United States Smart Pills Market – Drug Delivery Innovation & Forecast 2025–2033

Buy NowUnited States Smart Pills Market Size and Forecast 2025-2033

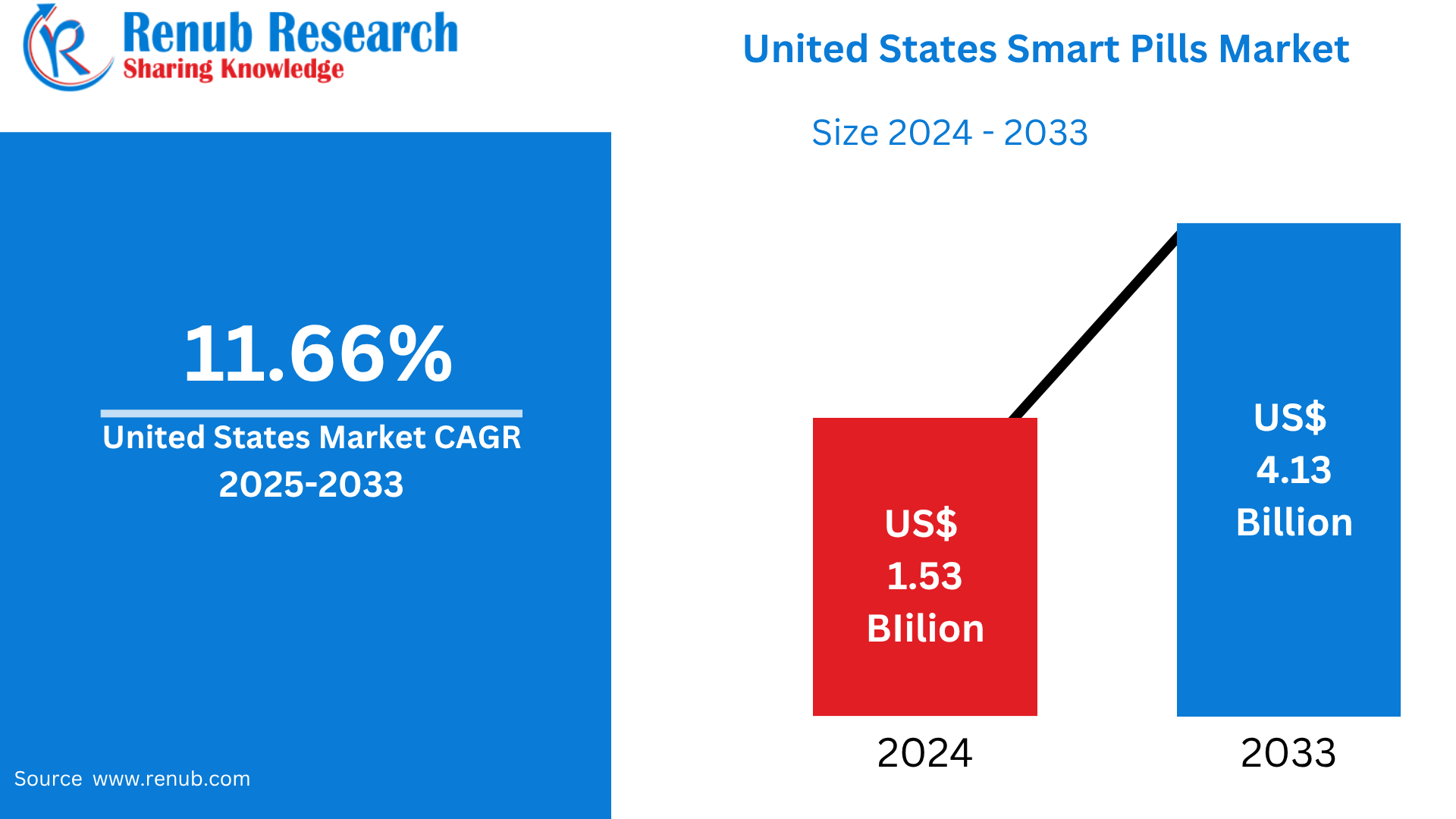

United States Smart Pills Market is expected to reach US$ 4.13 billion by 2033 from US$ 1.53 billion in 2024, with a CAGR of 11.66% from 2025 to 2033. Rising demand for minimally invasive diagnostics, an increase in gastrointestinal disorders, an aging population, improvements in wireless capsule technology, rising healthcare costs, and significant R&D investments from pharmaceutical and medical device companies are some of the major factors propelling the U.S. smart pill market.

United States Smart Pills Market Report by Application (Capsule Endoscopy, Patient Monitoring, Drug Delivery), Target Area (Esophagus, Small Intestine, Large Intestine, Stomach), End Users (Diagnostic Centers, Hospitals, Research Institutes, Others) and Company Analysis 2025-2033.

United States Smart Pills Market Overview

Smart pills, sometimes referred to as digital pills or ingestible sensors, are cutting-edge medications with microscopic electronic parts that allow for data collecting and remote monitoring. Patients often swallow these pills, which include transmitters, microchips, and sensors. After entering the body, they interact with biological fluids and communicate to external devices in real time information regarding a patient's physiological responses, medication adherence, and health indicators. This information is used by researchers and healthcare professionals to improve medication development, optimize treatment regimens, and improve patient care. By improving monitoring and data collection capabilities, smart tablets may have advantages in clinical trials, chronic illness management, and personalized treatment.

A number of important factors are driving the growth of the smart pill industry in the United States. The use of smart pill technologies is being aided by the growing need for less invasive diagnostic techniques, particularly in conditions pertaining to the gastrointestinal and colon. The demand for better diagnostics is further increased by the aging population, which is more susceptible to chronic illnesses. Smart pills are now more capable and dependable thanks to technological developments in wireless connection, sensors, and micro-cameras. Their acceptance is aided by improving infrastructure and rising healthcare costs. Furthermore, the pharmaceutical and medical device industries' significant investments in R&D are spurring innovation and broadening the range of uses.

Growth Drivers for the United States Smart Pills Market

Rising Prevalence of Chronic Diseases

One major factor propelling the growth of the smart pill market in the United States is the increasing incidence of chronic illnesses. Novel, non-invasive diagnostic approaches are needed for diseases such kidney disease, diabetes, and gastrointestinal disorders. As of February 2022, 92,000 people were waiting for kidney transplants, and an estimated 37 million Americans suffer from kidney disease, according to the American Kidney Fund. Furthermore, according to the American Cancer Society, there will likely be 79,000 new cases of kidney cancer detected in 2022, with men having a higher lifetime risk (2.02%) than women (1.03%). The need for sophisticated monitoring and diagnostic technologies, such smart pills, which facilitate early detection, ongoing health monitoring, and real-time data collection, is increasing as a result of these chronic illnesses. This tendency is propelling the use of smart pills and bolstering the market's expansion in the US, along with rising healthcare awareness and the need for minimally invasive remedies.

Technological Advancements

The market for smart pills in the United States is expanding due in large part to technological improvements. Real-time patient health monitoring is now possible thanks to advancements in wireless connection, downsizing, and sensor integration that have greatly improved the functionality of smart pills. These developments improve the ability of smart tablets to identify and treat diseases like cancer, chronic illnesses, and gastrointestinal issues. For example, in March 2023, etectRx (US) reached a noteworthy milestone by achieving 10,000 ingestions of its digital pill, the ID-Cap System. This product improvement illustrates how smart pills have the potential to revolutionize healthcare delivery by measuring patient adherence to oral prescriptions. It is anticipated that as technology advances, smart pills will provide even more features, which will encourage their use in home and hospital care settings.

Integration with Telemedicine

One of the key growth drivers for the US healthcare industry is the combination of smart pills and telemedicine. These cutting-edge ingestible gadgets make it possible to track patients' health parameters in real time, including physiological reactions, medication compliance, and gastrointestinal disorders. Smart pills improve patient outcomes by enabling prompt interventions and individualized treatment programs by sending this data to healthcare practitioners. The COVID-19 pandemic hastened the uptake of telemedicine and made it easier to implement smart pills for remote patient monitoring. This collaboration promotes the transition to patient-centric healthcare models that place a higher priority on convenience and ongoing monitoring, while also enhancing access to care, particularly in underprivileged areas. The use of smart pills to provide effective, remote healthcare is anticipated to increase as telemedicine develops, which will increase consumer demand.

Challenges in the United States Smart Pills Market

High Cost of Technology

The market for smart pills in the United States is significantly hampered by the high cost of technology. Smart pills are costly because they require sophisticated technology to be developed, manufactured, and integrated, including wireless connection, sensors, and downsizing. Due to the high cost, access may be restricted, especially for patients from lower-income groups or those without sufficient insurance coverage. The initial expenditures of equipment and training may also deter healthcare practitioners from implementing smart pill technology. Unless price improves, this could impede the broad acceptance and accessibility of smart pills, hence reducing their market growth.

Regulatory Approval

For the smart pill market in the United States, regulatory approval is a major obstacle. Approval procedures for smart pills can be drawn out and complicated due to the FDA and other regulatory agencies' strict safety and effectiveness requirements. Strict adherence to guidelines, data validation, and comprehensive clinical trials are necessary for this. Market expansion and the marketing of new products might be slowed down by approval delays. Furthermore, the constantly changing landscape of smart pill technology frequently creates regulatory uncertainty because the special characteristics of these cutting-edge medical devices may not be adequately addressed by current frameworks, making the licensing process more difficult.

Recent Developments in United States Smart Pills Industry

- In Jan 2025, The FDA has approved CapsoVision, Inc. (US) to use CapsoCam Plus in pediatric patients two years of age and up. A non-invasive, comfortable diagnostic approach that reduces the stress usually associated with standard endoscopic procedures, this milestone enables youngsters to benefit from the simplicity and accuracy of capsule endoscopy.

- In Jan 2024, The FDA approved the expanded indications for AnX Robotics' (US) NaviCam Small Bowel Video Capsule Endoscopy (SB) for adults and children ages 2 and up. This significant accomplishment solidifies NaviCam SB as the most cutting-edge technology in small bowel video capsule endoscopy, as does the FDA's recent approval of ProScan, the ground-breaking AI-assisted reading tool for VCE.

- In Feb 2022, The U.S. Food and Drug Administration (FDA) approved Check-Cap Ltd.'s modified Investigational Device Exemption (IDE) application, allowing the business to begin the pivotal research in the United States, the company reported.

United States Smart Pills Market Segments:

Application

- Capsule Endoscopy

- Patient Monitoring

- Drug Delivery

Target Area

- Esophagus

- Small Intestine

- Large Intestine

- Stomach

End Users

- Diagnostic Centers

- Hospitals

- Research Institutes

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Check-Cap Ltd.

- General Electric Company

- Fujifilm

- Koninklijke Philips N.V.

- Medtronic plc.

- Olympus Corporation

- Novartis AG

- Otsuka Holdings Co., Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Application, By Target Area and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Smart Pills Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Application

6.2 By Target Area

6.3 By End Users

7. Application

7.1 Capsule Endoscopy

7.2 Patient Monitoring

7.3 Drug Delivery

8. Target Area

8.1 Esophagus

8.2 Small Intestine

8.3 Large Intestine

8.4 Stomach

9. End Users

9.1 Diagnostic Centers

9.2 Hospitals

9.3 Research Institutes

9.4 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Check-Cap Ltd.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 General Electric Company

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Fujifilm

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Koninklijke Philips N.V.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Medtronic plc.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Olympus Corporation

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Novartis AG

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Otsuka Holdings Co., Ltd.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com