India Taxi Market Size, Share, Trends & Forecast 2025–2033

Buy NowIndia Taxi Market Size and Forecast 2025-2033

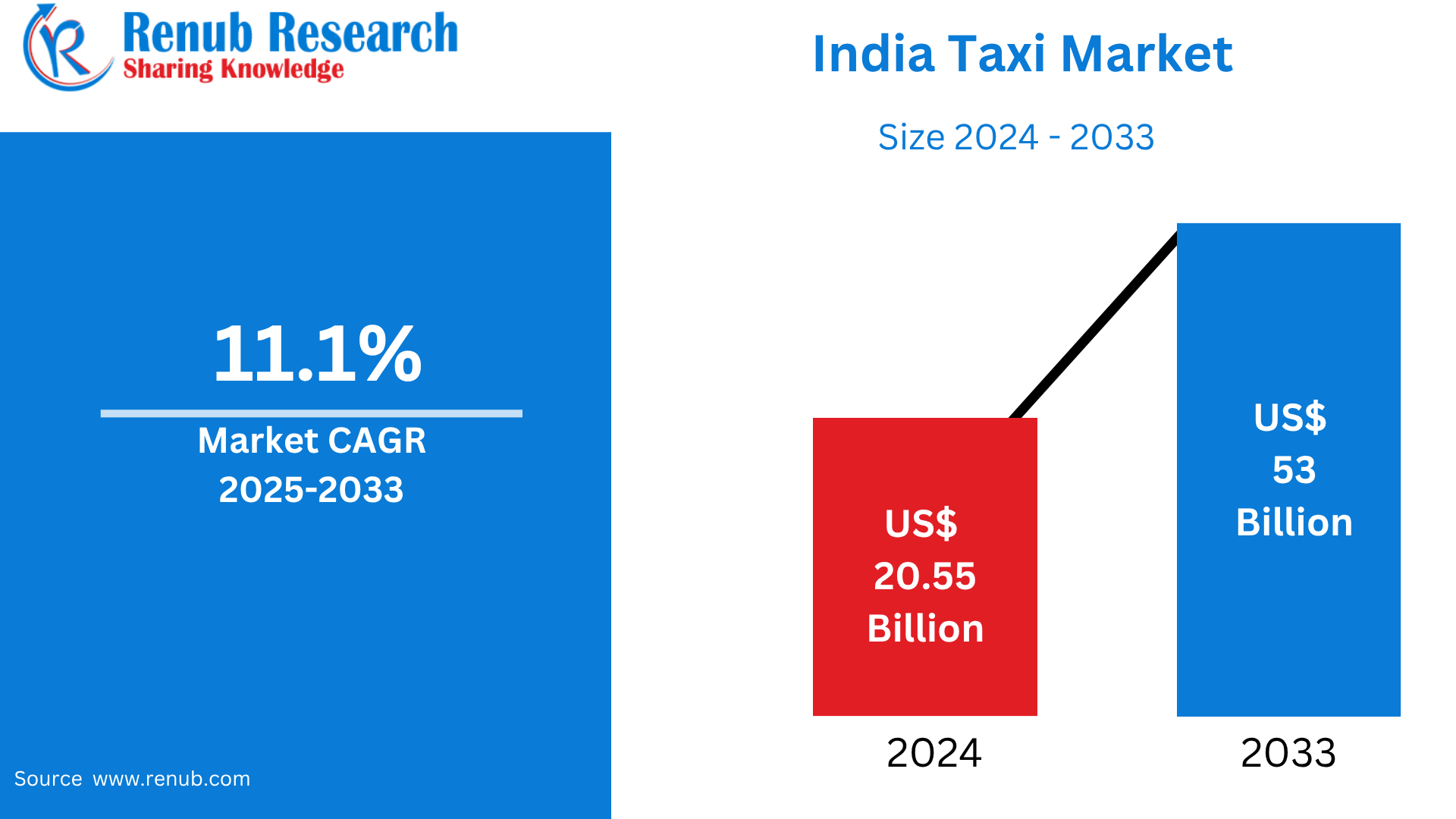

The India Taxi Market size was USD 20.55 billion in 2024 and is estimated to reach USD 53 billion by 2033, at a growth rate of 11.1% CAGR during the forecast period. The growth is spurred by fast-growing urbanization, growing smartphone penetration, heightened demand for app-based mobility solutions, and growth of ride-hailing services such as Ola and Uber in tier 1, 2, and 3 cities.

India Taxi Market Outlooks

A taxi is a commercial vehicle that offers passenger transport services for hire, typically by distance traveled or time. Taxis may be hailing from the street, phoned in advance, or reserved using mobile applications. In India, they range from the old black-and-yellow taxis and auto-rickshaws to the newer app-based services such as Ola and Uber.

Taxis are extensively used in urban and semi-urban regions for daily travel, airport runs, corporate travel, and tourism. Their comfort, affordability, and point-to-point feature make them an integral part of India's transportation sector. Increasing urbanization, increasing disposable incomes, and higher smartphone penetration have made app-based taxi services especially popular. In cities where public transport is overcrowded or not so widely accessible, taxis provide comfort and convenience. Business tourists and travelers also depend significantly on taxis for local transport. With India's ongoing modernization, the taxi market is growing at a fast pace with the help of digital platforms, state transport policies, and growing demand for personal, on-demand travel.

Drivers of Growth in the India Taxi Market

Urbanization and Growing Mobility Demand

Urbanization and the growing metropolitan regions of India have resulted in a substantial rise in the demand for good quality urban transport. With millions flocking to cities in search of jobs and education, the demand for mobility that is both affordable and accessible has increased. Taxis present an easy solution, particularly in regions where mass transit systems are weak. With cities expanding vertically and horizontally, the reliance on taxi services — both app-based and traditional — keeps increasing, and hence this industry becomes an integral component of India's changing transport landscape. Accelerating urbanization and growing motorization are driving India's mobility demand and causing inherent mobility problems like congestion, air pollution, and rising time of travel. By the year 2050, it is estimated that 70% of the population of India will be living in cities.

Proliferation of Smartphone and Internet Penetration

The availability of smartphones everywhere and cheap mobile internet has changed the face of commuting in India. Digital platforms like Ola and Uber have made it easy and hassle-free to book taxis, and it has prompted tech-savvy urbanites to opt for online taxi services compared to traditional transport modes. App-based services provide real-time tracking, fare transparency, and digital payments, which make the experience superior. The growing digital economy and technology adoption in tier-2 and tier-3 cities of India have made the taxi market more accessible and scalable. According to DataReportal's There were 806 million internet users in India at the beginning of 2025, when online penetration was 55.3 percent.

Government Programs and Policy Support

Government programs promoting electric mobility, smart cities, and digital infrastructure indirectly help the taxi industry. Initiatives such as FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) support electric taxis, and smart city missions provide push for app-based, pollution-free, and technology-enabled urban transportation solutions. Moreover, regulatory measures to legalize and license ride-hailing services set up a more organized ecosystem, enhancing investor sentiment and market transparency. These moves drive long-term growth and greening of the Indian taxi industry. Major government policies and regulations such as the introduction of Goods and Services Tax (GST) in India reduced the tax structure complexity for taxi services. The unified tax system has made it easy to comply with taxes and resulted in less tax evasion, and thus both operators and passengers have gained. Safety concerns of passengers have forced the government to regulate taxi services strictly. This involves GPS tracking requirements, panic buttons, and compulsory background screening of drivers for purposes of improving passenger safety.

Challenges in the India Taxi Market

Regulatory Uncertainty and Policy Fragmentation

India's taxi industry is plagued with regulatory issues caused by fragmented state-level rules and uncertain national regulation standards for ride-hailing services. Conflicts surrounding fare ceilings, driver licenses, and vehicle registration pose operational challenges for firms and consumer confusion. Spontaneous government crackdowns or policy fluctuations can suspend services, alter prices, or limit access for drivers. Uncertainty has deterred long-term investment and made it challenging for local and global players to scale sustainably in a variety of Indian states.

Driver Shortages and Labor Issues

Staff shortages are a major driver for the Indian taxi sector, accompanied by dissatisfaction over wages and the absence of social security benefits. Drivers have grievances regarding low net incomes after deducting platform commissions and fuel costs. Strikes and demonstrations are a regular feature in core cities like Delhi and Mumbai. Service reliability, user experience, and platform reputation are all impacted by these labor issues. Additionally, the lack of structured training and skill acquisition among drivers causes uneven service quality and safety issues.

India Online Taxi Market

India's online taxi market has expanded manifold through digitalization of transportation. App-based services such as Ola, Uber, and Rapido are dominating this space with real-time booking, route optimization, estimated fare, and online payments. Easy digital access and features such as customer care and ride rating by customers make the market highly engaging. Addition of electric and shared mobility solutions to these platforms further enhances their reach. With further smartphone usage throughout India, the taxi market online is likely to increase in urban as well as semi-urban areas.

India Ride-Hailing Taxi Market

Ride-hailing has changed day-to-day commutes for India's millions. Door-to-door transportation, dynamic pricing, and comfort are offered by these services, making them preferable to regular auto-rickshaws or public transportation by most urban residents. The industry enjoys greater employment opportunities for drivers and flexible working patterns. Platforms are also venturing into subscriptions and micro-mobility services. The ongoing consumer preference shift towards flexible, on-demand mobility — particularly post-pandemic — guarantees sustained growth in the ride-hailing segment among metros and emerging cities.

India Ride-Sharing Taxi Market

India's ride-sharing taxi market is growing as consumers grow more cost-sensitive and eco-conscious. Carpooling and shared rides save travel costs, reduce traffic congestion, and lower carbon footprints. Platforms provide carpooling solutions with dynamic algorithms that connect passengers going in the same direction. This is especially appealing for office workers and students traveling in big cities. Though COVID-19 initially affected shared mobility, it is picking up pace with additional health and safety functions. Ride-sharing also fits with sustainable urban mobility intentions and increasing green awareness

India Motorcycles Taxi Market

Motorbike taxis, spearheaded by companies such as Rapido and UberMoto, are increasing in popularity among Indian cities that are bogged down by traffic. They provide a cost-effective, fast, and agile transportation option, particularly for single riders. These services are best suited for last-mile connectivity and thrive where there is high traffic and narrow roads. More affordable than cars and quicker travel times make them popular among young office-goers and students. The two-wheeler taxi segment is likely to expand aggressively with increasing fuel prices, urbanization, and need for affordable transport.

India Cars Taxi Market

The segment of cars taxi is still the backbone of India's taxi market. A variety of car models catering to various customer segments are provided by both traditional taxi players and app-based aggregators. Sedans, hatchbacks, and compact SUVs lead in this segment on account of their versatility, comfort, and maneuverability on urban roads. The sector is boosted by corporate bookings, airport travel, and demand for intercity travel. New age developments such as electric taxis and luxury car rentals are also penetrating this segment, indicative of diversification and premiumization.

Delhi Taxi Market

Delhi taxi market ranks among the biggest in India, fuelled by high population density, tourist footfalls, and daily workday commutes. The availability of government buildings, education centers, and corporate business parks drives taxi demand. Air pollution issues and policy responses have led to platforms embracing cleaner technologies like electric and CNG-enabled taxis. Support by the Delhi government for shared and app-based mobility remains instrumental in fashioning the taxi industry's development in the national capital. November 2024, Delhi Metro Rail Corporation (DMRC) launched a bike taxi service through its Momentum app from 12 metro stations. The service has SHERYDS for ladies and RYDR for all passengers, which provide easy last-mile connectivity. The service initially has a fleet of 200 bikes but will soon cover more than 100 stations.

Maharashtra Taxi Market

Maharashtra, which houses large cities such as Mumbai and Pune, boasts a well-developed and heterogeneous taxi market. Black-and-yellow cabs run parallel to app-based cab services in Mumbai, providing consumers with differentiated alternatives. Pune's developing IT and startup environment has also boosted demand for taxis. Strong competition among aggregators and local operators is seen in the state. Regulatory reforms favouring electric vehicle uptake are likely to accelerate growth even more, particularly in Mumbai where congestion and pollution are major issues. Tourism and inter-city travel contribute towards market liveliness. According to Maharashtra Transport Department, approximately 3.5 Mn day-by-day taxi trips were conducted in the city during 2023. Mumbai is also hosting modern app-based as well as old-fashioned taxis, which combined share over 65% of total private taxi trips.

Uttar Pradesh Taxi Market

India's most populated state, Uttar Pradesh, offers immense opportunity for taxi solutions, especially in developing cities like Lucknow, Noida, and Kanpur. Urbanization and the development of road infrastructure are the primary drivers in this space. With growing disposable income and smartphone coverage, online taxi aggregators are moving beyond metros to tier-2 and tier-3 cities. The market, however, is yet to develop with issues of regulation and availability of drivers. Government initiatives like smart city projects and better connectivity will be driving demand in the next few years. December 2024, the Noida International Airport (NIA) announced its partnership with Mahindra Logistics Mobility to offer a top-tier, all-electric taxi service for travelers arriving at and departing from the airport. The 24/7 service will offer premium pick-up and drop-off options situated at the arrival and departure curbs, reducing walking distance.

Andhra Pradesh Taxi Market

Andhra Pradesh is experiencing increasing demand for taxis because of infrastructure growth, particularly in cities such as Visakhapatnam, Vijayawada, and Amaravati. With emphasis on smart city initiatives and IT parks, the state has experienced growing app-based taxi uptake. Tourism, port access, and urban development add to frequent taxi usage. State government encouragement of digital transportation solutions and electric mobility products reinforces the growth prospects. Ongoing investment in road and urban mobility infrastructure will further expand taxi service coverage and dependability.

Market Segmentation

Booking Type

- Online Booking

- Offline Booking

Service Type

- Ride-Hailing

- Ride-Sharing

Vehicle Type

- Motorcycles

- Cars

- Other Vehicle Types (Vans)

Top 12 States Taxi Market

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Karnataka

- Gujarat

- West Bengal

- Rajasthan

- Telangana

- Andhra Pradesh

- Madhya Pradesh

- Kerala

- Delhi

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Carzonrent India Pvt. Ltd.

- ANI Technologies Pvt. Ltd (Ola Cabs)

- Spice Cabs

- Uber technologies Inc.

- Meru Cabs

- Savaari Car Rentals

- FastTrack Taxi

- Mega Cabs

- My Taxi India

- BlaBlaCar

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Booking Type, Service Type, Vehicle Type and States |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Taxi Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Booking Type

6.2 By Service Type

6.3 By Vehicle Type

6.4 By States

7. Booking Type

7.1 Online Booking

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Offline Booking

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

8. Service Type

8.1 Ride-Hailing

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Ride-Sharing

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

9. Vehicle Type

9.1 Motorcycles

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Cars

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Other Vehicle Types (Vans)

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

10. Top 12 States Taxi Market

10.1 Maharashtra

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Tamil Nadu

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

10.3 Uttar Pradesh

10.3.1 Market Analysis

10.3.2 Market Size & Forecast

10.4 Karnataka

10.4.1 Market Analysis

10.4.2 Market Size & Forecast

10.5 Gujarat

10.5.1 Market Analysis

10.5.2 Market Size & Forecast

10.6 West Bengal

10.6.1 Market Analysis

10.6.2 Market Size & Forecast

10.7 Rajasthan

10.7.1 Market Analysis

10.7.2 Market Size & Forecast

10.8 Telangana

10.8.1 Market Analysis

10.8.2 Market Size & Forecast

10.9 Andhra Pradesh

10.9.1 Market Analysis

10.9.2 Market Size & Forecast

10.10 Madhya Pradesh

10.10.1 Market Analysis

10.10.2 Market Size & Forecast

10.11 Kerala

10.11.1 Market Analysis

10.11.2 Market Size & Forecast

10.12 Delhi

10.12.1 Market Analysis

10.12.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Carzonrent India Pvt. Ltd.

14.2 ANI Technologies Pvt. Ltd (Ola Cabs)

14.3 Spice Cabs

14.4 Uber technologies Inc.

14.5 Meru Cabs

14.6 Savaari Car Rentals

14.7 FastTrack Taxi

14.8 Mega Cabs

14.9 My Taxi India

14.10 BlaBlaCar

15. Key Players Analysis

15.1 Carzonrent India Pvt. Ltd.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 ANI Technologies Pvt. Ltd (Ola Cabs)

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Spice Cabs

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Uber technologies Inc.

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Meru Cabs

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Savaari Car Rentals

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 FastTrack Taxi

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Mega Cabs

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 My Taxi India

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 BlaBlaCar

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com