Saudi Arabia Halal Cosmetics Market Outlook 2025–2033

Buy NowSaudi Arabia Halal Cosmetics Market Size

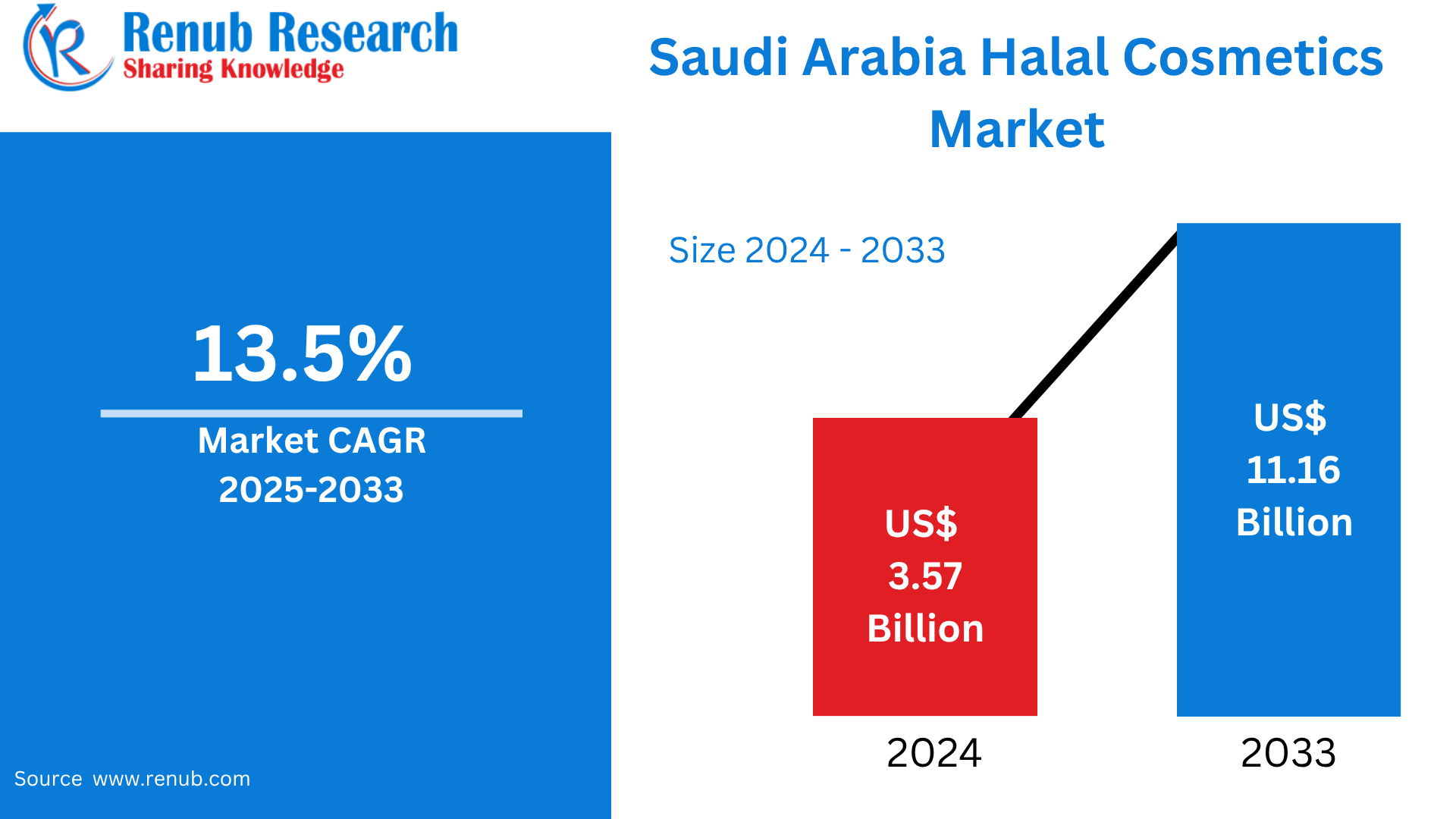

Saudi Arabia Halal Cosmetics Market is expected to reach US$ 11.16 billion by 2033 from US$ 3.57 billion in 2024, with a CAGR of 13.5% from 2025 to 2033. Rising religious observance, customer demand for ethical and chemical-free products, government backing under Vision 2030, rising female purchasing power, social media influence, and growing e-commerce accessibility and convenience are the main factors driving the growth of the Saudi Arabian halal cosmetics market.

Saudi Arabia Halal Cosmetics Market Report by Product Type (Personal Care Products, Color Cosmetics, Fragrances), Application (Hair Care, Skin Care, Face Care, Beauty Care), Distribution Channel (Hypermarkets & Supermarket, Online Stores, Convenience Stores, Specialty Stores, Others) and Company Analysis 2025-2033.

Saudi Arabia Halal Cosmetics Industry Overview

Cosmetics that adhere to Islamic law (Shariah) are known as halal cosmetics. These items don't contain any haram (forbidden) ingredients like alcohol or substances derived from animals, such pork or animal fats that aren't halal. In keeping with moral and environmentally friendly standards, halal cosmetics also steer clear of harsh ingredients and are frequently cruelty-free. The production procedure guarantees hygienic conditions, cleanliness, and the absence of cross-contamination with non-halal materials. Due to growing awareness of clean beauty standards, halal cosmetics, which are popular among Muslim consumers, are becoming more and more popular. They contain a variety of products that have been approved by halal authorities, such as skincare products, cosmetics, hair care products, and fragrances.

The market for halal cosmetics in Saudi Arabia is expanding rapidly due to a number of important considerations. One important factor is the growing knowledge and acceptance of halal lifestyles among consumers, who are looking for items that adhere to Islamic values and steer clear of substances like alcohol and pork byproducts. The halal business has benefited from government initiatives like the Saudi Vision 2030, which have created a favorable atmosphere for market growth. Additionally, consumers' discretionary expenditure on personal care goods has increased due to growing middle classes and rising disposable incomes. Consumer brand awareness has increased due to the growing impact of social media and digital marketing, which has increased demand for cosmetics with halal certification. All of these elements work together to support Saudi Arabia's halal cosmetics industry's rapid expansion.

Growth Drivers for the Saudi Arabia Halal Cosmetics Market

Religious Compliance

One of the main factors propelling the halal cosmetics business in Saudi Arabia is religious conformity. Being an Islamic country, a sizable section of the populace looks for goods that comply with Shariah law, which forbids the use of specific substances including alcohol, derivatives of pork, and animal byproducts that are not halal. Customers are placing a higher priority on cosmetics that reflect their moral and religious principles, making sure that the items are both physically and spiritually safe. The number of halal-certified companies selling skincare, haircare, and makeup products devoid of haram ingredients has increased as a result of this demand. Strong customer loyalty and trust are fostered by the guarantee of religious permissibility, which motivates both domestic and foreign businesses to invest in halal-certified products designed especially for the Saudi market.

Higher Disposable Incomes

The market for halal cosmetics is significantly influenced by Saudi Arabia's higher disposable incomes. With a per capita income of USD 27,680 as of June 2024, the nation also boasted low unemployment (5%) and inflation rates below 2%. These financial circumstances have enabled consumers—especially the younger generation—to spend money on high-end, ethically made, and religiously acceptable cosmetics. Growing demand for cosmetics that adhere to Islamic beliefs, stressing natural ingredients and ethical sourcing, is a result of rising purchasing power. The rise of the sector has been further fueled by this trend, which has drawn halal-certified brands from both domestic and foreign markets to Saudi Arabia.

Youth Demographics

The young population of Saudi Arabia is a major factor driving the market for halal cosmetics' explosive expansion. With almost 63% of the population under 30, this group is increasingly following Islamic values while adopting contemporary beauty standards. Products with halal certification appeal especially to young consumers since they fit in with their ethical principles and way of life. Social media sites like YouTube, Instagram, and TikTok have boosted beauty trends among Gen Z and millennials, increasing their brand awareness and product ingredient knowledge. The need for high-quality, religiously compliant halal cosmetics is being driven by this tech-savvy generation, which also pushes firms to innovate and satisfy these tastes.

Challenges in the Saudi Arabia Halal Cosmetics Market

Strict Certification Processes

In the Saudi Arabian halal cosmetics business, stringent certification procedures pose a serious obstacle. Manufacturers must adhere to strict safety, quality, and religious requirements established by Islamic authorities in order to receive halal certification. To guarantee that there is no contamination with haram compounds, this entails closely examining the origins of ingredients, production procedures, and supply chain integrity. For new or smaller brands in particular, the certification procedure can be expensive, time-consuming, and complicated. Additionally, there may be more operational challenges and uncertainty due to different certifying bodies' varying certification standards. These elements can hinder market entry, raise prices, and postpone product releases, making it difficult for businesses looking to successfully compete in the Saudi halal cosmetics industry.

Price Sensitivity

The market for halal cosmetics in Saudi Arabia is still beset by price sensitivity. Due to strict manufacturing procedures, higher production costs connected with sourcing halal-certified ingredients, and the expenditures associated with gaining halal certification, halal-certified products frequently attract premium rates. Due to these constraints, halal cosmetics may be more expensive than their conventional counterparts, which could restrict their availability to a wider range of consumers. The market's growth among middle- and lower-income groups is hampered by price-conscious consumers choosing non-halal options, despite the growing desire among wealthy consumers for items that reflect their ethical and religious values. In order to serve a wide range of consumer demographics, brands must balance quality, certification expenses, and pricing tactics, as this price sensitivity highlights.

Recent Developments in Saudi Arabia Halal Cosmetics Industry

- In May 2024, A contract was reached by Halal Products Development firm (HPDC) to invest in Believe, a company that produces halal cosmetics and personal hygiene items. The HPDC's dedication to enhancing the Kingdom's halal industrial ecosystem and offering premium goods that satisfy Islamic standards both locally and internationally is demonstrated by this step. The goal of this project is to move Believe's headquarters from Singapore to the Kingdom of Saudi Arabia, which will be a crucial hub for the company's exports to many parts of the world.

- In Dec 2023, A memorandum of understanding (MoU) for the cooperation in Halal product assurance and the reciprocal recognition of Halal certifications was signed by Saudi Arabia and Indonesia. The Saudi Food and Drug Authority and Indonesia's Halal Product Assurance Organizing Body (BPJPH) signed the deal. Crucially, the agreement also covers collaboration in laboratory analysis, R&D, and training for Halal products.

- In Nov 2022, The Singaporean FMCG conglomerate Believe, which specializes in personal care basics, teamed with the Indian company Iba Cosmetics. In order to increase its retail market share in Saudi Arabia, the United Arab Emirates, Bahrain, Bangladesh, and other nations, the latter invested USD 10 million in Iba Cosmetics through this partnership.

Saudi Arabia Halal Cosmetics Market Segmentation:

Product Type

- Personal Care Products

- Color Cosmetics

- Fragrances

Application

- Hair Care

- Skin Care

- Face Care

- Beauty Care

Distribution Channel

- Hypermarkets & Supermarket

- Online Stores

- Convenience Stores

- Specialty Stores

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Estee Lauder

- L’Oréal

- S&J International Enterprises

- Kao Corporation

- Clara International Beauty Group

- INIKA

- AMARA COSMETICS

- WARDAH COSMETICS

- SAMPURE MINERALS

- HALAL COSMETICS COMPANY

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application and Distribution Channel |

| Distribution Channel Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Halal Cosmetics Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By Distribution Channel

7. Product Type

7.1 Personal Care Products

7.2 Color Cosmetics

7.3 Fragrances

8. Application

8.1 Hair Care

8.2 Skin Care

8.3 Face Care

8.4 Beauty Care

9. Distribution Channel

9.1 Hypermarkets & Supermarket

9.2 Online Stores

9.3 Convenience Stores

9.4 Specialty Stores

9.5 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Estee Lauder

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 L’Oréal

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 S&J International Enterprises

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Kao Corporation

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Clara International Beauty Group

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.6 INIKA

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.7 AMARA COSMETICS

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.8 WARDAH COSMETICS

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.9 SAMPURE MINERALS

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.10 HALAL COSMETICS COMPANY

12.10.1 Overviews

12.10.2 Key Person

12.10.3 Recent Developments

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com