Saudi Arabia Frozen Vegetables Market Size - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Frozen Vegetables Market Forecast 2025–2033 | Renub Research

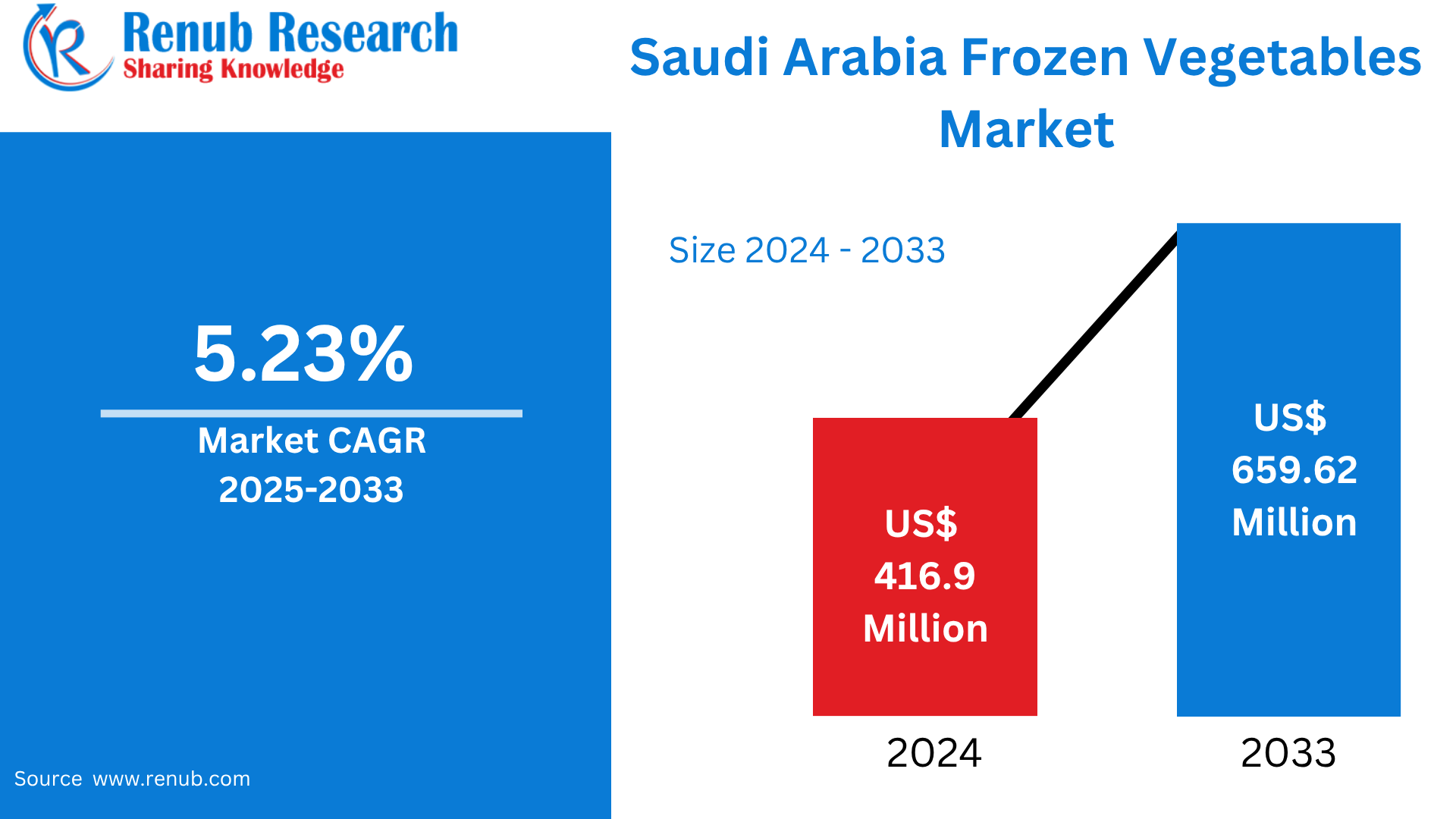

Saudi Arabia Frozen Vegetables Market is expected to reach US$ 659.62 million by 2033 from US$ 416.9 million in 2024, with a CAGR of 5.23% from 2025 to 2033. The market for frozen veggies in Saudi Arabia is developing due to a number of factors, including urbanization, growing retail infrastructure, growing health consciousness, the need for quick meal options, and shifting consumer habits.

Saudi Arabia Frozen Vegetables Market Report by Product (Corn, Asparagus, Spinach, Green Peas, Broccoli, Mushroom, Green Beans, Others), End User (Food Service Industry, Retail Customers), Distribution Channel (Discounters, Supermarket/Hypermarket, Others) and Company Analysis 2025-2033.

Saudi Arabia Frozen Vegetables Industry Overview

Veggies that are carefully frozen shortly after harvest are known as frozen veggies since this preserves their nutrients, brilliant colors, and maximum freshness. They are a year-round wholesome choice because they are rapidly frozen, retaining vital vitamins. Frozen vegetables offer convenience and reduce waste because they are always available, unlike fresh produce that spoils easily. They come in different slices or blends and are prepared for effortless usage, so there's no need for time-consuming preparation when adding them to meals. They are therefore a sensible, durable, and health-conscious option for hectic modern lives.

A number of important variables are driving the frozen vegetable market in Saudi Arabia. Consumer preference for frozen vegetables, which maintain their nutritional value, is a result of growing health and nutrition consciousness. Convenient meal options are in high demand due to busy lifestyles and urbanization; frozen vegetables provide time savings without sacrificing quality. These products are now more widely available thanks to the growth of contemporary retail formats including supermarkets, hypermarkets, and internet platforms. The quality and shelf life of frozen vegetables have been enhanced by technological developments like Individually Quick Freezing (IQF) technology, while cultural changes have increased the acceptance of frozen foods in Saudi cuisine.

Growth Drivers for the Saudi Arabia Frozen Vegetables Market

Changing Lifestyles and Busy Schedules

The market for frozen veggies in Saudi Arabia is mostly driven by shifting lifestyles and hectic schedules. Convenient, time-saving meal solutions are becoming more and more in demand as more people, particularly women, enter the job. Saudi Arabia's Q4 2024 labor data show that the country's employment rate is 66.4%. Saudi women's employment rate was 36.0%, compared to 27.9% for non-Saudi women. In the meantime, the employment rates for Saudi and non-Saudi men were 66.2% and 93.2%, respectively. A growing consumer sector that seeks ready-to-use food goods, such as frozen veggies, that save preparation time without sacrificing nutrition is reflected in this change in employment dynamics. Thus, the demand for and expansion of the frozen fruits and vegetables market in Saudi Arabia are being positively impacted by this changing lifestyle as well as a more active workforce.

Foodservice Industry Growth

The market for frozen vegetables is significantly influenced by the quick expansion of the foodservice sector in Saudi Arabia. The Kingdom's thriving tourism industry is driving up demand for reliable, superior, and conveniently preserved food ingredients in lodging facilities, dining establishments, and catering services. Saudi Arabia achieved this milestone seven years ahead of schedule in 2023, surpassing 100 million visitors. 2019 saw overall tourism expenditures of SAR 255.6 billion (about USD 69.01 billion), or 4.4% of the nation's GDP. While domestic tourism brought in 81.9 million people, international tourism brought in 27.4 million visitors and SAR 141.2 billion (USD 38.12 billion). The demand for frozen veggies, which provide chefs and foodservice providers with convenience, a long shelf life, and decreased waste, is rising as a result of the increase in tourism and hospitality activity. The market for frozen vegetables in Saudi Arabia is therefore being directly boosted by the expanding foodservice and hospitality industries.

Improved Cold Chain Infrastructure

The market for frozen vegetables in Saudi Arabia is expanding due in large part to improved cold chain infrastructure. The growing demand for frozen foods has made improvements in cold storage and transportation methods crucial to preserving the safety and quality of the final product. The Kingdom has made significant investments to develop refrigerated logistics networks, which have allowed for effective distribution in both urban and rural areas. By reducing spoiling, these enhancements guarantee that frozen veggies maintain their freshness and nutritious content throughout the production process and at the moment of sale. Improved cold chain capabilities also help the expanding restaurant and retail industries by guaranteeing a steady supply. Consequently, dependable cold chain systems are boosting consumer confidence in frozen vegetable goods throughout Saudi Arabia and enabling industry expansion.

Challenges in the Saudi Arabia Frozen Vegetables Market

Consumer Preference for Fresh Produce

The Saudi Arabian market for frozen veggies is severely hampered by consumers' preference for fresh food. Compared to frozen vegetables, many consumers believe that fresh vegetables are healthier, more natural, and taste better. This assumption stems from cultural norms and traditional purchasing patterns that support buying fresh ingredients on a regular basis. Misconceptions regarding frozen veggies continue to exist despite improvements in freezing technology that maintain quality and nutrition. Market expansion is constrained by this inclination, particularly among older and rural people. More consumer education and awareness initiatives emphasizing the nutritional value, safety, and convenience of frozen veggies are required to combat this.

High Import Dependence

The market for frozen vegetables in Saudi Arabia has significant challenges due to its high reliance on imports. The market is susceptible to disruptions in the global supply chain, fluctuating import prices, and currency instability because a significant amount of frozen veggies are acquired from foreign vendors. This dependence has an impact on product availability and price stability, particularly during times of global crisis or geopolitical unrest. The Kingdom's Vision 2030 objectives of food security and self-sufficiency are also at odds with it since it restricts the growth of indigenous agricultural and processing capacities. A more robust and sustainable frozen vegetable market requires increased investment in agri-processing facilities and local production to lessen reliance on imports.

Recent Developments in Saudi Arabia Frozen Vegetables Industry:

- Oct 2024: Four new investment opportunities for the establishment of integrated agricultural cities in the Makkah region were introduced by the Ministry of Environment, Water, and Agriculture. These projects include the establishment of a dedicated laboratory for the growth of wild seedlings and the production of fruit and vegetable trees. This program, which focuses on improving food security, promoting sustainable development, and developing the agricultural industry, is in line with the ministry's objectives, plans, and strategies.

- Sep 2024: In accordance with the national food security policy, the Saudi Agricultural Development Fund (ADF) announced that loans and credit facilities totaling more than SAR 2 billion (about USD 533 million) had been approved to support agricultural products. In particular, these loans help cold storage facilities and greenhouses that produce vegetables.

Saudi Arabia Frozen Vegetables Market Segments:

Product

- Corn

- Asparagus

- Spinach

- Green Peas

- Broccoli

- Mushroom

- Green Beans

- Others

End User

- Food Service Industry

- Retail Customers

Distribution Channel

- Discounters

- Supermarket/Hypermarket

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Conagra Brands

- Hormel Foods

- Unilever PLC

- The Kraft Heinz Company

- Nomad Foods Ltd

- B&G Foods, Inc.

- Greenyard

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Product, End User and Distribution Channel |

| Product Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Frozen Vegetables Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By End User

6.3 By Distribution Channel

7. Product

7.1 Corn

7.2 Asparagus

7.3 Spinach

7.4 Green Peas

7.5 Broccoli

7.6 Mushroom

7.7 Green Beans

7.8 Others

8. End User

8.1 Food Service Industry

8.2 Retail Customers

9. Distribution Channel

9.1 Discounters

9.2 Supermarket/Hypermarket

9.3 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 General Mills Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Conagra Brands

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Hormel Foods

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Unilever PLC

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 The Kraft Heinz Company

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Nomad Foods Ltd

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 B&G Foods, Inc.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Greenyard

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com