Air Taxi Market Size, Share, Trends & Forecast 2025–2033

Buy NowGlobal Air Taxi Market Size and Forecast

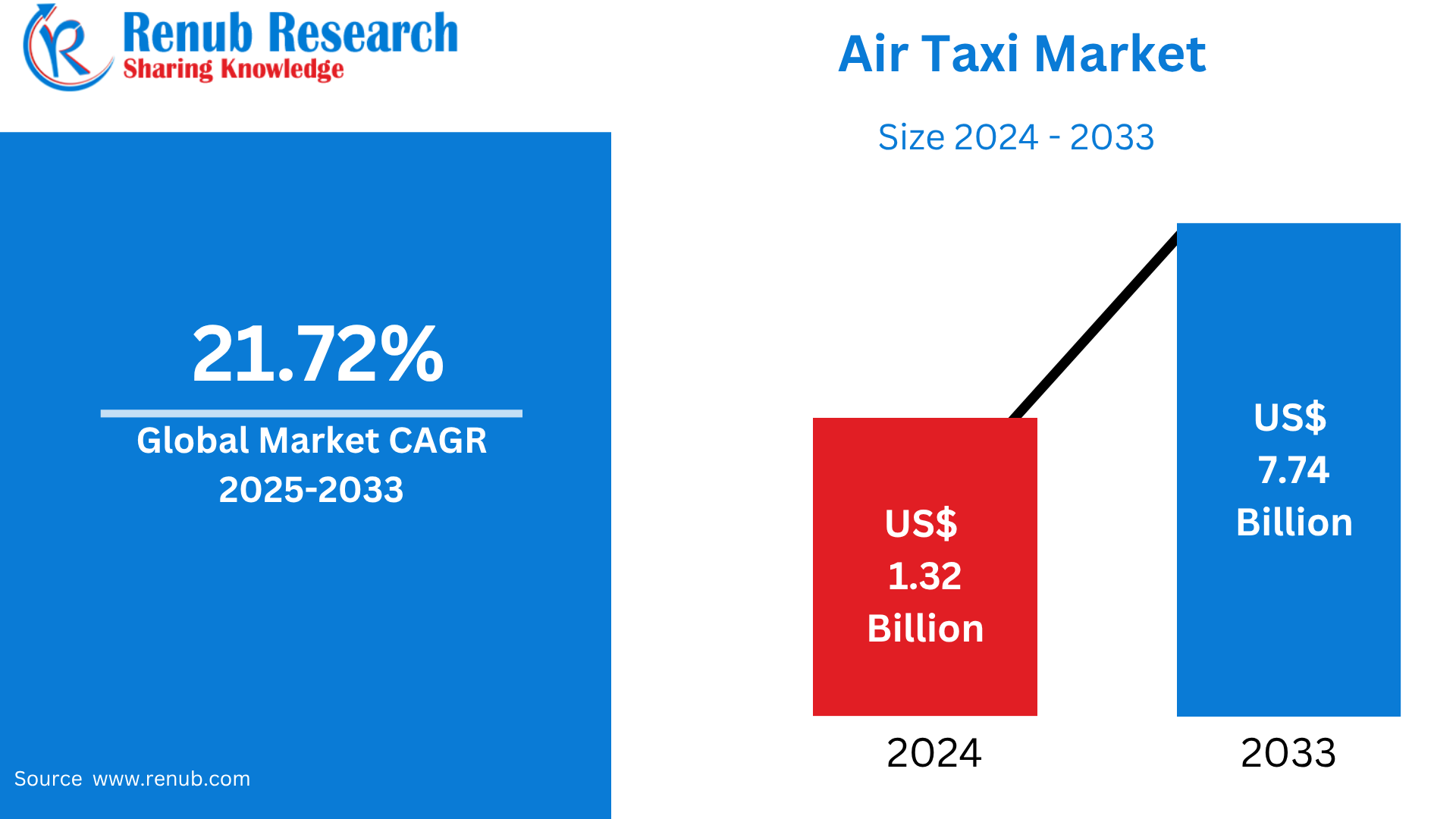

The Global Air Taxi Market was USD 1.32 billion in 2024 and is expected to reach USD 7.74 billion by 2033, with a CAGR of 21.72% over the forecast period. Bolstered by the development of electric vertical takeoff and landing (eVTOL) aircraft, urban air mobility solutions, and increasing demand for quicker, congested-free transit, air taxis are becoming a transformative future transport mode.

Global Air Taxi Market Outlooks

Air taxis are compact, on-demand planes—usually electric or hybrid-powered intended for short-range, point-to-point travel. Most air taxis are equipped with electric vertical takeoff and landing (eVTOL) technology, so they can fly in densely populated cities without the use of traditional runways. They are part of the wider urban air mobility (UAM) movement to decrease traffic congestion and transform personal and business travel.

Air taxis are mainly conceived for intra-city and inter-city commuting, airport hops, and linking remote or high-density areas more effectively. They provide shorter travel times than ground-based vehicles, especially in congested cities. Corporate business leaders, high-income executives, and emergency services are some of the primary target users. The idea is being watched worldwide as a result of improved battery capabilities, autonomous flight technology, and accommodating regulatory environments. Other nations such as the U.S., Germany, and the UAE are making significant investments in air taxi infrastructure. As the demand for eco-friendly, time-saving transport continues to rise, air taxis are emerging as a central point in planning for future mobility.

Drivers of Growth in the Global Air Taxi Market

Technological Advances in eVTOL and Electric Propulsion

Electric vertical takeoff and landing (eVTOL) technology is at the core of the air taxi revolution. Advances in energy density batteries, power electronics, and lightweight materials make quieter, cleaner, and more efficient aircraft possible. Several prototypes have made test flights successfully, attracting investment from aerospace industry leaders, startups, and traditional automakers. As urban air mobility regulation develops around the world, eVTOLs are the only practical solution to short-haul, intracity flight. As battery prices fall and charging infrastructure advances, the profitability of electric air taxis grows more appealing to investors and operators. June 2025, UK electric aircraft maker Vertical Aerospace has solidified its alliance with helicopter ride operator Bristow Group as it seeks to introduce air taxi services for business purposes.

Urban Congestion and Time-Saving Demand

Large cities across the globe experience increasingly bad traffic jams, long commutes, and outdated infrastructure. Urban air taxis offer a step-forward solution by using untapped airspace to avoid ground traffic altogether. They will halve travel times—airport trips which took hours by car could take 15–20 minutes by air taxi. Time-constrained business travel, medical response, and mass tourism transportation drive interest. Increasing urban populations create growing demand for fast, on-demand aerial mobility, driving air taxis toward commercialization.

Growing Investment and Regulatory Support

Investment from venture capital, aerospace companies, and government-backed innovation funds is flowing into the air taxi industry worldwide. Public–private funding is powering pilot projects in Dubai, Los Angeles, and Singapore. Regulatory agencies (FAA in the U.S., EASA in Europe) are actively developing operational safety regulations, air corridors, and pilot training. These initiatives drive ecosystem development—everything from vertiports to air traffic management. As regulatory standards become more defined and investment capital grows, the previously futuristic air taxi idea moves toward the daily norm. October 2024, Toyota Motor will make another $500 million investment in Joby Aviation to help certify and manufacture Joby's electric air taxi. This is following on from $394 million of earlier investment and is part of a strategic partnership. The financing will be in cash for common stock, and the first tranche will close towards the end of 2024 and the second one in a year's time.

Challenges in the Global Air Taxi Market

Infrastructure Requirements and Integration with Air Traffic

Making air taxi networks a reality requires massive infrastructure: vertiports with charging stations, passenger lounges, and repair facilities—usually in dense city centers with little available real estate. Integration with existing airspaces and ground traffic control is another major challenge. Managing low-altitude flight amidst drones and conventional aviation calls for novel air-traffic systems. Urban environments also call for new noise and flight safety regulations. Without coordinated investments in infrastructure and traffic management, expanding services cost-effectively is still an issue.

High Unit Costs and Ticket Price Affordability

Air taxis are sophisticated, capital-expensive vehicles costing between $1–5 million per aircraft. Production, certification, and operating costs remain high. Initial services—e.g., helicopter shuttle substitutes—will likely be premium-priced, excluding broad access. Economies of scale through standardization of the fleet and economies of large-scale manufacturing are essential but questionable. Until the cost decreases substantially, air taxi travel can become a luxury available mainly to high-income users, excluding mass-market use and scalability of the network.

Global Electric Air Taxi Market

Electric air taxis—largely eVTOL configurations—are the growth leader. They provide zero tailpipe emissions, minimal noise levels, and reduced operating expenses than internal combustion counterparts. Featuring payload capacities between two and six passengers, these aircraft are tailored specifically for urban and regional connectivity. Supported by quick tech development and robust regulatory emphasis, electric air taxi models from firms such as Joby Aviation, Lilium, and Archer are entering certification phases. With advancing battery technology and charging infrastructure, electric air taxis are well-poised to dominate the future of urban aerial transport.

Global Turboshaft Air Taxi Market

Turboshaft-powered air taxis use conventional turbine engines, which are commonly derived from helicopter technology, generating high range and power. Though providing well-tested reliability and performance, these systems produce large noise and CO₂ emissions, constraining city deployment. Turboshaft technology is more likely to be applied in hybrid models or intercity air taxis rather than intracity applications. They're appealing where electric propulsion is not feasible yet, like long-range or offshore flights. Environmental regulations and operating expense are still significant constraints as worldwide aviation is moving towards cleaner solutions.

Global Multicopter Air Taxi Market

Multicopters—a multiple small-rotor design—provide vertical takeoff stability and redundancy, which is well-suited to pilotless urban air taxis. They have a small footprint that is appropriate for rooftop vertiports. Multicopter platforms are frequently modular and less complex than full-size VTOL designs, enabling more rapid tech maturation. They have limited passenger capacity (1–2) and range today—typically less than 50 km. With drone-industry momentum behind them, multicopters are an important stepping stone in city air mobility. As battery range and energy density increase, multicopters may become viable eVTOL vehicles.

Worldwide Air Taxi Over Six Passengers Market

These aircraft for over six passengers are destined to carry out commuter shuttle or regional route duty with more effectiveness. They are similar to small commuter aircraft, with these models usually employing hybrid-electric propulsion. With seating capacity for 7–12 individuals, they will serve airport connections, island hopping, and longer flights. Producers for this category need to focus on payload, range, and certification—creating infrastructure akin to small airports. While their cost-per-seat could be less than smaller air taxis, complexity and infrastructure challenges are still considerable.

Global Four Passenger Capacity Air Taxi Market

Four-passenger air taxis find a balance between size and cost, with usability, and are well-suited for first-mile/last-mile city operations. They offer optimal use of space and are less complicated to certify than bigger eVTOLs. With sufficient cargo capacity, they are appropriate for city rides and short intra-city flights. Most prototypes—Volocopter and EHang, among others—emphasize this capacity. Their market is anticipated from high-end commuters, on-demand services, and first response operations. The efficient passenger layout makes them potential early movers into commercial operations.

United States Air Taxi Market

The U.S. is ahead in the air taxi competition with robust R&D, regulatory support, and innovation in the private sector. Joby Aviation, Archer, and Wisk Aero are working their way to FAA certification with electric VTOL prototypes. Urban locations like Los Angeles, New York, and Miami are early adopters because they have high traffic congestion and existing air infrastructure. The FAA is working on urban air mobility (UAM) regulations, such as vertiport rules and pilot training, actively. Federal and municipal government collaborations are also underwriting test programs. With abundant airspace, investment funds, and tech dominance, the U.S. continues to be the world's air taxi innovation hub. May 2025, Archer has been selected as the Official Air Taxi Provider for the LA28 Olympic and Paralympic Games and Team USA. This collaboration entails the employment of Archer's Midnight eVTOL aircraft to ferry VIPs and supporters, electrifying vertiport hubs in major venues, and assisting emergency services and security forces for the games.

Germany Air Taxi Market

Germany is a European market leader in the air taxi sector, spearheaded by players such as Lilium and Volocopter. The nation's engineering prowess and robust sustainability targets render it a perfect incubator for electric air mobility. The European Aviation Safety Agency (EASA) is closely working with German startups to create regulations that involve certification and flight. German metropolitan cities like Munich, Frankfurt, and Berlin are piloting launch corridors and vertiport ideas. With public and private funding, Germany plans to incorporate air taxis into city and regional transport systems, especially through collaborations with airports and metropolitan transit systems. Jul 2024, Germany's Federal Ministry for Digital and Transport (BMDV) wants to make Germany the leader in drones and electric flying taxis (eVTOL). They released a timeline for Advanced Air Mobility (AAM) to be deployed in four stages by 2032: first test routes by 2026, special AAM zones by 2028, regional transport by 2030, and national operations by 2032.

China Air Taxi Market

China's air taxi market is taking off with the strong government backing for emerging mobility technologies. EHang, its market leader, has already taken to flying autonomous air taxis in several provinces. China's Civil Aviation Administration (CAAC) is accelerating airworthiness certifications for eVTOLs, and cities such as Guangzhou and Shenzhen are experimenting with low-altitude logistics and passenger transportation. Given its large population, urbanization rate, and investment in intelligent city infrastructure, China has the potential to be a large market for autonomous air mobility. Green transport-fostering national policies combined with leadership in technology make China a global player in air taxi deployment. April 2025, AutoFlight, a flying taxi developer, has started building a new assembly facility in Wuhan, China, to be the final assembly hub for its flying cars and for ground and flight testing, sales, and service.

Saudi Arabia Air Taxi Market

Saudi Arabia is looking to integrate air taxis under its Vision 2030 initiative to update transport and diversify the economy. The kingdom will employ air taxis for tourism, airport transfers, and city mobility in megaprojects such as NEOM and The Line. Collaborations with international companies and early investments in vertiport infrastructure indicate commitment. Regulatory frameworks for autonomous and piloted aerial vehicles are being considered by the General Authority of Civil Aviation (GACA). With a plenty of investment money and an open sky policy for innovation, Saudi Arabia is becoming a central player in the Middle East air taxi future. May 2025, Saudi Arabia's Ministry of Transport and FlyNow Arabia are initiating the kingdom's first air taxi app to carry cargo and passengers. CEO of FlyNow Arabia, said the pilot programme will be launched this year in King Abdullah University of Science and Technology, in partnership with the Ministry of Transport.

Market Segmentation

Propulsion Type

- Parallel Hybrid

- Electric

- Turboshaft

- Turboelectric

Aircraft Type

- Multicopter

- Quadcopter

- Others

Passenger Capacity

- One

- Two

- Four

- More than six

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Honeywell International Inc.

- Ab Corporate Aviation

- Skyway Air Taxi

- Airbus SE

- Kitty Hawk Corporation

- Fly Aeolus

- Neva Aerospace Ltd.

- Hyundai Motor Company

- Joby Aviation

- Talkeetna Air Taxi Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Propulsion Type, Aircraft Type, Passenger Capacity and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Air Taxi Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Propulsion Type

6.2 By Aircraft Type

6.3 By Passenger Capacity

6.4 By Countries

7. Propulsion Type

7.1 Parallel Hybrid

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Electric

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Turboshaft

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Turboelectric

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

8. Aircraft Type

8.1 Multicopter

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Quadcopter

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Others

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

9. Passenger Capacity

9.1 One

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Two

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Four

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 More than six

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

10. Countries

10.1 North America

10.1.1 United States

10.1.1.1 Market Analysis

10.1.1.2 Market Size & Forecast

10.1.2 Canada

10.1.2.1 Market Analysis

10.1.2.2 Market Size & Forecast

10.2 Europe

10.2.1 France

10.2.1.1 Market Analysis

10.2.1.2 Market Size & Forecast

10.2.2 Germany

10.2.2.1 Market Analysis

10.2.2.2 Market Size & Forecast

10.2.3 Italy

10.2.3.1 Market Analysis

10.2.3.2 Market Size & Forecast

10.2.4 Spain

10.2.4.1 Market Analysis

10.2.4.2 Market Size & Forecast

10.2.5 United Kingdom

10.2.5.1 Market Analysis

10.2.5.2 Market Size & Forecast

10.2.6 Belgium

10.2.6.1 Market Analysis

10.2.6.2 Market Size & Forecast

10.2.7 Netherlands

10.2.7.1 Market Analysis

10.2.7.2 Market Size & Forecast

10.2.8 Turkey

10.2.8.1 Market Analysis

10.2.8.2 Market Size & Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Analysis

10.3.1.2 Market Size & Forecast

10.3.2 Japan

10.3.2.1 Market Analysis

10.3.2.2 Market Size & Forecast

10.3.3 India

10.3.3.1 Market Analysis

10.3.3.2 Market Size & Forecast

10.4 South Korea

10.4.1.1 Market Analysis

10.4.1.2 Market Size & Forecast

10.4.2 Thailand

10.4.2.1 Market Analysis

10.4.2.2 Market Size & Forecast

10.4.3 Malaysia

10.4.3.1 Market Analysis

10.4.3.2 Market Size & Forecast

10.4.4 Indonesia

10.4.4.1 Market Analysis

10.4.4.2 Market Size & Forecast

10.4.5 Australia

10.4.5.1 Market Analysis

10.4.5.2 Market Size & Forecast

10.4.6 New Zealand

10.4.6.1 Market Analysis

10.4.6.2 Market Size & Forecast

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Market Analysis

10.5.1.2 Market Size & Forecast

10.5.2 Mexico

10.5.2.1 Market Analysis

10.5.2.2 Market Size & Forecast

10.5.3 Argentina

10.5.3.1 Market Analysis

10.5.3.2 Market Size & Forecast

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.1.1 Market Analysis

10.6.1.2 Market Size & Forecast

10.6.2 UAE

10.6.2.1 Market Analysis

10.6.2.2 Market Size & Forecast

10.6.3 South Africa

10.6.3.1 Market Analysis

10.6.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Honeywell International Inc.

14.2 Ab Corporate Aviation

14.3 Skyway Air Taxi

14.4 Airbus SE

14.5 Kitty Hawk Corporation

14.6 Fly Aeolus

14.7 Neva Aerospace Ltd.

14.8 Hyundai Motor Company

14.9 Joby Aviation

14.10 Talkeetna Air Taxi Inc.

15. Key Players Analysis

15.1 Honeywell International Inc.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Ab Corporate Aviation

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Skyway Air Taxi

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Airbus SE

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Kitty Hawk Corporation

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Fly Aeolus

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Neva Aerospace Ltd.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Hyundai Motor Company

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Joby Aviation

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Talkeetna Air Taxi Inc

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com