UAE Halal Cosmetics Market Overview 2025–2033

Buy NowUAE Halal Cosmetics Market Size and Forecast

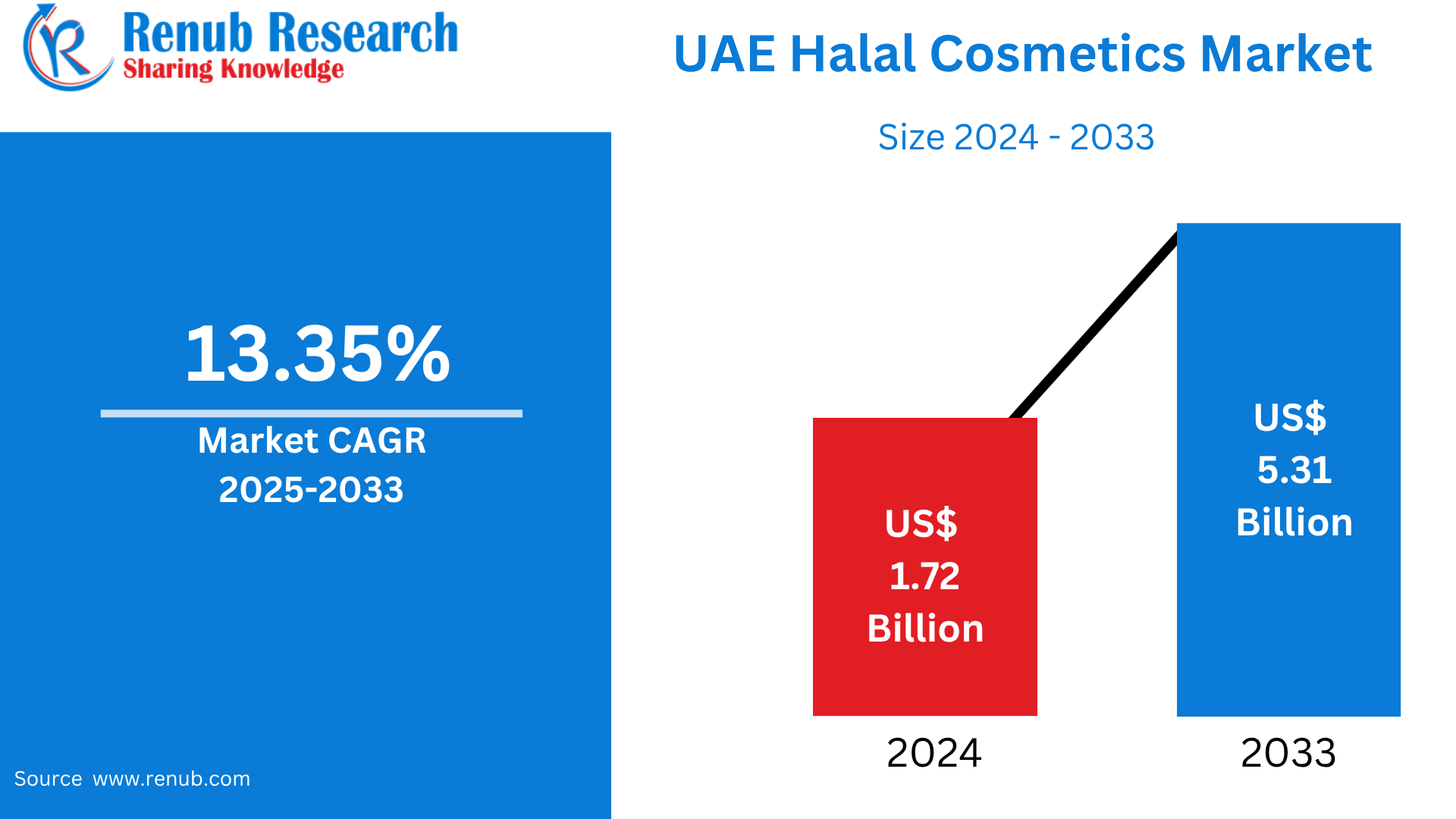

UAE Halal Cosmetics Market is expected to reach US$ 5.31 billion by 2033 from US$ 1.72 billion in 2024, with a CAGR of 13.35% from 2025 to 2033. Growing religious observance, the desire for natural and ethical goods, increased disposable incomes, the growth of e-commerce, and influencer marketing that raises consumer knowledge and product accessibility are the main factors propelling the UAE's halal cosmetics business.

UAE Halal Cosmetics Market Report by Product Type (Personal Care Products, Color Cosmetics, Fragrances), Application (Hair Care, Skin Care, Face Care, Beauty Care), Distribution Channel (Hypermarkets & Supermarket, Online Stores, Convenience Stores, Specialty Stores, Others) and Company Analysis, 2025-2033.

UAE Halal Cosmetics Industry Overview

Growing consumer awareness of environmental, ethical, and religious beauty goods is fueling the UAE's halal cosmetics market's rapid expansion. Because they don't include alcohol, substances originating from animals, or cruelty, halal cosmetics are in line with Islamic principles and are becoming more and more popular among Muslims and non-Muslims looking for safer, cleaner substitutes. The demand for cosmetics with halal certification has increased as customers get more aware of the components and origins of the beauty items they purchase. Government programs encouraging halal certification and rising awareness of preserving cultural identity have also supported industry growth. The UAE is a great place for both domestic and foreign firms to launch halal beauty products because of its status as a regional center for beauty.

Halal cosmetics are becoming more widely available thanks in large part to the growth of internet platforms and e-commerce. Customers may now experience a variety of halal-certified items from both domestic and international companies thanks to the expanded reach made possible by online shopping platforms. The appeal of halal items, particularly among younger people, has also been greatly aided by social media marketing and beauty influencers.

Additionally, the industry is expanding due to increased disposable incomes and a growing demand for high-end, organic personal care products. Innovation in packaging and formulations, as well as more extensive certification initiatives, will continue to influence the growth of the halal beauty market. Due to favorable legislation, robust consumer demand, and greater investment in product research and marketing, the halal cosmetics market in the United Arab Emirates is expected to rise gradually.

Key Factors Driving the UAE Halal Cosmetics Market Growth

Compliance with Religion and Culture

The UAE's desire for halal cosmetics is mostly driven by religious and cultural beliefs. Muslims are increasingly looking for goods that adhere to Islamic law, which forbids the use of non-halal components like alcohol and pig byproducts. Cosmetics with halal certification reassure consumers that the ingredients they use are responsibly obtained and acceptable, fulfilling their religious duties. In addition to promoting customer trust, this compliance increases brand loyalty. Furthermore, regulatory assistance and certification procedures provide transparency and quality assurance as the UAE markets itself as a global center for halal products. The cleanliness and morality of halal cosmetics also appeal to non-Muslim buyers, which grows the clientele and propels market expansion.

Growing Knowledge of Clean and Ethical Beauty

UAE consumers are becoming more conscious of the value of ecological, ethical, and clean beauty goods. By definition, halal cosmetics are cruelty-free, vegan, and devoid of harsh chemicals—qualities that align with the worldwide clean beauty trend. Because of their perceived safety and integrity, more customers are choosing halal-certified products as worries about skin sensitivity, animal welfare, and environmental effect increase. Users who are concerned about their health and the environment are also drawn to ethical branding and openness in sourcing and production methods. Customers are now pickier and more knowledgeable due to the increased awareness brought about by social media and digital platforms. The demand for halal cosmetics is rising dramatically as a result of this change in consumer perception, which presents them as an ethical and religious option for beauty.

Growing Number of Muslims and Youth Populations

The market for halal cosmetics is mostly driven by the UAE's expanding Muslim population as well as a youthful, image-conscious populace. Social media trends have a big impact on young customers, especially millennials and Gen Z, who quickly embrace new cosmetic products that align with their ideals and way of life. This generation appreciates cultural fit and ethical sourcing in addition to esthetic efficacy. The desire to display religious identity without sacrificing contemporary aesthetics is another factor driving demand for halal-certified items. This market segment is essential to the long-term future of the skincare and beauty industry because young people are more prepared to invest in high-end, halal-certified goods as their disposable incomes rise.

Challenges in the UAE Halal Cosmetics Market

Insufficient Standardized Certification

The lack of a widely accepted and uniform certification system is one of the biggest obstacles facing the halal cosmetics industry in the United Arab Emirates. Different certification organizations follow different rules, which causes discrepancies in the validity of products and halal labeling. Customers become confused as a result, with many not knowing which certificates to believe. As a result, brand reputation may suffer as trust in halal claims declines. Additionally, "halal-washing," in which companies falsely advertise their goods as halal without conducting the necessary certification, is made possible by the absence of a single, consistent rule. This damages the market's credibility in addition to misleading customers. These problems may be resolved and market openness increased with the support of a standardized, government-backed certification program.

High Production Costs

The production of cosmetics with halal certification entails careful procedures to guarantee adherence to Islamic law, such as the use of premium, acceptable materials and manufacturing facilities free from contamination. Compared to traditional cosmetics, production is substantially more costly due to these criteria, which also raise the cost of raw materials and operations. Higher overheads are also a result of the requirement for periodic audits, halal-certified sourcing, and stringent supply chain inspections. Because of this, these expenses are usually passed on to clients, which limits the availability of halal cosmetics, especially for those who are price conscious. This disparity in pricing may hamper competitiveness versus mainstream, non-halal alternatives and impede further market acceptance. The financial strain can be even more difficult for smaller firms, which limits their capacity to grow or innovate in the marketplace.

Market Segmentations

Product Type

- Personal Care Products

- Color Cosmetics

- Fragrances

Application

- Hair Care

- Skin Care

- Face Care

- Beauty Care

Distribution Channel

- Hypermarkets & Supermarket

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Estee Lauder

- L’Oréal

- S&J International Enterprises

- Kao Corporation

- Clara International Beauty Group

- INIKA

- AMARA COSMETICS

- WARDAH COSMETICS

- SAMPURE MINERALS

- HALAL COSMETICS COMPANY

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application and Distribution Channel |

| Distribution Channel Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. UAE Halal Cosmetics Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By Distribution Channel

7. Product Type

7.1 Personal Care Products

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Color Cosmetics

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Fragrances

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

8. Application

8.1 Hair Care

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Skin Care

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Face Care

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

8.4 Beauty Care

8.4.1 Market Analysis

8.4.2 Market Size & Forecast

9. Distribution Channel

9.1 Hypermarkets & Supermarket

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Online Stores

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Convenience Stores

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Specialty Stores

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Others

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

10. Value Chain Analysis

11. Regulatory and Policy Landscape

11.1 Certification Standards

11.2 Labeling Requirements

11.3 Import/Export Regulations

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Estee Lauder

14.2 L’Oréal

14.3 S&J International Enterprises

14.4 Kao Corporation

14.5 Clara International Beauty Group

14.6 INIKA

14.7 AMARA COSMETICS

14.8 WARDAH COSMETICS

14.9 SAMPURE MINERALS

14.10 HALAL COSMETICS COMPANY

15. Key Players Analysis

15.1 Estee Lauder

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 L’Oréal

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 S&J International Enterprises

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Kao Corporation

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Clara International Beauty Group

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 INIKA

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 AMARA COSMETICS

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 WARDAH COSMETICS

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 SAMPURE MINERALS

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 HALAL COSMETICS COMPANY

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com