North America Automotive Paint Market: Size, Trends, Forecast 2025-2033

Buy NowNorth America Automotive Paint Market Size and Forecast 2025-2033

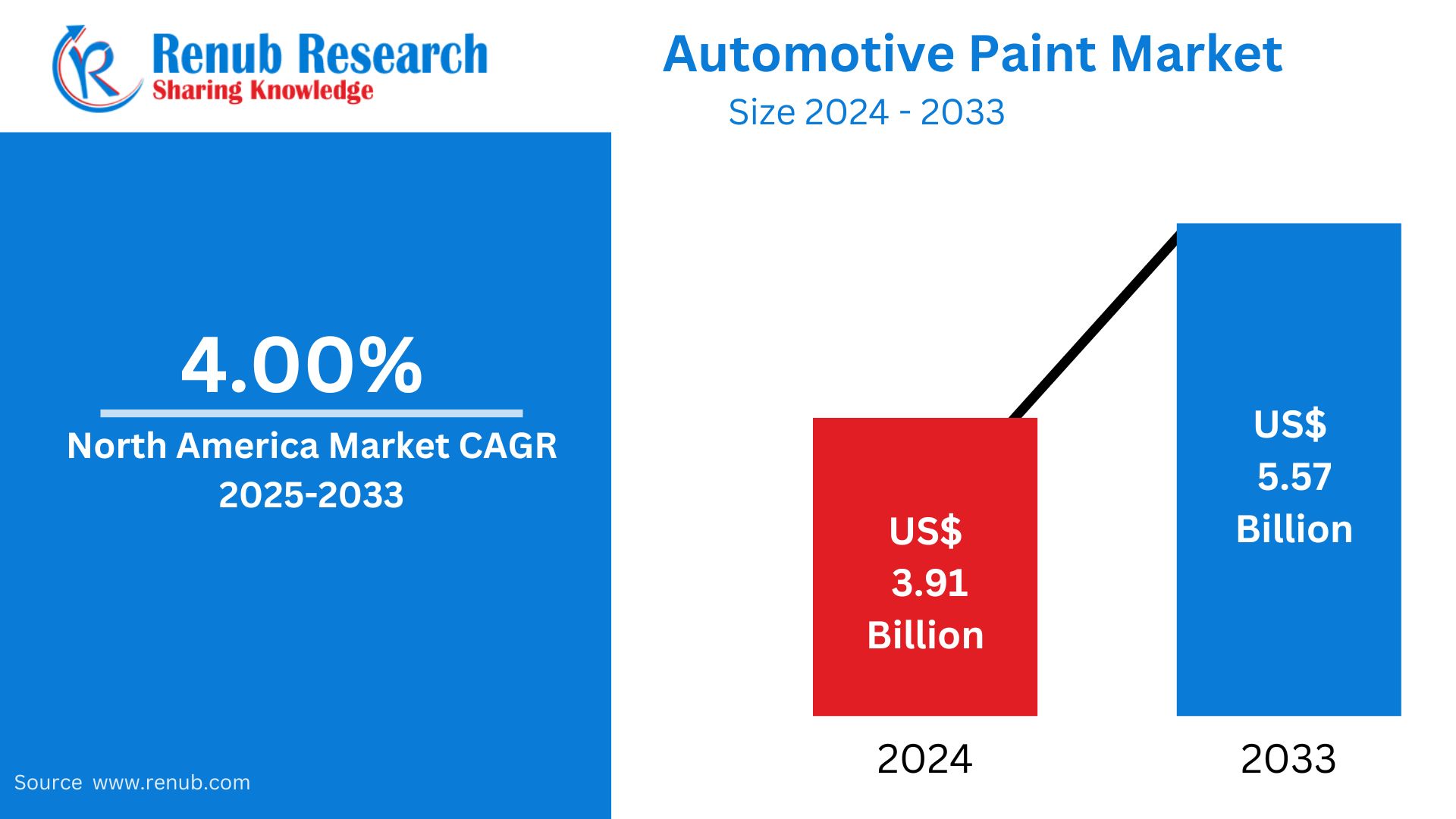

North America Automotive Paint Market is expected to reach US$ 5.57 billion by 2033 from US$ 3.91 billion in 2024, with a CAGR of 4.00% from 2025 to 2033. North America's automotive paint market is expanding due to a number of factors, including rising vehicle production, rising customization demand, paint technology breakthroughs, increased EV usage, and strict environmental laws.

North America Automotive Paint Market Report by Vehicle Types (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle), Technology (Waterborne Coatings, Solvent Borne Coatings, Powder Coatings), Paint Types (Primer, Base Coat, Clear Coat, Electrocoat), Countries (United States, Canada, Mexico, Rest of North America) and Company Analysis, 2025-2033

North America Automotive Paint Market Overview

With the aid of a spray gun, automotive paint, often known as a water-based solution, is applied to the surface of an automobile. These paints are made of enamel based on polyurethane, which shields the surface from environmental deterioration and improves the appearance of automobiles. To guarantee the application of a protective and effective coating, the car painting procedure consists of specific steps. Automobile body panels and parts are grouped together in a temporary assembly called body-in-white (BIW). To speed up the drying process, automotive paint is then applied in a temperature-controlled setting. To maintain the integrity of the paint job for a long time, several application phases are carried out.

Since base coats don't contain hardeners or strengtheners, they are the real color of the vehicle's paint that is put over the primer layer. To avoid flaws on painted surfaces, protective layers must be applied over this unfinished base coat layer, which is unable to defend itself. Because base coats are used extensively and are required because they extend paint life, market participants are creating new base coats for automakers. For example, Axalta Coating Systems announced the release of its solvent-borne Cromax XP base coats in February the year 2021. Therefore, it is projected that throughout the projection period, the base coat segment will rise as a result of these kinds of market player advancements.

Solid paints and a little amount of metal powder are included in the metallic texture type. Additionally, the manufacturer's preference and the intended texture determine the kind and size of metal that should be applied. Compared to solid textures, metallic textures are a little more expensive to produce; many manufacturers charge more for the upgrade from solid to metallic textures. Because of its shimmering look, metallic texture paint reflects lighter than a typical glossy vehicle finish. Additionally, applying metallic texture paints makes minor dents harder to spot, enhancing the appearance of automobiles. Customers now prefer metallic paints as a result of all these factors, which is driving the expansion of the automotive paints market.

Growth Drivers for the North America Automotive Paint Market

Rising Vehicle Production and Ownership

One of the main factors propelling the automotive paint market's expansion is the rise in vehicle ownership and production throughout North America, especially in the United States, Canada, and Mexico. Automakers are increasing production to satisfy the demands of both home and foreign markets as consumer demand for automobiles keeps rising. The demand for original equipment manufacturer (OEM) vehicle paints used in production is directly impacted by this growth. At the same time, as more cars are driven by maintenance, repairs, and aesthetic enhancements, the demand for aftermarket paints rises. As more automobiles are driven, there is a greater need for long-lasting, superior, and eco-friendly coatings, which opens up a lot of chances for paint and coating producers in the area.

Consumer Demand for Customization

The North American automobile paint market is being greatly impacted by consumer demand for vehicle customization. More and more contemporary consumers are looking for aesthetically distinctive, customized cars that represent their own preferences and way of life. Automakers and aftermarket suppliers are being pressured by this trend to supply a wider range of colors, finishes, and special effect paints, including metallic, pearlescent, matte, and color-shifting alternatives. Younger consumers and auto enthusiasts who see their cars as an extension of who they are are particularly fond of custom paint jobs. Because of this, auto paint producers are coming up with new formulas that satisfy environmental regulations while also producing finishes that are vivid and long-lasting. Strong demand across the OEM and refinishing industries is anticipated to be sustained by this increased need for personalization.

Strategic Investments by Industry Leaders

In order to satisfy the rising demand for automotive paints and coatings, PPG Industries is proactively expanding its manufacturing capacity in North America. A new 250,000-square-foot facility in Loudon County, Tennessee, will be the company's first new U.S. plant in more than 15 years as part of a $300 million investment spread over four years. When completed in 2026, this factory is anticipated to generate over 11 million gallons of paint and coatings yearly. In order to increase manufacturing efficiency and meet the growing demand for environmentally friendly solutions like aqueous coatings, PPG also intends to modernize its current facilities in Cleveland, Ohio, and San Juan Del Rio, Mexico, by implementing cutting-edge machinery and procedures.

Challenges in the North America Automotive Paint Market

Stringent Environmental Regulations

One of the biggest obstacles facing the North American automobile paint market is the strict environmental requirements. Because of their detrimental effects on human health and air quality, regulatory bodies like the U.S. Environmental Protection Agency (EPA) place stringent restrictions on emissions of volatile organic compounds (VOCs). Manufacturers of vehicle paint are being pressured by these restrictions to switch from conventional solvent-based solutions to more ecologically friendly substitutes like powder and aqueous coatings. Despite being more environmentally friendly, these solutions frequently necessitate large investments in R&D and new manufacturing techniques. Furthermore, upgrading the current production infrastructure may be necessary to deploy low-emission coating systems, which would raise operating expenses. Financial and technical obstacles are brought about by these regulatory demands, particularly for smaller market participants who are trying to maintain their competitiveness.

Rising Competition

For both established and up-and-coming companies, the growing rivalry in the North American automobile paint market presents a serious obstacle. Market saturation is exacerbated by the large number of domestic and international firms, which raises pricing pressures and lowers profit margins. To maintain market share, businesses must continuously work to set themselves apart through innovation in product performance, sustainability, and aesthetics. This involves creating cutting-edge formulas to satisfy changing consumer and regulatory requirements, such as coatings that are ecologically friendly, self-healing, or scratch-resistant. Strong customer service, branding, and strategic alliances with automakers and aftermarket service providers are also crucial. To remain competitive and relevant in a crowded market, the industry's fast-paced nature necessitates ongoing investment in research and development.

United States Automotive Paint Market

OEM (original equipment manufacturer) and aftermarket demand are the main drivers of the US automotive paint business, which is a crucial component of the larger North American coatings sector. The demand for automotive paints is growing along with the number of vehicles produced, especially for repairs and customizations. Demand for a broad range of colors, coatings, and unique effects is being driven by consumers' growing desire for customized automobiles.

The market is also being shaped by environmental restrictions, which are encouraging manufacturers to develop environmentally friendly products including powder and aqueous coatings. Many regional and international businesses are becoming more and more competitive in the industry, therefore maintaining a competitive edge requires constant innovation. The automobile paint market is anticipated to increase steadily as consumers and automakers place a greater priority on sustainability and aesthetics.

Canada Automotive Paint Market

OEM (original equipment manufacturer) and aftermarket demand are the main drivers of the Canadian automotive paint market. As vehicle production and ownership rise, so does the desire for premium coatings. The industry is moving toward environmentally friendly alternatives, such as powder and waterborne coatings, to lower VOC emissions as environmental laws tighten. Customers' need for a wide range of colors, finishes, and effects for customization is also influencing industry developments. Furthermore, the performance and visual appeal of automobile paints are being improved by technological developments including the creation of nano-coatings and long-lasting multi-layer systems. Market dynamics are still significantly impacted by issues like shifting raw material prices and the requirement for constant innovation to meet environmental regulations.

Mexico Automotive Paint Market

The strong automobile manufacturing industry in Mexico, which is the seventh-largest producer of passenger cars worldwide, is propelling the country's automotive paint market's expansion. Original equipment manufacturer (OEM) and aftermarket coatings are in high demand as a result of this expansion. In order to achieve sustainability goals, environmental rules are driving a shift towards eco-friendly solutions, such as aqueous coatings and low-VOC. Technological developments are improving the longevity and visual attractiveness of vehicle finishes, such as the use of nano-coatings and multi-layer systems. Nonetheless, issues like volatile raw material pricing and fierce rivalry in the industry continue to exist. Notwithstanding these obstacles, the industry is still developing, with prospects brought about by the growing popularity of electric cars and the need for lightweight automotive parts.

North America Automotive Paint Market Segments

Vehicle Types–Market breakup in 4 viewpoints:

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Technology –Market breakup in 3 viewpoints:

- Waterborne Coatings

- Solvent Borne Coatings

- Powder Coatings

Paint Types–Market breakup in 4 viewpoints:

- Primer

- Base Coat

- Clear Coat

- Electrocoat

Country –Market breakup in 4 viewpoints:

- United States

- Canada

- Mexico

- Rest of North America

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Nissan Motor Company

- PPG Industries

- DuPont de Nemours Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- The Sherwin Williams Company

- Cabot Corporation

- Volkswagen AG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Vehicle Types, Technology, Paint Types and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Automotive Paint Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Vehicle Types

6.2 By Technology

6.3 By Paint Types

6.4 By Countries

7. Vehicle Types

7.1 Passenger Cars

7.2 Light Commercial Vehicle

7.3 Heavy Commercial Vehicle

8. Technology

8.1 Waterborne Coatings

8.2 Solvent Borne Coatings

8.3 Powder Coatings

9. Paint Types

9.1 Primer

9.2 Base Coat

9.3 Clear Coat

9.4 Electrocoat

10. Countries

10.1 United States

10.2 Canada

10.3 Mexico

10.4 Rest of North America

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Nissan Motor Company

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 PPG Industries

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 DuPont de Nemours Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Akzo Nobel N.V.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Axalta Coating Systems Ltd.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 The Sherwin Williams Company

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Cabot Corporation

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Volkswagen AG

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com