Denmark Pharmaceutical Market – Drug Development & Forecast 2025–2033

Buy NowDenmark Pharmaceutical Market Size and Forecast 2025-2033

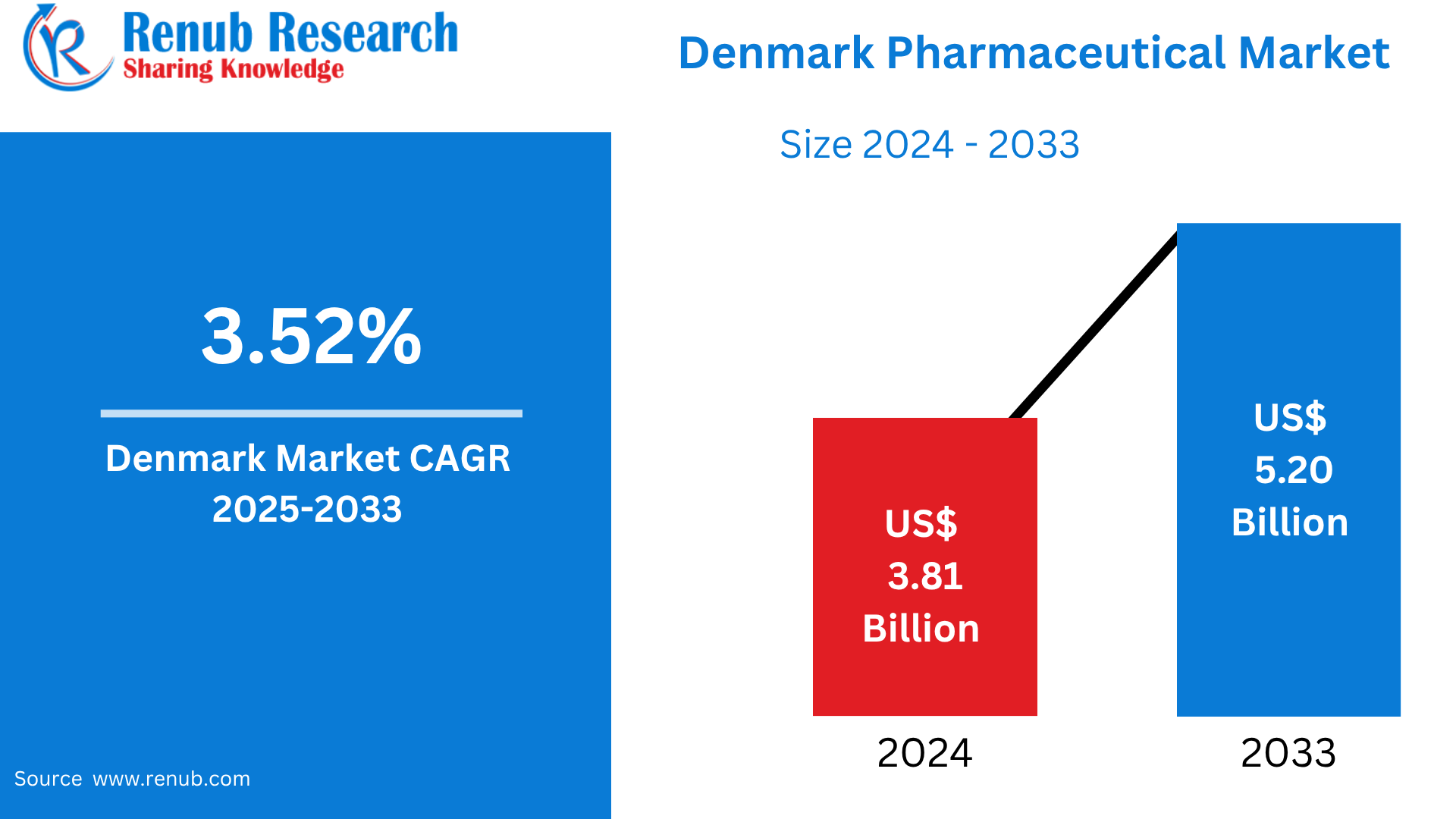

Denmark Pharmaceutical Market is expected to reach US$ 5.20 billion by 2033 from US$ 3.81 billion in 2024, with a CAGR of 3.52% from 2025 to 2033. Heavy R&D spending, government assistance, well-developed healthcare system, aging population, growth in the incidence of chronic diseases, advances in biotechnology, world demand for exports, and the location of world-class pharmaceutical giants such as Novo Nordisk and Lundbeck are all determinants of Denmark's expanding pharmaceutical market.

Denmark Pharmaceutical Market Report by Therapeutic Class (Cancer, Infectious Diseases, Cardiovascular Diseases, Diabetes, Respiratory Diseases, Central Nervous System Disorders, Autoimmune Diseases, Others), Drug Type (Branded, Generic), Prescription Type (OTC Drugs, Prescription Drugs), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Others), and Company Analysis 2025-2033.

Denmark Pharmaceutical Market Overview

Investigation, research, production, and promotion of drugs and therapies utilized to cure, prevent, or control disease fall within the pharmaceutical sector. Through the provision of innovative medical treatments and increased life expectancy and quality of life, it plays an important role in world medicine. Scientific breakthroughs, government approvals, and the ongoing demand for effective treatments drive this industry. Both small biotech firms and international corporations are prominent players. Prescription drugs, vaccines, and over-the-counter drugs are all pharmaceuticals. The sector often collaborates with research and clinical institutions to accelerate development and is highly regulated to ensure safety and efficacy of drugs.

High R&D expenditures, a collaborative academic and health environment, and supportive government regulations are the primary impetus for Denmark's pharmaceutical industry. Major contributions are made by leading global companies such as Novo Nordisk and Lundbeck through specialty medicine creation and global exports. Demand within the domestic market is also boosted by an aging population and the spread of chronic diseases such as diabetes. Innovation through personalized therapy and real-world evidence creation are enabled by advanced health data infrastructure in Denmark. Its global competitiveness is enhanced by an open regulatory system and access to EU markets. These combine to offer a robust, future-proof pharmaceutical sector with scope to expand.

Growth Drivers for the Denmark Pharmaceutical Market

Advanced Health Data Infrastructure

One of the key drivers for Denmark's pharmaceutical market's growth is its advanced heath data infrastructure. With biobanks, illness registries, and population-level electronic health records, the country boasts one of the most advanced and unified systems of healthcare data in the world. Since every Danish citizen is assigned a personal identification number, medical records can be exactly correlated between clinics, hospitals, and pharmacies. The approach opens up real-world data to academics and pharma companies to facilitate post-marketing surveillance, drug development, and clinical trials. Such access reduces the cost and time-to-market of research as well as speeds up pharmacovigilance and personalized treatment innovation. It also enhances the quality and efficiency of clinical trials by enabling long-term follow-up and targeted patient recruitment. In addition, Denmark is a safe destination for international collaboration due to the stringent data protection legislation that ensures patient confidentiality. This technological advantage enhances Denmark's competitiveness in the life sciences world and makes it a leading site for pharmaceutical R&D.

Supportive Government Policies

Denmark's pharma industry is growing largely due to the favorable government policies of the country. Denmark has established a comprehensive Life Sciences Growth Plan incorporating 36 initiatives across six key areas such as clinical trials, R&D, and regulatory environments. This strategic plan aims to further consolidate Denmark's reputation as a leading life sciences nation by fostering innovation and streamlining procedures.

The establishment of a "one-stop-shop" for drug companies that simplifies and quickens the regulatory approval process is an essential component of this program. By reducing administrative barriers, this program makes it easier for businesses to set up and expand production sites in Denmark. In addition, Denmark's climate agreement with the pharmaceutical industry illustrates its commitment to environmental responsibility. Consistent with international environmental aims, our partnership works to support green innovation and reduce CO2 emissions. Overall, taken as a package, all these beneficial government programs offer a good environment for pharmaceutical companies to expand, innovate, and become globally competitive for Denmark's pharmaceutical sector.

Strong R&D Investment

High investment in research and development (R&D) is one of the factors propelling the growth of the pharmaceutical market in Denmark. With a significant proportion being allocated to life sciences and pharmaceuticals, the country has some of the highest R&D expenditures per GDP of any nation globally. Both the public funding of the Danish government and substantial contributions from the private sector—particularly from major players such as Novo Nordisk and Lundbeck—funding this acquisition.

Universities, hospitals, and enterprise are in close collaboration to facilitate Denmark's R&D environment that encourages innovation in biotechnology, personalized medicine, and drug development. Tax reductions, subsidies, and strategic initiatives such as the Life Sciences Growth Plan are some of the government measures that actively encourage R&D. Contemporary research infrastructure and highly skilled staff are also available, which adds to Denmark's competitive edge. This robust R&D climate accelerates the development of novel treatments, attracts foreign partnerships, and makes Denmark a world leader in clinical excellence and pharmaceutical innovation.

Challenges in the Denmark Pharmaceutical Market

Regulatory Complexity and EU Compliance

EU compliance and regulatory complexity provide major obstacles for Denmark's pharmaceutical industry. Businesses have to deal with two sets of regulations: strict European Union guidelines and Danish state laws. This results in a complicated and frequently drawn-out approval process for new medications and clinical studies, which can raise expenses and postpone market entry. Startups and small and medium-sized businesses (SMEs) frequently find it difficult to satisfy these standards due to the resource requirements and administrative load. Furthermore, ongoing adaptation is necessary due to the EU's periodic revisions and harmonization initiatives. For Danish pharmaceutical businesses, sustaining innovation speed while balancing compliance is still a major concern.

Sustainability and Green Transition

For Denmark's pharmaceutical industry, sustainability and the green transition pose increasing obstacles. There is growing pressure on the business to lessen its environmental impact, which includes controlling water use in manufacturing processes, cutting carbon emissions, and limiting waste. Significant investments in cleaner technologies and process innovations are necessary to meet Denmark's aggressive climate targets and EU environmental requirements. Pharmaceutical businesses also need to strike a balance between sustainability measures and preserving cost-effectiveness and production efficiency. Changes in sourcing procedures and supply networks are also necessary for this shift. The Danish pharmaceutical industry must overcome the difficult task of successfully incorporating green practices while maintaining its competitiveness in order to keep up with worldwide sustainability trends.

Recent Developments in Denmark Pharmaceutical Industry

- July 2022: The Danish business Bavarian Nordic increased its ability to produce 10 million doses of the monkeypox vaccine.

- June 2022: To encourage early identification of non-alcoholic steatohepatitis (NASH) and increase patient awareness, Novo Nordisk A/S, a leading worldwide healthcare organization, and Echosens, a high-tech company offering liver diagnostic instruments, teamed.

Denmark Pharmaceutical Market Segments:

Therapeutic Class

- Cancer

- Infectious Diseases

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Central Nervous System Disorders

- Autoimmune Diseases

- Others

Drug Type

- Branded

- Generic

Prescription Type

- OTC Drugs

- Prescription Drugs

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- Novo Nordisk A/S

- H. Lundbeck A/S

- Leo Pharma A/S

- Orifarm Group A/S

- ALK-Abell A/S

- Xellia ApS

- Takeda Pharma A/S

- Sandoz A/S

- Ferring Pharmaceuticals A/S

- FUJIFILM Diosynth Biotechnologies

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Therapeutic Class, By Drug Type, By Prescription Type and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Denmark Pharmaceutical Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Therapeutic Class

6.2 By Drug Type

6.3 By Prescription Type

6.4 By Distribution Channel

7. Therapeutic Class

7.1 Cancer

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Infectious Diseases

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Cardiovascular Diseases

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Diabetes

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Respiratory Diseases

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

7.6 Central Nervous System Disorders

7.6.1 Market Analysis

7.6.2 Market Size & Forecast

7.7 Autoimmune Diseases

7.7.1 Market Analysis

7.7.2 Market Size & Forecast

7.8 Others

7.8.1 Market Analysis

7.8.2 Market Size & Forecast

8. Drug Type

8.1 Branded

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Generic

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

9. Prescription Type

9.1 OTC Drugs

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Prescription Drugs

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

10. Distribution Channel

10.1 Hospital Pharmacy

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Retail Pharmacy

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

10.3 Others

10.3.1 Market Analysis

10.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Novo Nordisk A/S

14.2 H. Lundbeck A/S

14.3 Leo Pharma A/S

14.4 Orifarm Group A/S

14.5 ALK-Abell A/S

14.6 Xellia ApS

14.7 Takeda Pharma A/S

14.8 Sandoz A/S

14.9 Ferring Pharmaceuticals A/S

14.10 FUJIFILM Diosynth Biotechnologies

15. Key Players Analysis

15.1 Novo Nordisk A/S

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 H. Lundbeck A/S

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Leo Pharma A/S

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Orifarm Group A/S

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 ALK-Abell A/S

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Xellia ApS

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Takeda Pharma A/S

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Sandoz A/S

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Ferring Pharmaceuticals A/S

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 FUJIFILM Diosynth Biotechnologies

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com