United States Next Generation Sequencing Market – Applications & Forecast 2025–2033

Buy NowUnited States Next Generation Sequencing Market Size and Forecast 2025-2033

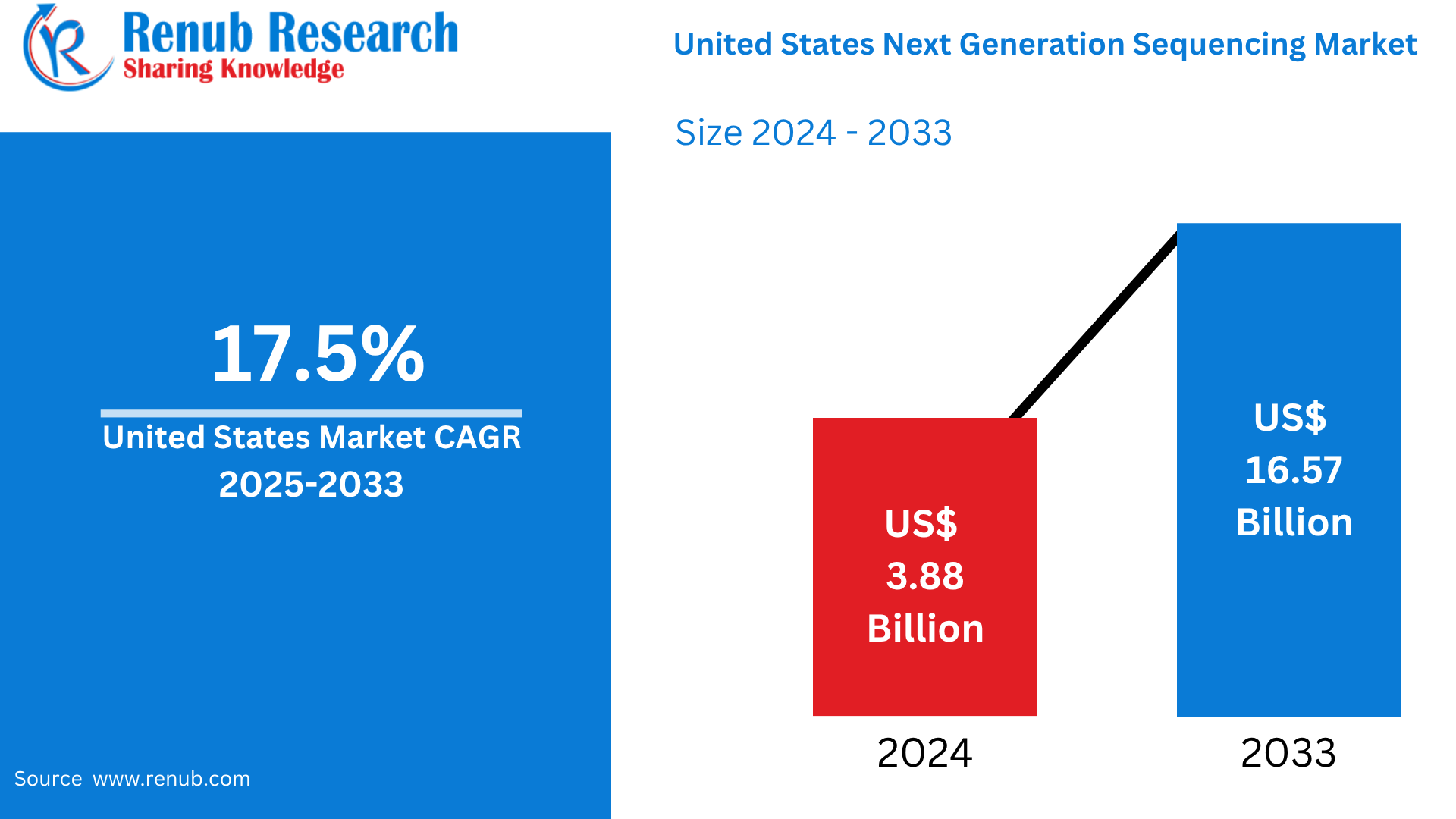

United States Next Generation Sequencing Market is expected to reach US$ 16.57 billion by 2033 from US$ 3.88 billion in 2024, with a CAGR of 17.5% from 2025to2033. Some of the main reasons propelling the market include the growing demand for tailored medications from the general public, the growing use of products in environmental and agricultural research, and many developments in automation and data analysis.

United States Next Generation Sequencing Market Report by Product (Instruments, Reagents & Consumables, Services), Application (Diagnostics, Agriculture and Animal Research, Drug Discovery, Personalized Medicine and Genetic Screening, Others), Technology (Sequencing by Synthesis, Ion Semiconductor Sequencing, Single Molecule Read Time Sequencing, Nanopore Sequencing, Others), End User (Academic and Clinical Research Centers, Pharmaceutical and Biotechnology Companies, Hospitals and Clinics, Others) and Company Analysis, 2025-2033.

United States Next Generation Sequencing Market Overview

In molecular biology, next generation sequencing (NGS), sometimes referred to as high-throughput sequencing, is a state-of-the-art technique that establishes the exact arrangement of nucleotides (adenine, guanine, cytosine, and thymine) in a DNA or RNA molecule. NGS has transformed genomics research by making it possible for researchers to quickly and affordably sequence vast amounts of genetic material. Numerous sectors, including genomics, genetics, customized medicine, and biomedical research, can benefit from this technique. In a single run, these machines may produce enormous volumes of sequencing data. Applications such as transcriptomics, metagenomics, whole-genome sequencing, and others depend on this high throughput. Each of the several NGS platforms has its own chemistry and technology. Oxford Nanopore Technologies, Pacific Biosciences (PacBio), Ion Torrent (now a division of Thermo Fisher Scientific), and Illumina are a few examples of popular systems. Every platform has distinct benefits and drawbacks that affect which applications it is appropriate for.

The market for next-generation sequencing in the US has grown significantly in recent years due to the rising need for customized therapy. NGS is being used more and more by pharmaceutical firms and healthcare practitioners to examine the genomes of individual patients, allowing for the creation of targeted treatments and the personalization of treatment regimens. This strategy minimizes the use of useless medicines, improving patient outcomes and lowering healthcare expenditures. The market's growth of applications outside of healthcare is another noteworthy trend. Environmental research and agriculture are increasingly using the technique extensively. By using NGS to examine the genetic composition of crops and livestock, scientists and farmers may create more robust and effective farming methods.

In order to better understand ecological dynamics and the effects of human activity on the environment, environmental researchers also utilize NGS to track biodiversity, analyze ecosystems, and keep an eye on environmental changes. Additionally, improvements in automation and data analysis are driving the use of NGS. The entrance hurdle for labs and research centers is decreasing as sequencing machines become more automated and intuitive to operate. Because of its accessibility and the growing number of bioinformatics tools and software available, a wider range of companies may now take use of NGS technology.

Key Factors Driving the United States Next Generation Sequencing Market Growth

Advancements in Sequencing Technology

Genome sequencing has been transformed by Illumina's NovaSeq X series, which dramatically lowers prices while boosting throughput. For example, the NovaSeq X Plus doubles the speed of earlier versions and can sequence more than 20,000 complete genomes each year at about $200 per genome. The XLeap-SBS chemistry and ultra-high-density flow cells, which improve data output and accuracy, are credited with this breakthrough. The DRAGEN IT platform's integration of onboard secondary analysis significantly optimizes processes, increasing the affordability and accessibility of genetic medicine. These advancements in technology are essential to democratizing clinical applications and genetic research.

Government Funding and Initiatives

Next-generation sequencing (NGS) technology has advanced thanks in large part to the U.S. government's expenditures in genomics research. Large-scale genomic research and infrastructure development are supported by substantial funding provided by organizations such as the National Institutes of Health (NIH). To customize treatment, for instance, the NIH's All of Us Research Program seeks to collect a variety of genetic data. These programs make it easier to use NGS into clinical practice, opening the door to precision medicine techniques. Recent regulatory changes, such as limitations on indirect research expenses, have sparked worries about how they can affect current and upcoming genomic research initiatives.

Increased Adoption in Clinical Diagnostics

Clinical diagnostics is using next-generation sequencing more and more because it provides thorough insights into infectious illnesses, cancer genomes, and genetic abnormalities. Sequencing complete genomes or exomes allows doctors to detect genetic changes with great precision, which results in more accurate diagnoses and individualized treatment regimens. Because targeted medicines may be guided by an understanding of tumor genetics, this method is especially advantageous in oncology. NGS's revolutionary promise to improve patient care and results is shown in its expanding use in clinical settings.

Challenges in the United States Next Generation Sequencing Market

High Costs of NGS and Associated Infrastructure

One of the biggest obstacles to Next Generation Sequencing (NGS) in the US market is still its high cost. Platforms like PacBio Sequel and Illumina NovaSeq need significant capital commitment, which frequently restricts access to big research institutes or well-funded businesses. Budgets are further strained by ongoing expenditures for reagents, system maintenance, and the processing and storage of massive genomic datasets, in addition to equipment costs. This is particularly true for startups and smaller labs. The cost-benefit ratio of NGS is still up for dispute in clinical settings, mostly because insurance companies' coverage is restricted and payment regulations are unclear. The integration of NGS into standard diagnostics and customized medicine processes is slowed down by these expensive obstacles, which also prevent wider use.

Competition and Market Saturation

Although there is fierce competition in the U.S. Next Generation Sequencing (NGS) sector, a small number of powerful companies dominate it, most notably Illumina, which commands a substantial market share. This concentration of power can create significant obstacles to entry for new businesses, restrict price flexibility, and hinder innovation. Established companies that own important patents, distribution networks, and client ties are frequently too strong for smaller competitors to compete with. The business is further made more difficult by the quick development of new technologies like CRISPR-based diagnostic tools and long-read sequencing (e.g., PacBio, Oxford Nanopore). Despite their potential, these developments raise questions about future industry standards and may cause stakeholders to postpone making investment choices as they wait to see whether platforms become clinically and commercially viable over the long run.

Market Segmentations

Product

- Instruments

- Reagents & Consumables

- Services

Application

- Diagnostics

- Agriculture and Animal Research

- Drug Discovery

- Personalized Medicine and Genetic Screening

- Others

Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Single Molecule Read Time Sequencing

- Nanopore Sequencing

- Others

End User

- Academic and Clinical Research Centers

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Illumina

- Thermo Fisher Scientific

- Pacific Biosciences

- QIAGEN N.V

- Roche

- Bio-Rad Laboratories, Inc.

- Takara Bio Inc.

- Hamilton Company

- Geneious

- BioMérieux SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Application, By Technology and By End User |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Next Generation Sequencing Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By Application

6.3 By Technology

6.4 By End User

7. Product

7.1 Instruments

7.2 Reagents & Consumables

7.3 Services

8. Application

8.1 Diagnostics

8.2 Agriculture and Animal Research

8.3 Drug Discovery

8.4 Personalized Medicine and Genetic Screening

8.5 Others

9. Technology

9.1 Sequencing by Synthesis

9.2 Ion Semiconductor Sequencing

9.3 Single Molecule Read Time Sequencing

9.4 Nanopore Sequencing

9.5 Others

10. End User

10.1 Academic and Clinical Research Centers

10.2 Pharmaceutical and Biotechnology Companies

10.3 Hospitals and Clinics

10.4 Others

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Illumina

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Thermo Fisher Scientific

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Pacific Biosciences

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 QIAGEN N.V

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Roche

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Bio-Rad Laboratories, Inc.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Takara Bio Inc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Hamilton Company

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Geneious

13.9.1 Overviews

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

13.10 BioMérieux SA

13.10.1 Overviews

13.10.2 Key Person

13.10.3 Recent Developments

13.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com