China Molecular Diagnostics Market & Volume Forecast, by Application [Oncology Testing, Infectious Disease Testing, and Genetic Disease Testing]

Buy NowGet Free Customization in This Report

Molecular diagnostics plays an important role in the identification of diseases and has gained more public & healthcare specialist attention than ever before. The molecular diagnostics is a technique used for the molecular biological detection of any change in the structure or expression of a patient's genetic material. According to Renub Research, China Molecular Diagnostics Market is expected to be US$ 6.3 Billion by 2026.

In recent years, Molecular diagnostics has changed the face of clinical laboratories by offering easy to use automated molecular systems that provide rapid results with less hands-on time. However, huddles for China diagnostic companies are Lack of Government Support, Public Awareness for Molecular Diagnostics test.

COVID-19 effect on Molecular Diagnostics Industry

Besides, COVID-19 has worked as a catalyst for molecular diagnostics industry in China. In order to spread the disease government of China is doing massive number of COVID test. The types of tests which are done to indentify the coronavirus disease are RT-PCR, and rapid anti-body tests also known as serological tests. RT-PCR is considered the ‘gold standard’ frontline test. In this test testing is done by taking a nasal/throat swab from a patient. This test involves extracting ribonucleic acid or RNA, which is the genetic material of the virus. This is a fairly expensive test it requires RNA extracting machines, a laboratory and trained technicians. On the other hand rapid anti-body tests are portable, administered on-site, provide quick answers and are inexpensive too.

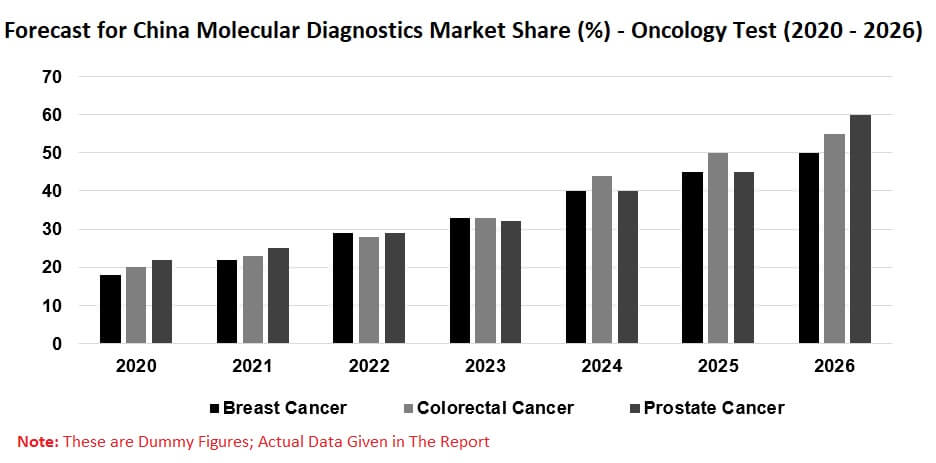

China molecular diagnostics market is segmented into three main categories: Oncology Test, Infectious Disease Test and Genetic Disease Test. Further, Oncology Test has been segmented into three types: Prostate Cancer, Colorectal Cancer and Breast Cancer. Infectious Disease Test has been further categorized into two main types, which is virology and HPV. Genetic Test has been categorized into HLA and Blood Screening. Blood screening test is a dominating segment in the China molecular genetic testing market. According to Renub Research analysis nearly 441 million molecular diagnostic tests will be performed in China by the end of 2026 of which Virology accounts for one of the most performed tests segments.

DICON Clinical Laboratories, Zhejiang Di’an Diagnostics Technology Co., Ltd, Kindstar Global, BGI-Shenzhen, A, Guangzhou Kingmed Diagnostics Center Co. Ltd and OriGene Technologies holds majority of market share in China. However, restriction on export is expected to have minimal impact on the manufacturers as the demand is very high in China which is creating a robust revenue pool for manufacturers dealing in the molecular diagnostics sector.

Renub Research report titled “China Molecular Diagnostics Market, Volume, by Application [Oncology Testing (Breast Cancer, Colorectal Cancer, Prostate Cancer), Infectious Disease Testing (Virology, HPV), and Genetic Disease Testing (Blood Screening, HLA)]” provides a complete analysis of China Molecular Diagnostics Market.

By Application

The report studies the market and volume of the following segments in Molecular Diagnostics: Infectious Disease Testing (Virology, HPV), Oncology Testing (Breast Cancer, Colorectal Cancer, Prostate Cancer), and Genetic Disease Testing (Blood Screening, HLA).

Segment Covered in this report are as follows:

Oncology Testing Market and Volume

• Breast Cancer

• Colorectal Cancer

• Prostate Cancer

Infectious Disease Testing Market and Volume

• Virology

• HPV

Genetic Testing Market and Volume

• Blood Screening

• HLA

Profiles of Private Clinical Labs and Diagnostic Services Companies in China

• Zhejiang Di’an Diagnostics Technology Co., Ltd

• ADICON Clinical Laboratories

• Guangzhou Kingmed Diagnostics Center Co. Ltd.

• Kindstar Global (Privately held)

• BGI-Shenzhen (Privately held)

• OriGene Technologies (Privately held)

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Driver

4.2 Challenges

5. China Molecular Diagnostic Market & Test Volume

5.1 China Molecular Diagnostic Market

5.2 China Molecular Diagnostic Test Volume

6. Market Share – China Molecular Diagnostic Share Analysis

6.1 Segments

6.2 Disease

6.3 Oncology Test

6.4 Genetic Test

6.5 Infectious Disease Test

7. Volume Share – China Molecular Diagnostics

7.1 Segments

7.2 Disease

7.3 Oncology Test

7.4 Infectious Disease Test

7.5 Genetic Test

8. Disease – China Molecular Diagnostic Test Volume

8.1 Oncology Test Volume

8.1.1 Breast Cancer Test Volume

8.1.2 Colorectal Cancer Test Volume

8.1.3 Prostate Cancer Test Volume

8.2 Infectious Disease Test Volume

8.2.1 Virology Test Volume

8.2.2 HPV Test Volume

8.3 Genetic Test Volume

8.3.1 Blood Screening Test Volume

8.3.2 HLA Test Volume

9. Disease – China Molecular Diagnostic Market

9.1 Oncology Testing Market

9.1.1 Breast Cancer Testing Market

9.1.2 Colorectal Cancer Testing Market

9.1.3 Prostate Cancer Testing Market

9.2 Infectious Disease Testing Market

9.2.1 Virology Testing Market

9.2.2 HPV Testing Market

9.3 Genetic Testing Market

9.3.1 Blood Screening Market

9.3.2 HLA Testing Market

10. China Healthcare Insurance Schemes

10.1 China Healthcare Insurance Schemes

10.1.1 New Rural Cooperative Medical Scheme (NRCMS)

10.1.2 Urban Employed Basic Medical Insurance (UEBMI)

10.1.3 Urban Resident Basic Medical Insurance (URBMI)

10.1.4 Private Health Insurance

11. Profiles of Private Clinical Labs and Diagnostic Services Companies

11.1 Zhejiang Di’an Diagnostics Technology Co., Ltd.

11.1.1 Company Overview

11.1.2 Products and Services Offered by Di’an

11.2 ADICON Clinical Laboratories (Privately held)

11.2.1 Company Overview

11.2.2 Products and Services Offered by ADICON

11.3 Guangzhou Kingmed Diagnostics Center Co. Ltd.

11.3.1 Company Overview

11.3.2 Products and Services Offered by Kingmed

11.4 Kindstar Global (Privately held)

11.4.1 Company Overview

11.4.2 Products and Services Offered by Kindstar

11.5 BGI–Shenzhen

11.5.1 Company Overview

11.5.2 BGI’s Innovative Approach

11.6 OriGene Technologies

11.6.1 Company Overview

11.6.2 Products and Services Offered by OriGene

List of Figures:

Figure 3‑1: China – Healthcare Spending (Billion US$), 2011 & 2020

Figure 4‑1: China – Molecular Diagnostic Market (Million US$), 2015 – 2019

Figure 4‑2: China – Forecast for Molecular Diagnostic Market (Million US$), 2020 – 2026

Figure 4‑3: China – Molecular Diagnostic Test Volume (Million), 2015 – 2019

Figure 4‑4: China – Forecast for Molecular Diagnostic Test Volume (Million), 2020 – 2026

Figure 5‑1: China – Molecular Diagnostic Market Share (Percent), 2015 – 2019

Figure 5‑2: China – Forecast for Molecular Diagnostic Market Share (Percent), 2020 – 2026

Figure 5‑3: China – Molecular Oncology Test Market Share (Percent), 2015 – 2019

Figure 5‑4: China – Forecast for Molecular Oncology Test Market Share (Percent), 2020 – 2026

Figure 6‑1: China – Molecular Diagnostic Test Volume Share (Percent), 2015 – 2019

Figure 6‑2: China – Forecast for Molecular Diagnostic Test Volume Share (Percent), 2020– 2026

Figure 6‑3: China – Molecular Oncology Test Volume Share (Percent), 2015 – 2019

Figure 6‑4: China – Forecast for Molecular Oncology Test Volume Share (Percent), 2020 – 2026

Figure 7‑1: Rural China – Cancer Screening Sites by Cancer Type (Number), 2013

Figure 7‑2: China – Oncology Test Volume (Million), 2015 – 2019

Figure 7‑3: China – Forecast for Oncology Test Volume (Million), 2020 – 2026

Figure 7‑4: China – Breast Cancer Molecular Test Volume (Million), 2015 – 2019

Figure 7‑5: China – Forecast for Breast Cancer Molecular Test Volume (Million), 2020 – 2026

Figure 7‑6: China – Colorectal Cancer Test Volume (Million), 2015 – 2019

Figure 7‑7: China – Forecast for Colorectal Cancer Test Volume (Million), 2020 – 2026

Figure 7‑8: China – Prostate Cancer Test Volume (Million), 2015 – 2019

Figure 7‑9: China – Forecast for Prostate Cancer Test Volume (Million), 2020 – 2026

Figure 7‑10: China – Infectious Disease Test Volume (Million), 2015 – 2019

Figure 7‑11: China – Forecast for Infectious Disease Test Volume (Million), 2020 – 2026

Figure 7‑12: China – Virology Test Volume (Million), 2015 – 2019

Figure 7‑13: China – Forecast for Virology Test Volume (Million), 2020 – 2026

Figure 7‑14: China – HPV Test Volume (Thousand), 2015 – 2019

Figure 7‑15: China – Forecast for HPV Test Volume (Thousand), 2020 – 2026

Figure 7‑16: China – Genetic Test Volume (Million), 2015 – 2019

Figure 7‑17: China – Forecast for Genetic Test Volume (Million), 2020 – 2026

Figure 7‑18: China – Blood Screening Test Volume (Million), 2015 – 2019

Figure 7‑19: China – Forecast for Blood Screening Test Volume (Million), 2020 – 2026

Figure 7‑20: China – HLA Test Volume (Thousand), 2015 – 2019

Figure 7‑21: China – Forecast for HLA Test Volume (Thousand), 2020 – 2026

Figure 8‑1: China – Oncology Testing Market (Million US$), 2015 – 2019

Figure 8‑2: China – Forecast for Oncology Testing Market (Million US$), 2020 – 2026

Figure 8‑3: China – Breast Cancer Testing Market (Million US$), 2015 – 2019

Figure 8‑4: China – Forecast for Breast Cancer Testing Market (Million US$), 2020 – 2026

Figure 8‑5: China – Colorectal Cancer Testing Market (Million US$), 2015 – 2019

Figure 8‑6: China – Forecast for Colorectal Cancer Testing Market (Million US$), 2020 – 2026

Figure 8‑7: China – Prostate Cancer Testing Market (Million US$), 2015 – 2019

Figure 8‑8: China – Forecast for Prostate Cancer Testing Market (Million US$), 2020 – 2026

Figure 8‑9: China – Infectious Disease Testing Market (Million US$), 2015 – 2019

Figure 8‑10: China – Forecast for Infectious Disease Testing Market (Million US$), 2020 – 2026

Figure 8‑11: China – Virology Testing Market (Million US$), 2015 – 2019

Figure 8‑12: China – Forecast for Virology Testing Market (Million US$), 2020 – 2026

Figure 8‑13: China – HPV Testing Market (Million US$), 2015 – 2019

Figure 8‑14: China – Forecast for HPV Testing Market (Million US$), 2020 – 2026

Figure 8‑15: China – Genetic Testing Market (Million US$), 2015 – 2019

Figure 8‑16: China – Forecast for Genetic Testing Market (Million US$), 2020– 2026

Figure 8‑17: China – Blood Screening Market (Million US$), 2015 – 2019

Figure 8‑18: China – Forecast for Blood Screening Market (Million US$), 2020 – 2026

Figure 8‑19: China – HLA Testing Market (Million US$), 2015 – 2019

Figure 8‑20: China – Forecast for HLA Testing Market (Million US$), 2020 – 2026

Figure 10–10‑1: Kindstar – Collaboration with Hospitals in China (Number), 2006 – 2012

List of Tables:

Table 3‑1: China – Major Diagnostic Reagent R&D and Manufacturing Companies in Infectious Diseases, 2010

Table 3‑2: Number of hospital beds for every 1,000 people

Table 5‑1: China – Molecular Diagnostic Application Market Share (Percent), 2015 – 2019

Table 5‑2: China – Forecast for Molecular Diagnostic Application Market Share (Percent), 2020 – 2026

Table 5‑3: China – Molecular Genetic Test Market Share (Percent), 2015 – 2019

Table 5‑4: China – Forecast for Molecular Genetic Test Market Share (Percent), 2020 – 2026

Table 5‑5: China – Molecular Infectious Disease Test Market Share (Percent), 2015 – 2019

Table 5‑6: China – Forecast for Molecular Infectious Disease Test Market Share (Percent), 2020 – 2026

Table 6‑1: China – Molecular Diagnostic Test Volume Application Share (Percent), 2015 – 2019

Table 6‑2: China – Forecast for Molecular Diagnostic Test Volume Application Share (Percent), 2020 – 2026

Table 6‑3: China – Molecular Infectious Disease Test Volume Share (Percent), 2015 – 2019

Table 6‑4: China – Forecast for Molecular Infectious Disease Test Volume Share (Percent), 2020 – 2026

Table 6‑5: China – Molecular Genetic Test Volume Share (Percent), 2015 – 2019

Table 6‑6: China – Forecast for Molecular Genetic Test Volume Share (Percent), 2020 – 2026

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com