Powersports Market Analysis Growth & Forecast 2025–2033

Buy NowGlobal Powersports Market size, Growth & Forecast 2025–2033

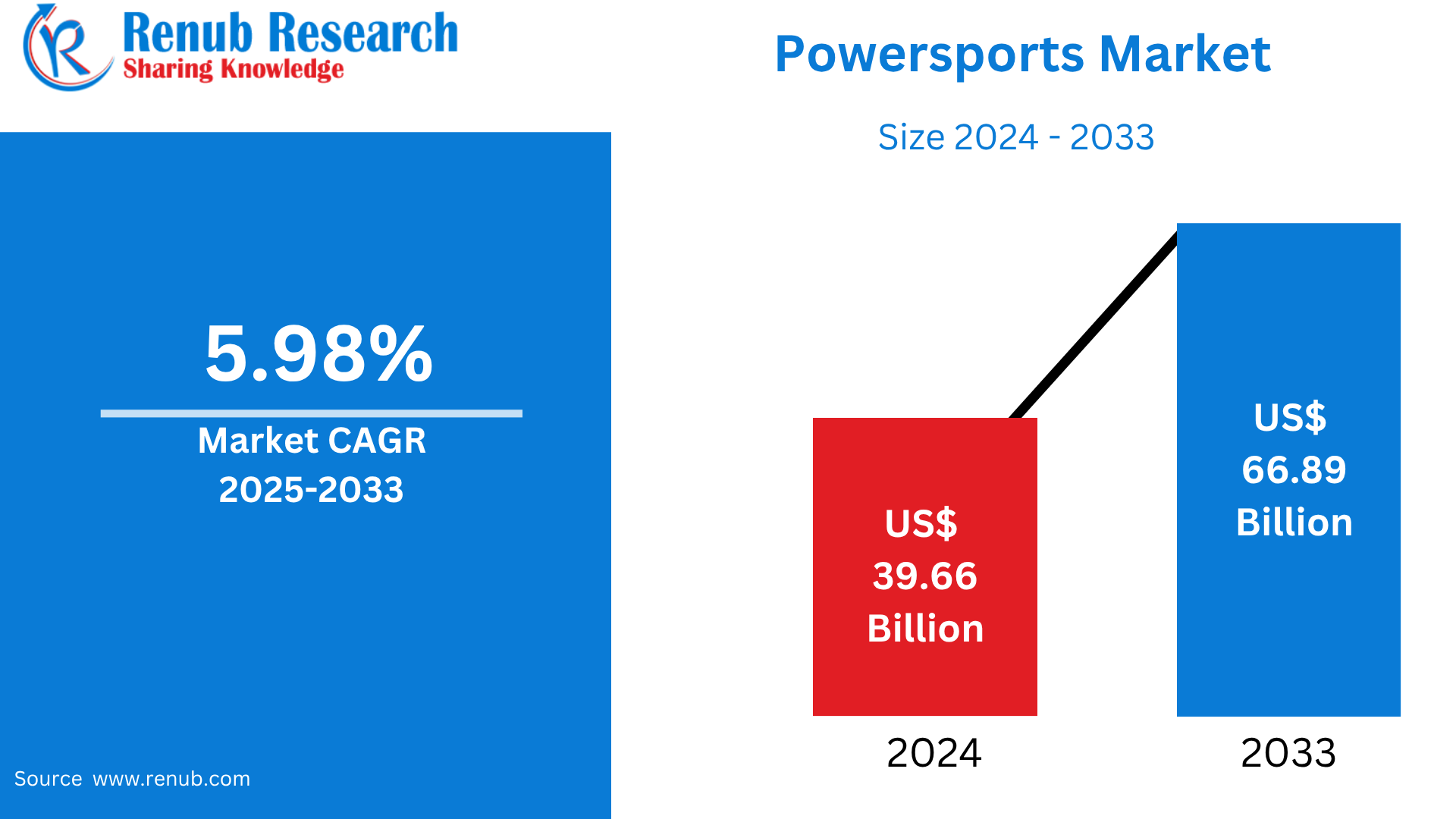

The global powersports market was worth USD 39.66 billion in 2024 and is expected to reach USD 66.89 billion by 2033, growing at a CAGR of 5.98% during the 2025-2033. Drivers include increasing demand for recreational vehicles, a rise in off-road sports activities, and advancement in ATVs, snowmobiles, personal watercraft, and motorcycles in the North American, European, and Asia-Pacific markets.

Global Powersports Market Outlooks

Powersports is a class of motorized equipment used for recreational and competitive purposes on land, water, or snow. All-terrain vehicles (ATVs), motorcycles, snowmobiles, personal watercraft (PWC) such as jet skis, and utility task vehicles (UTVs) are all part of this category. They are designed to go fast, turn quickly, and maneuver in off-road conditions, so they're well-suited for use in adventure sports, trail riding, water sports, and rural utility operations.

Powersports are extensively utilized for recreation, racing, outdoor adventure, and occupational purposes like farming, search and rescue operations, and patrolling off-track regions. Their capacity to travel over challenging terrain and harsh environments makes them invaluable both for recreation and utility purposes. Popularity has seen a significant boost from increased demand for outdoor living, motorsport culture, and off-grid experiences. Increased affordability, safety features, and better vehicle performance have increased their popularity among a wider audience, such as families, adventure-seekers, and working professionals in forestry, law enforcement, and agriculture.

Growth Drivers in the Global Powersports Market

Increased Interest in Outdoor Recreational and Adventure Sports

Increased interest in outdoor activities such as trail riding, water sports, and off-road travel is a primary driver. Consumers—particularly younger generations—are buying powersports vehicles for weekend recreation and leisure activities. The pandemic simply accelerated this trend, as consumers craved socially distanced outdoor amusement. Powersports vehicles like ATVs and UTVs deliver freedom, excitement, and versatility, making them attractive to individual riders as well as families. This lifestyle trend is increasingly extending, generating strong demand for new as well as pre-owned powersports models worldwide. According to the United States-based National Ski Areas Association (NSAA), more than 64.7 million skiers went to U.S. ski resorts in 2022-2023, an increase of 6.6% from the prior season.

Technological Innovations in Vehicle Design and Safety

Current powersports vehicles come equipped with innovations such as electronic power steering, fuel injection systems, GPS availability, adaptive suspension, and improved safety equipment. These technologies enhance comfort, performance, and usability for a broader consumer base—first-time buyers and seniors. Safety features, such as anti-lock braking and rider-assist systems, improve appeal and lower the risk of accidents. Technology is also facilitating hybrid and electric models, which attract ecologically aware consumers. As manufacturers spend on intelligent, networked capabilities, the market increases appeal among segments of consumers. Nov 2024, Massimo Group introduced its 2025 UTV model, the Buck 550-6 Crew, which is built for families, outdoor recreation, and light work.

Growth of Rental and Tourism-Based Powersports Services

The growth of adventure tourism and recreational rentals is driving the worldwide powersports marketplace. Consumers like to rent powersports vehicles—such as jet skis, snowmobiles, and ATVs—instead of buying. This trend is particularly prevalent in resort cities with seasonal sports such as beach resorts, ski resorts, and mountain roads. Rental options put the market within reach, even in developing countries. Companies with guided tours and rental fleets are expanding quickly, generating secondary demand for durable, low-maintenance, and easy-to-use powersports units. April 2024, Royal Enfield has rolled out its "Rentals and Tours" service across more than 25 nations and 60 locations, after its Indian rental program. This is to boost motorcycle touring by providing an arena for tourists who seek adventure.

Challenges in the Global Powersports Market

Stricter Environmental and Emissions Regulations

Governments across the globe are also getting stricter with emissions requirements for internal combustion engines, which affect the powersports sector. Snowmobiles, ATVs, and dirt bikes commonly use environmentally sensitive terrain, so there are limits on noise and emissions. Producers have increasing expenditures for R&D to meet changing regulations, particularly in Europe and North America. Certain models can be prohibited or discontinued, shrinking market size. Phasing in cleaner products such as electric vehicles is required but expensive and organizational challenging for many manufacturers.

High Purchase and Maintenance Costs

Powersports vehicles are costly, being considered luxury or optional items. Purchase prices are supplemented by recurring costs for repair, fuel, insurance, licensing, and safety gear. Financial obstacles restrict adoption in cost-conscious markets. Repair and parts support can also be irregular, particularly in distant or emerging locations. Rental alternatives ease entry barriers, but long-term market growth relies on a lower cost for ownership and servicing.

Global Powersports All-Terrain Vehicles (ATVs) Market

Worldwide ATV market continues to expand because they are very versatile to use in both recreational and utility purposes. They are favorite among outdoor recreationists, hunters, and ranchers, and are popular across the globe in agriculture, forestry, and emergency response. ATVs provide great off-road performance, compactness, and versatility with varying terrain. Growth in the market is aided by advancements in electric ATVs and increasing demand in the North America and Asia-Pacific regions. Moreover, youth and entry-level offerings have created new customer bases, bolstering this category even more.

Global Powersports Snowmobiles Market

The snowmobile industry prospers in cold-weather areas such as Canada, Scandinavia, and northern America. Both for recreation and commuting, snowmobiles are vital in isolated snowy communities. Recreational snowmobiling helps winter tourism and regional economies substantially. Suppliers are emphasizing lightweight frames, better fuel economy, and environmentally friendly models to meet stringent emissions regulations. Although seasonal fluctuations restrict geographic reach, new electric snowmobiles and high-performance models are creating niche markets around the world.

Global Electric Powersports Market

Electric powersports is among the fastest-growing segments as a result of sustainability trends and regulations over emissions. Manufacturers are putting money in electric ATVs, motorcycles, personal watercraft, and UTVs with no emissions and quiet running. The models are attracting environmentally friendly customers and adhering to regulations in urban and conserved natural environments. Advances in battery life, charging infrastructure, and torque delivery are bridging initial constraints. As costs decline and performance improves, electric powersports vehicles are becoming mainstream from niche.

World Diesel Powersports Market

Diesel-powered vehicles have a smaller but critical niche in the powersports market, particularly in heavy-duty utility and agricultural applications. Diesel engines are capable of delivering high torque and improved fuel economy for towing and hauling, making them suitable for commercial and off-grid applications. These bikes are prevalent in harsh terrains and work sites where gasoline or electric alternatives might be inadequate. That said, the diesel space is pressured by tightening emissions regulations and the trend toward electrification, which caps its long-term potential for growth.

Global On-Road Powersports Market

The on-road category comprises motorcycles, scooters, and three-wheelers for street use. This segment is booming in areas of high-density urban areas, where motorcycles provide affordable and convenient means of transportation. Sport and touring models are also popular among recreational users. Companies are emphasizing connected solutions, fuel economy, and rider convenience. Electric motorcycles are expanding at a strong pace in Europe and Asia. Although on-road powersports face competition from public transportation and EVs, increasing fuel prices and urban mobility requirements still remain supportive for demand.

United States Powersports Market

The U.S. is among the biggest powersports markets in the world, fueled by robust consumer culture surrounding outdoor recreation, motorsports, and rural utility. ATV, UTV, and snowmobile use is pervasive, fueled by a robust trail and off-road park network. The nation also boasts a well-established motorcycle community and an increasing need for electric powersports. Federal and state policy is starting to impact movement toward cleaner technologies. Robust aftermarket, financing, and tourism rentals complement the U.S. powersports infrastructure. March 2022, Tucker Powersports is introducing the Tucker ePower Experience, kicking off this month. It will tour more than 100 U.S. cities, providing test rides and product information on five brands in its ePower portfolio. Events will occur at powersports dealerships, where Tucker representatives and brand ambassadors will man the events.

Germany Powersports Market

Germany is a strong European center for high-performance and premium powersports machines. Market drivers are leisure riders, motorsport activities, and a strong tourist industry. German consumers prefer technologically sophisticated and high-quality products, challenging companies to continually improve. Electric and hybrid versions are proving to be popular, particularly in the wake of the EU's environmental regulations. Luxury automobile manufacturers and engineering capabilities also spur the market forward. Yet, stringent emissions regulations and high operating expenses may dampen mass-market acceptance. January 2025, ADVIK has acquired Powersports MTG GmbH, a German brake and clutch system specialist for motorcycles, successfully. The acquisition further solidifies ADVIK's position as a leading supplier of high-performance braking systems and supports its expansion strategy.

China Powersports Market

China's powersports market is growing fast, driven by increasing disposable incomes, urbanization, and recreational enthusiasm among young consumers. Although traditionally concentrated on low-budget utility vehicles, the market is turning towards performance and lifestyle products. Local manufacturers are also investing in electric and intelligent vehicle technologies, frequently subsidized by local governments. Urban regulation of motorcycles and noise issues are challenges, however. Export of Chinese-built ATVs and UTVs are also a significant contributor to growth. The market is dynamic and highly sensitive to changes in policy. May 2025, Honda debuted its first electric motorcycle, the E-VO, in China. Co-developed with Wuyang-Honda, the E-VO incorporates retro cafe racer looks with contemporary technology and performance. The E-VO enters Honda's electric motorcycle offerings, which currently are only for sale in China.

Brazil Powersports Market

Brazil's powersports industry is increasing steadily, especially in rural and agricultural markets where ATVs and UTVs are employed in transportation and agriculture. Recreational use is also increasing, particularly for off-road motorcycles. Diversified terrain and large rural base of the country provide a wide user base. Import duties and currency variations may influence prices, though. Future growth will be stimulated by local assembly and government incentives to agribusiness, and growing interest in electric versions. Jan 2025, BMW Motorrad will introduce seven new motorcycles in 2025, with six of them produced in Brazil. The R 1300 GS Adventure will lead the introductions, beginning production at the Manaus plant in early 2025.

Saudi Arabia Powersports Market

Saudi Arabia is becoming an interesting powersports market because of its desert landscapes, tourism growth, and increased youth interest in recreational activities outdoors. Dune bashing, quad biking, and jet skiing are among the most popular activities. Vision 2030 government initiatives favor tourism and recreational facilities, fueling demand for ATVs, UTVs, and watercraft. High disposable income and low vehicle restrictions permit high-speed adoption. Extreme weather and inadequate service infrastructure in off-road locations continue to be insignificant barriers. Sept 2023, Abdul Latif Jameel Motors, a licensed distributor of Toyota cars in Saudi Arabia for almost 70 years, and the Saudi Automobile and Motorcycle Federation (SAMF) have proudly introduced the Gazoo Racing (GR) Saudi Team to compete in the ongoing season of the highly regarded Saudi Toyota Championship.

Market Segmentation

Vehicle Type

- All-Terrain Vehicles (ATV)

- Side-By-Side Vehicles

- Snowmobiles

- Personal Watercraft

- Heavyweight Motorcycle

Propulsion Type

- Gasoline

- Electric

- Diesel

Application

- On-Road

- Off-Road

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Harley-Davidson, Inc.

- Polaris Inc.

- Changjiang Motorcycle Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- BRP Inc.

- Honda Motor Co. Ltd.

- KTM AG

- Arctic Cat Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Vehicle Type, Propulsion Type, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Powersports Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Vehicle Type

6.2 By Propulsion Type

6.3 By Application

6.4 By Countries

7. Vehicle Type

7.1 All-Terrain Vehicles (ATV)

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Side-By-Side Vehicles

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Snowmobiles

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Personal Watercraft

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Heavyweight Motorcycle

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

8. Propulsion Type

8.1 Gasoline

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Electric

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Diesel

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

9. Application

9.1 On-Road

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Off-Road

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

10. Countries

10.1 North America

10.1.1 United States

10.1.1.1 Market Analysis

10.1.1.2 Market Size & Forecast

10.1.2 Canada

10.1.2.1 Market Analysis

10.1.2.2 Market Size & Forecast

10.2 Europe

10.2.1 France

10.2.1.1 Market Analysis

10.2.1.2 Market Size & Forecast

10.2.2 Germany

10.2.2.1 Market Analysis

10.2.2.2 Market Size & Forecast

10.2.3 Italy

10.2.3.1 Market Analysis

10.2.3.2 Market Size & Forecast

10.2.4 Spain

10.2.4.1 Market Analysis

10.2.4.2 Market Size & Forecast

10.2.5 United Kingdom

10.2.5.1 Market Analysis

10.2.5.2 Market Size & Forecast

10.2.6 Belgium

10.2.6.1 Market Analysis

10.2.6.2 Market Size & Forecast

10.2.7 Netherlands

10.2.7.1 Market Analysis

10.2.7.2 Market Size & Forecast

10.2.8 Turkey

10.2.8.1 Market Analysis

10.2.8.2 Market Size & Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Analysis

10.3.1.2 Market Size & Forecast

10.3.2 Japan

10.3.2.1 Market Analysis

10.3.2.2 Market Size & Forecast

10.3.3 India

10.3.3.1 Market Analysis

10.3.3.2 Market Size & Forecast

10.4 South Korea

10.4.1.1 Market Analysis

10.4.1.2 Market Size & Forecast

10.4.2 Thailand

10.4.2.1 Market Analysis

10.4.2.2 Market Size & Forecast

10.4.3 Malaysia

10.4.3.1 Market Analysis

10.4.3.2 Market Size & Forecast

10.4.4 Indonesia

10.4.4.1 Market Analysis

10.4.4.2 Market Size & Forecast

10.4.5 Australia

10.4.5.1 Market Analysis

10.4.5.2 Market Size & Forecast

10.4.6 New Zealand

10.4.6.1 Market Analysis

10.4.6.2 Market Size & Forecast

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Market Analysis

10.5.1.2 Market Size & Forecast

10.5.2 Mexico

10.5.2.1 Market Analysis

10.5.2.2 Market Size & Forecast

10.5.3 Argentina

10.5.3.1 Market Analysis

10.5.3.2 Market Size & Forecast

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.1.1 Market Analysis

10.6.1.2 Market Size & Forecast

10.6.2 UAE

10.6.2.1 Market Analysis

10.6.2.2 Market Size & Forecast

10.6.3 South Africa

10.6.3.1 Market Analysis

10.6.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Harley-Davidson, Inc.

14.2 Polaris Inc.

14.3 Changjiang Motorcycle Co., Ltd.

14.4 Yamaha Motor Co., Ltd.

14.5 Kawasaki Heavy Industries

14.6 Suzuki Motor Corporation

14.7 BRP Inc.

14.8 Honda Motor Co., Ltd.

14.9 KTM AG

14.10 Arctic Cat Inc.

15. Key Players Analysis

15.1 Harley-Davidson, Inc.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Polaris Inc.

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Changjiang Motorcycle Co., Ltd.

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Yamaha Motor Co., Ltd.

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Kawasaki Heavy Industries

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Suzuki Motor Corporation

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 BRP Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Honda Motor Co., Ltd.

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 KTM AG

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Arctic Cat Inc.

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com