Saudi Arabia Online Gaming Market Size & Forecast 2025–2033 | Renub Research

Buy NowSaudi Arabia Online Gaming Market Outlook 2025–2033

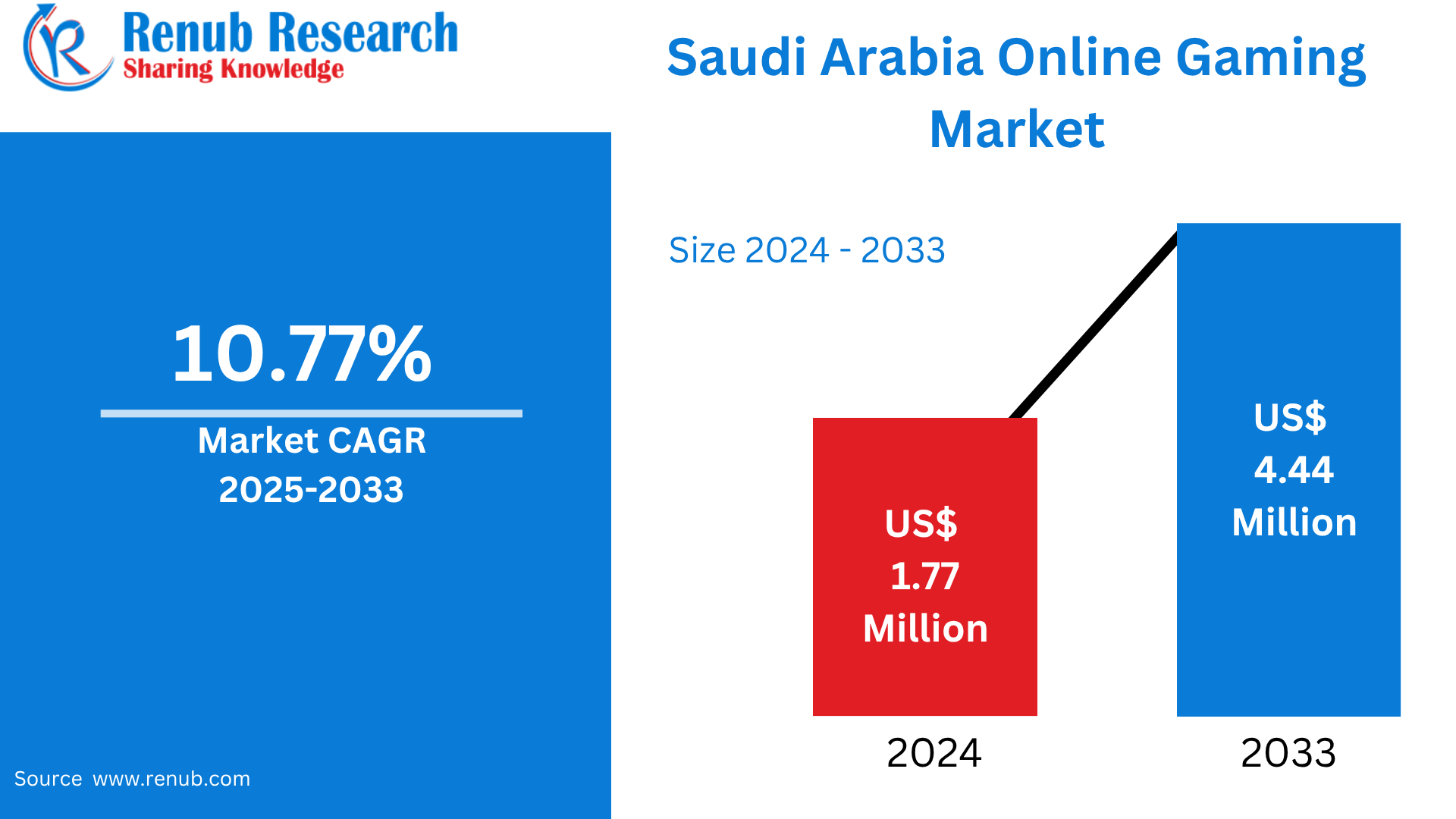

Saudi Arabia Online Gaming Market is expected to reach US$ 4.44 million by 2033 from US$ 1.77 million in 2024, with a CAGR of 10.77% from 2025 to 2033. Increasing internet penetration, youth demographics, government support through Vision 2030, growing smartphone usage, esports development, foreign investment, cultural shifts toward digital entertainment, and growing local game development initiatives are the main drivers of Saudi Arabia's online gaming market growth.

Saudi Arabia Online Gaming Market Report by Type (Action, Adventure, Puzzle, Arcade, Others), Platform (Mobile Phone, PCs, Console, Others), Gamer Type (Social Gamers, Serious Gamers, Core Gamers), Age Group (Below 10 Years, 11-24 Years, 25-44 Years, 45 and Above Years) and Company Analysis 2025-2033.

Saudi Arabia Online Gaming Industry Overview

Playing video games online enables players to interact and compete or collaborate in real time. This is known as online gaming. Action, strategy, sports, and role-playing games are among the many genres it covers, and it is available on a variety of platforms, including PCs, consoles, and mobile devices. Social connection, in-game purchases, and worldwide multiplayer experiences are all made possible via online gaming. Immersion virtual worlds, casual smartphone games, and competitive esports are popular formats. Online gaming has become a popular kind of entertainment due to technological and connection developments, drawing a wide range of viewers and fostering active communities all over the world.

The online gaming sector in Saudi Arabia is expanding quickly because of a number of important factors. Strong digital infrastructure and dependable, fast connectivity are available throughout the nation, enabling a flawless gaming experience. The demand for interactive digital entertainment is considerable due to the population's preponderance of young people. The gambling industry is being aggressively supported by government initiatives as part of larger attempts to diversify the economy. The growth of the gaming sector is being reinforced by strategic investments in both domestic and foreign firms. Furthermore, the emergence of esports and the holding of significant gaming competitions are establishing Saudi Arabia as a regional and international center for competitive digital entertainment and online gaming.

Growth Drivers for the Saudi Arabia Online Gaming Market

Youth Demographics

A major factor in the quick growth of the Saudi Arabian online gaming sector is the country's largely youthful population, with a sizable percentage under 35. A thriving gaming culture has been cultivated by this demographic's significant integration with digital technology and mobile platforms. Gaming is a major source of amusement and social contact for more than 70% of Saudi youth. This development is acknowledged by the government's Vision 2030 plan, which positions esport and gaming as important industries for economic diversification. This generation is further empowered by investments in infrastructure, esports competitions, and educational initiatives, which firmly establish their impact on the direction of the Saudi Arabian gaming market.

Government Initiatives boosts the market growth

Through strategic efforts in line with Vision 2030, the Saudi Arabian government is aggressively propelling the expansion of the online gaming business. The National Gaming and Esports Strategy, which encourages industry investment, talent development, and infrastructure development, is at the heart of this endeavor. By 2030, Saudi Arabia wants to become a global center for gaming and esport, with over 35,000 new employment and $13.3 billion in economic benefits, according to HRH Prince Faisal bin Bandar bin Sultan Al Saud, Chairman of the Federation of E-sports and Gaming. The Kingdom's determination to become a leader in the global gaming ecosystem is further supported by government-backed organizations like Savvy Gaming Group, major competitions like the Esports World Cup, and a $120 million investment fund.

Digital Infrastructure

Through strategic efforts in line with Vision 2030, the Saudi Arabian government is aggressively propelling the expansion of the online gaming business. The National Gaming and Esports Strategy, which encourages industry investment, talent development, and infrastructure development, is at the heart of this endeavor. By 2030, Saudi Arabia wants to become a global center for gaming and esport, with over 35,000 new employment and $13.3 billion in economic benefits, according to HRH Prince Faisal bin Bandar bin Sultan Al Saud, Chairman of the Federation of E-sports and Gaming. The Kingdom's determination to become a leader in the global gaming ecosystem is further supported by government-backed organizations like Savvy Gaming Group, major competitions like the Esports World Cup, and a $120 million investment fund.

Challenges in the Saudi Arabia Online Gaming Market

Cultural and regulatory restrictions

The Saudi Arabian internet gaming sector faces major obstacles due to cultural and legislative constraints. To guarantee that gaming material complies with regional cultural, religious, and social norms, the Kingdom maintains stringent regulations. This frequently leads to game censorship or alteration, which reduces the number of titles available. Complicated approval procedures that developers and publishers must handle can cause delays in game releases and deter foreign businesses from entering the market. These limitations may also have an impact on local game developers' inventiveness and ingenuity. One of the biggest challenges to the long-term success of the Saudi Arabian gaming business is juggling adherence to legal requirements with the varied tastes of players.

Piracy and intellectual property protection issues

The protection of intellectual property (IP) and piracy continue to be significant issues in the Saudi Arabian online gaming industry. Unauthorized game distribution and duplication reduce earnings for publishers and developers while deterring investment and creativity. Despite advancements in legal frameworks, IP law enforcement is continuously developing, making it challenging to successfully tackle digital piracy. Both domestic and foreign gaming companies face risks in this environment, which could restrict market expansion. To safeguard intellectual assets and promote a long-lasting, prosperous gaming ecosystem in Saudi Arabia, it is imperative that anti-piracy measures be strengthened, IP rights be better understood, and collaboration between government organizations and industry players be improved.

Recent Developments in Saudi Arabia Online Gaming Industry

- Jan 2023: Cloud gaming services were introduced in Saudi Arabia by Radian Arc, stc Group, and Blacknut. These services guarantee seamless performance by allowing users to access gaming content through STC's cutting-edge 5G network. The services, which are powered by Radian Arc's GPU Edge technology, guarantee gamers reduced latency and excellent experiences.

- Jan 2022: For its PS5 gaming console, Sony unveiled the PSVR2, a Virtual Reality (VR) headset that comes with VR2 sensing controllers for remarkable immersion capabilities and upgraded technology for improved headgear functions.

- Dec 2021: Microsoft released a multiplayer version of Halo Infinite for Windows, Xbox One, and Xbox Series X/S to commemorate the 20th anniversary of the Halo series and Xbox.

Saudi Arabia Flour Market Segmentation:

Type

- Action

- Adventure

- Puzzle

- Arcade

- Others

Platform

- Mobile Phone

- PCs

- Console

- Others

Gamer Type

- Social Gamers

- Serious Gamers

- Core Gamers

Age Group

- Below 10 Years

- 11-24 Years

- 25-44 Years

- 45 and Above Years

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Activision Blizzard, Inc.

- Apple Inc.

- Capcom Co., Ltd.

- Electronic Arts Inc

- Microsoft Corporation

- Nintendo Co., Ltd.

- Sony Interactive Entertainment Inc

- Tencent Holdings Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Type, Platform, Gamer Type and Age Group |

| Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Online Gaming Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Platform

6.3 By Gamer Type

6.4 By Age Group

7. Type

7.1 Action

7.2 Adventure

7.3 Puzzle

7.4 Arcade

7.5 Others

8. Platform

8.1 Mobile Phone

8.2 PCs

8.3 Console

8.4 Others

9. Gamer Type

9.1 Social Gamers

9.2 Serious Gamers

9.3 Core Gamers

10. Age Group

10.1 Below 10 Years

10.2 11-24 Years

10.3 25-44 Years

10.4 45 and Above Years

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Activision Blizzard, Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Apple Inc.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Capcom Co., Ltd.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Electronic Arts Inc.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Microsoft Corporation

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Nintendo Co., Ltd.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Sony Interactive Entertainment Inc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Tencent Holdings Ltd.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com