Online Gaming Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowOnline Gaming Market Size and Forecast 2025-2033

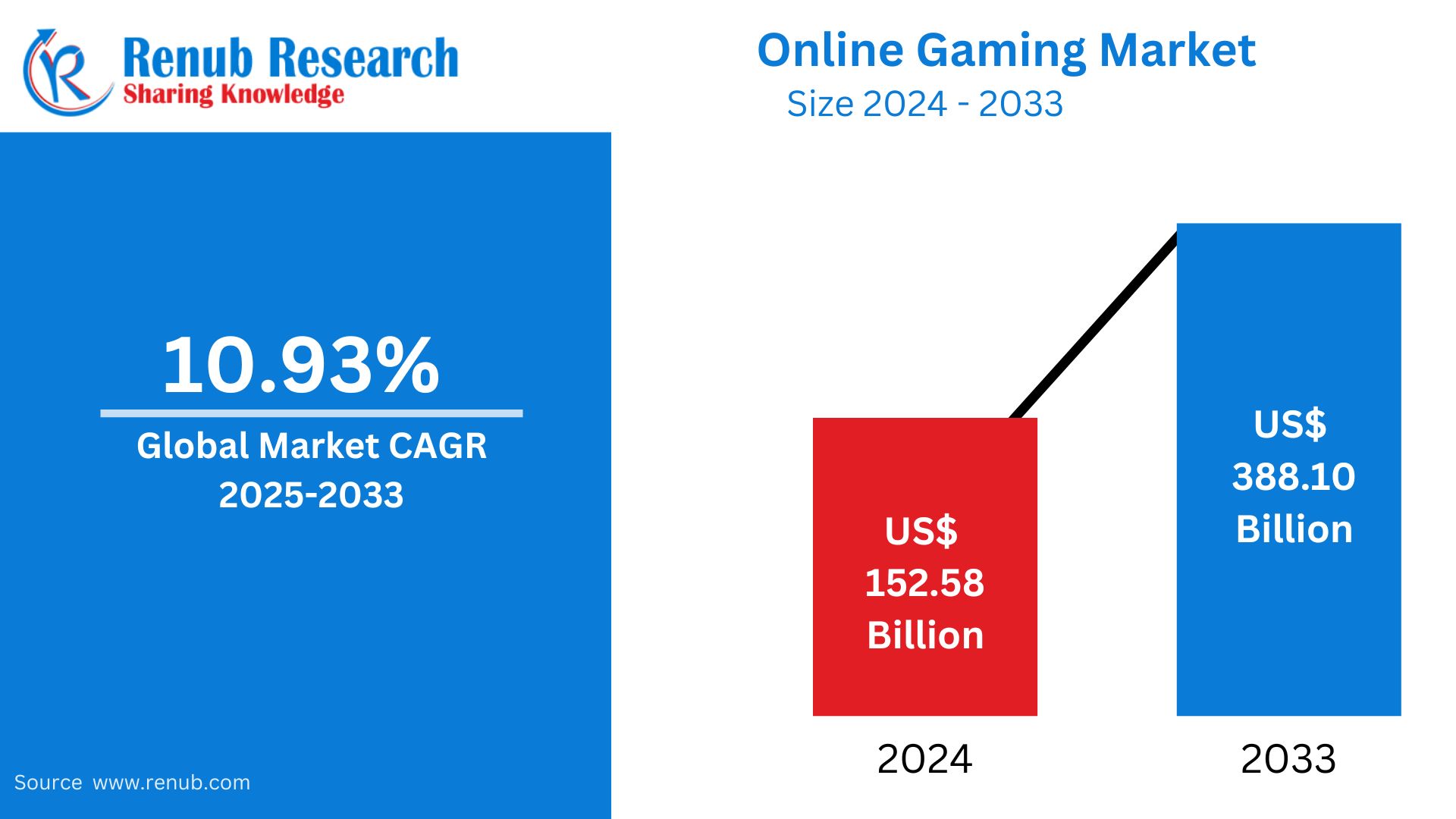

The Global Online Gaming Market size was valued at US$ 152.58 billion in 2024. This market is projected to grow at a CAGR of 10.93% from 2025 to 2033. The market will reach US$ 388.10 billion by 2033. The primary drivers of the market are technology advancement, increase in internet penetration, and increased popularity of multiplayer and mobile games. The increasing investments in esports and immersive gaming technologies also drive the market upward.

The report Online Gaming Market & Forecast covers by Type (Action, Adventure, Puzzle, Arcade, and Others), Platform (Mobile Phone, PCs, Console, and Others), Gamer Type (Social Gamers, Serious Gamers, and Core Gamers), Age Group (Below 10 Years, 11-24 Years, 25-44 Years, and 45 and Above Years), Region and Company Analysis 2025-2033.

Online Gaming Market Overview

Online game refers to video games that are played through the internet and enable players to connect and engage with each other in real time. It extends across PCs, consoles, and mobile devices to provide a spectrum of genres from first-person shooters (FPS) and multiplayer online battle arenas (MOBAs) to RPGs and casual games. There is also an area of esports where professional gamers compete in a tournament streamed online to global audiences. Features such as multiplayer modes, graphics, and social interactions have made online gaming the most preferred form of entertainment around the world.

Advances in technology, availability of internet access, and cheap devices have popularized multiplayer game industry. Mobile games has been an essential component, allowing the masses to have entertainment easily available. Socializing, competitive gameplay, and community building on gaming platforms and live-streaming sites enhance participation. The esports revolution, with massive tournaments and worldwide fan bases, has propelled online games into mainstream culture and placed it as a leading international entertainment industry.

Key Growth Drivers of the Online Gaming Market

Technological Advancements in Gaming

The global online games market has some growth drivers. These include high-speed internet, powerful computer hardware, and immersive technologies like virtual reality (VR) and augmented reality (AR). These technologies have enabled better graphics, smooth multiplayer experiences, and interactive gameplay. Cloud gaming services have also revolutionized access by allowing players to stream games without needing high-end devices. Also, improving gaming personalization will continue based on innovations made in artificial intelligence and machine learning. Engagements in playing will continue being up for better entertainment over diverse demographics and geographies while more innovations follow February 2023: SIE launches worldwide next-gen PlayStation(R) VR2. With high fidelity visuals, new sensory features, and enhanced tracking, PlayStation VR2 takes the virtual reality world of games further, enabling players to access a wider world of sensations.

Growing Smartphone Penetration

Advancements in mobile penetration across all regions have strongly contributed to increased online games industry, as mobiles provide accessibility and affordability, creating a large gaming audience from occasional gamers to pros. The better mobile internet connectivity, especially with the rollout of 5G networks, has enhanced games experiences and supported real-time multiplayer games and seamless streaming. Developers are also focusing on creating engaging, mobile-optimized content, further driving the popularity of online gaming among users of all ages and income levels. According to the GSMA's 2023 report, over half of the global population (54%) now owns a smartphone, which is 4.3 billion people.

Emergence of Esports and Streaming Services

Esports and live-streaming services have changed the face of online gaming by transforming it into a spectator sport for millions of people around the globe. Competitive gaming tournaments with high prize pools and professional gamers have become increasingly popular, drawing in sponsorships and investments from big brands. Platforms such as Twitch and YouTube Gaming enable game players to broadcast gameplay and connect with their audiences. This convergence of gaming and entertainment has expanded the market, making online gaming a cultural phenomenon and a lucrative industry for developers, players, and investors.

Challenges in the Online Games Market

Cybersecurity and Privacy Concerns

The global online games market faces significant challenges related to cybersecurity and privacy. More and more gamers are facing hacking, phishing, and data breaches because of multiplayer games that demand an account to sign up for a game and have in-game purchases.

The risk of hacking is also extended towards personal and financial information, as it gets stored on gaming platforms. Moreover, younger players get easily caught in scams and by online predators. For this, gaming companies have to establish a trustful position with security measures such as two-factor authentication and encryption. But this still remains a constant challenge in the implementation of such measures without interfering with the game.

Regulatory and Legal Issues

The online gaming industry faces various regulations and legal challenges. The regulations differ significantly from region to region. Gambling-like mechanics in games, such as loot boxes, have raised concern and regulatory actions. Some governments restrict gaming content, playtime, or monetization methods, which can restrict market growth. Another added complication to the process of operating a market are the tax policies and licensing required by gaming companies. While maintaining compliance with such regulatory standards, an online gaming company interested in going international faces a very important challenge-that of sustaining customer interest.

Online Action Game Market

The market for online action games is expanding dramatically. Increasing demands for intense experience games drive its growth. These games are mostly dynamic combat, adventure, and real-time multiplayer games that appeal to a broad audience. Technological advancements such as high-speed internet and improved graphics enhance gameplay and attract more players. The rise of mobile gaming and esports has further fueled demand, with competitive action games dominating global tournaments. Another key feature of adding social aspects such as live streaming and in-game communication that enhance engagement keeps online action game as one of the major areas within the gaming market.

Mobile Phone Online Game Market

The market of mobile phone online games is the fastest growing part of the gaming industry with growing penetration of smartphone and access to affordable internet. Mobile gaming can be conveniently done by accessing the entertainment. This market encompasses various genres, including casual, multiplayer, and battle royale games, appealing to diverse audiences. The rise of 5G connectivity has enhanced real-time multiplayer experiences, while in-app purchases and freemium models drive revenue. Social features like leaderboards and in-game chat boost engagement. With continuous advancements in mobile technology, this market is poised for sustained growth worldwide.

11-24 Years Age User Online Game Market

The 11-24 demographic is the market's most dynamic segment, comprising the majority of growth in online gaming. This segment is highly engrossed with casual and competitive games, most of which constitute their leisurely activities. Smartphones, game consoles, and PCs have seen an increase, which has enabled young users to access games and be attracted more by multiplayer features, graphics intensity, and a social experience in the game. Other interesting topics include esports and streaming sites. The new craze is now mobile gaming. In addition, there is the spending on in-game purchases from people of this age group that creates more revenues to the market.

United States Online Gaming Market

Online gaming is quite a gigantic as well as rapidly evolving business around the globe with technological innovation and strong culture, as well as widespread availability of internet in the US. The market includes mobile gaming, PC and console games, and esports. The market has grown significantly due to the increased popularity of online multiplayer games, streaming platforms such as Twitch, and the growth of esports tournaments. In-app purchases, subscriptions, and virtual economies are also a source of revenue. Game development is another key area in the U.S., which also fuels the domestic and global markets.

Germany online gaming market

The German online gaming market is one of the largest in Europe, driven by high internet penetration, a strong gaming culture, and technological advancements. The market spans various segments, including mobile, PC, and console gaming, with a growing interest in multiplayer online games, esports, and live-streaming platforms. Germany's well-established gaming industry, home to prominent game developers, continues to innovate and contribute to the global market. In-game purchases and subscription models have further fueled the growth of the market. Additionally, regulatory measures around gaming content and data privacy ensure a secure and sustainable gaming environment.

India online gaming market

The Indian online gaming market is growing at a rapid pace, driven by increasing internet penetration, affordable smartphones, and a rising middle class. The market is growing across all segments- mobile gaming, esports, and casual games-but mostly represented by the former for its easy availability and popularity. Young, tech-savvy Indians are online multiplayer game enthusiasts. This has helped fuel esports and competitive gaming. Money is largely made through in-app purchases and advertising. With ever-growing investment in gaming infrastructure and a supportive regulatory environment, the market is expected to continue its robust expansion. April 2024: South Korean gaming giant Krafton announced the official launch of its new shooter mobile game Bullet Echo India in association with its Spanish counterpart, ZeptoLab.

Saudi Arabia's online gaming market

The Saudi online gaming market is witnessing a strong growth rate due to a technologically savvy population, high internet penetration, and support from the government for the gaming industry. Gaming is very popular among the youth and there is a high demand for mobile, console, and PC games. Esports and gaming tournaments have been gaining momentum in the market. Saudi Arabia has emerged as one of the biggest competitive gaming hubs in the Middle East. The primary revenue drivers are in-app purchases, subscription services, and digital content sales. Additionally, government-backed initiatives, such as investments in local game development, are expected to boost the market further.

Online Gaming Market Segments

By Type

- Action

- Adventure

- Puzzle

- Arcade

- Others

By Platform

- Mobile Phone

- PCs

- Console

- Others

Gamer Type

- Social Gamers

- Serious Gamers

- Core Gamers

Age-group

- Below 10 Years

- 11-24 Years

- 25-44 Years

- 45 and Above Years

Regional Market Insights

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Activision Blizzard, Inc.

- Apple Inc.

- Capcom Co., Ltd.

- Electronic Arts Inc.

- Microsoft Corporation

- Nintendo Co., Ltd.

- Sony Interactive Entertainment Inc.

- Tencent Holdings Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Platform, Gamer Type, Age Group and Countries |

| Countries Covered |

|

| Companies Covered | 1. Activision Blizzard, Inc. 2. Apple Inc. 3. Capcom Co., Ltd. 4. Electronic Arts Inc. 5. Microsoft Corporation 6. Nintendo Co., Ltd. 7. Sony Interactive Entertainment Inc. 8. Tencent Holdings Ltd. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Online Gaming Market

6. Market Share

6.1 Type

6.2 Platform

6.3 Gamer Type

6.4 Age Group

6.5 Country

7. Type

7.1 Action

7.2 Adventure

7.3 Puzzle

7.4 Arcade

7.5 Others

8. Platform

8.1 Mobile Phone

8.2 PCs

8.3 Console

8.4 Others

9. Gamer Type

9.1 Social Gamers

9.2 Serious Gamers

9.3 Core Gamers

10. Age Group

10.1 Below 10 Years

10.2 11-24 Years

10.3 25-44 Years

10.4 45 and Above Years

11. Country

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players

14.1 Activision Blizzard, Inc.

14.1.1 Overview

14.1.2 Recent Development

14.1.3 Revenue

14.2 Apple Inc.

14.2.1 Overview

14.2.2 Recent Development

14.2.3 Revenue

14.3 Capcom Co., Ltd.

14.3.1 Overview

14.3.2 Recent Development

14.3.3 Revenue

14.4 Electronic Arts Inc

14.4.1 Overview

14.4.2 Recent Development

14.4.3 Revenue

14.5 Microsoft Corporation

14.5.1 Overview

14.5.2 Recent Development

14.5.3 Revenue

14.6 Nintendo Co., Ltd.

14.6.1 Overview

14.6.2 Recent Development

14.6.3 Revenue

14.7 Sony Interactive Entertainment Inc

14.7.1 Overview

14.7.2 Recent Development

14.7.3 Revenue

14.8 Tencent Holdings Ltd.

14.8.1 Overview

14.8.2 Recent Development

14.8.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com