Australia Vegan Food Market Forecast 2025–2033

Buy NowAustralia Vegan Food Market Size

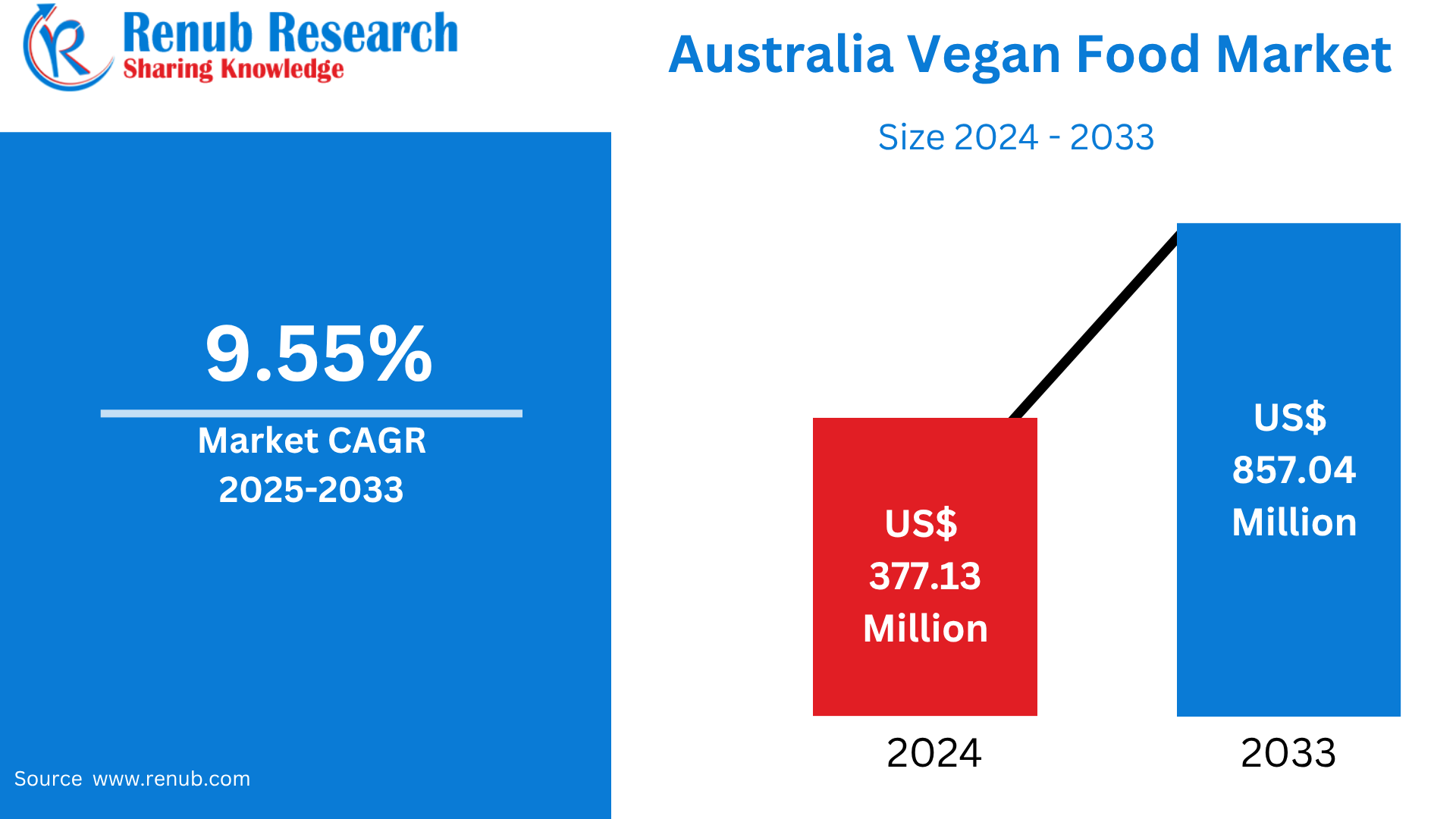

Australia Vegan Food Market is expected to reach US$ 857.04 million by 2033 from US$ 377.13 million in 2024, with a CAGR of 9.55% from 2025 to 2033. Increasing millennial and Generation Z shoppers, moral concerns regarding animal well-being, environmental sustainability, increased range of vegan products, increasing health consciousness, increasing lactose intolerance, and strong retail and online distribution channels are the primary drivers driving Australia's plant-based food market.

Australia Vegan Food Market Report by Product (Dairy Alternatives, Meat Substitutes, Others), Source (Almond, Soy, Oats, Wheat, Others), Distribution Channel (Supermarkets and, Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) and Company Analysis 2025-2033.

Australia Vegan Food Industry Overview

Vegan food is free from all animal materials such as meat, dairy, eggs, and honey and is prepared only with plant-derived ingredients. It delivers essential nutrients such as fiber, vitamins, and antioxidants and focuses on fruits, vegetables, grains, legumes, nuts, and seeds. Veganism promotes sustainable environmental policies through reduced carbon emissions, animal cruelty-free treatment, and potential health benefits such as reduced heart disease and certain cancer risks. Tofu, plant milk, meat substitutes, and ice cream-style desserts are only a few of the diverse options found in plant-based cuisine. Vegan food, increasingly popular worldwide, promotes conscious eating habits and presents delicious, healthy alternatives to those who wish to be cruelty-free.

The Australian vegan food industry is rapidly growing because of a variety of significant reasons. With more Australians adopting plant-based diets based on alleged health benefits, there is increasing health awareness. Environmental sustainability issues are causing individuals to opt for plant-based foods as they try to reduce their carbon footprint. Vegan food demand is increasing as consumers' food choices are impacted by ethical reasons involving the welfare of animals. Plant-based products are increasingly available as the retail sector expands and plant-based menus are made available by supermarkets and foodservice providers. Product innovation is the other factor, with companies designing numerous new vegan products to cater to evolving consumer needs. All these factors coalesce to fuel the growth of the vegan food market in Australia.

Growth Drivers for the Australia Vegan Food Market

Health Consciousness

The growth of the vegan food market in Australia is primarily attributable to health consciousness. An estimated 6.5 million Australians are actually reducing their meat consumption, and a remarkable 79% of them have plant-based meals in their diets at least once a week. Health reasons, including the desire to lower the risk of heart disease, diabetes, and certain cancers, are behind the trend. Consequently, meat alternatives made from plants are now extremely popular; in Australia, they have grown five times since 2015. This trend has also been supplemented by the rise of flexitarianism, which is the lifestyle where individuals follow predominantly plant-based diets but sometimes consume meat. Food manufacturers are being pushed by the growing demand for healthier foods to produce new, nutrient-rich, and appealing plant-based products in a bid to increase their market share and meet the health-conscious Australian consumer.

Environmental Awareness

The growth of the vegan food market in Australia is primarily fueled by environmental awareness. Increased consciousness of the necessity for sustainable food is due to the environmental impacts of meat production, such as extensive greenhouse gas emissions, deforestation, and heavy water consumption. As plant-based foods tend to require fewer resources to make and release fewer emissions, veganism is believed to be more eco-friendly. Young Australians are more conscious of the environment and are more likely to consider the environmental effects of what they eat. In anticipation of this, fast food outlets are promoting their vegan products as ecologically friendly alternatives and using green processes. The brand value of these fast food outlets is enhanced through their association with green ideals and also attracts green-conscious consumers. Besides attracting eco-conscious consumers, brand identity for these fast food restaurants is enhanced through their association with ecological ideals, driving market growth.

Animal Welfare

Animal cruelty concerns are a primary driver in Australia's growing vegan food market. Public outrage and an increased demand for moral substitutes have been initiated by horrific footage from slaughterhouses, such as the Carey Bros plant in Queensland, that has uncovered instances of animal cruelty. Plant-based foods that are aligned with their ethics are increasingly being consumed by many Australians due to this heightened awareness. Consequently, the demand for vegan products has increased as more individuals seek food options free of cruelty. This shift is representative of a broader social trend toward ethics and morally sound eating.

Challenges in the Australia Vegan Food Market

High Cost

One major issue facing the vegan food business in Australia is its high cost. Because of greater production costs, specialized components, and reduced economies of scale, plant-based goods are frequently more expensive than traditional animal-based diets. Due of the price difference, vegan options are less affordable for consumers on a tight budget, which restricts their wider adoption. Additionally, customs and transportation may result in additional expenses for imported vegan items. Additionally, the impression of increased costs deters infrequent or inexperienced buyers from trying plant-based substitutes. The market need improvements in production efficiency, more local manufacturing, and more competition to push prices down and make vegan goods more widely available and cheap in order to get beyond this obstacle.

Taste and Texture Concerns

The Australian market for hormone replacement therapy (HRT) is severely hampered by regulatory barriers. The lengthy and intricate approval process for novel HRT formulations, such as bioidentical hormones and alternate delivery systems, can postpone patients' access to them. Furthermore, different clinical trial standards and safety and efficacy regulations erect obstacles for businesses aiming to launch novel therapies. Patients' options for therapy may be limited by these legislative restrictions, which may also delay market expansion. In addition, patients may experience greater financial strain and less accessibility as a result of varying Pharmaceutical Benefits Scheme (PBS) reimbursement policies for more recent treatments.

Recent Developments in Australia Vegan Food Industry

- In Nov 2024, Harvest B established Australia's first plant-based meat ingredient production facility in Penrith, New South Wales, to supply clean-label, shelf-stable protein alternatives to food companies, promoting domestic manufacturing and reducing dependency on imported plant-based proteins.

- In Sep 2024, A line of carbon-neutral plant-based meat products, including beef mince and various sausages, was introduced by the Australian brand vEEF and is currently available at Woolworths. The range is priced similarly to animal meat, uses less plastic packaging, and attempts to satisfy Australian households' growing need for reasonably priced, sustainable, and healthful food options.

Australia Vegan Food Market Segmentation:

Product

- Dairy Alternatives

- Meat Substitutes

- Others

Source

- Almond

- Soy

- Oats

- Wheat

- Others

Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Beyond Meat Inc.

- Danone S.A

- The Archer Daniels Midland Company

- Tofutti Brands Inc.

- Vitasoy Australia Products Pty Ltd.

- SunOpta

- Daiya Foods, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Product, Source and Distribution Channel |

| Distribution Channel Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Vegan food Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By Source

6.3 By Distribution Channel

7. Product

7.1 Dairy Alternatives

7.2 Meat Substitutes

7.3 Others

8. Source

8.1 Almond

8.2 Soy

8.3 Oats

8.4 Wheat

8.5 Others

9. Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Convenience Stores

9.3 Specialty Stores

9.4 Online Stores

9.5 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Beyond Meat Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Danone S.A

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 The Archer Daniels Midland Company

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Tofutti Brands Inc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Vitasoy Australia Products Pty Ltd.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 SunOpta

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Daiya Foods, Inc.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com