Electric Cargo Bike Market Size, Share, and Global Forecast 2025–2033

Buy NowGlobal Electric Cargo Bike Market Size Forecast 2025–2033

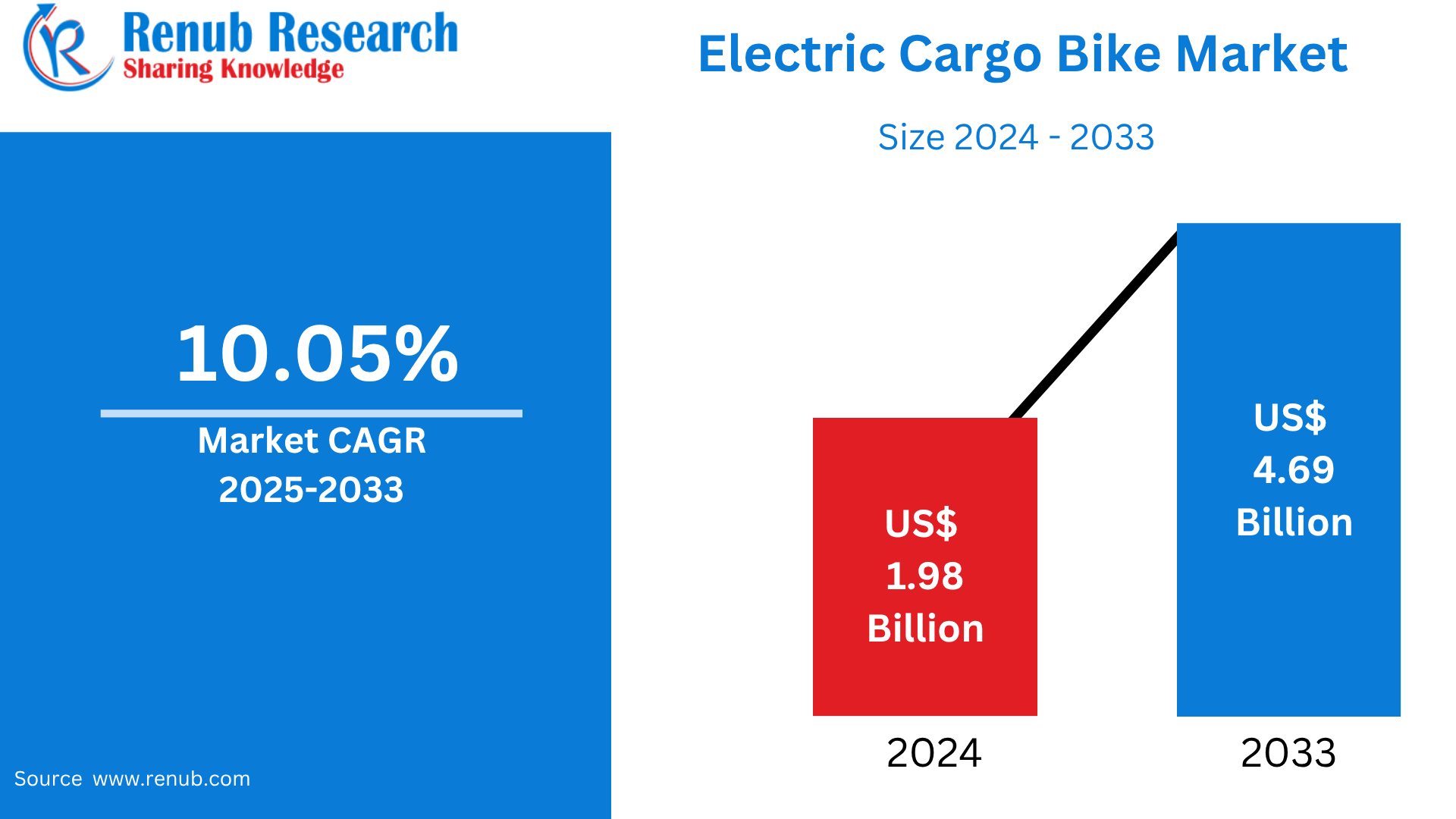

The Electric Cargo Bike market was valued at USD 1.98 billion in 2024 and is expected to reach USD 4.69 billion by 2033, growing at a CAGR of 10.05% over the forecast period. Urban delivery needs, sustainability targets, and increased fuel prices are compelling e-cargo bikes as a cost-effective, environmentally friendly option for last-mile logistics and personal mobility in urban cities.

Global Electric Cargo Bike Market Outlooks

An electric cargo bike is a bike with an electric motor and an integrated cargo space for carrying heavy loads, commodities, or people. They help riders pedal, compared to conventional bikes, so it is simpler to carry items a greater distance or up steep inclines. They are available in a range of configurations, such as front-loaders, rear-loaders, and trikes, that suit different transport requirements.

These bicycles are becoming increasingly popular as an eco-friendly substitute for delivery vans and personal vehicles, particularly for city use where traffic jams and exhaust emissions are issues. They are employed by firms for last-mile delivery, courier services, and mobile vending, while families employ them for school runs, grocery trips, or child-friendly commuting.

Governments and urban planners are promoting e-cargo bike use through incentives and infrastructure, including subsidies and dedicated bike lanes. Electric cargo bikes are an economical, emissions-free option for commercial and personal transportation due to their low costs of operation, zero emissions, and expanding range and capacity.

Drivers for Growth in the Global Electric Cargo Bike Market

Sustainable Urban Transport Initiatives

Urban cities across the globe are promoting low-emission zones and sustainable urban transportation. Electric cargo bikes are an eco-friendly answer to short-distance and last-mile logistics. They don't release tailpipe emissions, decongest traffic, and cut noise pollution. Policy initiatives, including subsidies and bike-lane widening, are giving adoption a push among logistics companies, small-scale enterprises, and consumers. As governments pursue carbon neutrality, demand for electric cargo bikes will increase. The International Energy Agency (IEA) forecasts a 35% rise in low-emission vehicle adoption, including e-bikes, by 2030. Urban mobility solutions and state subsidies are fueling cargo bike demand across different markets. Electric cargo bikes provide greater efficiency, reduced emissions, and cost savings, fulfilling the need for more sustainable transportation.

Increased Last-Mile Delivery and E-Commerce Logistics

Growth in e-commerce has escalated the requirement for effective, low-cost last-mile delivery options. Electric cargo bikes enable convenient maneuverability within crowded city streets, shorten delivery time, and decrease the cost of operations relative to vans. Giant delivery companies and neighborhood couriers alike are resorting to e-cargo bikes to serve burgeoning volumes of orders. They're especially useful in cities with scarce parking space and congested traffic, making them perfectly suited for food, parcel, and grocery delivery. The International Transport Forum (ITF) has reported that the volume of last-mile delivery will increase by 78% by 2030. Cargo bikes enhance delivery efficiency because they can ride through narrow city streets and crowded urban streets easily.

Battery Efficiency and Technological Advances

Advances in lithium-ion battery technology have boosted the range, speed, and payload capacity of electric cargo bikes considerably. Economies of scale and advances in technology are making features such as regenerative braking, modular cargo bays, GPS tracking, and weather-resistance more practical and desirable. With battery prices declining due to technological advancements and charging times decreasing, electric cargo bikes are increasingly a viable, practical, and cost-effective option for both enterprises and families. U.S. sales of e-bikes had reached nearly one million in 2022, almost four times the sales of 2019, showing rising acceptance and dependence on e-bikes as a means of transport in light of advances in technology.

Challenges in the Global Electric Cargo Bike Market

High Initial Cost and Limited Financing

Relative to their conventional bicycle or scooter counterparts, electric cargo bikes are more expensive to purchase upfront, partly because of batteries, motors, and frame strengthening. This may discourage low-income individuals and small businesses. Moreover, financing products and leasing schemes are yet to develop sufficiently in most markets. Absent sufficient subsidies or payment plans, widespread adoption is constrained, especially in the developing nations or in rural areas.

Lack of Infrastructure and Regulatory Standardization

Most cities do not have the infrastructure—wide bike lanes, secure parking, and charging facilities—necessary for seamless e-cargo bike operation. In addition, electric cargo bikes are not regulated uniformly across size, speed, or class. This lack of regulatory clarity can hinder manufacturers and delivery services with multi-market operations, capping scalability and cross-border deployment.

Global Two-Wheeler Electric Cargo Bike Market

The two-wheeler electric cargo bike is the most prevalent model, with its popularity riding on lightweight, maneuverability, and economical cost. Suited for last-mile delivery and small cargo haulage, they are highly sought in high-density urban areas where parking and maneuverability are key. Food delivery, courier, and retail companies employ them to capitalize on speed and efficiency. Their more straightforward design also makes them simpler to keep up with and ideal for personal ownership as well. With high demand from both Asia and Europe, this segment dominates global volume sales and continues to expand with additional models designed to meet both commercial and family demands.

Global Four-Wheeler Electric Cargo Bike Market

Four-wheeler electric cargo bikes or cargo e-quads are becoming increasingly popular due to their improved stability, increased load capacity, and applicability for heavier-duty usage. They find applications in city services, campus logistics, industrial parks, and high-volume delivery networks. These models, with enclosed cargo space, can weatherproof and safeguard the goods. While more expensive than two-wheelers, they offer a sturdy solution compared to compact delivery vans, particularly where emissions are regulated. Adoption is increasing in Europe, where green logistics and freight solutions for urban areas are highly incentivized. As additional designs become available, this category has good growth potential.

Global Electric Cargo Bike Lithium-Ion Market

Lithium-ion batteries are the choice for electric cargo bikes because they have high energy density, a longer lifespan, and lighter weight. They provide more range and charge faster, thus being suitable for commercial delivery and high daily usage. Their durability and efficiency make the additional upfront cost worth it for most consumers. With improving lithium-ion technology and decreasing prices, this segment is likely to sustain high growth. Smart battery management system integration is also boosting performance and safety, enhancing their attractiveness in urban logistics and high-end consumer markets.

Global Electric Cargo Bike Lead-Based Market

Lead-acid batteries provide an affordable solution for electric cargo bikes, particularly in price-conscious or emerging markets. Although heavier and less efficient than lithium-ion batteries, lead-based systems are simpler to make and repair. They are usually found in entry-level or utilitarian models where demands for performance are lower. Environmental issues and reduced lifespans are, however, constraints. Increasing recycling regulation and increasing awareness of sustainability are slowly driving demand to greener battery technologies, but the lead-based market remains niche, particularly in agricultural and industrial applications.

Global Electric Cargo Bike Service Delivery Market

The service delivery industry is the backbone of e-cargo bike uptake. Food delivery, parcel logistics, and courier companies are increasingly using these bikes to lower delivery times and carbon emissions. E-cargo bikes can move more easily through congested traffic and park in smaller spaces, saving operational expenses heavily. They are most useful in urban low-emission areas where vans are limited. Retailers and logistics operators such as DHL and Amazon are testing fleets in key cities. As sustainability targets heighten, service delivery is the highest growth sector in the e-cargo bike market.

Global Electric Cargo Bike Personal Use Market

Electric cargo bikes are becoming increasingly popular among individuals and households for daily activities such as grocery shopping, school runs, and commuting. As city dwellers look for car substitutes, these bikes provide an inexpensive, environmentally friendly alternative with reduced costs of ownership. Coupled with child seats, cargo boxes, and protective gear, they're perfect for busy families. They're increasing in popularity in Europe and North America, where cycling infrastructure is well established and environmental consciousness is prevalent. As models become more stylish and convenient, adoption for personal use should skyrocket—particularly in cities that are supporting sustainable, car-free lifestyles.

United States Electric Cargo Bike Market

The U.S. electric cargo bike industry is growing, propelled by increasing demand for eco-friendly mobility and last-mile delivery. Urban areas such as New York, Portland, and San Francisco are embracing e-cargo bikes for commercial and personal application. E-commerce and food delivery businesses are investing in fleet electrification, and city governments are encouraging adoption via incentives and pilot schemes. But car-dominated infrastructure and narrow bike lanes remain a challenge. As people become more aware and infrastructure is developed, the U.S. is on track for robust market growth in family and logistics uses. Apr 2025, Tenways entered the US cargo bike market with the introduction of the Tenways Cargo One, a front-loading electric cargo bicycle providing a low-cost alternative to family transport, competing with brands such as Urban Arrow.

Germany Electric Cargo Bike Market

Germany is among the leaders in Europe for electric cargo bike adoption, supported by robust environmental policies, cycling infrastructure, and government incentives. Cities such as Berlin, Munich, and Hamburg have incorporated e-cargo bikes into city services and logistics systems. They are used by families and companies as eco-friendly transportation alternatives to cars, with extensive bike lanes and secure storage facilities. Germany's financial aid for e-cargo bike acquisition—especially for business purposes—is propelling adoption. The market keeps expanding, harmonizing engineering advancements with a clean urban lifestyle theme. Sep 2023, Maxion Wheels, the biggest wheel manufacturer, has collaborated with German electric cargo bike maker Antric. They are the exclusive wheel supplier for Antric's heavy cargo bike, the Antric One, offering an affordable steel wheel solution tailored for inner-city logistics.

China Electric Cargo Bike Market

Electric two-wheelers are a huge market in China, and cargo bikes are changing at a fast pace within this market. Although low-end versions dominate for domestic deliveries and utility purposes, high-end e-cargo bikes are appearing in tier-one cities. Powered by the thriving e-commerce and food delivery industries, these bikes represent a cost-effective and nimble last-mile solution. Local manufacturers are creating competitive products engineered specifically for high-density urban environments. But difficulties are weak regulation and saturation of low-quality products. Nevertheless, with ongoing investment in intelligent logistics and battery development, China continues to be a significant growth driver for the worldwide market. May 2025, Honda has introduced its first electric motorcycle, the E-VO, in China, in collaboration with Guangzhou and marketed as Wuyang-Honda. Cafe racer-type E-VO features two battery sizes: 4.1kWh and 6.2kWh.

Saudi Arabia Electric Cargo Bike Market

Saudi Arabia is a new but growing market for e-cargo bikes. While the country develops its economy in accordance with Vision 2030, there is an emphasis on eco-friendly transport and high-tech urban infrastructure. E-cargo bikes are being introduced for university logistics, last-mile delivery, and pilot urban schemes, particularly in Riyadh and NEOM smart city developments. High temperatures and restricted cycling culture are hindrances, but government sustainability initiatives and escalating e-commerce usage are bringing adoption through the door. Given proper infrastructure and incentives, the market might experience steady growth in the coming years. Dec 2022, Careem collaborates with ALMQR Development Company to introduce Medina's first public network of electric scooters and bicycles.

Market Segmentation

Product Type

- Two-wheeler

- Three-wheeler

- Four-wheeler

Battery Type

- Lithium-ion

- Lead-based

- Nickel-based

End User

- Courier and Parcel Service Providers

- Service Delivery

- Personal Use

- Large Retail Suppliers

- Waste Municipal Services

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Butchers & Bicycles Ltd.

- Accell Group N.V.

- Mahindra & Mahindra Limited

- Amsterdam Bicycle Company

- Xtracycle Cargo Bikes

- Riese & Müller GmbH

- CERO Inc.

- Kalkhoff Werke GmbH

- Giant Bicycles

- Rad Power Bikes Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Battery Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Electric Cargo Bike Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Battery Type

6.3 By End User

6.4 By Countries

7. Product Type

7.1 Two-wheeler

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Three-wheeler

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Four-wheeler

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

8. Battery Type

8.1 Lithium-ion

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Lead-based

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Nickel-based

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

9. End User

9.1 Courier and Parcel Service Providers

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Service Delivery

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Personal Use

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Large Retail Suppliers

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Waste Municipal Services

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

9.6 Others

9.6.1 Market Analysis

9.6.2 Market Size & Forecast

10. Countries

10.1 North America

10.1.1 United States

10.1.1.1 Market Analysis

10.1.1.2 Market Size & Forecast

10.1.2 Canada

10.1.2.1 Market Analysis

10.1.2.2 Market Size & Forecast

10.2 Europe

10.2.1 France

10.2.1.1 Market Analysis

10.2.1.2 Market Size & Forecast

10.2.2 Germany

10.2.2.1 Market Analysis

10.2.2.2 Market Size & Forecast

10.2.3 Italy

10.2.3.1 Market Analysis

10.2.3.2 Market Size & Forecast

10.2.4 Spain

10.2.4.1 Market Analysis

10.2.4.2 Market Size & Forecast

10.2.5 United Kingdom

10.2.5.1 Market Analysis

10.2.5.2 Market Size & Forecast

10.2.6 Belgium

10.2.6.1 Market Analysis

10.2.6.2 Market Size & Forecast

10.2.7 Netherlands

10.2.7.1 Market Analysis

10.2.7.2 Market Size & Forecast

10.2.8 Turkey

10.2.8.1 Market Analysis

10.2.8.2 Market Size & Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Analysis

10.3.1.2 Market Size & Forecast

10.3.2 Japan

10.3.2.1 Market Analysis

10.3.2.2 Market Size & Forecast

10.3.3 India

10.3.3.1 Market Analysis

10.3.3.2 Market Size & Forecast

10.4 South Korea

10.4.1.1 Market Analysis

10.4.1.2 Market Size & Forecast

10.4.2 Thailand

10.4.2.1 Market Analysis

10.4.2.2 Market Size & Forecast

10.4.3 Malaysia

10.4.3.1 Market Analysis

10.4.3.2 Market Size & Forecast

10.4.4 Indonesia

10.4.4.1 Market Analysis

10.4.4.2 Market Size & Forecast

10.4.5 Australia

10.4.5.1 Market Analysis

10.4.5.2 Market Size & Forecast

10.4.6 New Zealand

10.4.6.1 Market Analysis

10.4.6.2 Market Size & Forecast

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Market Analysis

10.5.1.2 Market Size & Forecast

10.5.2 Mexico

10.5.2.1 Market Analysis

10.5.2.2 Market Size & Forecast

10.5.3 Argentina

10.5.3.1 Market Analysis

10.5.3.2 Market Size & Forecast

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.1.1 Market Analysis

10.6.1.2 Market Size & Forecast

10.6.2 UAE

10.6.2.1 Market Analysis

10.6.2.2 Market Size & Forecast

10.6.3 South Africa

10.6.3.1 Market Analysis

10.6.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Butchers & Bicycles Ltd.

14.2 Accell Group N.V.

14.3 Mahindra & Mahindra Limited

14.4 Amsterdam Bicycle Company

14.5 Xtracycle Cargo Bikes

14.6 Riese & Müller GmbH

14.7 CERO Inc.

14.8 Kalkhoff Werke GmbH

14.9 Giant Bicycles

14.10 Rad Power Bikes Inc.

15. Key Players Analysis

15.1 Butchers & Bicycles Ltd.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Accell Group N.V.

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Mahindra & Mahindra Limited

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Amsterdam Bicycle Company

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Xtracycle Cargo Bikes

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Riese & Müller GmbH

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 CERO Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Kalkhoff Werke GmbH

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Giant Bicycles

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Rad Power Bikes Inc.

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com