Global Pharmaceutical Packaging Market – Material Trends & Forecast 2025–2033

Buy NowGlobal Pharmaceutical Packaging Market Size and Forecast 2025-2033

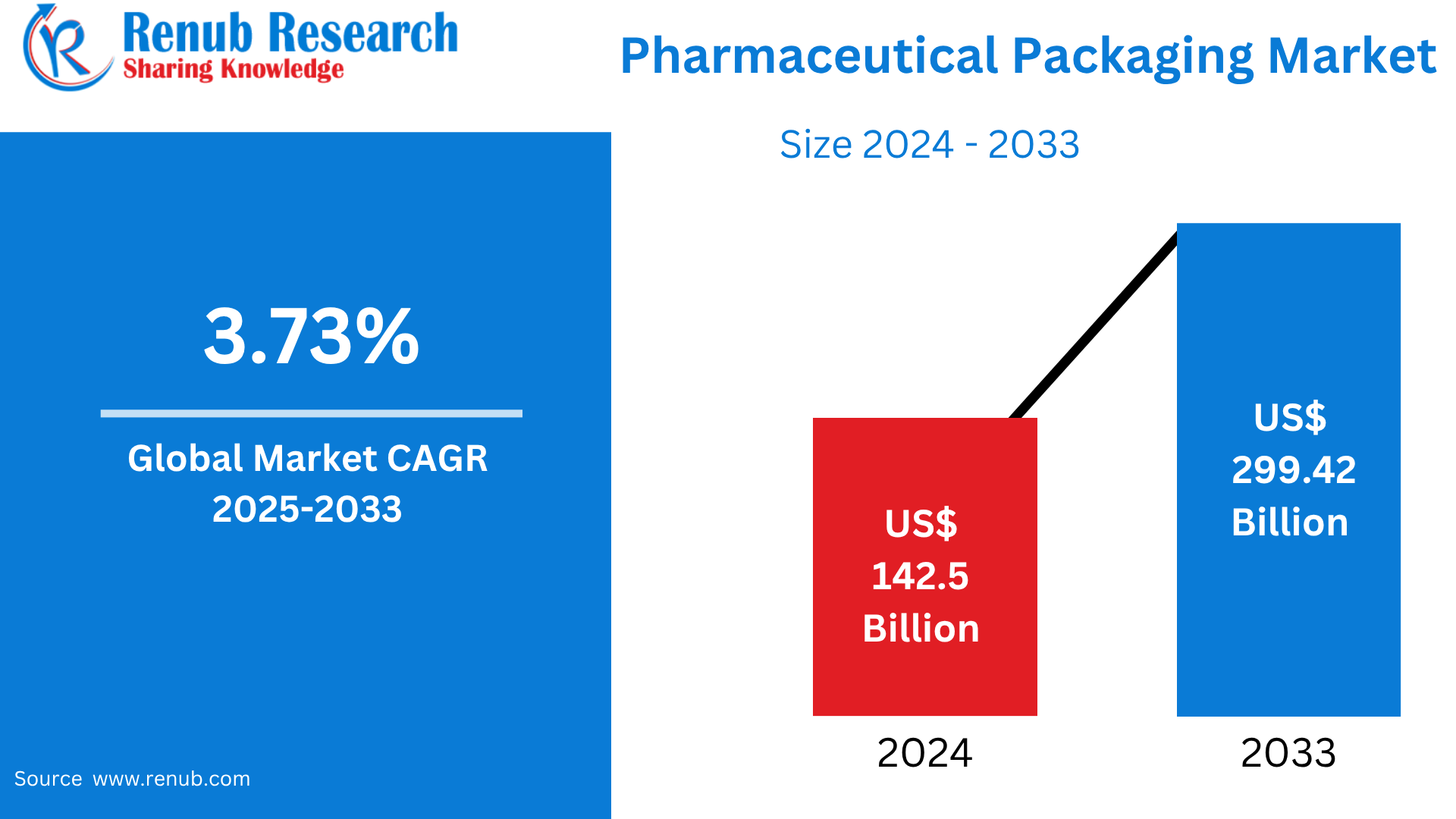

Pharmaceutical Packaging Market is expected to reach US$ 299.42 billion by 2033 from US$ 142.5 billion in 2024, with a CAGR of 8.60% from 2025 to 2033. Increased global demand for drugs, aging populations, the commonality of chronic diseases, developments in drug delivery systems, regulatory compliance needs, increased usage of biologics, new packaging materials, and expansion of access to healthcare in emerging markets are some of the key drivers driving the growth of the pharmaceutical packaging market.

Pharmaceutical Packaging Market Report by Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, Others), Product (Bottles, Caps & Closures, Pre-Filled Syringes, Vials & Ampoules, Jars & Canisters, Blister Packs, Pre-Filled Inhalers, Cartridges, Bags & Pouches, Others), Countries and Company Analysis 2025-2033.

Pharmaceutical Packaging Market Overview

Encapsulation and protection of drugs for use, sale, storage, and distribution are referred to as pharmaceutical packaging. Pharmaceutical packaging in a number of different packages is employed, such as pre-filled syringes, blister packs, bottles, vials, and ampoules. Contamination, manipulation, and counterfeiting should be avoided while ensuring product safety, stability, and effectiveness are the primary aims. Regulatory standards must be complied with by the packaging, which often involves labelling with relevant drug information. Functionality is being enhanced by innovations like child-resistant closures, intelligent packaging, and the use of environmental-friendly materials. Patient safety, compliance, and the overall integrity of the healthcare supply chain are all materially affected by pharmaceutical packaging.

Several significant reasons are propelling the pharmaceutical packaging industry. The demand for safe and efficient packaging is driven by increasing global demand for pharmaceuticals, especially due to aging populations and increasing chronic diseases. Innovation in medication delivery technology, such as blister packs and prefilled syringes, also drives market growth. Regulations on safety, tamper-evidence, and traceability drive the demand for special packaging. More sophisticated packaging is also needed with the growth of biologics and personalized medicine. The global growth of the market is also being significantly facilitated by innovation in environmentally friendly, smart, and sustainable packaging materials and increasing healthcare access in emerging economies.

Growth Drivers for the Pharmaceutical Packaging Market

Increasing Global Drug Demand

Growing global demand for drugs is one of the major drivers of the expansion of the pharmaceutical packaging market. Global pharmaceutical product consumption is being driven by factors such as increased population density, better access to healthcare, and more public knowledge of health issues. In emerging nations, the middle class is growing and the prevalence of chronic diseases is rising, which increases demand. In order to maintain medicine integrity and ensure patient safety, secure, durable, and effective packaging solutions are increasingly needed as more drugs are being produced and sold. These requirements are addressed by packaging materials innovation, such as the PharmaGuard blister packaging Südpack will launch in April 2023. PharmaGuard, being a polypropylene product, offers better protection against oxygen, UV light, and water vapor, prolonging medicine stability and shelf life and addressing increasing pharmaceutical demand globally.

Aging Population

The aging population is one of the key drivers of the pharmaceutical packaging market. With increased life expectancy all over the world, especially in developed countries, the population of old individuals is growing tremendously. Age-related conditions like diabetes, cardiovascular disease, neurological conditions, and arthritis tend to cause older individuals to require more drugs. This, in turn, boosts the demand for pharma packaging by elevating the consumption of prescription and over-the-counter medications. In addition, packaging that accommodates proper dosing and compliance, easy opening, and proper labeling is often demanded for elderly patients. This drives innovation in elderly-friendly and user-friendly packaging designs. In addition to driving market growth, the aging population also impacts packaging trends that ensure safety, convenience, and compliance, thereby creating increased demand for medications.

Technological Innovations

The pharmaceutical packaging market is growing tremendously with the help of technological advancements that enhance sustainability, functionality, and safety. With real-time tracking and authentication, advanced technologies such as smart packaging involving RFID chips, QR codes, and sensors enhance patient engagement, anti-counterfeiting, and product tracing. Pre-filled syringes, auto-injectors, and blister packs are some examples of advanced drug delivery packaging that enhances convenience for users and dosage accuracy. Compliance and safety are also bolstered by innovation in tamper-evident, child-resistant, and elderly-friendly packaging. Businesses are also emphasizing sustainability through the use of recyclable solutions and green materials. For example, Constantia Flexibles launched REGULA CIRC, a pharma packaging solution consisting of coldform foil to replace PE sealing layer for conventional PVC, in July 2023. This innovation promotes pharma pack sustainability by reducing the plastic content, enhancing the proportion of aluminum, and enhancing recyclability.

Challenges in the Pharmaceutical Packaging Market

Strict Regulatory Compliance

In the market for pharmaceutical packaging, strict regulatory compliance is a major obstacle. To guarantee medication safety, effectiveness, and traceability, packaging needs to adhere to strict national and international requirements. Labeling, serialization, tamper evidence, child resistance, and material compatibility are all covered by regulations. It can be expensive and time-consuming to continuously update packaging technologies and procedures to comply with changing regulations from organizations like the FDA, EMA, and others. Risks associated with non-compliance include product recalls, fines, and harm to a brand's reputation. Maintaining uniform worldwide adherence, particularly for multinational pharmaceutical corporations, complicates operations and necessitates strict quality control and documentation at every stage of the package lifecycle.

Complexity of Biologics and Specialty Drugs

One of the biggest obstacles facing the pharmaceutical packaging industry is the intricacy of biologics and specialized medications. These medications need sophisticated packaging methods that guarantee stability and sterility because they are extremely sensitive to environmental factors including temperature, light, and humidity. Many biologics require specialized containers, such as vials, syringes, or auto-injectors, because they must be given in injectable formats and stored in cold chain conditions. In addition to design and material requirements, packaging must also guard against contamination and deterioration. In addition to raising production costs and requiring strict quality control, its intricacy restricts the number of appropriate packaging solutions that satisfy patient use requirements and regulatory criteria.

United States Pharmaceutical Packaging Market

The market for pharmaceutical packaging in the US is expanding rapidly due to rising consumer demand for creative, ecological, and safe packaging options. The market is expanding due to factors such increased pharmaceutical manufacturing, stricter regulations, and the requirement for child-resistant and tamper-evident packaging. Crown Packaging Corp. stated in November 2024 that it would increase its presence in the Midwest of the United States by opening a new branch in Chicago in 2025. This action is a component of the business's continuous plan to improve the services it provides and satisfy the region's rising need for packaging solutions. The U.S. pharmaceutical packaging market is well-positioned for future expansion and innovation due to developments in smart packaging and an increasing focus on patient safety.

Germany Pharmaceutical Packaging Market

The German pharmaceutical packaging business is changing quickly, with a focus on innovation, sustainability, and legal compliance. Investments in cutting-edge materials and technology are being driven by the demand for economical and environmentally friendly packaging solutions. Amcor collaborated with Cheer Pack North America and Stonyfield Organic in March 2024 to create the first spouted pouch composed completely of polyethylene (PE). In keeping with Germany's strong emphasis on environmental responsibility, this innovation aims to revolutionize packaging by cutting prices and carbon footprints. Without sacrificing the integrity and safety of the product, such developments are anticipated to have an impact on pharmaceutical packaging by promoting sustainable practices. With a growing emphasis on eco-friendly packaging and effective supply chain solutions, Germany's industry is expanding and mirroring broader European trends toward sustainability and innovation.

India Pharmaceutical Packaging Market

Due to rising pharmaceutical production, more exports, and a greater emphasis on quality and safety, the Indian pharmaceutical packaging market is growing quickly. The nation's status as a global pharmaceutical hub is being supported by the growing demand for sophisticated, affordable, and environmentally friendly packaging solutions. In order to provide high-end yet reasonably priced packaging for medications and vaccines, TPG announced in May 2025 that it would purchase a 35% share in SCHOTT Poonawalla, a joint venture between SCHOTT Pharma and the Serum Institute of India (SII). Novo Holdings, a Danish company, also became a co-investor, bolstering the venture's strategic and financial standing. This investment demonstrates how India's pharmaceutical packaging industry is placing an increasing focus on innovation and teamwork to satisfy changing consumer demands.

Saudi Arabia Pharmaceutical Packaging Market

Growing healthcare demands and regulatory emphasis on sustainability and safety are driving the Saudi Arabian pharmaceutical packaging market's notable expansion. Novel packaging approaches are being used to improve supply chain effectiveness, patient compliance, and medication stability. Organon and Eli Lilly extended their partnership in August 2024, with Organon now serving as the only distributor and marketer of Emgality, a migraine drug, throughout Saudi Arabia and the surrounding areas. This collaboration demonstrates Organon's robust commercialization skills, global presence, and proficiency in women's health. Crucially, Organon's participation is anticipated to support environmentally friendly packaging methods in the pharmaceutical industry, supporting the market's transition to green, ethical packaging technologies and conforming to worldwide trends toward eco-friendly solutions.

Pharmaceutical Packaging Market Segments:

Material

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Aluminum Foil

- Others

Product

- Bottles

- Caps & Closures

- Pre-Filled Syringes

- Vials & Ampoules

- Jars & Canisters

- Blister Packs

- Pre-Filled Inhalers

- Cartridges

- Bags & Pouches

- Others

Country

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- United Arab Emirates

- Saudi Arabia

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- Amcor PLC

- 3M Company

- Schott AG

- WestRock Company

- Berry Global Group Inc.

- McKesson Corporation

- AptarGroup Inc.

- Klockner Pentaplast Group

- CCL Industries Inc.

- FlexiTuff International Ltd

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Material, By Product and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Pharmaceutical Packaging Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Material

6.2 By Product

6.3 By Countries

7. Material

7.1 Plastics & Polymers

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Paper & Paperboard

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Glass

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Aluminum Foil

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Others

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

8. Product

8.1 Bottles

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Caps & Closures

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Pre-Filled Syringes

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

8.4 Vials & Ampoules

8.4.1 Market Analysis

8.4.2 Market Size & Forecast

8.5 Jars & Canisters

8.5.1 Market Analysis

8.5.2 Market Size & Forecast

8.6 Blister Packs

8.6.1 Market Analysis

8.6.2 Market Size & Forecast

8.7 Pre-Filled Inhalers

8.7.1 Market Analysis

8.7.2 Market Size & Forecast

8.8 Cartridges

8.8.1 Market Analysis

8.8.2 Market Size & Forecast

8.9 Bags & Pouches

8.9.1 Market Analysis

8.9.2 Market Size & Forecast

8.10 Others

8.10.1 Market Analysis

8.10.2 Market Size & Forecast

9. Countries

9.1 North America

9.1.1 United States

9.1.1.1 Market Analysis

9.1.1.2 Market Size & Forecast

9.1.2 Canada

9.1.2.1 Market Analysis

9.1.2.2 Market Size & Forecast

9.2 Europe

9.2.1 France

9.2.1.1 Market Analysis

9.2.1.2 Market Size & Forecast

9.2.2 Germany

9.2.2.1 Market Analysis

9.2.2.2 Market Size & Forecast

9.2.3 Italy

9.2.3.1 Market Analysis

9.2.3.2 Market Size & Forecast

9.2.4 Spain

9.2.4.1 Market Analysis

9.2.4.2 Market Size & Forecast

9.2.5 United Kingdom

9.2.5.1 Market Analysis

9.2.5.2 Market Size & Forecast

9.2.6 Belgium

9.2.6.1 Market Analysis

9.2.6.2 Market Size & Forecast

9.2.7 Netherlands

9.2.7.1 Market Analysis

9.2.7.2 Market Size & Forecast

9.2.8 Turkey

9.2.8.1 Market Analysis

9.2.8.2 Market Size & Forecast

9.3 Asia Pacific

9.3.1 China

9.3.1.1 Market Analysis

9.3.1.2 Market Size & Forecast

9.3.2 Japan

9.3.2.1 Market Analysis

9.3.2.2 Market Size & Forecast

9.3.3 India

9.3.3.1 Market Analysis

9.3.3.2 Market Size & Forecast

9.3.4 South Korea

9.3.4.1 Market Analysis

9.3.4.2 Market Size & Forecast

9.3.5 Thailand

9.3.5.1 Market Analysis

9.3.5.2 Market Size & Forecast

9.3.6 Malaysia

9.3.6.1 Market Analysis

9.3.6.2 Market Size & Forecast

9.3.7 Indonesia

9.3.7.1 Market Analysis

9.3.7.2 Market Size & Forecast

9.3.8 Australia

9.3.8.1 Market Analysis

9.3.8.2 Market Size & Forecast

9.3.9 New Zealand

9.3.9.1 Market Analysis

9.3.9.2 Market Size & Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Analysis

9.4.1.2 Market Size & Forecast

9.4.2 Mexico

9.4.2.1 Market Analysis

9.4.2.2 Market Size & Forecast

9.4.3 Argentina

9.4.3.1 Market Analysis

9.4.3.2 Market Size & Forecast

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Market Analysis

9.5.1.2 Market Size & Forecast

9.5.2 UAE

9.5.2.1 Market Analysis

9.5.2.2 Market Size & Forecast

9.5.3 South Africa

9.5.3.1 Market Analysis

9.5.3.2 Market Size & Forecast

10. Value Chain Analysis

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Pricing Benchmark Analysis

13.1 Amcor PLC

13.2 3M Company

13.3 Schott AG

13.4 WestRock Company

13.5 Berry Global Group Inc.

13.6 McKesson Corporation

13.7 AptarGroup Inc.

13.8 Klockner Pentaplast Group

13.9 CCL Industries Inc.

13.10 FlexiTuff International Ltd

14. Key Players Analysis

14.1 Amcor PLC

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 SWOT Analysis

14.1.5 Revenue Analysis

14.2 3M Company

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 SWOT Analysis

14.2.5 Revenue Analysis

14.3 Schott AG

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 SWOT Analysis

14.3.5 Revenue Analysis

14.4 WestRock Company

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 SWOT Analysis

14.4.5 Revenue Analysis

14.5 Berry Global Group Inc.

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 SWOT Analysis

14.5.5 Revenue Analysis

14.6 McKesson Corporation

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 SWOT Analysis

14.6.5 Revenue Analysis

14.7 AptarGroup Inc.

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 SWOT Analysis

14.7.5 Revenue Analysis

14.8 Klockner Pentaplast Group

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 SWOT Analysis

14.8.5 Revenue Analysis

14.9 CCL Industries Inc.

14.9.1 Overviews

14.9.2 Key Person

14.9.3 Recent Developments

14.9.4 SWOT Analysis

14.9.5 Revenue Analysis

14.10 FlexiTuff International Ltd

14.10.1 Overviews

14.10.2 Key Person

14.10.3 Recent Developments

14.10.4 SWOT Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com