North America Halal Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Halal Food Market Size & Forecast 2025-2033

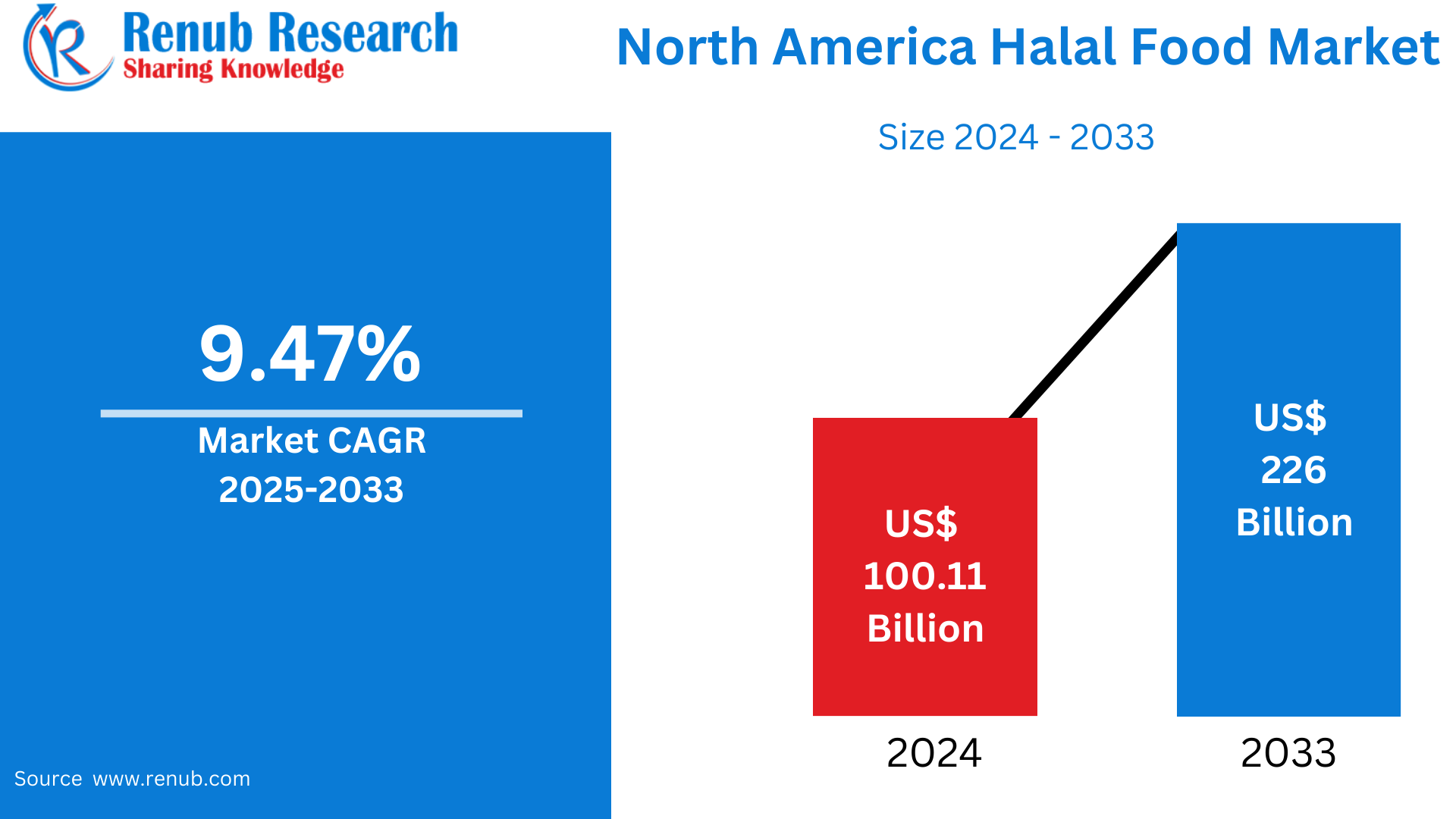

North America Halal Food Market is expected to reach US$ 226 billion by 2033 from US$ 100.11 billion in 2024, with a CAGR of 9.47% from 2025 to 2033. The halal food industry in North America is driven by factors such as the growing number of Muslims, the growing desire for clean-label and ethical goods, the expansion of halal certification, rising awareness, and availability in mainstream retail.

North America Halal Food Market Report by Product (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Cereals & Grains, Oil, Fats & Waxes, Confectionery, Others), Distribution Channel (Hypermarkets & Supermarket, Online Stores, Convenience Stores, Specialty Stores, Others), Countries (United States, Canada) and Company Analysis, 2025-2033.

North America Halal Food Industry Overview

A growing Muslim population and increased consumer demand for premium, ethically produced food goods are driving the halal food industry's steady expansion in North America. With more than 3.5 million Muslims living in the US alone, halal-certified products that satisfy dietary restrictions are becoming more and more popular. Beyond religious observance, halal products are becoming more and more well-liked by non-Muslim customers who connect them to norms for food safety, cleanliness, and animal care. From well-established food giants to up-and-coming niche companies, this wider appeal is broadening the market's reach and drawing new participants to the sector.

In order to meet changing customer demands, the retail and catering industries in the US and Canada are progressively incorporating halal products. The halal product lines of supermarkets, hypermarkets, and internet platforms are growing to include ready-to-eat meals, meat, snacks, and drinks. Additionally, restaurants and fast-food companies are changing their menus to provide halal alternatives, particularly in cities with significant Muslim populations. Consumer confidence is further strengthened and adherence to global halal standards is guaranteed by government assistance in the form of halal certification organizations and regulatory frameworks. Together, these elements are fortifying the supply chain for halal food and fostering steady market growth.

The halal food business in North America is also growing because to technological innovation, strategic alliances, and marketing initiatives. Halal items are now more widely available because to the expansion of e-commerce, especially for customers in underdeveloped or distant locations. Businesses are using influencer marketing and social media to increase brand recognition and inform customers about the advantages of eating halal cuisine. Furthermore, the industry's attractiveness is being enhanced by the growing emphasis on sustainability, traceability, and health-conscious consumption, all of which are in line with halal values. As a consequence, it is anticipated that the halal food industry in North America will keep growing thanks to technical, cultural, and economic factors that are changing the culinary scene in the area.

In the United States, for example, where there are 3.45 million Muslims and numerous other followers of the halal lifestyle, the halal business is still growing, according to the American Halal Foundation. By 2024, it is expected to have grown by USD 8.17 billion. Furthermore, the Islamic Food and Nutrition Council of America (IFANCA) estimates that in 2020, halal customers in the US market spent about USD 20 billion on food. But just a small number of producers are taking advantage of this wealthy consumer segment, which has enormous potential for product growth in the nation.

Growth Drivers for the North America Halal Food Market

Rising Muslim Population

One of the main factors propelling the expansion of the halal food industry in North America is the growing number of Muslims, especially in the United States and Canada. With over a million Muslims in Canada and an estimated 3.5 million in the United States, there is a growing need for halal-certified goods. These customers look for food that complies with Islamic dietary regulations, which place a strong emphasis on hygienic practices, the ethical treatment of animals, and the ban on specific substances like alcohol and pork. The demand for conventional halal meat as well as a greater variety of halal-certified products, such as snacks, drinks, and cooked meals, is increased by this population development. In order to serve this growing and more significant market, food producers and merchants are extending their halal product lines.

Expansion of Halal Certification and Regulation

One of the main factors propelling market expansion is the extension and uniformity of halal certification and regulations throughout North America. Consumer trust in halal-labeled products has grown dramatically as a result of more transparent certification processes, more established certifying organizations, and clearer criteria. Both Muslim and non-Muslim customers, who identify halal with morally upright, hygienic, and superior culinary standards, depend on this confidence. More producers and foodservice providers are seeking halal certification as awareness rises in order to satisfy changing customer needs and reach a wider market. Certification is becoming even more streamlined because to industry cooperation and regulatory backing, guaranteeing uniformity and adherence to global halal standards. This change is assisting in the mainstreaming of halal goods in the foodservice and retail sectors.

Urbanization and Ethnic Food Demand

North America's urbanization is having a big impact on how people eat, especially when it comes to ethnic and culturally varied cuisines. Cities are become more multicultural as more people move there, which increases demand for and exposure to real international cuisine, including halal alternatives. Large Muslim communities and a varied range of people looking for halal-certified food for religious, cultural, or health-related reasons may be found in urban areas including New York, Toronto, Los Angeles, and Chicago. Food trucks, restaurants, and supermarkets are being pushed to increase their halal selections because to the rising interest in ethnic cuisine, which is being fueled by curiosity, travel, and a desire for gastronomic diversity. The trend reflects wider movements toward inclusion and cultural representation in food choices, in addition to supporting the expansion of the halal food sector.

Challenges in the North America Halal Food Market

Higher Production Costs

Because of the particular standards for halal slaughter, processing, and certification, the production costs of certified halal meat and food items are frequently higher. These include hiring qualified staff, following religious guidelines, and making sure that halal and non-halal products are kept apart throughout the supply chain. Because of this, halal items are typically more costly than their conventional counterparts, which may reduce customer demand, particularly from budget-conscious consumers. Because it can be expensive to achieve and maintain halal certification, small and medium-sized manufacturers face extra difficulties. This covers the cost of personnel training, facilities improvements, and audits. Smaller companies may be deterred from joining or growing in the halal market by these financial constraints, which would lower market variety and innovation in North America as a whole.

Distribution & Availability

In North America, halal items are still underrepresented in major retail chains, especially in rural and smaller communities where demand is less concentrated. Muslim customers' access is restricted by this limited availability, which also lowers market exposure. Distribution also poses logistical issues since, in order to prevent contamination, halal products must be strictly separated from non-halal ones during storage and transportation. Although they are frequently required, specialized handling, specialized storage facilities, and compatible shipping methods are not always practical or economical for providers. Many merchants may decide not to stock halal items at all as a result. These problems impede market expansion and reduce customer confidence in the halal status of available items by contributing to irregular supply, particularly outside of large cities.

United States Halal Food Market

Due to the rising and diversified Muslim community as well as the growing interest of non-Muslim customers looking for high-quality, ethical food alternatives, the halal food industry in the United States is developing significantly. Meat, processed goods, snacks, and drinks are among the market's many categories, and demand is growing in both mainstream and ethnic grocery shops. Notwithstanding this expansion, the industry still has to contend with issues including uneven certification requirements, low public awareness, and distribution disparities in non-urban regions. But companies are starting to see halal as more than simply a religious requirement; it's a value-based one. This change is promoting more industry-wide investment, innovation, and product development, setting up the US halal food sector for sustained growth and wider consumer appeal.

In January 2022, Cresent Foods began selling its halal-certified goods in the H.E.B. Stores in Houston, Texas. A range of freshly cut halal beef, lamb, and poultry items are among the offerings.

Canada Halal Food Market

The rapidly growing Muslim population and rising consumer demand for halal-certified goods are driving Canada's halal food market's notable expansion. Due to this increase, a greater variety of halal meats, snacks, and packaged foods are being introduced by both individual manufacturers and major merchants. Notwithstanding these advancements, issues still exist, such as uneven certification requirements and restricted accessibility in non-urban regions. Furthermore, questions of product integrity and traceability are brought up by the intricacy of halal supply chains. However, the market's growth offers companies significant chances to serve a wide range of customers, making the halal food industry a vibrant and exciting part of Canada's larger food industry.

North America Halal Food Market Segmentation

Product

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Dairy Products

- Cereals & Grains

- Oil, Fats & Waxes

- Confectionery

- Others

Distribution Channel

- Hypermarkets & Supermarket

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

Country

- United States

- Canada

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Nestle SA

- JBS SA

- BRF SA

- Kawan Food Berhad

- Cargill Inc.

- Carrefour SA

- Crescent Foods Inc.

- VegaVites

- American Halal Company Inc.

- American Foods Group LLC

- Al Islami Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Halal Food Market

6. Market Share

6.1 Product

6.2 Distribution Channel

6.3 Country

7. Product

7.1 Meat, Poultry & Seafood

7.2 Fruits & Vegetables

7.3 Dairy Products

7.4 Cereals & Grains

7.5 Oil, Fats & Waxes

7.6 Confectionery

7.7 Others

8. Distribution Channel

8.1 Hypermarkets & Supermarket

8.2 Online Stores

8.3 Convenience Stores

8.4 Specialty Stores

8.5 Others

9. Country

9.1 United States

9.2 Canada

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Nestle SA

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 JBS SA

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 BRF SA

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Kawan Food Berhad

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Cargill Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Carrefour SA

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Crescent Foods Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.8 VegaVites

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.9 American Halal Company Inc.

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.10 American Foods Group LLC

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.11 Al Islami Foods

12.11.1 Overview

12.11.2 Key Persons

12.11.3 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com