Car Rental Market Insights, Trends & Forecast 2025–2033

Buy NowGlobal Car Rental Market Size

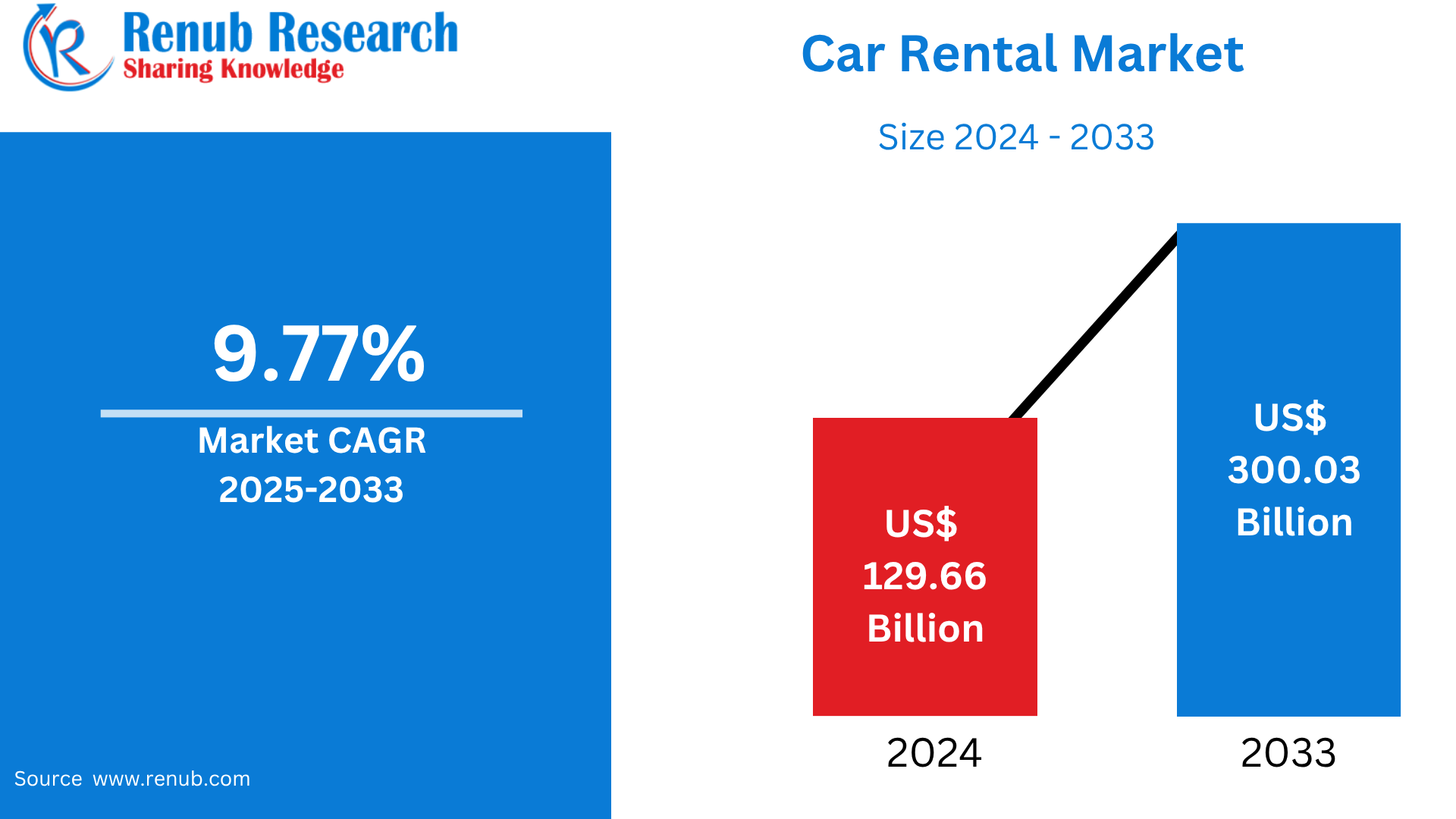

The Global Car Rental Market was USD 129.66 billion in 2024 and is anticipated to grow to USD 300.03 billion by 2033 at a CAGR of 9.77% over the forecast period. The market is fueled by growing tourism, urban mobility patterns, online reservation platforms, and the growing need for flexible transportation modes in corporate, leisure, and on-demand travel segments globally.

Global Car Rental Market Outlooks

Car rental is the service of hiring a vehicle for a limited period of time for a fee, usually provided by businesses to individuals or companies without the long-term commitment of ownership. Clients can hire cars on an hourly, daily, weekly, or extended basis, with choices available from economy cars to luxury and specialty vehicles. This kind of flexibility has made car rentals common for numerous applications such as traveling, business trips, special occasions, or when one's own vehicle is out of commission.

Car rental services are particularly favored among tourists and businesspeople needing seamless transportation without depending on public transport or taxis. Increased use of online booking websites, contactless check-in, and mobile apps has simplified the process and made it more convenient. Moreover, increasing demand for economical and flexible transport in cities has helped fuel popularity, especially in car-sharing and subscription formats. The attractiveness of the market is also enhanced by changing lifestyle choices, waning desire for car ownership, and growing service networks in developed and emerging economies.

Global Car Rental Market Growth Drivers

Increase in Tourism and Business Travel Demand

Global recovery in leisure and business travel has strongly fueled demand for rental cars. People prefer the freedom, privacy, and comfort of renting a car compared to using public transportation. Whether for holiday exploration or business travel, car rentals offer local mobility. With air travel becoming more typical post-pandemic, airport pickup and dropoff based rentals along with city-based pick-up points are doing well. Short-term car rental bookings in popular tourist areas, particularly in Europe, Asia-Pacific, and the Americas, are seeing significant growth. In 2023, foreign visitor arrivals were 89% of the pre-pandemic level, and during January-September 2024, they were 98%, as per United Nations Tourism Agency data. As per fresh data for 2023, foreign travel-generated export earning came to USD 1.8 Trillion, which is roughly the same as before the pandemic (1% lower in real terms than in 2019). Car rentals offer travelers the freedom to move at their convenience, to places that are not easily accessible by public transport.

Urbanization and Evolving Ownership Trends

As cities become more populous and it is no longer feasible to own cars because of their high prices and scarce parking space, urbanites are turning toward car-sharing and rental services. Millennials and Gen Z in especially so are turning toward mobility-as-a-service (MaaS) rather than having cars. Car rentals provide them with flexible access without long-term financial commitment. This development is driving both short-term and subscription-based rentals, particularly in megacities with increasing traffic congestion and environmental codes that discourage private car ownership.

Technology and App-Based Booking Platforms

Digital innovation is transforming the car rental market. Online sites and mobile apps now enable customers to compare prices, book a vehicle instantly, and make transactions without paper. Convenience features like contactless pickup/drop-off, keyless entry, real-time availability of vehicles, and GPS tracking are improving user convenience. Collaboration with AI and data analytics is also assisting providers in fleet utilization optimization and offer personalization. With consumers wanting quicker, smarter experiences, technology-enabled rental services are becoming a competitive differentiator. March 2023: IndusGo, a self-drive car rental business, raised INR 100 crore (USD 11.75 Million) in its second financing round to support expansion and technology upgrade. The capital will be utilized to increase its fleet, go to new markets, and enhance the user experience and app. As a member of Indus Motors Group, IndusGo seeks to offer flexible and economical self-drive rental options in various Indian cities.

Challenges in the Global Car Rental Industry

Rising Operation and Maintenance Expenses

Car rental companies face increasing vehicle acquisition costs due to global supply chain issues and semiconductor shortages. Maintenance, insurance, and fuel prices are also rising. These costs eat into profit margins and can lead to higher rental prices, potentially deterring budget-conscious customers. Additionally, fleet downtime due to delayed servicing or part availability can reduce vehicle availability, negatively impacting customer satisfaction. Managing a well-maintained, cost-efficient fleet is becoming more complex, especially for small to mid-sized operators.

Regulatory Complexity and Liability Exposure

Operations in multiple jurisdictions involve regulatory concerns such as diverse insurance regulations, emission standards, taxation policies, and driver verification procedures. Additionally, incidents such as accidents, theft, or misuse of the vehicle create liability and legal issues, particularly in areas where there is no consolidated regulatory environment. More stringent environmental regulations are also compelling businesses to invest in electric or hybrid vehicles, which necessitates investment in infrastructure and training. Adjusting to these legal and regulatory pressures is imperative for maintaining long-term business in the international market.

Global Online Car Rental Market

The car rental market's online segment has seen explosive growth, fueled by mobile uptake, digital payments, and demand for touchless experiences from consumers. Sites such as Hertz, Enterprise, Avis, and more recent digital native firms such as Turo and Zoomcar provide frictionless app-based booking. Price transparency, vehicle comparisons, and hassle-free cancellation policies are attractive features. The trend towards online rental patterns also supports greater geographic coverage and operational effectiveness. With users demanding more self-service and mobile-first engagement, the online segment will be the future of car rental offerings.

Global Short-Term Car Rental Market

Short-term rentals—usually for a few hours to a few days—are the backbone of car rental businesses. These are favored by travelers, business users, and locals requiring temporary mobility. Convenience of airport counters, city center addresses, and bundled hotel services facilitates short-term rentals. The growth of hourly-based models and peer-to-peer automobile car sharing platforms is revolutionizing this segment. Flexibility is what consumers want, particularly for spontaneous trips or last-minute outings. With the growth in remote working and off-the-cuff travel, short-term rentals remain a popular mobility choice globally.

Global Luxury Car Rental Market

Luxury car rentals provide high-end customers with premium automobiles for weddings, corporate functions, VIP airport transport, or experiential travel. Mercedes-Benz, BMW, Audi, and Tesla are the brands that lead this segment. Expansion is particularly robust in metros and vacation destinations where luxury experiences are a part of lifestyle or business culture. Rentals frequently incorporate chauffeurs, concierge service, and customized packages. With the growth of luxury tourism and experiential expenditure, this niche is growing with the help of online reservation and influencer marketing. Growing demand for luxury electric models is also influencing future developments.

Global Economy Car Rental Market

The economy segment provides low-cost, fuel-efficient cars that are suitable for daily usage, budget tourists, or small families. These car rentals capture the majority of the market's volume share because of their affordability and minimal environmental impact. Economy models are in ready supply at airports, terminals, and city centers. With cost-cutting and inflationary conditions hitting people's pocketbooks, consumers continue to favor economy rentals. This segment is also used by companies to lure in first-time consumers and travelers. Eco-friendly models are also offered by several providers in this category and appeal to environmentally conscious renters at an affordable price point.

Global Car Rental Leisure/Tourism Market

The tourism/leisure segment is a key driver of the automobile rental business, with customers looking for convenience in movement during vacations, road tours, and local sightseeing. Car rentals provide freedom from public transport, particularly in areas of poor infrastructure or scenic routes. In popular tourist destinations such as Europe, North America, and Southeast Asia, this segment is fueled by peak season, package promotions, and airport rentals. Travel websites and tour operators typically package car rentals along with accommodations. With the world's economy recovering from the COVID pandemic and travelers increasingly looking for customized experiences, the leisure car rental market continues to grow steadily.

Chauffeur-Driven Rental Market Globally

The chauffeur-driven rental business is picking up pace, particularly in corporate travel, weddings, VIP service, and airport pick-up/drop-offs. Customers prefer the luxury of having a professional driver and a high-end experience, especially in new cities or for celebrities' events. The service is most in demand in Asia, the Middle East, and some areas in Europe. Luxury travelers, corporate clients, and tourists tend to book these cars for half-day or full-day hire. As the demand for safety, privacy, and hassle-free travel increases, chauffeur-driven rentals are becoming a luxury mobility solution and a significant value-add to the rental ecosystem.

United States Car Rental Market

The United States is the world's largest car rental market, dominated by industry leaders such as Enterprise, Hertz, and Avis. Strong infrastructure, extensive car culture, and high volumes of travel underpin strong demand. Rentals at airports dominate, fueled by both business and leisure customers. The nation also boasts an increasing peer-to-peer and subscription-based rental system. Urban cities are experiencing increasing demand for short-term rentals and luxury options. Environmental regulations are encouraging rental companies to increase electric vehicle (EV) fleets. Generally, the U.S. market remains mature, competitive, and first to adopt digital and green rental innovations. In April 2022, SIXT, one of the world's leading global mobility providers, continued its growth across the U.S. The firm announced expansion plans for new branches in Charlotte and Baltimore, to offer customers a wider range of rental choices along the East Coast.

Germany Car Rental Market

Germany's car rental market is characterized by high tourism, extensive highway networks, and a demand for high-quality vehicles. City tourism and business travel drive consistent demand for short- and long-term rentals. Market leaders such as Sixt and Europcar dominate the market, with a broad array of economy to luxury options available. The nation's drive toward sustainability is speeding up the integration of electric and hybrid cars into fleets. Germany's well-developed market, supported by high-speed Autobahns and a rich automotive heritage, presents a strong and high-service-expectation marketplace comprised of both local and international visitors. April 2022, Hylane GmbH (hylane), a climate-neutral mobility provider, commenced operations as a subsidiary of Cologne-based DEVK Versicherung. Environmentally conscious at its core, hylane's exclusively climate-neutral vehicle rental service features hydrogen trucks with various superstructures and fittings.

China Car Rental Market

The car rental market in China is growing rapidly with the help of urbanization, increasing middle-class income, and rising domestic tourism. Market leaders such as CAR Inc. and eHi Car Services rule the roost. The market has moved away from long-term business rentals to short-term, app-driven, self-drive offerings, particularly in urban areas. Clean mobility incentives by the government are propelling the investment in electrically charged rental fleets. Although vehicle ownership remains strong, smart mobility trends and urban congestion are compelling consumers towards flexible rental solutions. Demand is most robust in tier-one cities and holiday spots, with digital channels and mobile payment acceptance at the forefront. May 2025, Chinese technology giant Baidu's smart driving division Apollo announced on Thursday that it would partner with domestic automobile rental company Car Inc to roll out a "first-of-its-kind" autonomous driving rental service.

Saudi Arabia Car Rental Market

The car rental sector of Saudi Arabia is growing at a fast rate, aided by tourism growth under Vision 2030, domestic travel expansion, and rising expatriate numbers. Relaxation of travel bans and improvement in airport and tourism area expansion raised demand for chauffeur-driven and self-drive rentals. Luxury and SUV models have particular demand for desert and long-distance drives. The entry of women drivers into the market from 2018 has increased the customer base as well. Mobile bookings and digital platforms are becoming popular, albeit at present, the rental counters remain the dominant force. The growth potential is still high due to continuous investment in infrastructure. Aug, 2022, UAE-based homegrown brand Udrive, the specialist pay-per-minute, and daily car rental platform, has announced its launch in Saudi Arabia. The new operations will address the growing demand by the residents, tourists, students, and startups in the kingdom.

Market Segmentation

By Booking Type

- Offline Booking

- Online Booking

Rental Length

- Short Term

- Long Term

Vehicle Type

- Luxury

- Executive

- Economy

- SUVs

- Others

Application

- Leisure/Tourism

- Business

End-User

- Self-Driven

- Chauffeur-Driven

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Avis Budget Group, Inc.

- Carzonrent India Private Limited

- Eco rent a car

- Enterprise Holdings Inc.

- Enterprise Rent-A-Car

- Europcar

- Localiza

- Sixt SE

- The Hertz Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Booking Type, Rental Length, Vehicle Type, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Car Rental Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Booking Type

6.2 By Rental Length

6.3 By Vehicle Type

6.4 By Application

6.5 By End-User

6.6 By Countries

7. By Booking Type

7.1 Offline Booking

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Online Booking

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

8. Rental Length

8.1 Short Term

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Long Term

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

9. Vehicle Type

9.1 Luxury

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Executive

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Economy

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 SUVs

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Others

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

10. Application

10.1 Leisure/Tourism

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Business

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

11. End-User

11.1 Self-Driven

11.1.1 Market Analysis

11.1.2 Market Size & Forecast

11.2 Chauffeur-Driven

11.2.1 Market Analysis

11.2.2 Market Size & Forecast

12. Countries

12.1 North America

12.1.1 United States

12.1.1.1 Market Analysis

12.1.1.2 Market Size & Forecast

12.1.2 Canada

12.1.2.1 Market Analysis

12.1.2.2 Market Size & Forecast

12.2 Europe

12.2.1 France

12.2.1.1 Market Analysis

12.2.1.2 Market Size & Forecast

12.2.2 Germany

12.2.2.1 Market Analysis

12.2.2.2 Market Size & Forecast

12.2.3 Italy

12.2.3.1 Market Analysis

12.2.3.2 Market Size & Forecast

12.2.4 Spain

12.2.4.1 Market Analysis

12.2.4.2 Market Size & Forecast

12.2.5 United Kingdom

12.2.5.1 Market Analysis

12.2.5.2 Market Size & Forecast

12.2.6 Belgium

12.2.6.1 Market Analysis

12.2.6.2 Market Size & Forecast

12.2.7 Netherlands

12.2.7.1 Market Analysis

12.2.7.2 Market Size & Forecast

12.2.8 Turkey

12.2.8.1 Market Analysis

12.2.8.2 Market Size & Forecast

12.3 Asia Pacific

12.3.1 China

12.3.1.1 Market Analysis

12.3.1.2 Market Size & Forecast

12.3.2 Japan

12.3.2.1 Market Analysis

12.3.2.2 Market Size & Forecast

12.3.3 India

12.3.3.1 Market Analysis

12.3.3.2 Market Size & Forecast

12.4 South Korea

12.4.1.1 Market Analysis

12.4.1.2 Market Size & Forecast

12.4.2 Thailand

12.4.2.1 Market Analysis

12.4.2.2 Market Size & Forecast

12.4.3 Malaysia

12.4.3.1 Market Analysis

12.4.3.2 Market Size & Forecast

12.4.4 Indonesia

12.4.4.1 Market Analysis

12.4.4.2 Market Size & Forecast

12.4.5 Australia

12.4.5.1 Market Analysis

12.4.5.2 Market Size & Forecast

12.4.6 New Zealand

12.4.6.1 Market Analysis

12.4.6.2 Market Size & Forecast

12.5 Latin America

12.5.1 Brazil

12.5.1.1 Market Analysis

12.5.1.2 Market Size & Forecast

12.5.2 Mexico

12.5.2.1 Market Analysis

12.5.2.2 Market Size & Forecast

12.5.3 Argentina

12.5.3.1 Market Analysis

12.5.3.2 Market Size & Forecast

12.6 Middle East & Africa

12.6.1 Saudi Arabia

12.6.1.1 Market Analysis

12.6.1.2 Market Size & Forecast

12.6.2 UAE

12.6.2.1 Market Analysis

12.6.2.2 Market Size & Forecast

12.6.3 South Africa

12.6.3.1 Market Analysis

12.6.3.2 Market Size & Forecast

13. Value Chain Analysis

14. Porter's Five Forces Analysis

14.1 Bargaining Power of Buyers

14.2 Bargaining Power of Suppliers

14.3 Degree of Competition

14.4 Threat of New Entrants

14.5 Threat of Substitutes

15. SWOT Analysis

15.1 Strength

15.2 Weakness

15.3 Opportunity

15.4 Threats

16. Pricing Benchmark Analysis

16.1 Avis Budget Group, Inc.

16.2 Carzonrent India Private Limited

16.3 Eco rent a car

16.4 Enterprise Holdings, Inc.

16.5 Enterprise Rent-A-Car

16.6 Europcar

16.7 Localiza

16.8 Sixt SE

16.9 The Hertz Corporation

17. Key Players Analysis

17.1 Avis Budget Group, Inc.

17.1.1 Overviews

17.1.2 Key Person

17.1.3 Recent Developments

17.1.4 SWOT Analysis

17.1.5 Revenue Analysis

17.2 Carzonrent India Private Limited

17.2.1 Overviews

17.2.2 Key Person

17.2.3 Recent Developments

17.2.4 SWOT Analysis

17.2.5 Revenue Analysis

17.3 Eco rent a car

17.3.1 Overviews

17.3.2 Key Person

17.3.3 Recent Developments

17.3.4 SWOT Analysis

17.3.5 Revenue Analysis

17.4 Enterprise Holdings, Inc.

17.4.1 Overviews

17.4.2 Key Person

17.4.3 Recent Developments

17.4.4 SWOT Analysis

17.4.5 Revenue Analysis

17.5 Enterprise Rent-A-Car

17.5.1 Overviews

17.5.2 Key Person

17.5.3 Recent Developments

17.5.4 SWOT Analysis

17.5.5 Revenue Analysis

17.6 Europcar

17.6.1 Overviews

17.6.2 Key Person

17.6.3 Recent Developments

17.6.4 SWOT Analysis

17.6.5 Revenue Analysis

17.7 Localiza

17.7.1 Overviews

17.7.2 Key Person

17.7.3 Recent Developments

17.7.4 SWOT Analysis

17.7.5 Revenue Analysis

17.8 Sixt SE

17.8.1 Overviews

17.8.2 Key Person

17.8.3 Recent Developments

17.8.4 SWOT Analysis

17.8.5 Revenue Analysis

17.9 The Hertz Corporation

17.9.1 Overviews

17.9.2 Key Person

17.9.3 Recent Developments

17.9.4 SWOT Analysis

17.9.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com