82: Global – Sanofi Pasteur’s Vaccines Revenue (Million US$), 2015 – 2019

Figure-83: Global – Forecast For Sanofi Pasteur’s Vaccines Revenue ( Million US$) 2020 – 2026

Figure-84: Global – Pfizer, Inc.’s Vaccine Revenue (Million US$), 2015 – 2020

Figure-85: Global – Forecast For Pfizer, Inc.’s Vaccine Revenue (Million US$), 2020 – 2026

List of Tables:

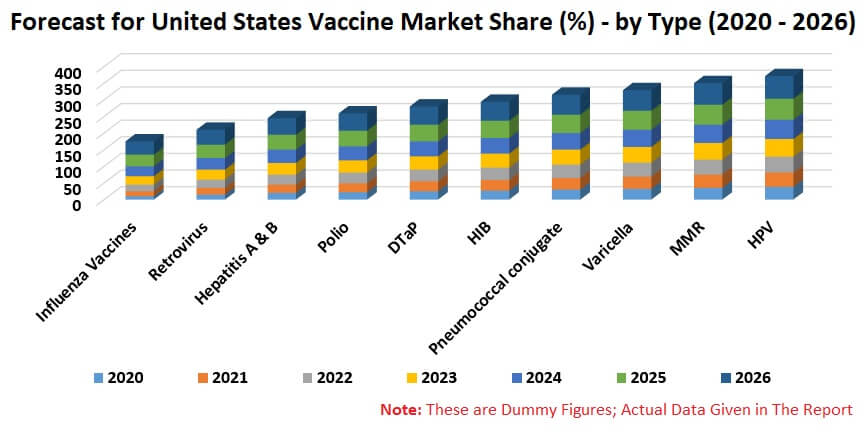

Table-01: United States – Market Share by Vaccine Type (Percentage), 2017 – 2020

Table-02: United States – Forecast For Market Share by Vaccine Type (Percentage), 2020 – 2026

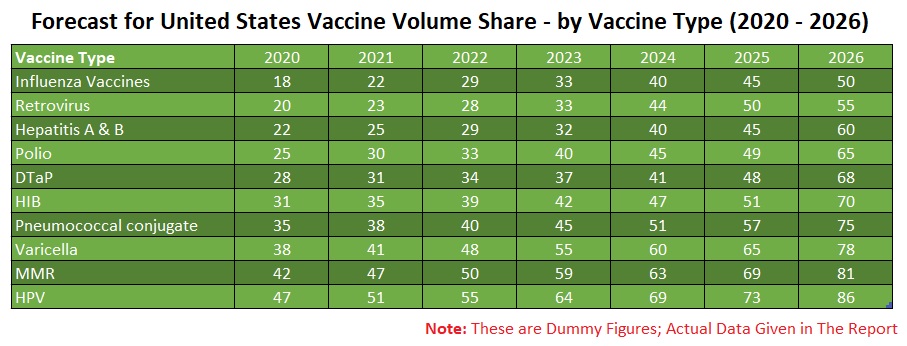

Table-03: United States – Volume Share by Vaccine Type (Percentage), 2017 – 2020

Table-04: United States – Forecast For Volume Share by Vaccine Type (Percentage), 2020 – 2026

Table-05: GlaxoSmithKline, plc. Products & Pipelines

Table-06: Sanofi Pasteur Products & Pipelines

Table-07: Pfizer Products & Pipelines

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com