Europe Halal Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Halal Food Market Trends & Summary

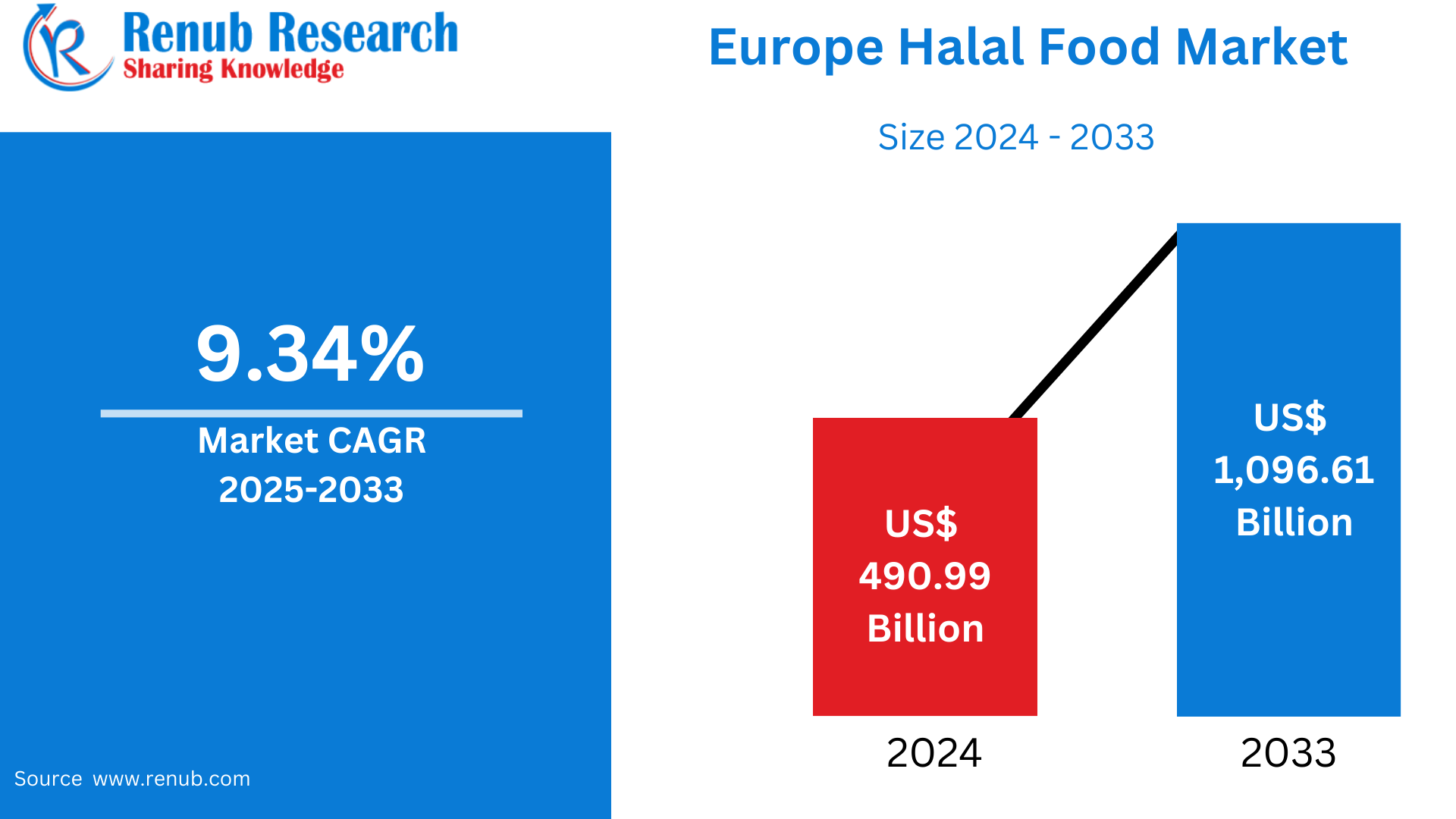

Europe Halal Food Market is expected to reach US$ 1,096.61 billion by 2033 from US$ 490.99 billion in 2024, with a CAGR of 9.34% from 2025 to 2033. Growing Muslim populations, customer desire for ethical food, retail development, increased knowledge of certification, and a variety of halal options are the main drivers of the halal food industry's growth in Europe.

The report Europe Halal Food Market & Forecast covers by Product (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Cereals & Grains, Oil, Fats & Waxes, Confectionery, Others), Distribution Channel (Hypermarkets & Supermarket, Online Stores, Convenience Stores, Specialty Stores, Others), Countries (Russia, France, Germany, Italy, United Kingdom, Turkey) and Company Analysis, 2025-2033.

Europe Halal Food Industry Overview

Due to a confluence of changing consumer tastes, demographic shifts, and easier availability, the halal food market in Europe is expanding significantly. The demand for halal-certified products is growing as the number of Muslims in nations like France, Germany, and the UK continues to climb. But the market isn't only for Muslims; a lot of non-Muslim Europeans are also choosing halal food because they see it as a symbol of excellence, cleanliness, and moral animal care. Due to its increased consumer appeal, halal products are becoming more widely available in supermarkets and online marketplaces, surpassing the reach of specialty ethnic businesses.

In response, European producers and retailers are increasing the variety of halal products they provide, including as frozen foods, snacks, drinks, and ready-to-eat meals. In order to satisfy contemporary customer demands, companies are innovating in the industry by creating halal-certified items that are organic, vegan, and sustainably sourced. Concerns about transparency and religious conformity are being addressed by nations with established food businesses spending more in halal certification infrastructure to guarantee product authenticity and traceability. Halal food is becoming more widely available thanks in large part to the expansion of e-commerce and digital food platforms, especially for younger and tech-savvy consumers looking for convenience without sacrificing moral or religious principles.

The European halal food business has a number of obstacles to overcome despite its expansion. Diverse certification requirements in several nations lead to misunderstandings and undermine customer confidence. In many areas, halal practices—like ritual slaughter—have generated political and cultural sensitivities that have influenced market operations and legislation. Smaller manufacturers could also find it difficult and expensive to get halal certification, which would restrict their ability to compete in the market. The long-term picture is still favorable, though. A robust customer base, technological developments, and a change toward more inclusive and ethical food consumption habits are projected to boost the halal food industry's upward trajectory in Europe as awareness grows and regulatory frameworks become more unified.

Changes in consumer tastes and demographics are causing a major upheaval in the European halal food and beverage market. In 2021, there were 3.9 million Muslims in the United Kingdom, according to the Office for National Statistics (ONS), which reflects the expansion of the Islamic community throughout Europe. This generational shift is especially significant since, according to data from the Pew Research Center, two-thirds of Muslims are under 30, and one-third of all Muslims are under 15, making them a youthful and powerful customer base. In contrast to other generations, the rise of Muslim millennials, also known as "Generation M," has produced a unique consumer demographic with greater purchasing power and greater brand awareness.

Growth Drivers for the Europe Halal Food Market

Government Support and Regulations

Due to the growing demand for halal products, some European countries put in place robust regulatory

frameworks to guarantee adherence and preserve consumer trust in halal labeling. With an estimated 5.5 million Muslims, or more than 8% of the 66 million residents, France has the highest Muslim population in Western Europe, according to the Halal Accreditation Agency (HAK). Additionally, it is estimated that the French halal market is worth 5.5 billion euros, of which 4.5 billion are related to the halal food sector. Furthermore, with several agencies supervising the stringent examination and certification of halal products, France leads the world in halal certification.

In order to build consumer trust, these rules make sure that the halal products on the market adhere to stringent quality requirements and Islamic law. Furthermore, the existence of government-backed institutions like the UK's Halal Monitoring Committee (HMC) shows that the halal market is officially acknowledged and encouraged. As a result, this promotes the growth of the halal food industry and helps to establish halal standards by ensuring that the products are actually compliant, which enhances local consumption and export prospects.

Germany's Increasing Need for Halal Food

The market for halal cuisine in Germany is expanding significantly as a result of a confluence of factors such as rising cultural variety, economic integration, and demographic shifts. Higher birth rates within these groups and migration from nations with a large Muslim population have contributed to the country's growing Muslim population. The demand for goods that adhere to Islamic dietary regulations has increased as a result of this demographic transition. The study, which was conducted in collaboration with Lufthansa Cargo and the Halal Council, the organization that certifies halal food, polled 772 Muslims in Germany on their readiness to pay more for halal food. According to the results, nearly all participants (88%), said that halal food was either very important or fairly important (9%).

Additionally, 59% of respondents stated they would be prepared to pay more for food that satisfies halal standards, and 94% of respondents stated they preferred halal-certified products. Additionally, German businesses are recognizing the financial potential of this sector and are increasing the variety of halal-certified products they provide. As a result, improved certification processes and more knowledge of halal standards enable this, bolstering consumer trust and ensuring compliance with global dietary guidelines.

Growing Market Demand and the Muslim Population

By 2030, there will be 8% more Muslims in Europe than there were in 2010, up from 6% in 2010, according to the Pew Research Center. This is a huge change that will have a big effect on the economy. Over the next 20 years, the number of Muslims is expected to rise by almost one-third. By 2030, there are expected to be 58.2 million Muslims in Europe, up from 44.1 million in 2010. This rise, particularly in the food sector, suggests a developing market niche with specific consumer needs.

The demand for halal items, which must adhere to Islamic dietary requirements, is rising as the Muslim population develops. More supermarkets, eateries, and manufacturers are providing halal products as a result of the food industry's developments brought about by this growing demand. As a result, companies are realizing how profitable it is to include halal into their product lines, which is diversifying food offers and increasing the items' cultural acceptance throughout Europe.

Challenges in the Europe Halal Food Market

Fragmented Certification Standards

The scattered certification requirements provide a substantial barrier to the European halal food business. There is a lack of consistency throughout the area as a result of different nations and certification organizations operating under disparate policies and interpretations of halal regulations. Customers become confused by this discrepancy and may wonder if a product actually satisfies halal requirements, especially when certificates are not commonly accepted or trusted. Navigating these conflicting standards makes cross-border trading more difficult for companies, adds operational complexity, and raises compliance expenses. Lack of a standardized or unified system for halal certification erodes customer trust and restricts industry expansion. Because of this, manufacturers and customers alike are left unsure about the legitimacy and dependability of halal-labeled goods that are sold in the European market.

Regulatory and Legal Restrictions

The European halal food market is severely hampered by legal and regulatory constraints. A number of nations have enacted legislation mandating stunning before to slaughter, which some Islamic authorities see as being in opposition to conventional halal practices. Although these rules are meant to protect animal welfare standards, they conflict with religious freedom, which sparks ethical and legal disputes. Because of this, halal manufacturers could find it difficult to operate freely, particularly in nations with stringent animal welfare laws. These limitations have the potential to lower production capacity, dissuade new competitors from entering the market, and discourage investment in businesses with halal certification. Cross-border trade is further complicated by the absence of a uniform regulatory framework throughout Europe, which makes it challenging for consumers to obtain reliable halal products and for companies to grow.

United Kingdom Halal Food Market

The market for halal cuisine in the UK is developing rapidly thanks to the country's diversified and expanding Muslim community as well as the growing desire for high-quality, ethical food. In addition to ethnic shops, halal-certified goods are becoming more widely available online and in large supermarket chains. Halal cuisine is sought after by both Muslim and non-Muslim consumers for a variety of reasons, such as animal welfare, ethical sourcing, and cleanliness. The market offers a wide variety of goods, ranging from processed and ready-to-eat items to fresh meat. Nonetheless, issues like inconsistent certification requirements and discussions over halal slaughter methods still exist. Notwithstanding these problems, the halal food market in the UK is still growing because to new ideas, improved awareness, and a move toward inclusive food options that adhere to moral and religious principles.

France Halal Food Market

Due to the country's sizable Muslim population and rising consumer demand for halal-certified goods, the French market for halal cuisine is expanding steadily. Halal products are becoming more widely available, showing up in supermarkets, internet sites, and ethnic businesses alike as people's awareness of ethical consumption and high-quality food grows. The market attracts both Muslim and non-Muslim customers seeking high-quality, sanitary, and ethical food alternatives. Products vary from fresh meat and poultry to snacks, dairy, and ready-to-eat meals.

Notwithstanding this expansion, there are still a number of obstacles facing the French halal food business, especially with relation to certification requirements. The authenticity of halal items may be unclear to companies and customers due to the absence of a consistent certification mechanism.

Furthermore, the controversy surrounding halal slaughter methods and their adherence to animal welfare laws fuels conflict and affects market dynamics. The French halal food market is positioned for long-term growth, nonetheless, as the industry continues to change due to expanding product innovation and distribution channels. In order to unleash more market potential, efforts must be made to standardize certification and resolve regulatory obstacles.

Germany Halal Food Market

The huge Muslim community in Germany and the growing need for high-quality, ethical food alternatives are driving the country's steady growth in the halal food sector. More and more mainstream supermarkets and internet retailers are carrying halal-certified meat, snacks, and prepared meals. Muslim customers are not the only ones who are becoming interested in halal cuisine; non-Muslims are also doing so for reasons such as ethical sourcing and improved cleanliness standards. However, the market has difficulties, especially because different areas have disjointed halal certification processes, which cause misunderstandings and raise doubts about the legitimacy of the products. Production and regulation may also be impacted by discussions over halal slaughter methods and how well they adhere to animal welfare regulations. Notwithstanding these obstacles, the industry is still growing due to rising consumer awareness and the need for ethical food options.

Market News for Halal Foods and Drinks in Europe

The Halal Food Company introduced five new prepared meals in Sainbury's, UK, in June 2022. The restaurant serves shepherd's pie, beef lasagna, peri-peri stir-fried chicken, macaroni pasta with slow-cooked meatballs, and a snack pot of chicken curry and basmati rice.

GetHalal Group, a Berlin-based firm, began offering halal food delivery services across the nation in February 2022. Reaching the consumer base and satisfying the grocery requirements of Muslim families are key components of the company's strategy objective.

Europe Halal Food Market Segmentation

Product

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Dairy Products

- Cereals & Grains

- Oil, Fats & Waxes

- Confectionery

- Others

Distribution Channel

- Hypermarkets & Supermarket

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

Country

- Russia

- France

- Germany

- Italy

- United Kingdom

- Turkey

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Nestle SA

- JBS SA

- BRF SA

- Kawan Food Berhad

- Cargill Inc.

- Carrefour SA

- Crescent Foods Inc.

- VegaVites

- American Halal Company Inc.

- American Foods Group LLC

- Al Islami Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Halal Food Market

6. Market Share

6.1 Product

6.2 Distribution Channel

6.3 Country

7. Product

7.1 Meat, Poultry & Seafood

7.2 Fruits & Vegetables

7.3 Dairy Products

7.4 Cereals & Grains

7.5 Oil, Fats & Waxes

7.6 Confectionery

7.7 Others

8. Distribution Channel

8.1 Hypermarkets & Supermarket

8.2 Online Stores

8.3 Convenience Stores

8.4 Specialty Stores

8.5 Others

9. Country

9.1 Russia

9.2 France

9.3 Germany

9.4 Italy

9.5 United Kingdom

9.6 Turkey

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Nestle SA

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 JBS SA

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 BRF SA

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Kawan Food Berhad

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Cargill Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Carrefour SA

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Crescent Foods Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.8 VegaVites

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.9 American Halal Company Inc.

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.10 American Foods Group LLC

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.11 Al Islami Foods

12.11.1 Overview

12.11.2 Key Persons

12.11.3 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com