Thailand Organic Fertilizer Market Outlook 2025–2033

Buy NowThailand Organic Fertilizer Market Size

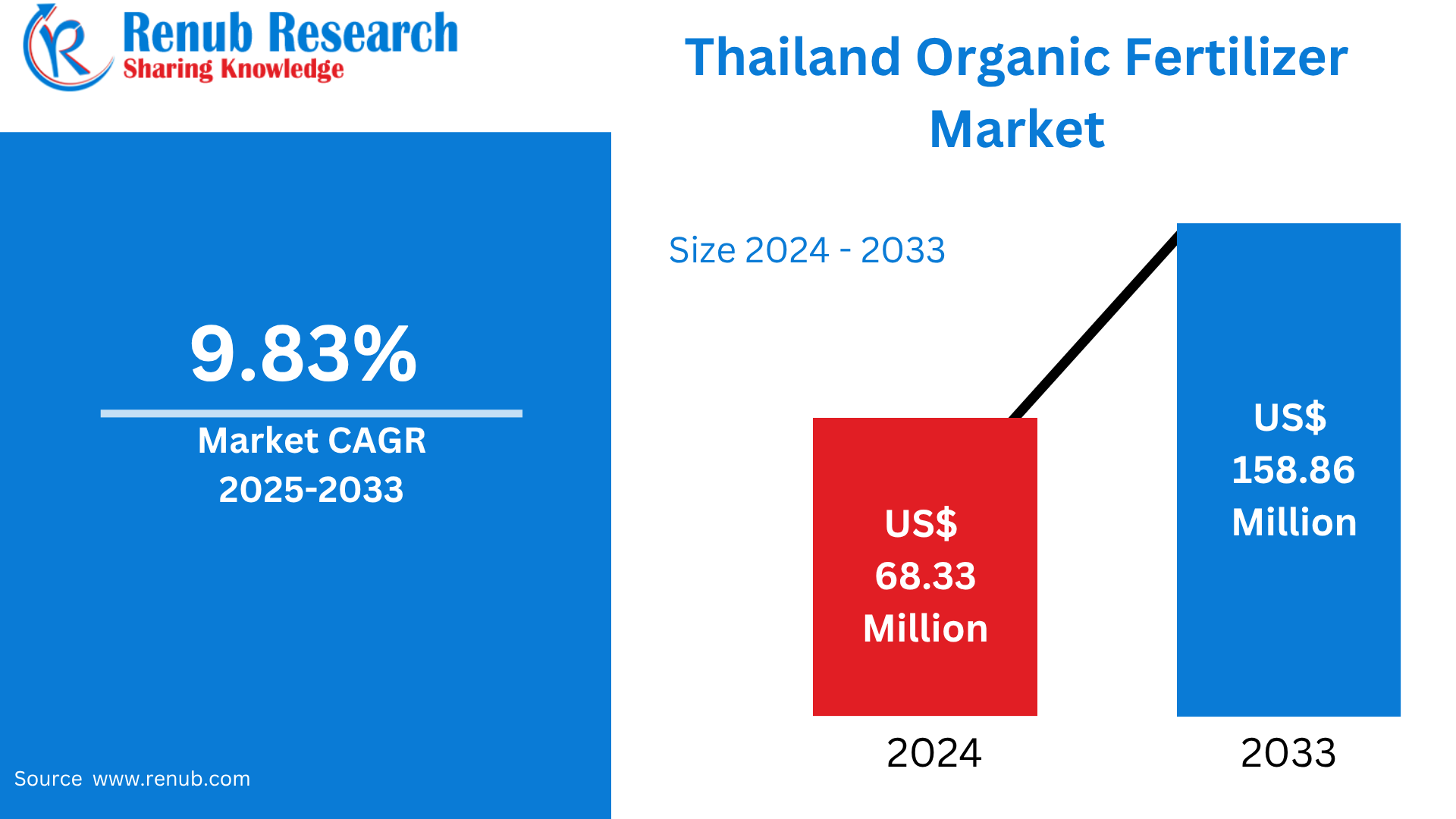

Thailand Organic Fertilizer Market is expected to reach US$ 158.86 million by 2033 from US$ 68.33 million in 2024, with a CAGR of 9.83% from 2025 to 2033. Increasing need for sustainable agriculture, government support, increasing health awareness, concerns regarding soil erosion, and increasing consumption of organically produced food are the key drivers of Thailand's organic fertilizer market. Farming is further accelerated by technology advancements and eco-friendly farming practices.

Thailand Organic Fertilizer Market Report by Source (Plant Based, Animal Based, Synthetic Based), Mode of Application (Seed Treatment , Soil Treatment , Root Dripping), Product Type (Microorganism, Azospirillum, Cyanobacteria, Phospate-Solublizing Bacteria, Azolla, Aulosira, Rhizobium, Azotobacter, Other), Organic Residues (Farm Yard Manure, Crop Residue, Green Manure, Other Products), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), Form (Dry, Liquid) and Company Analysis 2025-2033.

Thailand Organic Fertilizer Industry Overview

A plant, animal, or mineral source-derived natural material, organic fertilizer is used for the soil to enhance soil health as well as promote plant growth. It provides essential nutrients such as potassium, phosphorus, and nitrogen in the form of slow-release substances and does not contain artificial chemicals, unlike synthetic fertilizers. Compost, manure, bone meal, and seaweed are some of the common types. Organic fertilizers are ideal for sustainable agriculture as they enhance soil structure, increase microbial activity, and ensure water retention. They also reduce the risk of long-term soil degradation and chemical release. Generally, organic fertilizers ensure healthier crops and ecosystems, complementing environmentally friendly farming practices and increasing global demand for organic produce.

The Thai organic fertilizer market is growing incrementally with the combination of government support, evolving consumer preferences, and technological advancements. With regulations that restrict chemical fertilizers, promotional campaigns, and subsidies, the government of Thailand is pursuing sustainable agriculture aggressively. Simultaneously, farmers are also being urged to adopt organic ways by an increasing organic food demand from consumers, which is fueled by health and environmental awareness. Technology advancements such as precision farming and improved fertilizer recipes are also enhancing efficiency and appeal. The industry is also expanding because of rising awareness of soil degradation and the benefits of organic fertilizers in restoring soil health.

Growth Drivers for the Thailand Organic Fertilizer Market

Consumer Demand

The organic fertilizer market in Thailand is growing strongly because of demand from consumers for organic products. Increasing Thai consumers are opting for organic food as health and environmental awareness increases, which encourages farmers to adopt sustainable and organic farming practices. Government initiatives that promote organic farming are also reinforcing the shift. Apart from the rising demand for organic fertilizers, increased consumer preference for organic produce also contributes to better soil health and reduction of their dependence on chemical fertilizers. Generally, Thailand's sustainable agriculture and conservation are complemented by increased market demand for organic products, which promotes the application of organic fertilizer.

Technological Advancements

The organic fertilizer market in Thailand is growing at a fast pace courtesy of technological advancements enhancing farming methods' accuracy, sustainability, and effectiveness. Enhancements to nutrient availability and uptake by plants, including slow-release fertilizers and microbial inoculants, are maximizing farm output with a lesser adverse impact on the environment. Farmers can best achieve efficiency and reduce waste through optimizing the application of fertilizer in accordance with real-time information through the adoption of precision agriculture tools such as soil sensors, drones, and data analysis. In addition, development of smart fertilizers that provide nutrients based on crop needs enhances nutrient utilization efficiency and encourages sustainable agriculture practices. Thai agriculture is becoming increasingly efficient and sustainable due to these advances in technology.

Government Support

The government of Thailand is a key driver of development of the organic fertilizer industry through promotion of organic farming. By means of strategic plans that assist in organic product growth, certification, production, and market entry, national policy seeks to lower the utilization of agrochemicals and encourage organic farming. Efforts to keep costs low and decrease dependence on imports also involve measures to advance local fertilizer manufacturing and subsidize farm inputs. These vast government efforts encourage the use of organic fertilizers among farmers and also encourage sustainable agricultural practices and contribute to the growth of Thailand's organic fertilizer market as a whole.

Challenges in the Thailand Organic Fertilizer Market

Supply Chain and Distribution

Thailand's organic fertilizer business is greatly impacted by supply chain and distribution issues, especially for small-scale farmers. Their potential to reach larger markets is hampered by their limited access to contemporary trade routes and the high expense of organic certification. Furthermore, especially for small farmers, the difficulties of shipping organic fertilizers are frequently costly and ineffective. When compared to traditional fertilizers, this inefficiency raises prices and decreases competitiveness. Additionally, production schedules are disrupted and product quality is impacted by the irregular supply of raw materials, such as animal manure and composted food waste, caused by seasonal variations and market demand fluctuations. To promote the expansion of Thailand's organic fertilizer industry, these issues call for concerted measures to upgrade infrastructure, expedite certification procedures, and create effective distribution networks.

High Production Costs

One of the biggest obstacles to Thailand's organic fertilizer market expansion is the high cost of manufacture. The natural raw resources needed to produce organic fertilizers, such as compost, manure, or plant-based waste, can be costly and scarce. Operational costs are further raised by the processing and quality assurance required to satisfy organic requirements. Financial difficulties are further increased by certification fees and regulatory compliance, particularly for small-scale producers. Due to premium pricing brought on by these increased expenses, organic fertilizers are less competitive when compared to less expensive synthetic substitutes. Many farmers are deterred from switching to organic farming methods by this price difference, which restricts the market's ability to embrace organic practices widely.

Recent Developments in Thailand Organic Fertilizer Industry

- June 2024: More than 4 million households that grow rice are having their fertilizer expenses covered by a co-payment program that the Thai government is putting into place. Farmers will be able to access this program via the Bank for Agriculture and Agricultural Cooperatives mobile application. Fertilizer providers will be invited to take part in price standardization in order to allay worries about price volatility.

Thailand Organic Fertilizer Market Segmentation:

Source

- Plant Based

- Animal Based

- Synthetic Based

Mode of Application

- Seed Treatment

- Soil Treatment

- Root Dripping

Product Type

- Microorganism

- Azospirillum

- Cyanobacteria

- Phospate-Solublizing Bacteria

- Azolla

- Aulosira

- Rhizobium

- Azotobacter

- Other

Organic Residues

- Farm Yard Manure

- Crop Residue

- Green Manure

- Other Products

Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Form

- Dry

- Liquid

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- National Fertilizers

- Madras Fertilizers

- Seek Biotechnology Co. Ltd

- Coromandel International

- Nagarujuna fertilizers and Chemicals Ltd

- T Stanes & Company Limited

- Novozymes

- Kribhco

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Source, Mode of Application, Product Type, Crop Type and Form |

| Product Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Thailand Organic Fertilizers Market

6. Market Share Analysis

6.1 By Source

6.2 By Mode of Application

6.3 By Product Type

6.4 By Crop Type

6.5 By Form

7. Source

7.1 Plant Based

7.2 Animal Based

7.3 Synthetic Based

8. Mode of Application

8.1 Seed Treatment

8.2 Soil Treatment

8.3 Root Dripping

9. Product Type

9.1 Microorganism

9.1.1 Azospirillum

9.1.2 Cyanobacteria

9.1.3 Phospate-Solublizing Bacteria

9.1.4 Azolla

9.1.5 Aulosira

9.1.6 Rhizobium

9.1.7 Azotobacter

9.1.8 Other

9.2 Organic Residues

9.2.1 Farm Yard Manure

9.2.2 Crop Residue

9.2.3 Green Manure

9.2.4 Other Products

10. Crop Type

10.1 Cereals & Grains

10.2 Oilseeds & Pulses

10.3 Fruits & Vegetables

10.4 Others

11. Form

11.1 Dry

11.2 Liquid

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 National Fertilizers

14.1.1 Key Persons

14.1.2 Overview

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 Madras Fertilizers

14.2.1 Key Persons

14.2.2 Overview

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 Seek Biotechnology Co. Ltd

14.3.1 Key Persons

14.3.2 Overview

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Coromandel International

14.4.1 Key Persons

14.4.2 Overview

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Nagarujuna fertilizers and Chemicals Ltd

14.5.1 Key Persons

14.5.2 Overview

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 T Stanes & Company Limited

14.6.1 Key Persons

14.6.2 Overview

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 Novozymes

14.7.1 Key Persons

14.7.2 Overview

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 Kribhco

14.8.1 Key Persons

14.8.2 Overview

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com