Asia Halal Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowAsia Halal Food Market Size & Forecast 2025-2033

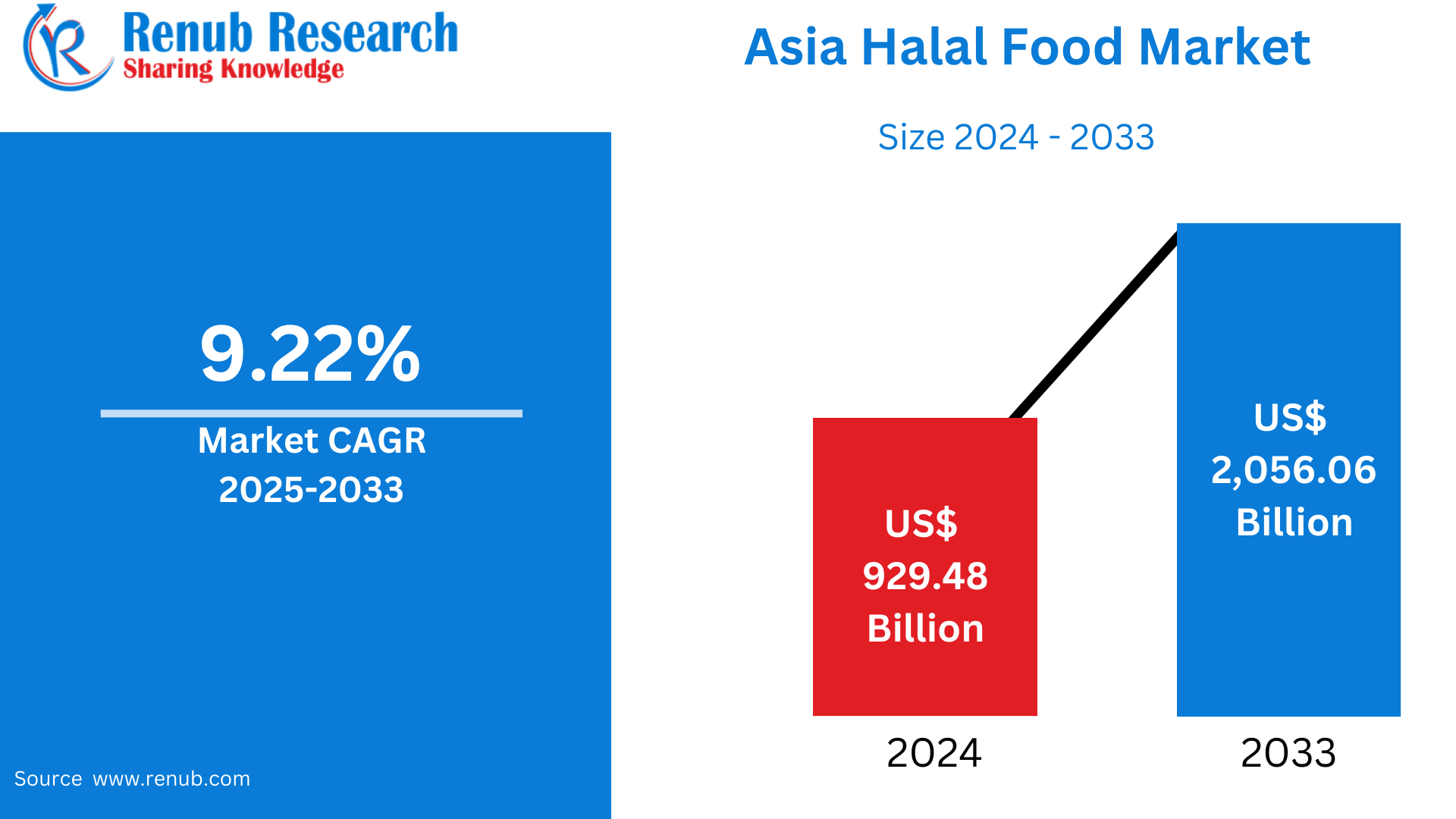

Asia Halal Food Market is expected to reach US$ 2,056.06 billion by 2033 from US$ 929.48 billion in 2024, with a CAGR of 9.22% from 2025 to 2033. Rising public awareness, the speed at which diversity and globalization are occurring, strict standards, the growth of e-commerce platforms, and the escalating worries about health and safety are the main factors driving the industry.

The report Asia Halal Food Market & Forecast covers by Product (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Cereals & Grains, Oil, Fats & Waxes, Confectionery, Others), Distribution Channel (Hypermarkets & Supermarket, Online Stores, Convenience Stores, Specialty Stores, Others), Countries (Pakistan, Indonesia, India, Bangladesh, China, Malaysia, Kazakhstan) and Company Analysis, 2025-2033.

Asia Halal Food Industry Overview

Asia's halal food market is one of the biggest and most vibrant in the world, thanks to the region's sizable Muslim population and strong cultural ties to halal eating habits. As significant producers and consumers, nations like Bangladesh, India, Pakistan, Malaysia, and Indonesia are essential to the expansion of this industry. The broad demand for meat, poultry, snacks, drinks, and processed foods that have been certified halal is a result of both religious commitments and a developing trend among non-Muslim customers who identify halal with safety, quality, and cleanliness. Through national halal regulations and certification organizations, the governments of several Asian nations actively promote the halal industry, bolstering consumer confidence and laying the groundwork for both home and international expansion.

Asia is essential to the global halal supply chain in addition to local demand. For example, by creating strong certification systems, cutting-edge technology, and logistical networks specifically designed for halal goods, Malaysia and Indonesia are establishing themselves as major worldwide centers for halal. Furthermore, halal items are becoming more widely available due to the quick growth of digital retail channels and e-commerce platforms throughout Asia, especially among urban and younger customers. The dissemination of halal products throughout Asia and beyond is further supported by regional cooperation and trade agreements, which also assist to improve market efficiency and streamline regulations. Diversification of the industry is also being aided by innovative product creation, such as convenience meals, nutraceuticals, and halal cosmetics.

The Asian halal food market is confronted with a number of obstacles in spite of its robust development trajectory. Among these are disparate certification requirements among nations, which may impede international commerce and erode customer trust in certain markets. Concerns over supply chain transparency and the veracity of halal claims are also persistent, especially in uncontrolled or informal markets. Resolving these problems will be crucial to maintaining long-term development as the sector develops. The full potential of Asia's halal food business may be realized while maintaining integrity and inclusivity across many cultural and religious settings by bolstering regional certification harmonization, investing in halal traceability technology, and increasing consumer education.

One of the main factors driving market expansion is the increasing number of Muslims worldwide. Because of their religious beliefs, this group is driving the market for certain food products. In many nations, the growing Muslim population is increasing the demand for this meal. Indonesia has the largest Muslim population in the world, with an estimated 231 million people. According to the World Population Review 2024, this amounts to 86.7% of Indonesians and more than 13% of all Muslims globally. Mainstream merchants have been urged to stock halal-certified goods due to the expanding Muslim population. Large supermarket chains are opening special halal food departments with a broad selection of goods, from frozen dinners and snacks to halal meat and poultry. Additionally, quick-service restaurants (QSRs) and fast-casual eating places are increasingly offering halal-certified selections.

Growth Drivers for the Asia Halal Food Market

Large and Growing Muslim Population

Since Asia has the biggest Muslim population in the world, it is the region that drives the demand for halal food items worldwide. Large Muslim populations in Bangladesh, India, Pakistan, Indonesia, and Malaysia adhere to halal dietary regulations as part of their religious duties. This group generates a steady and expanding market for halal-certified food, including packaged and processed commodities as well as fresh meat and poultry. There is a growing need for easily accessible and varied halal choices as the population continues to expand, especially in metropolitan areas. Long-term market stability is ensured by this solid basis of religious observance, which also motivates both domestic and foreign manufacturers to invest in halal product lines that are suited to Asian regional tastes and cultural preferences.

Regional and Global Trade Initiatives

Initiatives for regional and international commerce are significantly contributing to the growth of the halal food sector in Asia. Regional alliances like ASEAN and free trade agreements are facilitating the cross-border movement of halal-certified goods by lowering tariffs and streamlining processes. In an effort to facilitate exports, nations like Malaysia and Indonesia are aggressively establishing themselves as international centers for halal, encouraging the mutual acceptance of halal standards. These partnerships increase the effectiveness of the supply chain, cut down on redundant certification procedures, and foster mutual confidence among trade partners. Such activities are pushing manufacturers to expand their operations and investigate new markets by promoting regulatory harmonization and market access, which will ultimately assist the expansion and competitiveness of Asia's halal food sector on a worldwide scale.

Growing Non-Muslim Consumer Interest

As non-Muslim customers become more aware of halal goods' quality, hygienic practices, and moral manufacturing requirements, the Asian halal food business is growing outside its traditional Muslim clientele. Halal certification is a desirable option for people who are morally and health-conscious since it is frequently linked to stringent ingredient sourcing, cleaner processing techniques, and compassionate animal care. This wider appeal is particularly seen in cities where people are more conscious of food certifications and labeling. As a result, halal goods are now available in mainstream retail and hospitality industries rather of being restricted to specialized ethnic markets. In the increasingly competitive Asian halal food business, this increased acceptability among non-Muslims is promoting innovation, diversifying demand, and propelling total market development.

Challenges in the Asia Halal Food Market

High Certification and Compliance Costs

One of the biggest obstacles facing small and medium-sized businesses (SMEs) in the Asian halal food sector is the high cost of certification and compliance. It takes a lot of financial and administrative resources to obtain halal certification since it requires thorough paperwork, facility inspections, personnel training, and frequent audits. These regulations can be onerous for SMEs with little funding and personnel, discouraging them from joining or growing in the official halal industry. Furthermore, maintaining certification status requires constant compliance, which raises continuing operating expenses. These obstacles hinder product diversity and regional competitiveness by preventing many local manufacturers from reaching halal-conscious consumer markets. Because of this, bigger companies frequently control the majority of certified halal products, while smaller companies are underrepresented even when they adhere to halal requirements through conventional or unofficial means.

Supply Chain Transparency Issues

In the Asian halal food industry, supply chain transparency is a major problem, especially as supply networks get more intricate and interconnected. It may be challenging to ensure halal compliance at every level, particularly when working with imported components, from sourcing raw materials to processing, packaging, and distribution. Strong methods for monitoring and confirming the halal status of inputs across borders are lacking in many manufacturers. Product integrity may be jeopardized by cross-contamination with non-halal products or the use of uncertified components in the absence of appropriate traceability procedures. This ambiguity erodes customer confidence and may harm a brand's reputation. To guarantee complete halal compliance and preserve trust in certified products, it will be crucial to bolster supply chain monitoring and implement digital tracking technologies.

India Halal Food Market

With the help of a sizable Muslim population and rising consumer awareness of halal-certified goods, India's halal food sector is expanding gradually. Although religious observance has historically fueled the business, it is now steadily growing to include ethical and health-conscious customers who identify halal with compassionate, high-quality, and clean methods. In India, halal products include meat, snacks, processed meals, and personal hygiene products. They are becoming more widely available in urban stores and online. The lack of a centralized certification system, low knowledge in rural regions, and political sensitivities around halal standards are some of the market's obstacles, nevertheless. Despite these obstacles, the industry has a lot of room to develop, especially with increased standardization, better supply chain procedures, and rising demand from both Muslim and non-Muslim customers.

China Halal Food Market

Due to the country's large Muslim population and rising demand for halal-certified goods both domestically and abroad, China's halal food business is growing. With the help of regional certification programs and government initiatives, halal food production is concentrated in areas with sizable Muslim populations, such as Ningxia, Xinjiang, and Gansu. Export prospects have increased as a result of the Belt and Road Initiative's enhanced facilitation of trading with nations having a majority of Muslims.

Notwithstanding its expansion, the sector still confronts obstacles, such as a disjointed halal certification system that lacks national uniformity, making both internal and foreign trading more difficult. Furthermore, previous food safety incidents have damaged customer confidence in China's halal food sector. The authenticity and international acceptance of Chinese halal products may also be impacted by cultural differences between Chinese Muslims and Muslims in other nations. However, China's halal food industry is still developing because to more investment, better certification procedures, and non-Muslim consumers who are looking for safety and quality becoming more aware of halal goods. These elements put China in a position to become a bigger player in the future of the global halal food market.

Pakistan Halal Food Market

The market for halal food in Pakistan is expected to increase significantly due to the country's substantial Muslim population and agricultural potential. The nation only accounts for a small portion of the worldwide halal food trade, while producing a significant amount of halal meat and dairy. The main causes of this include issues like uneven certification requirements, inadequate processing facilities, and undeveloped export routes. In order to solve these problems, the Pakistan Halal Authority (PHA) was founded in 2016 with the goals of fostering global trade and standardizing halal certification. The PHA's efficacy has been hampered by operational delays, though. Pakistan must make investments in state-of-the-art processing facilities, improve certification procedures, and fortify trade links in order to realize its full potential, particularly with regional markets such as the Middle East and Central Asia. Pakistan has the potential to grow into a major force in the global halal food market with the right investments and regulatory backing.

Asia Halal Food Market Segmentation

Product

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Dairy Products

- Cereals & Grains

- Oil, Fats & Waxes

- Confectionery

- Others

Distribution Channel

- Hypermarkets & Supermarket

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

Country

- Pakistan

- Indonesia

- India

- Bangladesh

- China

- Malaysia

- Kazakhstan

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Nestle SA

- JBS SA

- BRF SA

- Kawan Food Berhad

- Cargill Inc.

- Carrefour SA

- Crescent Foods Inc.

- VegaVites

- American Halal Company Inc.

- American Foods Group LLC

- Al Islami Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Asia Halal Food Market

6. Market Share

6.1 Product

6.2 Distribution Channel

6.3 Country

7. Product

7.1 Meat, Poultry & Seafood

7.2 Fruits & Vegetables

7.3 Dairy Products

7.4 Cereals & Grains

7.5 Oil, Fats & Waxes

7.6 Confectionery

7.7 Others

8. Distribution Channel

8.1 Hypermarkets & Supermarket

8.2 Online Stores

8.3 Convenience Stores

8.4 Specialty Stores

8.5 Others

9. Country

9.1 Pakistan

9.2 Indonesia

9.3 India

9.4 Bangladesh

9.5 China

9.6 Malaysia

9.7 Kazakhstan

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Nestle SA

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 JBS SA

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 BRF SA

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Kawan Food Berhad

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Cargill Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Carrefour SA

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Crescent Foods Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.8 VegaVites

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.9 American Halal Company Inc.

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.10 American Foods Group LLC

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.11 Al Islami Foods

12.11.1 Overview

12.11.2 Key Persons

12.11.3 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com