Global Smart Pills Market Size, Trends & Forecast 2025-2033

Buy NowGlobal Smart Pills Market Size and Forecast 2025-2033

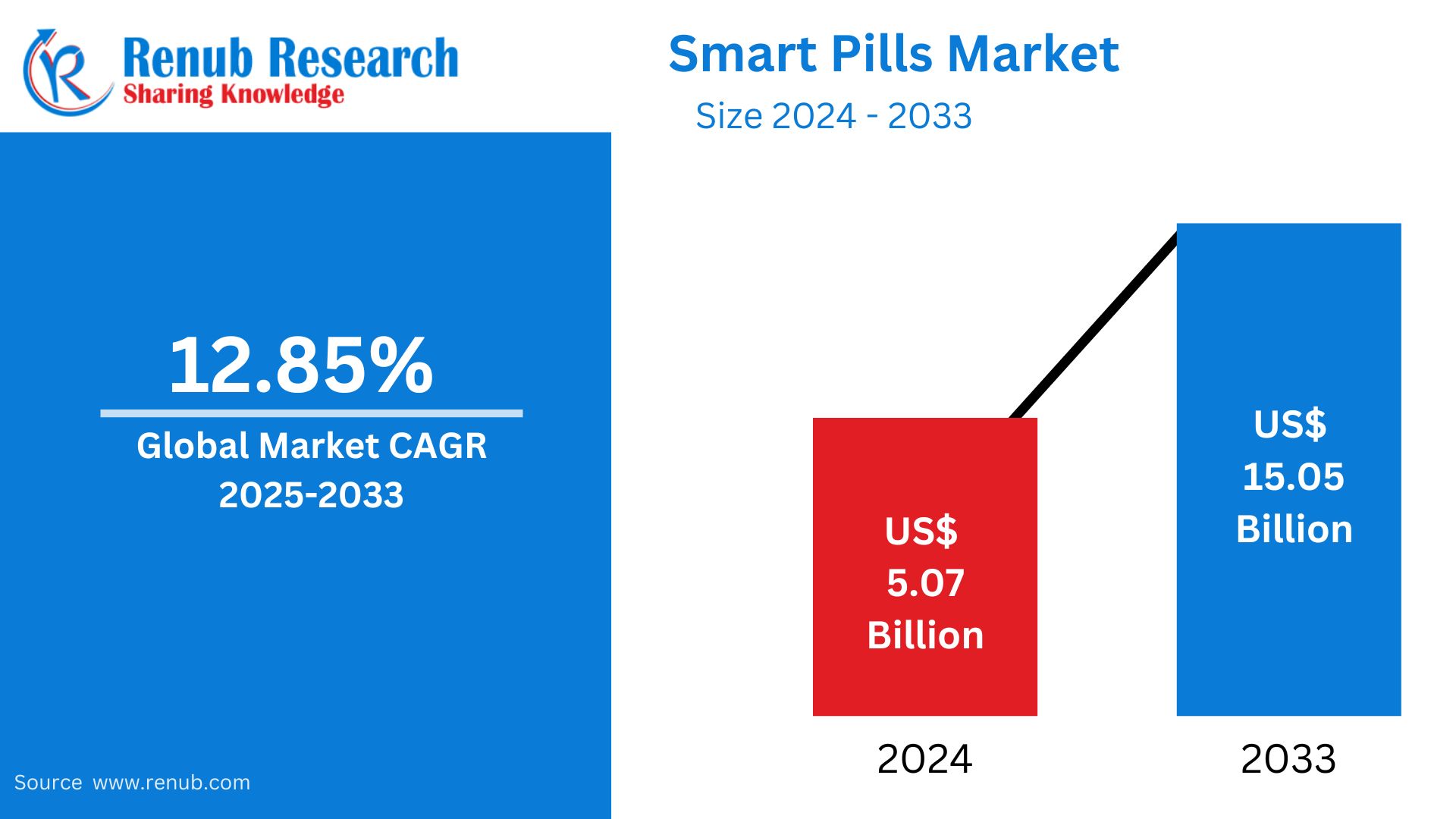

Smart Pills market is expected to reach US$ 15.05 billion by 2033 from US$ 5.07 billion in 2024, with a CAGR of 12.85% from 2025 to 2033. The geriatric population's growing need for chronic disease management, the quick development of technology, the growing popularity of minimally invasive surgeries (MIS), and the pharmaceutical industry's growing emphasis on drug delivery and personalized medicine are some of the key factors driving the market.

The report Smart Pills Market & Forecast covers by Application (Capsule Endoscopy, Patient Monitoring, Drug Delivery), Target Area (Esophagus, Small Intestine, Large Intestine, Stomach), End-Users (Diagnostic Centers, Hospitals, Research Institutes, Others), Countries and Company Analysis 2025-2033.

What are Smart Pills? Definition & Overview

Smart pills, sometimes known as digital pills, are antibiotics that contain automated, edible parts that, when consumed, send wireless signals to various external devices, such as tablets, patches, or cell phones. These systems include an insulin pump, a blood sugar meter, a drug artificial lake, and portable delivery devices. They began as capsule-sized vitamin pills and have now evolved into wearable gadget devices, mobile device applications, and provider portals. Smart tablets have emerged as a useful tool in the field of gastrointestinal diagnosis because of their non-invasive nature. The gastrointestinal tract was represented on the smart tablet to facilitate the identification and monitoring of lesions and illness conditions.

Smart pills can help with prescription non-adherence and allow a doctor to monitor a patient's medication usage patterns. The strong demand for less invasive operations, the increased focus on patient convenience, and technological developments like integrated circuit shrinkage are all expected to drive the industry's growth. The market for smart pills is being driven by the increasing need for advanced drug delivery systems that offer benefits such tailored drug administration, safer carriers, less side effects, less frequent dosing, and optimal use of active pharmaceutical ingredients.

In an effort to combat addictive pharmaceuticals, PillSafe introduced a smart pill bottle for prescribed medications in January 2024 along with new disruptive technology.

Growth Drivers for the Smart Pills Market

Continuous improvements in technology

The market for smart pills has expanded thanks in large part to developments in wireless connectivity, sensors, and miniature electronics. Smaller, easier-to-ingest smart pills have been developed as a result of these technological advancements, improving patient comfort and compliance while lowering the possibility of discomfort or resistance during ingestion. Moreover, the downsizing of components has not only lowered production costs but also increased the overall efficiency and lifetime of smart tablets. As a result, consumers and healthcare professionals may use more affordable and accessible options, and the medical community has come to appreciate smart pills' improved accuracy and dependability, which has helped the industry grow.

Growing interest in innovative drug delivery and personalized medicine

Another motivating element is the pharmaceutical industry's increasing interest in precision medication delivery systems and individualized therapy. A novel method of delivering drugs straight to the intended location in the body is provided by smart tablets. While reducing adverse effects, this focused drug delivery can improve therapeutic effectiveness. In order to enhance drug development and guarantee that prescriptions are customized to meet the needs of each patient, pharmaceutical companies are investing more and more in smart pill technology. In addition, smart pills can be used in clinical studies to collect data on the effects of the drug in real time, which might expedite the research process and possibly hasten the release of novel treatments.

Management of chronic diseases and the aging population

The growing number of elderly people worldwide is one important factor. Chronic conditions including diabetes, high blood pressure, and heart disease are more common as the population's average age increases. Medication adherence and ongoing monitoring are frequently necessary for the management of these disorders. By providing non-invasive, real-time data collecting on a patient's health indicators, smart pills offer a novel alternative. Older patients who might struggle with traditional monitoring techniques will especially benefit from this remote monitoring feature. The quality of care for older people can be enhanced by healthcare providers using data from smart pills to make prompt interventions, modify treatment programs, and guarantee better disease management.

Challenges in the Smart Pills Market

Integration with healthcare systems

Since smooth data interoperability is necessary for the broad adoption of smart pills, integration with healthcare systems is a significant barrier for the market. Large volumes of patient data, including biometrics, medication adherence, and treatment progress, are gathered via smart pills. This data must be successfully integrated with current health information systems and electronic health records (EHR) in order to be helpful. Data interchange is challenging, though, because healthcare institutions frequently employ disparate platforms and formats. Delays in diagnosis, treatment, and decision-making may result from this lack of consistency. Healthcare professionals can also have trouble deciphering data from smart gadgets. Improving patient care and health outcomes requires seamless data transfer between smart pills, physicians, and patient management systems.

Regulatory hurdles

The market for smart pills has major regulatory obstacles since approving these devices can be a difficult, expensive, and time-consuming procedure. The FDA in the United States, the European Medicines Agency (EMA) in Europe, and other regulatory agencies across the world have strict controls on smart pills since they are regarded as medical devices or drug-delivery systems. There are differences in approval timelines since every location has different standards and procedures for safety, efficacy, and clinical trials. Manufacturers who must manage these many procedures may experience delays in product introductions and higher expenses as a result of this regulatory fragmentation. The commercial environment is further complicated by changing laws pertaining to cybersecurity, data privacy, and digital health, which necessitate constant modification to maintain compliance and win acceptance in foreign countries.

In smart pills, capsule endoscopy may play a significant role

Capsule endoscopy might stand out as a leading application in the global smart pills market. This is because of its minimally invasive nature and complete visualization skills of the gastrointestinal tract. Capsule endoscopy, which provides ease of management and targeted examination without requiring traditional endoscopic approaches, is increasingly preferred by sufferers and healthcare companies. Its ability to offer accurate diagnostic facts while ensuring patient comfort and convenience positions it as an essential driver in the continued increase of the smart pills market.

One significant market niche for smart tablets worldwide is the esophageal region

The esophagus is among the significant segments in the global smart pills market. This is due to its crucial role in digestive health and the diagnosis of various gastrointestinal disorders. Smart pills designed for esophageal tracking provide a non-invasive and convenient technique for assessing situations like gastroesophageal reflux disease (GERD), esophagitis, and Barrett's esophagus. By providing real-time data on esophageal features and potential abnormalities, these smart pills enable early detection, specific analysis, and personalized remedy techniques, driving their need and adoption in the healthcare enterprise.

Diagnostic clinics may grow to be a sizable market niche for smart pills

Diagnostic centers could emerge as a considerable global smart pills market segment. This is owed to their pivotal role in healthcare diagnostics. Smart pills offer a non-invasive and efficient technique for diagnosing gastrointestinal issues and tracking situations, including colon cancer, Crohn's sickness, and minor bowel issues. Integrating smart pill technology into diagnostic center services enhances diagnostic accuracy, patient comfort, and universal healthcare performance, propelling their adoption and prominence in the smart pills market.

Smart Pills Market Overview by Regions

Based on country, the global smart pills market is organized into North America (United States, Canada), Europe (France, Germany, Italy, Spain, United Kingdom, Belgium, the Netherlands, and Turkey), Asia Pacific (China, Japan, India, Australia, South Korea, Thailand, Malaysia, Indonesia, and New Zealand), Latin America (Brazil, Mexico, and Argentina), Middle East & Africa (South Africa, Saudi Arabia, and the United Arab Emirates). The United States asserts dominance in the global smart pills market. This is attributed to its advanced healthcare infrastructure, robust technological innovation, and a high prevalence of chronic diseases.

United States Smart Pills Market

The market for smart pills in the US is expanding significantly due to biotechnology advancements, rising healthcare demands, and the growing desire for remote patient monitoring. The need for non-invasive, effective solutions, such as smart tablets that track patient health and medication adherence, has increased due to the huge aging population and the rise in chronic diseases. Drug delivery system advancements, individualized therapy, and improved diagnostic capabilities are important motivators. Strong healthcare infrastructure, significant investments in digital health technology, and advantageous regulatory frameworks—especially from the FDA—all contribute to the market's strength. But there are still issues like exorbitant development costs, complicated regulations, and privacy issues. Smart pills have the potential to significantly improve patient care and treatment outcomes in the US market as healthcare continues to change.

AnX Robotica Corp. (US) introduced the NaviCam Small Bowel System in the US in February 2023. A key component in the prognosis of intestinal disorders, the NaviCam SB System uses spherical lens ears to reduce distortion and enhance the sector of vision.

Germany Smart Pills Market

The market for smart pills is growing quickly in Germany thanks to a robust healthcare system, cutting-edge technology, and a growing emphasis on individualized therapy. The introduction of smart pills is facilitated by Germany's extensive healthcare system and established regulatory framework. The desire for non-invasive diagnostic solutions, the nation's aging population, and the rise in chronic illness incidence are the main drivers of market expansion. Smart pills are being used more and more in German diagnostic and medical facilities for purposes like chronic illness management, medication adherence tracking, and capsule endoscopy. Additionally, local tech and pharmaceutical businesses make large investments in R&D, which fosters innovation in smart pill technologies. For Germany's industry to continue growing, however, obstacles including complicated regulations, worries about data protection, and reimbursement issues must be overcome.

India Smart Pills Market

India's market for smart pills is expected to grow quickly due to the country's vast population, rising chronic disease incidence, and growing healthcare needs. Smart pills provide a non-invasive, effective way to monitor and manage medical issues as India moves toward digital health solutions. The industry gains from advancements in diagnostic technologies including capsule endoscopy, enhanced drug administration methods, and a growing interest in personalized treatment. Additionally, the adoption of smart pills is facilitated by India's growing healthcare investments and infrastructure. However, issues like lack of awareness among patients and healthcare professionals, affordability, and regulatory ambiguity need to be addressed. If these obstacles are removed and the IT and pharmaceutical industries work together more, India's smart pill business may rise to prominence in the global healthcare system.

Saudi Arabia Smart Pills Market

Saudi Arabia's ambition to modernize its healthcare system under the Vision 2030 project is driving the country's growing smart pill business. Adoption of smart pills presents a possible alternative for remote monitoring, individualized medication, and non-invasive diagnostics in light of increased healthcare demands, an aging population, and an increasing burden of chronic diseases. Market expansion is aided by the government's emphasis on healthcare innovation and large investments in digital health technologies. Smart tablets have the potential to improve healthcare delivery, expedite treatment procedures, and increase patient adherence. Regulatory obstacles, data security worries, and the high expense of putting such cutting-edge technologies into practice are obstacles, though. The industry is anticipated to grow considerably as infrastructure and awareness increase, positioning Saudi Arabia as a major player in the regional smart pill market.

Smart Pills Market Segmentation:

Application

- Capsule Endoscopy

- Patient Monitoring

- Drug Delivery

Target Area

- Esophagus

- Small Intestine

- Large Intestine

- Stomach

End-Users

- Diagnostic Centers

- Hospitals

- Research Institutes

- Others

Regional Insights:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Check-Cap Ltd.

- General Electric Company

- Fujifilm

- Koninklijke Philips N.V.

- Medtronic plc

- Olympus Corporation

- Novartis AG

- Otsuka Holdings Co., Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Target Area, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Smart Pills Market

6. Market Share

6.1 By Application

6.2 By Target Area

6.3 By End Users

6.4 By Country

7. Application

7.1 Capsule Endoscopy

7.2 Patient Monitoring

7.3 Drug Delivery

8. Target Area

8.1 Esophagus

8.2 Small Intestine

8.3 Large Intestine

8.4 Stomach

9. End Users

9.1 Diagnostic Centers

9.2 Hospitals

9.3 Research Institutes

9.4 Others

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Check-Cap Ltd.

13.1.1 Company Overview

13.1.2 Product Portfolio

13.1.3 Recent Developments/Updates

13.1.4 Financial Performance

13.2 General Electric Company

13.2.1 Company Overview

13.2.2 Product Portfolio

13.2.3 Recent Developments/Updates

13.2.4 Financial Performance

13.3 Fujifilm

13.3.1 Company Overview

13.3.2 Product Portfolio

13.3.3 Recent Developments/Updates

13.3.4 Financial Performance

13.4 Koninklijke Philips N.V.

13.4.1 Company Overview

13.4.2 Product Portfolio

13.4.3 Recent Developments/Updates

13.4.4 Financial Performance

13.5 Medtronic plc

13.5.1 Company Overview

13.5.2 Product Portfolio

13.5.3 Recent Developments/Updates

13.5.4 Financial Performance

13.6 Olympus Corporation

13.6.1 Company Overview

13.6.2 Product Portfolio

13.6.3 Recent Developments/Updates

13.6.4 Financial Performance

13.7 Novartis AG

13.7.1 Company Overview

13.7.2 Product Portfolio

13.7.3 Recent Developments/Updates

13.7.4 Financial Performance

13.8 Otsuka Holdings Co., Ltd.

13.8.1 Company Overview

13.8.2 Product Portfolio

13.8.3 Recent Developments/Updates

13.8.4 Financial Performance

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com