United States Epilepsy Drugs Market – Therapeutic Landscape & Forecast 2025–2033

Buy NowUnited States Epilepsy Drugs Market Size and Forecast 2025-2033

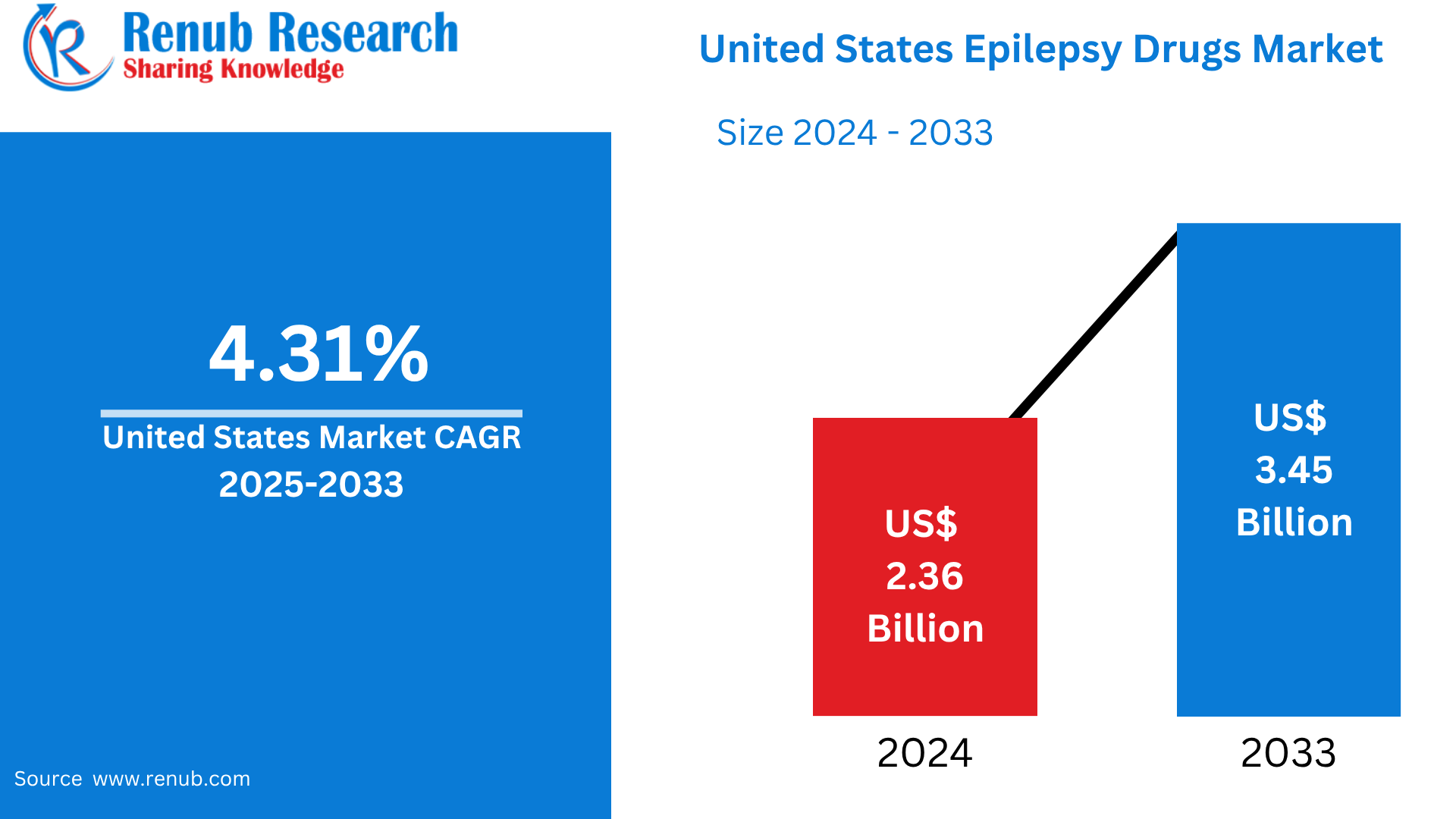

United States Epilepsy Drugs Market is expected to reach US$ 3.45 billion by 2033 from US$ 2.36 billion in 2024, with a CAGR of 4.31% from 2025 to 2033. In order to satisfy shifting customer needs, firms are being prompted by this transition to innovate and diversify their product lines. All things considered, the market for French-flavored milk is expected to grow further due to innovation, custom, and customer preferences.

United States Epilepsy Drugs Market Report by Drugs Category (First Generation Drugs, Second Generation Drugs, Third Generation Drugs), Seizure Types (Focal Seizures, Generalized Seizures, Non-Epileptic Seizures), Distribution Channels (Hospital Pharmacies, Drug Stores and Retail Pharmacies, Online Providers) and Company Analysis, 2025-2033.

United States Epilepsy Drugs Industry Overview

The market for epilepsy medications in the United States is a vibrant area of the larger neurology therapeutics business, with a wide range of antiepileptic medications (AEDs) that target different kinds of seizures. North America accounted for the greatest portion of the worldwide market for epilepsy medications in 2024, with the United States leading the way in terms of market size and revenue production. Due to their enhanced safety profiles and effectiveness, second-generation AEDs are growing at the quickest rate in the market, which is divided into first, second, and third-generation AEDs. The high demand for efficient treatment solutions is shown by the estimated 1.2% prevalence of epilepsy in the United States.

The prevalence of epilepsy has increased in the U.S. population. The seizures Foundation estimates that more than 3.4 million Americans suffer from seizures. Furthermore, 1 in 26 Americans are predicted to receive a diagnosis of epilepsy at some point in their lives, with over 150,000 receiving a diagnosis each year.

New developments in medication development have accelerated the market's growth even further. The FDA's 2022 approval of ganaxolone (Ztalmy) for the treatment of seizures linked to CDKL5 deficient condition was a noteworthy milestone that provided a new therapeutic option for a patient population that had previously been underserved. Furthermore, the growing investment in specialist epilepsy medicines is demonstrated by Lundbeck's $2.6 billion acquisition of Longboard Pharmaceuticals in 2024, which was intended to develop bexicaserin for the treatment of developmental and epileptic encephalopathies. These advancements are in line with the demand for treatments that target complicated and uncommon epilepsy disorders as well as the increased emphasis on customized therapy.

Key Factors Driving the United States Epilepsy Drugs Market Growth

Increasing Prevalence of Epilepsy

One of the main factors propelling market growth is the increasing prevalence of epilepsy in the United States. It affects around 2.9 million individuals who are 18 years of age or older, with a significant incidence in youngsters. The need for efficient anti-epileptic medications (AEDs) is increased by this expanding patient base. Certain demographics, such as those from minority racial and ethnic groups and those with lower educational attainment, are more likely to have the syndrome. As more people look for medical intervention and treatment alternatives, the market is growing as a result of growing awareness and diagnosis of epilepsy. In order to satisfy the needs of a varied patient population, this trend emphasizes the necessity of ongoing innovation and accessibility in the creation and distribution of AEDs.

Advancements in Drug Development

Second and third-generation anti-epileptic medications (AEDs), which have better effectiveness and safety profiles, have been introduced as a result of ongoing research and development efforts. These more recent drugs aim to overcome the drawbacks of previous therapies by improving seizure control while reducing adverse effects. For example, the FDA approved UCB's FINTEPLA (fenfluramine) oral solution in 2022 to treat Lennox-Gastaut syndrome-related seizures in individuals two years of age and older. These developments not only improve patient outcomes but also provide medical professionals more treatment alternatives. The dedication to meeting the unmet requirements of the epilepsy community is seen in the ongoing pipeline of new AEDs, which propels market expansion.

Favorable Regulatory Environment

Faster access to new medicines is made possible by the U.S. Food and Drug Administration's (FDA) accelerated approval of innovative anti-epileptic medications (AEDs). Pharmaceutical firms are encouraged to invest in the discovery of novel medicines by this regulatory assistance. Furthermore, programs like the Epilepsy Foundation's #RemoveTheFilter and National Epilepsy Awareness Month have raised public awareness and decreased stigma, which has encouraged more people to seek treatment. Because of these initiatives, the patient population is more informed, which increases the likelihood of diagnoses and treatment compliance. The market for epilepsy medications is expected to develop in a favorable environment because to a mix of supportive regulatory frameworks and increased public awareness.

Challenges in the United States Epilepsy Drugs Market

High Treatment Costs and Affordability Issues

Access to therapy is severely hampered by the rising costs of antiepileptic medications (AEDs) in the US. For example, generic drugs are frequently less expensive than name-brand ones, such as Fycompa and Aptiom, which may cost thousands of dollars a month. Generics are not always readily available, and some more recent AEDs do not have generic counterparts, which keeps their prices high. Furthermore, insurance coverage might vary; Medicare seniors are frequently not eligible for co-pay assistance programs, and other plans have hefty deductibles or co-pays. These monetary difficulties may cause patients to stop taking their medications, which raises the risk of seizures and related problems. In order to provide fair access to efficient epilepsy therapies, it is imperative that these economic concerns be addressed.

Regulatory Hurdles and Market Entry Delays

New antiepileptic medications (AEDs) must pass rigorous regulatory criteria enforced by the U.S. Food and Drug Administration (FDA), which include thorough documentation and lengthy clinical studies. For pharmaceutical firms, this stringent procedure may raise development costs and postpone the release of new medications. Furthermore, generic versions of important AEDs are introduced when their patents expire; although they are less expensive, they might not always satisfy the unique demands of every patient. People who need specialized care may have fewer alternatives due to these market factors. Additionally, market access and the profitability of AED development initiatives may be hampered by the drawn-out and expensive approval procedures linked to regulatory obstacles.

Market Segmentations

Drugs Category

- First Generation Drugs

- Second Generation Drugs

- Third Generation Drugs

Seizure Types

- Focal Seizures

- Generalized Seizures

- Non-Epileptic Seizures

Distribution Channel

- Hospital Pharmacies

- Drug Stores and Retail Pharmacies

- Online Providers

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Eisai Co., Ltd.

- UCB Inc.

- H. Lundbeck A/S

- GW Pharmaceuticals Plc.

- Abbott Laboratories

- Alkem Laboratories Limited

- Bausch Health Companies Inc.

- GSK plc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Drugs Category, By Seizure types and By Distribution Channels |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Exploring the Disease – Background and Key Insights

5.1 Introduction

5.2 Causes

5.3 Classificationof Epilepsies

5.3.1 West Syndrome

5.3.2 Dravet syndrome

5.3.3 Lennox–Gastaut syndrome

5.3.4 Landau–Kleffner syndrome

5.3.5 Epilepsy with continuous spike-and-waves during slow-wave sleep (ECSWS)

5.3.6 CDKL5 deficiency disorder (CDD)

5.4 Risk Factors

5.5 Pathophysiology

5.6 Diagnosis

5.6.1 Diagnostic Guidelines

5.6.1.1 NICE: Epilepsies in Children, Young People, and Adults (2022)

5.6.1.2 American Family Physician: Diagnostic Evaluation (2017)

5.6.1.3 The French National Authority for Health (HAS): 2020

5.6.1.4 German Society for Neurology (DGN) Guidelines: Diagnostics and Therapy in Neurology (2023)

5.7 Treatment

5.7.1 Antiepileptic Medications (AEDs)

5.7.2 Receptor Blockers

5.7.3 Others

5.7.4 Diet Therapy

5.7.5 Surgery

5.7.5.1 Phase I Evaluation (Noninvasive Tests)

5.7.5.2 Phase II Evaluation (Invasive Mon)

5.7.6 Treatment Algorithm for Medical Condition

5.7.7 Treatment Guidelines

5.7.7.1 American Epilepsy Society

5.7.7.2 American Family Physician – Epilepsy Treatment Options (2017)

5.7.7.3 The International League against Epilepsy (ILAE) Epilepsy Guidelines

5.7.7.4 NICE Guidelines: (2022)

5.7.8 Living and Coping with Epilepsy

6. United States Epilepsy Drugs Market

6.1 Historical Market Trends

6.2 Market Forecast

7. Market Share Analysis

7.1 By Drugs Category

7.2 By Seizure types

7.3 By Distribution Channels

8. Drugs Category

8.1 First Generation Drugs

8.2 Second Generation Drugs

8.3 Third Generation Drugs

9. Seizure Types

9.1 Focal Seizures

9.2 Generalized Seizures

9.3 Non-Epileptic Seizures

10. Distribution Channels

10.1 Hospital Pharmacies

10.2 Drug Stores and Retail Pharmacies

10.3 Online Providers

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Analysis of Marketed Medications/Drugs

13.1 Key Players

13.2 EPIDIOLEX/EPIDYOLEX (cannabidiol) – Jazz Pharmaceuticals

13.2.1 Description of Drugs

13.2.2 Regulatory Milestones

13.2.3 Clinical Development Process

13.2.4 Safety and Efficacy

13.3 XCOPRI/ONTOZRY(cenobamate) – SK Biopharmaceutical/ Pharma/Ono Pharmaceutical

13.3.1 Description of Drugs

13.3.2 Regulatory Milestones

13.3.3 Clinical Development Process

13.3.4 Safety and Efficacy

13.4 FINTEPLA (fenfluramine) – UCB/Nippon Shinyaku

13.4.1 Description of Drugs

13.4.2 Regulatory Milestones

13.4.3 Clinical Development Process

13.4.4 Safety and Efficacy

13.5 NAYZILAM (midazolam) nasal spray – UCB Pharma

13.5.1 Description of Drugs

13.5.2 Regulatory Milestones

13.5.3 Clinical Development Process

13.5.4 Safety and Efficacy

13.6 VALTOCO (diazepam nasal spray) – Neurelis/Aculys Pharma

13.6.1 Description of Drugs

13.6.2 Regulatory Milestones

13.6.3 Clinical Development Process

13.6.4 Safety and Efficacy

13.7 ZTALMY (ganaxolone) – Marinus Pharmaceuticals/Ovid Therapeutics/Orion

13.7.1 Description of Drugs

13.7.2 Regulatory Milestones

13.7.3 Clinical Development Process

13.7.4 Safety and Efficacy

13.8 BRIVIACT/NUBRIVEO (brivaracetam) – UCB Pharma

13.8.1 Description of Drugs

13.8.2 Regulatory Milestones

13.8.3 Clinical Development Process

13.8.4 Safety and Efficacy

13.9 FYCOMPA (perampanel) – Eisai/Catalyst Pharmaceutical

13.9.1 Description of Drugs

13.9.2 Regulatory Milestones

13.9.3 Clinical Development Process

13.9.4 Safety and Efficacy

13.10 OXTELLAR XR (oxcarbazepine) – Supernus Pharmaceuticals

13.10.1 Description of Drugs

13.10.2 Regulatory Milestones

13.10.3 Clinical Development Process

13.10.4 Safety and Efficacy

13.11 VIMPAT (lacosamide) – UCB Pharma/Daiichi Sankyo

13.11.1 Description of Drugs

13.11.2 Regulatory Milestones

13.11.3 Clinical Development Process

13.11.4 Safety and Efficacy

14. Analysis of Emerging Drugs

14.1 Key Cross Competition

14.2 XEN1101 – Xenon Pharmaceuticals

14.2.1 Description of Drug

14.2.2 Clinical Research & Development

14.2.3 Safety and efficacy

14.3 LIBERVANT (diazepam buccal film) – Aquestive Therapeutics/Atnahs Pharma (Pharmanovia)

14.3.1 Description of Drug

14.3.2 Clinical Research & Development

14.3.3 Safety and efficacy

14.4 Soticlestat (TAK-935) – Takeda/Ovid Therapeutics

14.4.1 Description of Drug

14.4.2 Clinical Research & Development

14.4.3 Safety and efficacy

14.5 COMFYDE (carisbamate) – SK Biopharmaceuticals (SK Life Science)

14.5.1 Description of Drug

14.5.2 Clinical Research & Development

14.5.3 Safety and efficacy

14.6 BHV-7000 (KB-3061) – Biohaven Pharmaceuticals/Knopp Biosciences

14.6.1 Description of Drug

14.6.2 Clinical Research & Development

14.6.3 Safety and efficacy

14.7 STACCATO alprazolam (benzodiazepine) – UCB Pharma/Alexza Pharmaceuticals

14.7.1 Description of Drug

14.7.2 Clinical Research & Development

14.7.3 Safety and efficacy

14.8 NBI-827104 (ACT-709478) – Neurocrine Biosciences/Idorsia Pharmaceuticals

14.8.1 Description of Drug

14.8.2 Clinical Research & Development

14.8.3 Safety and efficacy

14.9 Ivermectin (EQU-001) – Equilibre Biopharmaceuticals

14.9.1 Description of Drug

14.9.2 Clinical Research & Development

14.9.3 Safety and efficacy

15. Regulations and Reimbursement Policies

16. Key Players Analysis

16.1 Eisai Co., Ltd.

16.1.1 Overviews

16.1.2 Key Person

16.1.3 Recent Developments

16.1.4 Revenue

16.2 UCB Inc.

16.2.1 Overviews

16.2.2 Key Person

16.2.3 Recent Developments

16.2.4 Revenue

16.3 H. Lundbeck A/S

16.3.1 Overviews

16.3.2 Key Person

16.3.3 Recent Developments

16.3.4 Revenue

16.4 GW Pharmaceuticals Plc.

16.4.1 Overviews

16.4.2 Key Person

16.4.3 Recent Developments

16.4.4 Revenue

16.5 Abbott Laboratories

16.5.1 Overviews

16.5.2 Key Person

16.5.3 Recent Developments

16.5.4 Revenue

16.6 Alkem Laboratories Limited

16.6.1 Overviews

16.6.2 Key Person

16.6.3 Recent Developments

16.6.4 Revenue

16.7 Bausch Health Companies Inc.

16.7.1 Overviews

16.7.2 Key Person

16.7.3 Recent Developments

16.7.4 Revenue

16.8 GSK plc.

16.8.1 Overviews

16.8.2 Key Person

16.8.3 Recent Developments

16.8.4 Revenue

16.9 Novartis AG

16.9.1 Overviews

16.9.2 Key Person

16.9.3 Recent Developments

16.9.4 Revenue

16.10 Pfizer Inc.

16.10.1 Overviews

16.10.2 Key Person

16.10.3 Recent Developments

16.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com