European Union Passenger Car Market Size, Trends, and Forecast 2025–2033

Buy NowEuropean Union Passenger Car Market Size and Forecast 2025-2033

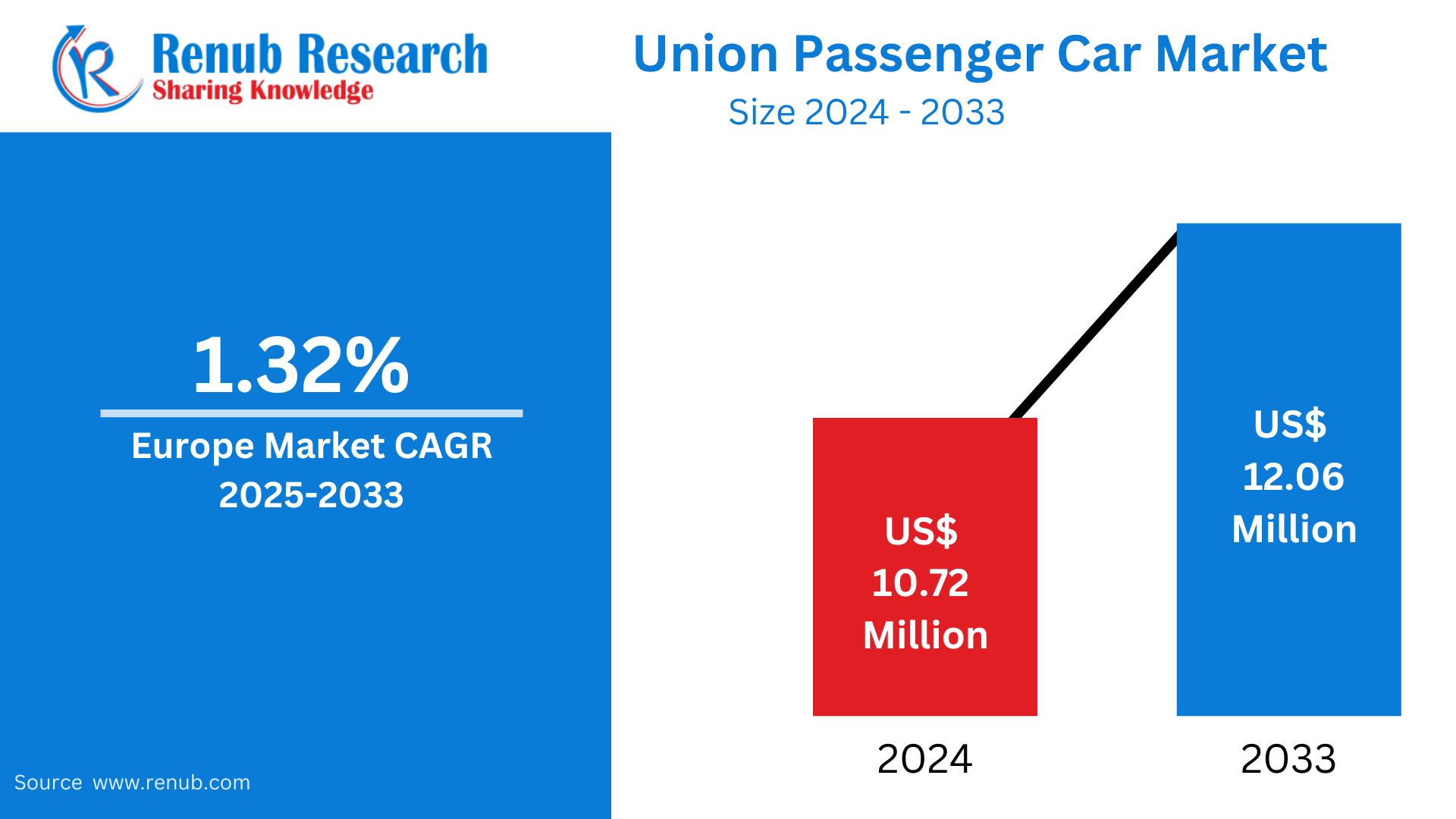

European Union Passenger Car Market is expected to reach 12.06 Million Units in 2033 from 10.72 Million Units in 2024. From 2025 to 2033, it will increase at a CAGR of 1.32%. Increased demand for electric vehicles, favorable government policies, and improvement in automotive technology in major EU member countries are the drivers for this growth.

European Union Passenger Car Market Report by Types (Hatchbacks, MUV’s, Sedans, SUV’s), Fuel Type (Petrol, Diesel, Battery Electric (BEV), Hybrid, Others), Transmission Type (Manual, Automatic), Countries and Company Analysis, 2025-2033.

European Union Passenger Car Market Overview

A passenger vehicle is a car used mainly to carry people in comparison to freight, usually able to accommodate a maximum of five persons. It is commonly applied in everyday transport, tourism trips, and general mobility. Passengers cars have found a special place in European nations because Europe boasts a high-density road infrastructure, urban infrastructure, and relatively high standard of living.

Fuel-efficient and compact models are especially popular in highly populated cities, whereas electric and hybrid vehicles are becoming popular because of tight emission controls and increasing environmental concerns. The region has some of the world's most prominent car manufacturers, such as Volkswagen, BMW, and Renault. Strong consumer demand, government subsidies, and technology innovations continue to propel the popularity of passenger cars throughout the region.

Growth Driver in the European Union Passenger Car Market

Government Incentives and Emission Rules

EU countries are providing massive subsidies and tax concessions to promote the use of low-emission and electric vehicles. Tighter carbon emission rules—like the EU Green Deal and Fit for 55 goals—are pushing carmakers to innovate and consumers to switch to cleaner technology. Incentives comprise cash rebates, lower VAT, and registration charges or road tax relief. These policies stimulate demand for electric and hybrid cars and create the development of supporting infrastructure such as EV charging stations. This regulatory drive is a main driver of the transformation in the passenger car market in the European Union. The EU ETS creates a market mechanism to price CO2 and to reward cost-efficient reductions in emissions, which is an important element of EU climate policy. The initial ETS I is designed to reduce emissions in power generation and energy-intensive sectors each year. Existing regulations go out until 2030, which could see the cap reach zero by 2039, although future overhauls could change this.

Innovation in Electric and Autonomous Technology

Accelerating developments in electric powertrains, battery technology, and autonomous driving are revolutionizing the passenger car industry across Europe. Car makers are introducing new models with better range, quicker charging, and more intelligent onboard systems, making EVs more practical and desirable. At the same time, investments in artificial intelligence, sensor systems, and vehicle-to-vehicle communications are laying the foundation for autonomous mobility in the future. They make driving easier, safer, and more environmentally friendly. Younger consumers in Europe, in particular, are attracted to these new technologies, fueling market strength and competitiveness within an increasingly technological environment. January 2025, Mercedes-Benz Drive Pilot becomes the first approved system in Germany for Level 3 autonomous driving on production cars at speeds of up to 95 km/h.

Urbanization and Car-Sharing Trends

Increased urban dwellings and urban intelligent city building in Europe is growing demand for convenient, cost-effective transportation alternatives. Most city dwellers opt for smaller, low-emission cars for narrow parking lots and shorter distances. At the same time, the car-sharing and mobility-as-a-service (MaaS) markets are growing fast, led by price-conscious and eco-conscious consumers. This has prompted manufacturers to create urban-friendly passenger vehicles with digital connectivity, adjustable ownership, and reduced emissions. As cities adopt low-emission zones and limit high-pollution vehicles, these trends make important contributions to long-term demand and diversification for the EU passenger car market. In 2023, Hertz has partnered with Uber to offer 25,000 electric cars (EVs) to European capital city drivers by 2025. The tie-up is in line with Hertz's vision to grow its EV fleet and that of Uber's vision of going zero-emission by 2030 in Europe and North America.

Challenges in the European Union Passenger Car Market

Electric Vehicle and Infrastructure Costs

Even with government incentives, the upfront cost of electric vehicles (EVs) is prohibitively high for most consumers in the EU. Production of batteries, advanced materials, and software integration inflate vehicle prices above those of conventional internal combustion engine vehicles. The infrastructure to support widespread adoption of EVs, such as charging networks, is also still unevenly spread, particularly in rural or economically disadvantaged areas. This cost disparity influences both supply and demand. Until economies of scale are completely achieved and charging networks are widespread, affordability and accessibility will hold back the growth of the market for electric and hybrid passenger vehicles.

Supply Chain Disruptions and Component Shortages

The passenger car market in Europe experiences considerable disruptions caused by global supply chain uncertainty. Deficiencies of key components, particularly semiconductors, have pushed back production schedules, depleted stock, and raised manufacturing expenses. The COVID-19 pandemic and current geopolitical tensions, such as EU trade exposures to Asia, heightened these vulnerabilities. Car producers have had to shut down factory lines, skip features, or postpone car rollouts. Disruptions like this undermine consumer trust, affect sales, and make long-term planning for manufacturers harder. These risks need to be addressed through regional diversification, strategic stockholding, and spending on local capacity for critical car parts.

European Union Sedans Passenger Car Market

Sedans continue to be an important segment in the EU passenger car market because they offer a perfect blend of comfort, fuel economy, and style. Despite being challenged by SUVs and hatchbacks, sedans continue to appeal to city and corporate consumers seeking a fashionable and convenient option. Germany, France, and Italy particularly highly demand mid-size and luxury sedans, usually employed for private and business use. Improvements in hybrid and electric sedan vehicles are also keeping this segment in touch. Companies more and more emphasize incorporating connectivity technologies and efficient powertrains to make sedans competitive in an evolving marketplace.

The European Union Petrol Passenger Car Market

Even with the growing popularity of electric cars, petrol-powered passenger vehicles remain a significant portion of the EU market, particularly in the nations with less advanced EV infrastructure. Petrol cars are often cheaper upfront, easier to maintain, and widely supported in refueling infrastructure. Their continued appeal lies in improved fuel efficiency and performance-enhancing technologies, such as turbocharging and direct injection. While their market share is expected to decline over the next decade, they remain popular for budget-conscious consumers and rural drivers. Regulatory pressures, however, are gradually steering manufacturers and buyers toward cleaner alternatives.

European Union Electric Battery Passenger Car Market

The battery electric vehicle (BEV) segment is growing quickly in the EU, driven by stringent carbon emissions standards and strong government incentives. Norway (influential, non-EU), Germany, and the Netherlands are at the forefront of this change. BEVs have zero tailpipe emissions and enjoy lower running costs and tax benefits. The EU spends extensively on charging infrastructure, battery manufacturing, and recycling technologies to enable long-term take-up. Automakers are introducing new BEV models with better ranges, quicker-charging times, and affordable prices. With emerging battery technology and economies of scale lowering costs, the BEV segment is well set for long-term growth.

European Union Hybrid Electric Passenger Car Market

Hybrid electric cars (HEVs) provide a pragmatic transition between conventional combustion engine vehicles and pure electric cars. In the EU, they appeal to customers who desire improved fuel economy and decreased emissions without range anxiety. HEVs are particularly well-liked in nations with city low-emission zones because they enable low-speed electric-only driving. The segment is supported by tax benefits and conformity regulation benefits. The manufacturers are broadening their hybrid line across sedans, SUVs, and sub-compacts. As the technology for full EVs continues to improve, hybrids are a bridge technology for most motorists and should have level demand.

European Union Manual Passenger Car Market

Manual transmission passenger vehicles have long been the European market leaders because they are less expensive, provide improved fuel economy, and allow drivers to have more control over the performance of their vehicles. Demand, however, slowly decreases as automatics become more sophisticated, affordable, and common in hybrid and electric vehicles. In eastern and southern European nations, manual vehicles continue to be popular, especially among low-cost and younger motorists. They are likewise prevalent in smaller cars and fleet transactions. Even though this segment can decline in the long run, manual vehicles will persist in rural and cost-effective markets in the EU, particularly in the near to medium term.

France Passenger Car Market

France is one of the biggest passenger car markets in the EU, with powerful domestic brands such as Renault, Peugeot, and Citroën. Low-emission vehicles have been actively encouraged by the country through incentives, scrappage schemes, and urban mobility policies. Electric and hybrid versions are rapidly gaining traction, with the help of a growing charging network. Sedans and compact cars are leading sales, but SUVs are increasingly popular. France's automotive sector is also deeply engaged in R&D, contributing to the wider European green mobility transition. The market is responsive to regulatory policy, and thus it serves as a gauge of how sustainability policy influences consumer purchasing habits. In 2024, The French new car market declined by 3.17% to 1,718,416 cars, with Renault, Peugeot, and Dacia being the leading brands, and the Renault Clio and Peugeot 208 being the top-selling models.

Germany Passenger Car Market

Germany, the domicile of car titans Volkswagen, BMW, and Mercedes-Benz, is the EU's largest and most significant passenger car market. It is the driver of technological progress, premium car manufacturing, and the transition to EV. Demand is strong domestically in every segment—from the budget to luxury vehicles—towards electric mobility. Policies at the level of the government, including the environmental bonus for EVs and CO₂ fleet caps, are pushing the industry to change. German carmakers invest significantly in EVs, battery tech, and autonomous driving. The nation is also an export base, driving trends throughout Europe. Robust industrial infrastructure backs traditional and future vehicle production.

United Kingdom Passenger Car Market

Though no longer a member of the EU, the UK is still a key European passenger car market. It features varied consumer tastes, heavily biased towards compact vehicles, hatchbacks, and hybrids. British buyers increasingly turn to electric cars, spurred by the government's intention to phase out new petrol and diesel car sales by 2035. Domestic production by manufacturers such as Jaguar Land Rover entails high levels of imports from EU countries. Urban congestion charging areas and green initiatives also shape purchasing habits. In spite of Brexit-induced trade complications, the UK continues to influence passenger car trends in Europe, particularly in EV take-up and regulatory convergence.

Netherlands Passenger Car Market

The Netherlands is a leader in electric mobility in the EU, with one of the highest per capita adoption rates of electric cars. Government subsidies, minimal taxation of EVs, and a high-density public charging network have established the country as a model for sustainable transport. The market is biased toward small and electric cars, particularly in urban regions. Dutch consumers value eco-friendliness, efficiency, and connectivity in car purchases. Whereas conventional petrol and diesel cars are losing ground, hybrids and BEVs are on the rise. With robust policy support and an increasingly tech-aware population, the Netherlands remains at the forefront in the European passenger car market.

European Union Passenger Car Market Segmentations

Types

- Hatchbacks

- MUV’s

- Sedans

- SUV’s

Fuel Type

- Petrol

- Diesel

- Battery Electric (BEV)

Hybrid

- Plug-in Hybrid (PHEV)

- Hybrid Electric (HEV)

- Others

Transmission Type

- Manual

- Automatic

Country

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis

- Volkswagen AG

- Stellantis N.V.

- Renault S.A

- Hyundai Motor Company

- Bayerische Motoren Werke AG

- Toyota Motor Europe

- Daimler Motor Company Limited

- Ford Motor Company Limited

- Volvo Car Corporation.

- Nissan Motor Co., Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Types, Fuel Type, Transmission Type and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. European Union Passenger Car Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market share Analysis

6.1 By Types

6.2 By Fuel Type

6.3 By Transmission Type

6.4 By Country

7. Types

7.1 Hatchbacks

7.1.1 Historical Market Trends

7.1.2 Market Forecast

7.2 MUV’s

7.2.1 Historical Market Trends

7.2.2 Market Forecast

7.3 Sedans

7.3.1 Historical Market Trends

7.3.2 Market Forecast

7.4 SUV’s

7.4.1 Historical Market Trends

7.4.2 Market Forecast

8. Fuel Type

8.1 Petrol

8.1.1 Historical Market Trends

8.1.2 Market Forecast

8.2 Diesel

8.2.1 Historical Market Trends

8.2.2 Market Forecast

8.3 Battery Electric (BEV)

8.3.1 Historical Market Trends

8.3.2 Market Forecast

8.4 Hybrid

8.4.1 Plug-in Hybrid (PHEV)

8.4.1.1 Historical Market Trends

8.4.1.2 Market Forecast

8.4.2 Hybrid Electric (HEV)

8.4.2.1 Historical Market Trends

8.4.2.2 Market Forecast

8.5 Others

8.5.1 Historical Market Trends

8.5.2 Market Forecast

9. Transmission Type

9.1 Manual

9.1.1 Historical Market Trends

9.1.2 Market Forecast

9.2 Automatic

9.2.1 Historical Market Trends

9.2.2 Market Forecast

10. By country

10.1 France

10.2 Germany

10.3 Italy

10.4 Spain

10.5 United Kingdom

10.6 Belgium

10.7 Netherlands

10.8 Russia

10.9 Poland

10.10 Greece

10.11 Norway

10.12 Romania

10.13 Portugal

10.14 Rest of Europe

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Volkswagen AG

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Developments & Strategies

13.1.4 Revenue Analysis

13.2 Stellantis N.V.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Developments & Strategies

13.2.4 Revenue Analysis

13.3 Renault S.A

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Developments & Strategies

13.3.4 Revenue Analysis

13.4 Hyundai Motor Company

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Developments & Strategies

13.4.4 Revenue Analysis

13.5 Bayerische Motoren Werke AG

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Developments & Strategies

13.5.4 Revenue Analysis

13.6 Toyota Motor Europe

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Developments & Strategies

13.6.4 Revenue Analysis

13.7 Daimler Motor Company Limited

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Developments & Strategies

13.7.4 Revenue Analysis

13.8 Ford Motor Company Limited

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Developments & Strategies

13.8.4 Revenue Analysis

13.9 Volvo Car Corporation.

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Developments & Strategies

13.9.4 Revenue Analysis

13.10 Nissan Motor Co., Ltd.

13.10.1 Overview

13.10.2 Key Persons

13.10.3 Recent Developments & Strategies

13.10.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com