Global Menswear Market Size, Share & Forecast 2025–2033

Buy NowMenswear Market Size & Summary

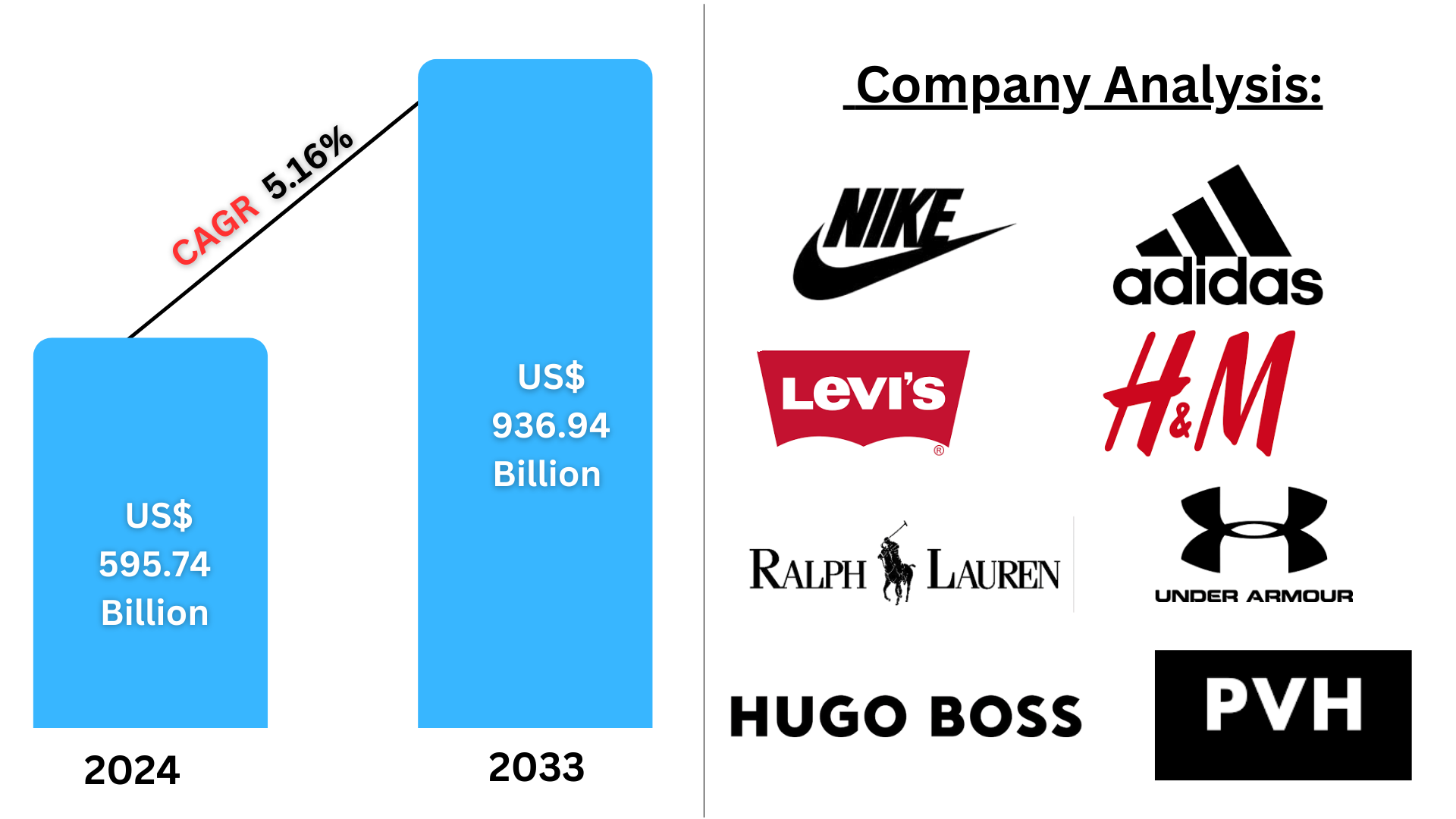

The Global Menswear Market will reach US$ 936.94 Billion by 2033, up from US$ 595.74 Billion in 2024, with a CAGR of 5.16% between 2025 and 2033. Some of the primary factors driving the market growth include the introduction of sustainable clothes made from natural materials to prevent skin allergies, the expansion of the e-commerce channel, and the growing fashion consciousness among men.

The report Menswear Market Global Forecast Covers by Apparel (Top Wear, Bottom Wear, Innerwear), Category (Mass, Premium, Luxury), Distribution Channel (Online, Offline), Countries and Company Analysis 2025-2033

Global Menswear Market Overview

Menswear is the term for apparel and accessories made especially for men. It includes a broad variety of designs, from casual wear like jeans, t-shirts, and jackets to formal wear like suits, shirts, and ties. Additionally, it encompasses niche markets including luxury clothes, outerwear, and sportswear. Over time, menswear has changed dramatically to reflect shifts in social, cultural, and economic trends. Comfort, adaptability, and customization are key components of contemporary menswear, and there is a rising need for eco-friendly and sustainable solutions. Menswear continues to evolve, providing options for various events, individual preferences, and lifestyles, influenced by both traditional and modern trends.

The market's expansion is mostly being driven by men's growing fashion consciousness and importance of looks. The market is also expanding as a result of menswear's easy accessibility to internet shopping platforms, which provide a large selection of products.

Growth Drivers of the Global Menswear Market

Growing Interest in Eco-Friendly Apparel

The market for menswear is expanding significantly due to the growing demand for eco-friendly apparel. Sustainable fashion is becoming increasingly popular as consumers grow more concerned about the environment. This includes clothing created from recycled textiles, organic ingredients, and eco-friendly production techniques. Growing environmental consciousness, including the waste and pollution from quick fashion, is the driving force behind this movement. With a preference for businesses that emphasize sustainability, men are increasingly looking for apparel that reflects their ideals. The industry is changing due to the rise of ethical fashion, which is pushing for firms to embrace ethical and transparent production methods and fostering innovation in eco-friendly textiles.

Men's Growing Predilection for Online Buying

The market's growth is mostly being driven by the growing e-commerce industry and rising internet penetration. Additionally, the desire for luxury brands and uncommon items in the menswear sector is being supported by rising consumer disposable incomes and men's increased emphasis on physical appearance. Furthermore, online transactions and the average amount of money spent online have steadily increased in tandem with the growing number of internet users. For example, Amazon's total consolidated net sales revenue in 2023 was US$ 575 billion, of which US$ 131 billion came from foreign revenue sources.

Furthermore, a lot of luxury brands are collaborating with tech firms to improve consumers' shopping experiences. For example, LMVH Japan and SoftBank Corp. inked a partnership agreement in February 2022. With the assistance of SoftBank Corp.'s digitization skills, this arrangement improved LMVH's online sales.

Expanding Product Selection

A growing number of major industry participants are funding the creation of more inventive and eco-friendly fashion items at competitive prices. For example, the 2023-launched brand Y Chroma debuted age-defying male styles during New York Fashion Week in February 2024. The goal of the new fashion company is to appeal to the middle-aged market, which is frequently overlooked. In addition, a number of male fashion firms are raising money to grow their clientele and operations, which is expected to boost the menswear market's earnings in the upcoming years.

For instance, in December 2023, SWC Global and IvyCap Ventures co-led a Series A fundraising round for the direct-to-consumer (D2C) apparel firm Snitch, raising INR 110 Cr (US$ 13.19 Million). The additional funds will be used by the business to develop an offline retail strategy and to scale up its workforce and technology. According to Snitch, their FY23 turnover exceeded INR 100 Cr. Additionally, a number of businesses are providing plus-size clothing to accommodate a range of body shapes and sizes, guaranteeing that people of all shapes and sizes can find fashionable and well-fitting clothing. The fashion-focused multi-brand retail retailer Shoppers Stop, for instance, announced in April 223, the launch of its plus-sized private label under the 'U R You' name.

Impact of Athleisure on Global Menswear Demand

The rise of athleisure has significantly transformed global menswear demand, blending comfort, functionality, and style. As consumers prioritize wellness and active lifestyles, demand for versatile clothing that transitions from gym to casual settings has surged. Men increasingly favor joggers, hoodies, and performance fabrics over traditional formalwear, driving growth in sports-inspired fashion. The move to working from home and casual dress codes has accelerated the trend further. Large brands now incorporate athletic elements into mainstream menswear, catering to changing tastes. With athleisure becoming a lifestyle phenomenon, it continues to change global fashion dynamics, driving sales in both high-end and mass-market men's wear sectors.

Menswear E-Commerce Sales Trends

Online shopping has emerged as the powerhouse of the menswear industry, led by convenience, choice, and online engagement. Online sales of menswear have exploded, particularly after the pandemic, as customers favor increasingly browsing and buying clothing from the convenience of their homes. Mobile shopping and tailored shopping experiences through AI-recommended offerings are driving customer satisfaction and conversion rates. Subscription models and virtual try-on capabilities are also becoming increasingly popular, cutting return rates and fostering loyalty. High-end and specialty menswear brands are doing well online by providing targeted marketing and proprietary collections. As online platforms keep changing, e-commerce is likely to grab an even bigger percentage of the world menswear market in the years to come.

Sustainable Fashion – Eco-Conscious Consumerism

Sustainable fashion is transforming the clothing industry as consumers increasingly require ethical, eco-friendly clothing. Brands are incorporating organic materials, recycled materials, and low-impact manufacturing practices to minimize environmental impacts. Open sourcing, fair labor, and circular fashion concepts—such as resale and rental—are on the rise. The movement is an extension of a larger commitment to sustainability, especially among younger, socially aware consumers. As awareness and regulation escalate, sustainability becomes a competitive imperative, not an niche phenomenon.

Athleisure – Comfort-Driven Lifestyle Shift

Athleisure has become the leading lifestyle phenomenon, blending effortlessly athletic performance and casual, comfortable wear. It represents a cultural shift in consumer values, placing comfort, adaptability, and a general sense of wellness as priorities. As remote work habits become more commonplace and more people adopt active lifestyles, athleisure has broken out of niche markets to mainstream fashion.

Not only does athleisure provide functional advantages—like moisture-wicking materials, stretchy fabrics, and fashionable designs—it also mirrors the increasing demand for apparel that promotes a balanced lifestyle. Today's consumers look for clothing that can seamlessly shift from a workout session to everyday outings, emphasizing the versatility of these items. Since well-being and exercise move to center in our lifestyles, athleisure becomes one symbol of health as well as fashion, most intimately reflecting present sensibilities as well as agendas.

Nike Strategy

Nike went 35% digital and aims to hit 50% in 2025. Nike has grown amazingly and is also on course to finish year 2022 at over 50-billion-dollar turnover. Nike, in its strategies, is also giving a preference to DTC (direct to consumer) business. Covid 19 has only demonstrated growth in its sales in all segments and brands. Nike also recently achieved its first 5-billion-dollar quarter. All these occurred with recession in many sectors and segments all over the globe which makes one think about Nike from a new perspective. To stay up to date, Nike continually updates its trends, marketing and communications. It has consistently been highly competitive and current with the newest fashions within the distribution system, expanding its DTC channels, leading fashion on digital platforms such as Tik-Tok or Instagram reels. It also seeks to bring its brand, Jordan, to retail in a search for expansion.

E-commerce and Digital Transformation in Menswear

The menswear market is being transformed rapidly at the digital level, fueled by the expansion of e-commerce and changing consumer behaviors. Brands are using online channels to engage with larger audiences, personalized shopping experiences, AI, data analysis, and virtual fitting capabilities. Social media, influencer marketing, and live shopping activities are influencing purchase decisions, particularly among younger consumers. Mobile apps and frictionless checkout experiences increase convenience and drive conversion rates. Digital-first brands and direct-to-consumer (DTC) models are also shaking traditional retail by providing high-quality men's wear at competitive prices. With continued digital innovation, the menswear industry is getting increasingly agile, customer-focused, and technology-driven than ever.

Men's Top Wear Market

The men's top wear market includes shirts, t-shirts, jackets, sweatshirts, and ethnic tops. This category is the most dominant in the men's clothing market because of its regular use, seasonal demand, and fashion flexibility. The growth in work-from-home culture has increased demand for casual and comfortable tops, especially polos and knitwear. Fashion-forward younger generations are increasingly turning to printed and oversized t-shirts. Formal shirts continue to have good demand in workplaces, while layering alternatives such as jackets and hoodies come into fashion in colder climates. Online shopping and influencer trends also contribute heavily to the drivers of consumer desire in this sector.

Men's Bottom Wear Market

Men's bottom wear comprise jeans, trousers, shorts, chinos, joggers, and ethnic lowers such as dhotis or pajamas in some geographies. This category has changed a great deal, with increased demand for comfort and performance apparel, particularly from young and active consumers. The athleisure trend has propelled joggers and sweatpants into the mainstream, with denim still a wardrobe staple. Consumers look for practical, durable, and fashionable items appropriate for office and leisure activities alike. Brands are getting creative with sustainable materials, stretch fabrications, and ergonomic fits to appeal to this style-forward but comfort-driven crowd. Brand collaborations and online platforms also enhance segment visibility and reach.

Mass Menswear Market

The mass menswear market serves the price-conscious consumer segment with basic clothing at low prices. It operates on high volumes, standardized fits, and little design customization. This segment is strong in developing economies where middle-income segments are the majority of the population. Major products are basic t-shirts, trousers, innerwear, and seasonal products such as sweaters. Value-based retailers and fast fashion chains such as Walmart, Target, and local counterparts serve this market with regular discount sale promotions and bundle packs. Urbanization and penetration of retail into Tier II and III cities are continuously augmenting the growth and expansion of mass menswear.

Premium Menswear Market

The premium menswear is dominated by brand-sensitive customers looking for superior quality, exclusivity in design, and craftsmanship of fabric. This category comprises designer tops, fitted suits, high-end denim, and business attire usually constructed from high-end materials. Urban working professionals and upper-income segments are the key consumers, primarily in world fashion centers. Luxury brand influence and celebrity culture generate aspirational worth for high-end menswear. Furthermore, ethical and sustainable fashion options are increasingly sought after within this category. Retail experiences, including personalized styling and boutique offerings, also increase the popularity of high-end menswear. Global brands Hugo Boss, Ralph Lauren, and Armani corner this market.

Online Menswear Market

The online menswear market has seen accelerating growth with increasing internet penetration, smartphone usage, and convenience shopping. Buyers increasingly shop online for clothes due to ample product offerings, promotions, easy returns, and personalized suggestions. Online e-commerce platforms and direct-to-consumer (DTC) brands have revolutionized men's shopping for casual as well as formal clothing. Product categories such as t-shirts, jeans, and activewear are particularly favored online. Influencer marketing, virtual try-on, and artificial intelligence (AI)-based sizing solutions also improve digital shopping further. Additionally, subscription boxes and fashion curation services are growing, promoting experimentation and personalization in the men's fashion arena online.

United States Menswear Market

The United States menswear industry is mature and very diverse with deep consumer interests in casual wear and athleisure wear. It is strengthened by high spendability, recurring seasonal promotions, and a growing movement toward sustainability in fashion trends. In addition, youth population presence in the United States also drives the growth of the market. For example, in 2022 there were approximately 21.64 million youths in the United States aged 15 to 19 years old. In comparison with the preceding year, when 21.57 million youths were in the U.S. between 15 and 19 years of age, this was a small increase. Also, a positive image for the market as a whole is being developed by the fact that the region is being served by popular menswear brands, which are extending their product lines to expand the customer base. For instance, U.S. Skims officially launched the arrival of Skims Mens in October 2023 with an All-Star campaign featuring NBA All-Star Shai Gilgeous-Alexander, 2022 NFL Defensive Player of the Year Nick Bosa, and football legend Neymar Jr. Easy tanks and tees, plush boxers, and technically constructed briefs are all included in the range.

France Menswear Market

France's menswear market is one that is known for elegance and high-fashion. French men value style, high-quality tailoring, and fit, especially in cities such as Paris and Lyon. The market is a balance between tradition and contemporary, with high-end brands and designer labels dominating. There is still strong demand for suits, outerwear, and fashionable casual wear. French fashion houses drive global menswear trends, while domestic consumers increasingly demand sustainability and ethical production. Consequently, numerous local brands are embracing organic textiles, handcrafting techniques, and traceable supply chains to serve changing consumer values in this discerning and fashion-conscious segment.

United Kingdom Menswear Market

United Kingdom menswear market combines classical British tailoring with modern streetwear fashion. London is still a fashion hub, where men are willing to experiment with new fashion. There is increasing need for both casualwear and formalwear, thanks to evolving fashion cycles and work culture. Major players include high-street traders such as Marks & Spencer, high-end brands such as Burberry, and sportswear brands such as Gymshark. While the physical stores are adapting to consumers' changing needs, the e-tail sector is expanding with lightning speed. Fashion-conscious consumers, evolving trends, and growth in demand for work-from-home attire are all influencing the industry.

China Menswear Market

The menswear market in China is one of the world's fastest-growing markets, led by growing incomes, urbanization, and fashion consciousness among millennial and Gen Z men. Domestic and foreign brands alike are experiencing growth in demand across premium as well as mass segments. E-commerce is a key driver, with websites such as Tmall and JD.com providing an extensive range of styles. Increasing influence of KOLs (Key Opinion Leaders) and live streaming further enhances market pull. From classic suits to streetwear and smart casuals, Chinese consumers are looking for fashion that reflects both cultural identity and global trends. Local designers are also gaining traction by blending modern and traditional looks.

India Menswear Market

India's menswear industry is growing fast with a huge youth population, increasing incomes, and changing fashion trends. Both western and ethnic wear are in demand, with high demand for kurtas, shirts, denim, and formal trousers. Fast fashion brands and e-commerce lead to accessibility. For example, in March 2024, The rights to distribute and manage the UK fashion retailer Next were acquired by the e-commerce giant Myntra. Therefore, the company is provided with the privilege of opening brand stores for Next's fashion company in India as well as providing Next's product. The business is also said to be supplemented by other segments such as increasing trend of adopting eco-friendly as well as sustainable fashion options, increasing fashion awareness and style-experimentation trends among Indian men, and increase in the obsession with fitness as well as wellbeing.

Saudi Arabia Menswear Market

The menswear market in Saudi Arabia is changing, influenced by global fashion trends and cultural heritage. Although thobes and traditional clothing are still the strongest, western attire like shirts, jeans, and formal wear are increasingly popular among youth. Urbanization, social interaction, and the trend toward casual and branded clothing are impacting buying behavior. Global brands are increasing retail footprint in cities such as Riyadh and Jeddah. Additionally, Vision 2030's emphasis on retail and lifestyle sector development is stimulating local production and fashion entrepreneurship. The increasing trend of male grooming also supplements fashion-awareness, underpinning further growth in the menswear market.

Menswear Market Segmentation

Apparel- Industry is divided into 3 viewpoints:

- Top Wear

- Bottom Wear

- Innerwear

Category- Industry is divided into 3 viewpoints:

- Mass

- Premium

- Luxury

Distribution Channel- Industry is divided into 2 viewpoints:

- Online

- Offline

Countries- Industry is divided into 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis

- Nike, Inc.

- Adidas AG

- H & M Hennes & Mauritz AB

- Levi Strauss & Co

- Ralph Lauren Corp

- PVH Corp

- Hugo Boss Group

- Under Armour Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Apparel, Category, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Menswear Market

6. Market Share Analysis

6.1 By Apparel

6.2 By Category

6.3 By Distribution Channel

6.4 By Countries

7. Apparel

7.1 Top Wear

7.2 Bottom Wear

7.3 Innerwear

8. Category

8.1 Mass

8.2 Premium

8.3 Luxury

9. Distribution Channel

9.1 Online

9.2 Offline

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Nike, Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Adidas AG

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 H & M Hennes & Mauritz AB

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Levi Strauss & Co

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Ralph Lauren Corp

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 PVH Corp

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Hugo Boss Group

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Under Armour Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com