Saudi Arabia Perfume Market Size, Share & Forecast 2025–2033

Buy NowSaudi Arabia Perfume Market Size and Forecast 2025-2033

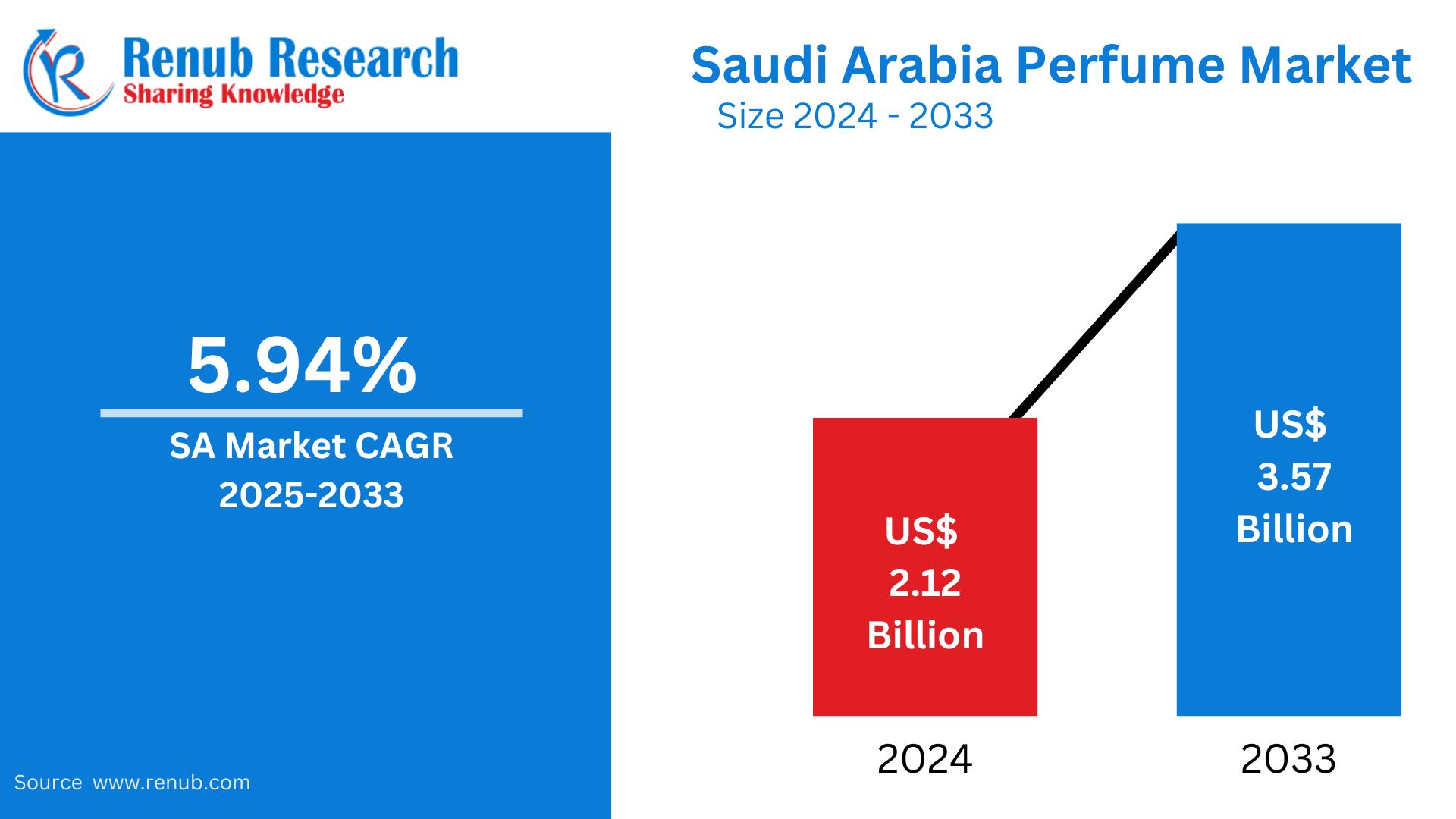

Saudi Arabia Perfume market is expected to reach US$ 3.57 billion by 2032 from US$ 2.12 billion in 2023, with a CAGR of 5.94% from 2025 to 2033. Strong demand for luxury and high-end perfumes, growing interest in traditional Arabic scents, and the development of digital and e-commerce platforms are the primary drivers of the market's notable expansion. Growing customer preferences for ecological components and unisex fragrances are also favorably influencing the market's expansion.

Saudi Arabia Perfume Market Overview

Saudi Arabia has one of the biggest and richest perfume industries in the Middle East, thanks to a strong cultural connection to smell and a long history of scent usage. High-end, long-lasting perfumes are highly preferred by Saudi consumers, who are especially interested in oriental and oud-based scents. Demand for high-end and designer fragrances is further fueled by the growing trend of luxury items and high disposable incomes. Additionally, a large variety of perfume goods are available in Saudi Arabia's retail industry, which includes both physical storefronts and online marketplaces. Tourism also helps the sector since pilgrims who travel to Mecca and Medina buy perfumes as mementos. Local and foreign firms are fighting for market share, though, as competition heats up. Increasing awareness of sustainability and eco-friendly products is also impacting the market’s future.

In 2021, there were 35,340,680 people living in Saudi Arabia, with 20,437,084 men and 14,903,596 women. 8,671,039 people under the age of 14 make up the whole population. There are 12,188,458 people in the population between the ages of 20 and 40. There are 5,462,868 people living in rural areas and 29,799,824 people living in metropolitan areas. According to 2020 estimates, Saudi Arabia's GDP is worth USD 1.5 trillion, its inflation rate is 3.1%, and its per capita income is $47,700. In 2021, luxury goods are expected to make up 80% of Saudi Arabia's sales. This is because Saudi Arabia's economy is among the fastest-growing in the world, thanks to its robust banking sector, high personal income levels, and oil and gas industries. Sales of luxury products rose as a result. The nation's population has grown significantly as well, and the demand for luxury fragrance items is currently being driven primarily by young people.

Growth Drivers for the Saudi Arabia Perfume Market

Increasing Preference for High-End and Expensive Fragrances

Premium and luxury perfumes are strongly preferred in Saudi Arabia, which reflects a cultural penchant for fine, distinctive scents. These scents are a sign of refinement, money, and status in addition to being a declaration of personal taste. Saudi customers prefer distinctive, enduring fragrances that make a statement, and they frequently choose niche brands that provide a feeling of exclusivity and custom craftsmanship. The market's ongoing demand for high-end fragrances is fueled by a long-standing love for opulent goods, where expensive perfumes are regarded as a means of expressing social status as well as a personal luxury.

For example, the Ghawali brand of the Chalhoub Group debuted its modern flagship shop at the Nakheel Mall in Riyadh in January 2023. With natural features from the GCC, the renovated store combines modern design with regional cultural influences. The store wants to serve the changing beauty and fragrance market in the area by specializing in contemporary and niche oriental scents. In the upcoming months, Ghawali also intends to introduce a new line of perfumes and a special fragrant homage to Saudi Arabia.

Focus on Oriental and Arabic Fragrances

Arabic and Oriental fragrances are highly valued in Saudi Arabia and continue to be a mainstay of the perfume industry. The rich and enduring components of perfumes like oud, rose, amber, and musk are prized for their depth and richness, which represent the customs and cultural legacy of the area. These fragrances are prized for their capacity to generate a feeling of history and identity in addition to their olfactory qualities, which makes them appropriate for both special events and everyday wear. The persistence of these scents' popularity highlights the area's pride in its ancient perfumery methods as well as its wish to honor and maintain regional traditions via aroma.

For example, in May 2024, the Institut du Monde Arabe and the National Museum in Riyadh, under the patronage of Prince Badr bin Farhan, opened the "Perfumes of the East" exhibition. With more than 200 artifacts from archaeology and modern artwork, this exhibition highlights the long history of the Arab world's love of fragrances.

Growth of Online Advertising and E-Commerce

The perfume industry has undergone a change thanks to the growth of digital marketing and e-commerce platforms in Saudi Arabia, which have made it possible for companies to more successfully reach a larger audience. Online channels improve the shopping experience by enabling clients to browse and buy perfumes at any time and from any location. Additionally, they give consumers access to a wider variety of goods, such as international and niche brands that would not be found in physical locations. E-commerce platforms also make direct-to-consumer sales possible, which enables firms to interact with consumers more closely and customize their marketing tactics to suit individual preferences. This, in turn, promotes growth and increases market penetration in the fiercely competitive perfume sector.

The International Trade Administration (ITA) report projects that by the end of 2024, there would be 33.6 million Saudi internet users for e-commerce, a 42% increase from 2019. Amazon Prime and other new players are being drawn to Saudi Arabia's e-commerce business, which could help the general trend of online buying.

Challenges in the Saudi Arabia Fragrances Market

Rise in Intense Competition

The Saudi Arabian perfume business is characterized by fierce competition, with both domestic and foreign companies vying for consumers' attention. Global luxury brands like Chanel and Dior give international prestige and superior products, while well-known local brands like Abdul Samad Al Qurashi and Al Haramain have devoted followings and strong cultural ties. It is challenging for new competitors to stand out and gain market share in this competitive environment. Since consumers frequently favor well-known companies, new brands must make significant investments in branding, marketing, and gaining their trust. Additionally, it's critical to provide distinctive perfumes that satisfy Saudi consumers' inclination for powerful, oud-based aromas. Particularly in the expanding e-commerce sector, new entrants require creative items, aggressive pricing, and a robust distribution network to stand out.

High Import Costs

The Saudi Arabian perfume business is severely hampered by high import prices, especially for high-end and luxury products. Due to tariffs, shipping costs, and taxes, a significant amount of luxury fragrances in Saudi Arabia are imported, frequently from Europe and other countries. These additional expenses may limit the attractiveness of luxury perfumes to affluent demographics by making them less affordable for a wider range of consumers. Additionally, this financial barrier prevents smaller businesses and new entrants from entering the market because they cannot afford such expenses. Furthermore, although local perfume production is increasing, it is still quite tiny in comparison to imports. The sales of imported luxury perfumes may be impacted as a result of many customers switching to less expensive, domestically made alternatives.

Saudi Arabia Eau de Perfume Market

Eau de Parfum (EDP) constitutes a significant market share in the Saudi Arabian fragrance market, where consumers prefer long-lasting fragrances that can complement the country's hot climate. Being oil-enriched EDPs come with more fragrance concentration than Eau de Toilette or Cologne and thus are able to perform fragrance longevity during the day. High-end international brands and domestic perfume companies both fulfill this demand, mixing Western and authentic Arabic fragrance notes like oud, amber, and rose. Disposable income, gifting, and personal hygiene behavior continue to drive demand for EDPs, particularly among young adults and working professionals.

Saudi Arabia Eau de Cologne Perfume Market

Saudi Arabia's Eau de Cologne market is picking up, particularly among younger customers and those seeking light, budget-friendly fragrances for everyday use. Being less concentrated (usually 2-5% perfume oils), colognes provide light and crisp scents good for informal or warm-weather wear. They are also used for layering with other perfumes. As grooming trends spill over beyond the elite class, mass-market colognes with citrus, aquatic, and floral fragrances are becoming more prevalent in local retail stores, convenience stores, and online websites throughout the kingdom.

Saudi Arabia Luxury Perfume Market

Saudi Arabia is among the most profitable markets for luxury perfumes in the Middle East. High-income consumers look for exclusivity, high-quality ingredients, and sophisticated packaging in their perfumes. Premium brands like Dior, Chanel, and Tom Ford fare well, along with niche Arabic brands that incorporate oud, musk, and saffron into their fragrances. Perfumes are status symbols and perfect for gifting on weddings, festivals, and Eid, driving market growth. The availability of high-end stores in malls and growing e-commerce platforms also increases access to luxury fragrances. November 2023, Chalhoub Group partnered with Inter Parfums, Inc. to exclusively distribute Roberto Cavalli perfumes in the United Arab Emirates, Bahrain, Kuwait, Saudi Arabia, and Egypt. This partnership is intended to enhance the presence of Roberto Cavalli perfumes in the region through both retail stores and digital channels. The collaboration represents an important step forward for Inter Parfums towards larger regional pacts and the drive to meet increasingly high needs of regional customers.

Saudi Arabia Mass Perfume Market

Perfumes at a mass price point are trending strongly in Saudi Arabia, serving middle-income cohorts and youth niches. Fragrances are priced modestly and are easily spread through supermarkets, neighborhood perfumeries, and web sites. Despite declining oil levels, companies are enhancing fragrance duration and packaging attractiveness. Regional players are the major forces in this sector, providing Arabic-style mixes to address cultural sensibilities. Holiday offers, festive discounts, and growing personal hygiene awareness have all led to mounting uptake of mass-market fragrances, and so this segment forms a vital part of Saudi Arabia's overall perfume industry. In March 2024, one of the major UAE-based perfume players, Ahmed Perfume, disclosed plans to grow its network of perfumery retailers across the UAE, Saudi Arabia, and the Gulf Cooperation Council (GCC) countries.

Saudi Arabia Male Perfume Market

Saudi Arabia's male perfume market is strong due to entrenched habits in grooming and cultural fondness for body odor. Men wear perfumes many times throughout a day, particularly at social gatherings or religious activities. Oud, sandalwood, musk, and amber-based fragrances are extremely popular. The presence of Western-style designer colognes as well as traditional attar-based perfumes caters to the varying tastes across age groups. Gifting culture, high spending power, and social status associated with personal fragrance are major growth drivers in the male segment.

Saudi Arabia Women Perfume Market

Saudi Arabian women are increasingly adopting a range of perfume products blending classic Arabic oils with contemporary global fragrances. Popular among these are floral, fruit, and gourmand notes, and dense orientals. The female perfume market enjoys high social customs relating to gift-giving, pampering, and fashion sensitivity. Both premium and mass-market companies have widened the range of products catering to women's tastes. As more women have gone into the labor force and entered public life, the need for flexible, all-day wear perfumes has risen substantially.

Saudi Arabia Perfume Market Segmentation

Type – Market breakup in 4 viewpoints:

- Eau de Parfum

- Eau de Toilette

- Eau de Cologne

- Eau Fraiche

Value – Market breakup in 4 viewpoints:

- Luxury

- Mass

Gender – Market breakup in 4 viewpoints:

- Male

- Female

- Unisex

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Abdul Samad Al Qurashi

- Ahmed Al Maghribi Perfumes

- Ajmal Perfumes

- Arabian Oud

- Rasasi Perfume Industry LLC.

- Rashat

- Swiss Arabian Perfumes Group

- The Fragrance Kitchen (TFK)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Value, and Gender |

| Type Covered | 1. Eau de Parfum 2. Eau de Toilette 3. Eau de Cologne 4. Eau Fraiche |

| Companies Covered | 1. Abdul Samad Al Qurashi 2. Ahmed Al Maghribi Perfumes 3. Ajmal Perfumes 4. Arabian Oud 5. Rasasi Perfume Industry LLC. 6. Rashat 7. Swiss Arabian Perfumes Group 8. The Fragrance Kitchen (TFK) |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Perfume Market

6. Market Share

6.1 By Type

6.2 By Value

6.3 By Gender

7. Type

7.1 Eau de Parfum

7.2 Eau de Toilette

7.3 Eau de Cologne

7.4 Eau Fraiche

8. Value

8.1 Luxury

8.2 Mass

9. Gender

9.1 Male

9.2 Female

9.3 Unisex

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1.1 Strength

11.1.2 Weakness

11.1.3 Opportunity

11.1.4 Threat

12. Key Players Analysis

12.1 Abdul Samad Al Qurashi

12.1.1 Overview

12.1.2 Recent Development

12.2 Ahmed Al Maghribi Perfumes

12.2.1 Overview

12.2.2 Recent Development

12.3 Ajmal Perfumes

12.3.1 Overview

12.3.2 Recent Development

12.4 Arabian Oud

12.4.1 Overview

12.4.2 Recent Development

12.5 Rasasi Perfume Industry LLC

12.5.1 Overview

12.5.2 Recent Development

12.6 Rashat

12.6.1 Overview

12.6.2 Recent Development

12.7 Swiss Arabian Perfumes Group

12.7.1 Overview

12.7.2 Recent Development

12.8 The Fragrance Kitchen (TFK)

12.8.1 Overview

12.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com